Mirrorless Housing Market Overview

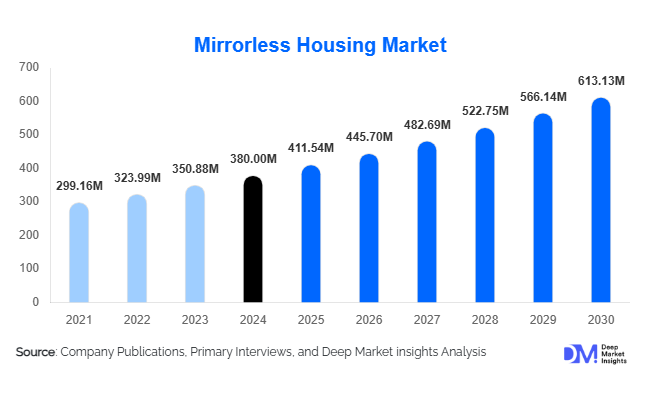

According to Deep Market Insights, the global mirrorless housing market size was valued at USD 380 million in 2024 and is projected to grow from USD 411.54 million in 2025 to reach USD 613.13 million by 2030, expanding at a CAGR of 8.3% during the forecast period (2025–2030). Market growth is driven by the increasing adoption of mirrorless cameras among professional and hobbyist photographers, the surge in underwater and adventure tourism, and ongoing innovations in lightweight and durable housing materials.

Key Market Insights

- Underwater photography remains the dominant application segment, accounting for nearly 45% of the 2024 market value, fueled by growing adventure tourism and marine exploration activities.

- Professional-grade aluminum housings lead the market, representing around 30% of total revenue due to their superior durability and depth performance.

- Asia-Pacific is the fastest-growing region, driven by increasing disposable incomes, marine tourism, and social-media-driven photography culture in China, Japan, and Australia.

- Technological innovation and material advancementincluding carbon fiber composites and electronic leak detection systems, are transforming product performance and reducing weight.

- The top five players control 40–60% of the global market share, underscoring moderate consolidation among established specialists like Nauticam and Ikelite.

- Full-frame mirrorless camera housings dominate sensor-based segmentation, capturing approximately 35–40% of market revenue in 2024.

What are the latest trends in the mirrorless housing market?

Lightweight and Modular Housing Systems

Manufacturers are shifting toward modular housing designs that allow users to interchange ports, lenses, and accessories seamlessly. These modular systems improve compatibility with multiple camera models, reducing ownership cost for professionals. Lightweight carbon fiber and aluminum composites are replacing older polycarbonate designs, improving portability and corrosion resistance for travel and underwater photographers alike. The integration of interchangeable domes, vacuum-sealed locks, and ergonomic handles is making these housings more versatile and travel-friendly.

Smart Housing and Digital Integration

Emerging mirrorless housings now feature integrated leak detection sensors, electronic moisture alarms, and wireless control interfaces. These innovations enhance equipment safety and user experience, particularly during deep-water dives or long outdoor shoots. Some high-end housings are being designed with Bluetooth or Wi-Fi control compatibility for remote camera operation. This trend aligns with the broader push toward smart imaging ecosystems, catering to professionals who demand real-time feedback, reliability, and enhanced usability under extreme conditions.

What are the key drivers in the mirrorless housing market?

Growing Popularity of Mirrorless Cameras

Mirrorless cameras are replacing traditional DSLRs across both professional and consumer segments due to superior portability, autofocus performance, and video capabilities. As adoption expands, demand for compatible housings naturally follows, particularly among photographers exploring underwater and extreme environments. The rising availability of full-frame mirrorless cameras at affordable prices is further accelerating housing sales in mid-tier segments.

Expansion of Adventure and Marine Tourism

The growth of marine tourism, scuba diving, and adventure travelespecially across Southeast Asia, Latin America, and Oceania creating a surge in demand for underwater camera housings. Divers and content creators increasingly seek professional-grade housings to document experiences, contributing to steady volume and value growth. Marine conservation projects and oceanic research initiatives are also driving institutional purchases of specialized housings designed for scientific imaging.

Advancements in Material Science and Design

Improvements in materials such as anodized aluminum, high-density polymers, and carbon composites have enhanced product lifespan while reducing weight. These innovations enable housings with better corrosion resistance, impact strength, and operational depth. Enhanced sealing technologies, vacuum testing systems, and ergonomic design improvements are ensuring reliable performance at greater depths, thereby widening application potential and improving brand loyalty among professionals.

What are the restraints for the global market?

High Product Cost and Compatibility Challenges

Professional mirrorless housings can range from USD 1,000 to USD 2,500 per unit, limiting accessibility for entry-level photographers. Additionally, compatibility issues where each housing fits a specific camera model restrict reusability, forcing frequent upgrades as camera models evolve. These challenges deter widespread adoption in emerging markets where price sensitivity remains high.

Limited After-Sales Support and Distribution Barriers

The niche nature of mirrorless housings often results in limited repair, servicing, and parts availability, especially in developing regions. Long shipping times, import duties, and a lack of authorized distributors increase total ownership cost. Smaller manufacturers face logistical and warranty challenges, constraining market expansion beyond developed economies.

