Mens Underwear Market Size

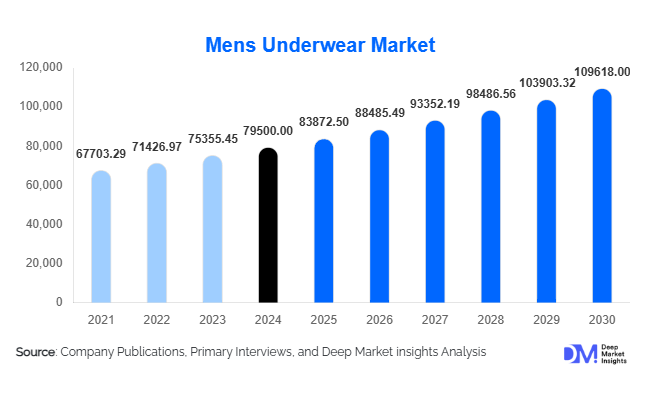

According to Deep Market Insights, the global mens underwear market size was valued at USD 79,500 million in 2024 and is projected to grow from USD 83,872.5 million in 2025 to reach USD 109,618.0 million by 2030, expanding at a CAGR of 5.5% during the forecast period (2025–2030). The mens underwear market growth is primarily driven by increasing consumer focus on personal grooming, the rising adoption of premium and eco-friendly fabrics, and the expansion of online retail channels providing convenience and product variety.

Key Market Insights

- Boxer briefs dominate globally, offering a hybrid of comfort and style, catering to both fashion-conscious and comfort-oriented consumers.

- Cotton remains the leading material, with high breathability and affordability, making it the preferred choice for everyday wear.

- Online retail channels are expanding rapidly, driven by digital adoption, convenience, and subscription-based models targeting younger demographics.

- North America holds the largest market share, supported by high disposable incomes and mature branded underwear preferences.

- APAC is the fastest-growing region, led by rising urbanization, growing middle-class income, and increasing brand awareness among youth in China, India, and Japan.

- Technological integration, including moisture-wicking fabrics, antibacterial textiles, and smart underwear innovations, is reshaping consumer expectations in performance and premium segments.

Latest Market Trends

Premiumization and Eco-Friendly Fabric Adoption

Consumers are increasingly opting for premium fabrics such as modal, bamboo, and microfiber blends that provide enhanced comfort, durability, and moisture management. Eco-conscious fabrics like bamboo and organic cotton are gaining traction, especially in Europe and North America, where sustainability certifications influence buying decisions. Brands are leveraging these trends to differentiate their offerings and command higher price points, leading to significant revenue growth in the premium segment.

Digital Transformation and E-Commerce Growth

E-commerce is rapidly transforming the mens underwear market. Online platforms allow consumers to access a wide variety of brands, styles, and sizes, along with detailed product information and reviews. Subscription services and direct-to-consumer (D2C) models are emerging, providing personalized recommendations and exclusive launches. Social media and influencer marketing also play a pivotal role, particularly among millennials and Gen Z, driving both awareness and sales in the digital ecosystem.

Mens Underwear Market Drivers

Rising Fashion Consciousness

Mens underwear is increasingly seen as a fashion statement rather than purely functional apparel. Younger consumers, especially in urban areas, are adopting stylish cuts, vibrant colors, and hybrid designs like boxer briefs and trunks. This trend has led brands to innovate with premium fabrics and unique design elements, boosting overall market revenue.

Premiumization and Comfort Focus

Increasing disposable incomes and willingness to pay for comfort-oriented apparel have fueled growth in the premium mens underwear segment. Fabrics such as modal, bamboo, and performance blends cater to health-conscious and athleisure consumers, offering moisture-wicking, antibacterial, and stretchable options that justify higher price points.

Rapid E-Commerce Penetration

The expansion of online retail channels has created new opportunities for brands to reach broader audiences, including Tier-2 and Tier-3 cities in APAC. Subscription-based models, exclusive online collections, and seamless shopping experiences are contributing to faster adoption and higher sales volumes globally.

Market Restraints

Intense Competition and Brand Saturation

The market is highly competitive with numerous global and local players. Price wars and aggressive promotional strategies can limit profit margins, particularly in mature markets like North America and Europe. Emerging brands face challenges in gaining visibility against established players with strong brand loyalty.

Raw Material Price Volatility

Fluctuations in cotton, polyester, and other textile fiber prices impact production costs, posing a challenge for manufacturers in maintaining consistent pricing. Supply chain disruptions and regional textile shortages can further constrain growth.

