Mini Figures Market Size

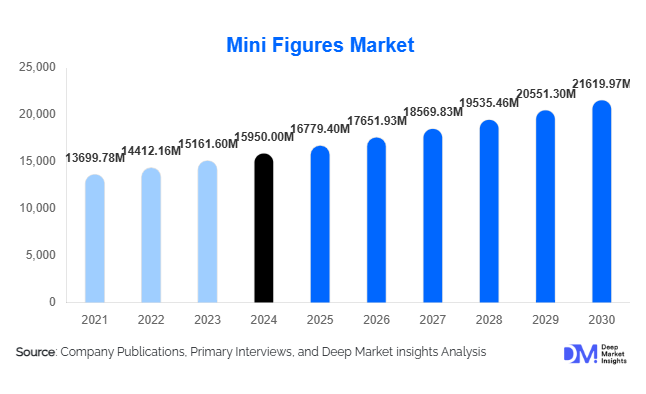

According to Deep Market Insights, the global mini figures market size was valued at USD 15,950.00 million in 2024 and is projected to grow from USD 16,779.40 million in 2025 to reach USD 21,619.97 million by 2030, expanding at a CAGR of 5.2% during the forecast period (2025–2030). The market growth is primarily driven by rising demand from both children and adult collectors, increasing franchise and pop-culture tie-ins, and the rapid expansion of e-commerce and global online retail distribution.

Key Market Insights

- Action figures remain the largest product category, accounting for about 45% of global revenue in 2024 due to strong franchise licensing and mainstream toy demand.

- Adult collectors represent a rapidly expanding consumer group, contributing approximately 30% of total market value in 2024, with higher average spending per figure.

- Online retail dominates distribution, comprising nearly 45% of all mini figure sales, thanks to global accessibility and exclusive online releases.

- North America leads the market with about 38% share in 2024, followed by Europe (25%) and Asia-Pacific (28%), the latter being the fastest-growing region.

- Technological integration and customization trends, such as 3D printing, limited-edition drops, and digital companion experiences, are redefining consumer engagement.

- Plastic remains the most widely used material, representing more than half of total mini figure production due to scalability and cost efficiency.

Latest Market Trends

Franchise Licensing and Pop-Culture Integration

Licensing partnerships with global entertainment franchises continue to drive sales of mini-figures. Popular film, anime, and gaming IPs such as Star Wars, Marvel, Pokémon, and Nintendo contribute heavily to brand loyalty and repeat purchases. Cross-media marketing, linking toys to streaming content and games, strengthens emotional attachment and enhances collectibility. As streaming platforms release more original content, demand for new figure lines tied to fresh intellectual properties is increasing globally.

Rise of the “Kidult” Collector Segment

The adult collector base has transformed the mini-figures market. Adults purchase mini figures for nostalgia, investment, and home décor. Manufacturers are responding with premium lines, limited editions, and display-oriented designs using resin and die-cast metals. The average adult collector spends three to five times more per purchase than parents buying for children, supporting a profitable premiumization trend. This segment also fuels demand for exclusive releases and convention-based sales events.

Sustainable Materials and Eco-Friendly Manufacturing

Environmental awareness is reshaping product design and production processes. Manufacturers are adopting recycled plastics, plant-based biopolymers, and low-waste packaging to align with consumer sustainability preferences. European and North American markets, in particular, reward brands promoting eco-credentials, while Asian manufacturers are investing in energy-efficient injection molding and renewable-energy production facilities to meet global standards.

Mini Figures Market Drivers

Expansion of Franchise Licensing

The proliferation of entertainment IPs across streaming, film, and gaming is a critical growth engine. Licensed mini figures from blockbuster series or games immediately capture fan communities, ensuring steady demand. Expanding media universes provide a recurring stream of collectible opportunities, enabling brands to renew lines annually.

E-Commerce and Direct-to-Consumer Growth

Digital platforms enable manufacturers to sell directly to collectors worldwide, eliminating dependence on intermediaries. Online exclusives, pre-orders, and influencer-driven marketing accelerate launch visibility. Global marketplaces and social platforms like Instagram, TikTok, and Reddit have become vital for community engagement and limited-edition promotions.

Adult Collector Market Expansion

Adults represent an increasingly large share of revenue. They are drawn to nostalgia, craftsmanship, and scarcity-driven collectibility. This group fuels the secondary resale market and supports premium pricing models. Manufacturers are capitalizing through subscription boxes, numbered editions, and collaborations with pop-culture artists.