What are the key opportunities in the mirrorless housing industry?

Emerging Regional Markets in Asia-Pacific and Latin America

Rapidly growing adventure and marine tourism industries across Indonesia, Thailand, the Philippines, Brazil, and Mexico are creating strong regional demand for mirrorless housings. Manufacturers establishing local partnerships and assembly facilities can reduce logistics costs and capture new market share. Regional distribution hubs also improve after-sales support and strengthen brand presence among emerging consumer bases.

Technological Innovation and Hybrid Integration

New opportunities lie in the integration of smart sensors, IoT-enabled monitoring, and advanced modular attachments like lighting systems and grips. These features enhance usability and safety, catering to a rising class of professional videographers and documentary producers. OEM collaborations with camera brands also offer potential to design housings pre-calibrated for specific mirrorless models, improving user convenience and expanding product ecosystems.

Scientific and Environmental Applications

Rising demand from marine biology, oceanography, and environmental research institutions opens niche opportunities for deep-water housings with extreme durability. Governments and NGOs are funding underwater research projects, boosting institutional demand. Manufacturers developing specialized housings rated for depths beyond 100 meters can command premium margins within this segment.

Product Type Insights

Professional/heavy-duty housings dominate the global mirrorless housing market, contributing about 30–35% of total 2024 revenue. These housings are built for extreme environments and professional usage, featuring precise mechanical controls, deep depth ratings, and compatibility with full-frame cameras. Entry- and mid-range housings cater to travel and hobbyist photographers, offering affordability but lower depth ratings. Meanwhile, compact and polycarbonate-based housings are growing in volume, particularly for lightweight applications and casual content creation.

Application Insights

Underwater photography remains the largest application segment, representing roughly 45% of total revenue in 2024. Demand is driven by recreational diving, professional underwater videography, and scientific research. Other key applications include adventure and outdoor protection housings for travel bloggers, wildlife photographers, and sports content creators. Commercial cinematography, boosted by film studios and streaming platforms investing in aquatic visuals, also contributes notably to premium housing demand.

Material Insights

Aluminum housings lead the market, holding an estimated 25–30% share of the 2024 global revenue. Their superior durability, corrosion resistance, and precision machining make them the preferred choice for professional photographers. Polycarbonate and hybrid materials are gaining traction among hobbyists for being cost-effective and lightweight. Future trends indicate growing use of carbon fiber composites and high-performance alloys to enhance strength-to-weight ratios and depth resistance.

| By Product Type | By Application | By Material Type | By Camera Type Compatibility | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounted for around 25–30% of the global mirrorless housing market in 2024. The United States leads, driven by high penetration of mirrorless cameras, strong demand from diving destinations such as Hawaii and Florida, and the presence of major manufacturers. Canada contributes to niche adventure photography markets. Rising e-commerce availability and content creation culture support long-term growth.

Europe

Europe held approximately 20–25% market share in 2024, anchored by Germany, the U.K., France, and Italy. European consumers emphasize premium build quality and sustainable materials, making it a key market for high-end aluminum housings. Adventure travel and diving in the Mediterranean, along with robust distribution networks, reinforce steady demand across the region.

Asia-Pacific

Asia-Pacific is the fastest-growing region, holding nearly 25–30% of market share and projected to register the highest CAGR through 2030. China and Japan dominate, benefiting from strong camera industries and consumer enthusiasm for underwater photography. Australia’s Great Barrier Reef and Southeast Asia’s diving hubs (Indonesia, Thailand, Philippines) drive regional sales, supported by increasing tourism and social-media-driven photo culture.

Latin America

Latin America represents around 5–8% of the global market share, with emerging opportunities in Brazil and Mexico. Growing adventure tourism and improved e-commerce infrastructure are encouraging the adoption of mid-range housing. Limited local manufacturing and high import costs currently restrain faster market expansion but signal long-term potential for partnerships.

Middle East & Africa

Holding approximately 5–7% of 2024 global revenue, the region’s demand centers around diving destinations in the UAE, South Africa, and Egypt. The Middle East’s luxury travel culture and Africa’s expanding ecotourism contribute to demand for both professional and mid-range housing. Improved distribution and tourism promotion programs could unlock higher growth in the coming years.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Mirrorless Housing Market

- Nauticam

- Ikelite

- AOI

- Isotta

- Aquatica

- Fantasea

- Inon

- 10Bar

- Marelux

- Sea & Sea

- Subal

- Recsea

- Olympus

- Aquatech

- Hugyfot

Recent Developments

- In May 2025, Nauticam introduced a new carbon-composite deep-water housing rated to 100 m, improving weight balance by 20% compared to previous models.

- In April 2025, Ikelite announced the expansion of its aluminum housing line for Canon and Sony full-frame mirrorless cameras, focusing on ergonomic redesign and leak-detection integration.

- In March 2025, AOI launched a modular port system enabling cross-compatibility with multiple camera bodies, significantly reducing upgrade costs for professional users.

- In February 2025, Isotta collaborated with diving associations in Europe to promote certified deep-sea housings with extended warranties and after-sales service support.