Mens Underwear Market Opportunities

Expansion in Emerging Economies

Markets in Asia-Pacific, Latin America, and Africa present significant growth potential. Rising urbanization, increasing disposable incomes, and the adoption of branded underwear are driving demand. Companies can leverage retail expansion, e-commerce platforms, and targeted marketing campaigns to capture these emerging markets.

Sustainable and Eco-Friendly Products

The increasing awareness of sustainability among consumers creates an opportunity for eco-friendly underwear made from bamboo, organic cotton, and recycled fibers. Brands that emphasize ethical production and environmental certifications are likely to gain a competitive edge and attract premium-conscious customers.

Technological Integration and Smart Fabrics

Innovation in performance and smart fabrics, including moisture-wicking, anti-bacterial, and temperature-regulating textiles, allows companies to address health-conscious and athleisure consumer segments. Integration of wearable technology for fitness tracking in sports-oriented underwear could emerge as a niche market, providing higher margins for early adopters.

Product Type Insights

Boxer briefs are the leading product type globally, representing approximately 40% of the 2024 market. Their hybrid design, combining the support of briefs with the coverage of boxer shorts, makes them versatile and preferred by younger and urban consumers. Briefs and boxers follow as secondary product types, with trunks gaining popularity among fashion-driven youth. Long and thermal underwear remain niche but are relevant in colder climates.

Material Insights

Cotton remains the most widely used material, capturing 55% of the market in 2024 due to its comfort, breathability, and affordability. Modal and microfiber blends are growing rapidly in premium and performance segments, while bamboo-based fabrics are emerging due to eco-conscious consumer preferences. Lycra and spandex blends dominate the athletic and performance categories.

Distribution Channel Insights

Online retail accounts for 30% of the global market in 2024 and is the fastest-growing distribution channel, driven by convenience, variety, and targeted digital marketing. Offline retail, including supermarkets, department stores, and brand-owned outlets, remains significant in emerging markets. Third-party retailers also play a key role in reaching non-urban regions.

Age Group Insights

The 26–35 years age group represents the largest market share at 35%, driven by urban professionals seeking comfort, style, and premium products. The 18–25 years segment is highly trend-sensitive, preferring fashion-forward designs, while the 36–50 years cohort focuses on durability and classic styles. Consumers aged 50+ prioritize functional and comfortable underwear.

End-Use Insights

Casual and everyday wear dominates the market, accounting for approximately 60% of demand in 2024. The athleisure and performance segments are growing fastest due to fitness trends and sportswear integration. Formal/professional wear remains niche but stable, while thermal/seasonal use is relevant in colder regions. Export-driven demand is significant from North America and Europe, while production hubs in China, India, and Bangladesh support global supply chains.

| By Product Type | By Material | By Distribution Channel | By Age Group | By End-Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds 35% of the global market in 2024, led by the U.S. and Canada. High disposable incomes, brand awareness, and preference for premium products drive demand. Online channels and retail stores both contribute significantly to sales.

Europe

Europe accounts for 30% of the market in 2024, with Germany, the U.K., and France as leading consumers. Sustainability, eco-friendly fabrics, and fashion-conscious preferences are key growth drivers. Europe remains a leader in premium and designer underwear adoption.

Asia-Pacific

APAC is the fastest-growing region (9% CAGR), driven by urbanization, rising middle-class income, and brand awareness in China, India, and Japan. Online retail penetration accelerates market growth, and younger demographics drive fashion-oriented trends.

Latin America

Brazil, Mexico, and Argentina are leading markets in LATAM, with rising interest in fashion-forward and mid-range underwear. Growth is driven by urban youth and emerging online retail infrastructure.

Middle East & Africa

Premium demand is emerging in Gulf countries such as UAE, Saudi Arabia, and Qatar. Africa remains a manufacturing and export hub, with rising intra-regional consumption supporting market expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Mens Underwear Market

- Hanesbrands Inc.

- Fruit of the Loom

- Calvin Klein (PVH Corp.)

- Jockey International

- Gildan Activewear

- Tommy Hilfiger

- Hugo Boss

- Uniqlo

- Marks & Spencer

- Zara

- H&M

- Puma

- Nike

- Adidas

- Lululemon

Recent Developments

- In March 2025, Hanesbrands Inc. launched a new eco-friendly underwear line using bamboo and organic cotton fabrics across North America and Europe.

- In January 2025, Jockey International expanded its D2C online platform in India, offering personalized subscriptions and exclusive boxer brief collections.

- In February 2025, Calvin Klein introduced a smart underwear range with moisture-wicking and temperature-regulating fabrics, targeting athleisure consumers in APAC and North America.