Market Restraints

Rising Licensing and Production Costs

Licensing fees for top franchises are increasing, reducing profitability for smaller producers. Additionally, competition among license holders and content saturation can diminish novelty appeal. Manufacturing costs are further affected by volatility in raw materials and shipping expenses.

Market Saturation and Consumer Fatigue

In mature markets, the constant influx of new releases can lead to collector fatigue and inventory overhangs. Consumers may shift toward fewer, higher-quality purchases rather than high-volume buying, requiring producers to emphasize exclusivity and artistic value to sustain growth.

Mini Figures Market Opportunities

Emerging Markets and Regional IP Development

Rising middle-class income in India, China, and Southeast Asia presents a major untapped consumer base. Local entertainment franchises and regional characters are gaining recognition, offering licensing opportunities for regionally tailored figure collections. Domestic manufacturing policies such as “Make in India” support this regional expansion.

Technological Innovation and Digital Integration

Integration of AR and digital companion apps with physical figures offers new engagement models. Smart figures connected to apps, digital collectibles, and NFTs provide hybrid physical-digital ecosystems. As technology adoption grows, hybrid collectible ecosystems are expected to drive incremental revenue streams.

Customization and Personalization Platforms

Custom figure platforms allow consumers to design or modify figures with personalized features. Through 3D printing and modular assembly systems, consumers can create unique mini figures, fostering brand loyalty and community engagement. This direct interaction also provides manufacturers with valuable consumer insights for new product lines.

Product Type Insights

Action Figures dominate the global mini figures market, accounting for approximately 45% of total revenue in 2024 (USD 6.7 billion). Their strong performance is driven by consistent tie-ins with blockbuster films, comic franchises, and gaming IPs. The launch of cinematic universes and collectible gaming merchandise continues to propel sales across both retail and digital channels. The action/articulated segment benefits from a steady mix of playability and display value, attracting both younger audiences and adult collectors. Collectible mini figures, especially blind-box and limited-edition variants, are expanding rapidly as impulse buying and social media “unboxing” trends surge. Building-block mini figures (notably LEGO and compatible brands) sustain robust growth through STEM-focused play and their integration within larger construction sets, generating a higher attach rate and recurring consumer engagement. Meanwhile, customizable figures are emerging as a creative niche, allowing users to personalize designs and accessories, aligning with the maker movement and digital customization tools.

Material Insights

Plastic mini figures represent roughly 55% of total market value (USD 8.1 billion in 2024), underpinned by cost-efficient injection molding, scalability, and compliance with global safety standards. The segment remains the material of choice for mass-market and children-focused products due to its balance of durability and affordability. Resin and die-cast materials dominate the high-end collectible spectrum, favored by adult hobbyists for their premium finish, intricate detailing, and weight. This premiumization trend supports higher average selling prices (ASPs) and encourages limited production runs. In parallel, sustainable and recycled materials are emerging as a differentiating factor, particularly across Europe and Japan, where eco-conscious consumers drive demand for biopolymer-based and recycled PVC models. These environmentally aligned materials are expected to grow at a double-digit CAGR through 2030, reflecting rising sustainability standards in the global toy and collectibles sector.

Distribution Channel Insights

Online retail leads the distribution landscape with approximately 45% of total 2024 sales (USD 6.7 billion). Global e-commerce platforms and brand-owned websites have expanded reach and consumer engagement through personalized recommendations, loyalty programs, and flash “drop” campaigns. The growing influence of influencer marketing and livestream commerce in Asia-Pacific and North America continues to drive this channel’s growth. Specialty and collector stores remain crucial for exclusivity-driven purchases, limited editions, and event-based sales (e.g., Comic-Con, toy expos). These channels foster community engagement and brand loyalty through in-person events and early access programs. Meanwhile, mass-market toy chains sustain children’s segment sales by leveraging seasonal gifting peaks and extensive physical presence. The direct-to-consumer (D2C) model is increasingly attractive for manufacturers seeking better margins, control over brand storytelling, and access to first-party customer data, making it a key strategic focus for market leaders.

Age Group Insights

Adults (18+ years) represent the fastest-growing demographic, contributing approximately 30% of global sales (USD 4.4 billion in 2024). This growth is fueled by rising disposable income, nostalgia-driven purchasing, and the perception of mini figures as collectible investments. Adult collectors prioritize authenticity, rarity, and certification, driving demand for serial-numbered limited editions and artist collaborations. Children (under 12 years) remain the largest consumer base by volume, supported by safety-certified, play-oriented designs that encourage imaginative and interactive play. Teenagers, though smaller in share, influence market trends through social media and crossover interests between play and collection, helping bridge traditional toy segments with lifestyle collectibles.

| By Product Type | By Licensing / IP | By Age Group / End User | By Distribution Channel | By Material / Manufacturing |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads the global mini figures market with an estimated 38% share in 2024 (USD 5.6 billion). The United States is the dominant contributor, supported by an entrenched pop-culture ecosystem encompassing Hollywood franchises, comic conventions (e.g., Comic-Con, Toy Fair), and high collector engagement. Region-specific drivers include a strong collector culture, high disposable income enabling premium and limited-edition purchases, and mature e-commerce and specialty retail networks that facilitate nationwide distribution. Growth is further bolstered by licensed IP launches tied to major entertainment releases and collaborations between toy brands and gaming studios. Canada contributes steadily, with a growing focus on sustainability and digital retail channels.

Europe

Europe commands around 25% of global market share (USD 3.7 billion in 2024), driven by an established base of collectible manufacturers and a highly regulated toy safety environment. Key markets such as the U.K., Germany, and France emphasize design-led and licensed collectibles, often integrating sustainability narratives and recycled materials. Region-specific drivers include strong regulatory compliance encouraging trust in premium toys, a mature network of specialty retailers and auctions, and a sophisticated adult collector base valuing craftsmanship and brand heritage. Eastern Europe shows rising adoption through improved retail infrastructure and local manufacturing partnerships, making it a nascent growth zone for the next decade.

Asia-Pacific

Asia-Pacific (APAC) is the fastest-growing region, holding about 28% share (USD 4.1 billion in 2024) and projected to expand at a CAGR of 7–10% (2025–2030). The region combines the world’s largest manufacturing base (China, Vietnam, India) with booming consumer demand for anime, gaming, and character-driven collectibles. Key growth drivers include rapid e-commerce adoption, urban youth demographics, and the social media-fueled popularity of blind-box collectibles and gachapon models. China and Japan dominate the collector segment, while India and Southeast Asia are emerging as dual manufacturing-consumption hubs. APAC’s deep integration of online-to-offline retail ecosystems and cross-brand licensing models makes it the top priority region for expansion.

Latin America

Latin America contributes about 6% (USD 0.8 billion) of global mini-figures revenue. Brazil and Mexico lead demand, supported by a growing middle class, expanding e-commerce penetration, and increasing exposure to global pop-culture franchises. Region-specific drivers include the rise of local retail partnerships and franchised entertainment IPs entering mass-market channels. Price sensitivity remains a challenge, but entry-level and mid-tier collectibles continue to attract younger consumers, while adult collector communities are emerging online. As logistics improve and import duties stabilize, Latin America’s accessibility to international brands is expected to accelerate regional adoption.

Middle East & Africa

Middle East & Africa (MEA) represents approximately 4–5% (USD 0.7 billion) of the global market share. The Gulf Cooperation Council (GCC) countries, led by the UAE, Saudi Arabia, and Qatar, are driving premium sales due to high disposable incomes, youth population growth, and strong exposure to global entertainment media. Expansion of organized retail, shopping malls, and e-commerce infrastructure has enhanced collectible availability in urban centers. Africa, while smaller in market value, presents long-term potential through demographic expansion and rising toy retail networks in South Africa, Nigeria, and Kenya. Overall, MEA growth is expected to accelerate as cultural affinity for licensed brands and premium imports deepens, positioning the region as an emerging opportunity frontier for 2030.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Mini Figures Market

- The LEGO Group

- Hasbro Inc.

- Mattel Inc.

- Funko Inc.

- Bandai Namco Holdings Inc.

- McFarlane Toys

- Good Smile Company

- Playmobil (Brandstätter Group)

- Takara Tomy Co., Ltd.

- Mezco Toyz

- Jazwares LLC

- Diamond Select Toys

- Hot Toys Ltd.

- 52TOYS

- Sonny Angel Co.

Recent Developments

- In May 2025, LEGO announced the expansion of its collectible minifigure series, including sustainability-focused packaging made from recyclable materials.

- In April 2025, Funko introduced a hybrid digital-physical collectible line integrating blockchain authentication and AR visualization for collectors.

- In February 2025, Bandai Namco launched a global e-commerce platform enabling pre-orders and customization for limited-edition Gundam mini figures.