Mastectomy Breast Forms Market Size

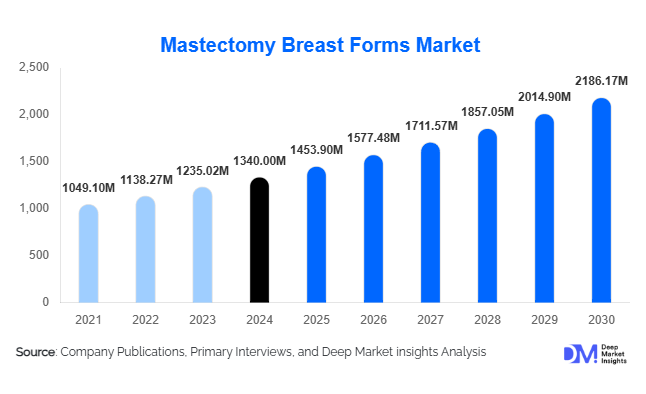

According to Deep Market Insights, the global mastectomy breast forms market size was valued at USD 1,340 million in 2024 and is projected to grow from USD 1,453.90 million in 2025 to reach USD 2,186.17 million by 2030, expanding at a CAGR of 8.5% during the forecast period (2025–2030). The market growth is primarily driven by rising incidences of breast cancer, increasing post-mastectomy rehabilitation awareness, innovations in comfort and customization of breast forms, and the expansion of distribution channels, including online and direct-to-consumer platforms.

Key Market Insights

- Silicone breast forms dominate the market, owing to their realistic appearance, weight, and comfort, accounting for nearly 50% of global market share in 2024.

- Full breast forms represent the leading product type, capturing more than 45% of the market, as they are preferred by patients undergoing unilateral or bilateral mastectomies for symmetry and aesthetic restoration.

- North America leads the market, contributing around 40% of global revenues in 2024 due to established healthcare infrastructure, insurance coverage, and patient awareness.

- Asia-Pacific is the fastest-growing region, driven by rising breast cancer incidence, improving healthcare facilities, and increasing disposable incomes in countries like India and China.

- Online and direct-to-consumer distribution channels are rapidly expanding, offering virtual fittings, customization options, and greater accessibility to end users globally.

- Technological integration, including 3D scanning, 3D printing, and adjustable prosthetic designs, is reshaping product innovation and consumer adoption.

Latest Market Trends

Personalization and Customization of Breast Forms

Manufacturers are increasingly adopting 3D scanning and printing technologies to create custom-fitted breast forms that match individual body contours. Adjustable and modular designs allow patients to modify the form based on swelling, body changes, or lifestyle needs. Eco-friendly and hypoallergenic materials are also gaining traction, providing lightweight, breathable, and sustainable options. These innovations improve comfort, aesthetic appeal, and overall patient satisfaction, driving higher adoption rates globally.

Growth of Online and Direct-to-Consumer Channels

Digital platforms and e-commerce channels are transforming the distribution of mastectomy breast forms. Consumers can now access virtual fitting tools, explore a wide range of product types, and compare prices without visiting physical boutiques or clinics. Telehealth services integrated with post-surgery care allow remote guidance, consultations, and follow-ups, enhancing patient support. These channels are particularly effective in emerging markets, where physical access to specialty centers is limited.

Mastectomy Breast Forms Market Drivers

Increasing Breast Cancer Incidences and Surgeries

Rising breast cancer prevalence worldwide, combined with better detection and treatment options, is driving demand for mastectomy procedures. As more women undergo unilateral or bilateral mastectomies, the need for post-surgical prosthetic breast forms increases. Early detection and improved survival rates also lengthen the duration of prosthetic use, boosting overall market demand.

Technological and Material Advancements

Advances in silicone, gel, and foam materials, along with realistic textures and adjustable designs, have improved wearer comfort and aesthetics. Custom-fit solutions, lightweight designs, and modular inserts cater to diverse patient needs, enhancing adoption and market penetration. Innovation in materials also enables applications for sports, swimming, and daily wear, expanding functional use cases.

Growing Awareness and Insurance Support

Patient awareness, advocacy programs, and social support initiatives are encouraging post-mastectomy prosthetic use. Health insurance and reimbursement schemes in North America and Europe are making premium products more accessible. Hospitals, clinics, and NGOs actively promote the psychological and physical benefits of breast forms, contributing to steady market growth.

Market Restraints

High Costs of Premium Prosthetics

Silicone and custom breast forms are expensive, limiting adoption in developing economies. Import duties, lack of insurance coverage, and out-of-pocket expenses remain barriers to broader penetration. Lower-cost alternatives such as foam or polyfill forms, though more affordable, may not meet patient preferences for realism or comfort.

Regulatory and Standardization Challenges

Breast forms are classified as medical devices in many countries, requiring compliance with safety, biocompatibility, and labeling standards. Regulatory differences across regions can delay product launches and increase costs. Manufacturers must ensure quality consistency, fit accuracy, and durability to meet stringent standards, which may limit smaller players’ market entry.

Mastectomy Breast Forms Market Opportunities

Technology-Driven Customization

3D scanning, 3D printing, and adjustable prosthetic designs present a significant opportunity for innovation. Customization improves patient satisfaction, comfort, and aesthetics, creating differentiation for manufacturers. Modular and adaptive designs enable a single form to meet multiple sizing requirements, expanding the addressable market and enhancing repeat purchase potential.

Emerging Market Expansion

Asia-Pacific, Latin America, and parts of the Middle East and Africa represent high-growth markets due to rising breast cancer incidence, increasing healthcare access, and improving incomes. Governments and NGOs promoting awareness, subsidized programs, and insurance support are facilitating greater adoption. Localized manufacturing hubs can further reduce costs and improve accessibility.

Enhanced Distribution Channels

Online retail and direct-to-consumer channels are transforming accessibility. Virtual fittings, telehealth consultations, and enhanced e-commerce platforms reduce dependence on physical boutiques and clinics. Partnerships with hospitals, specialty centers, and NGOs for distribution and awareness campaigns can further boost adoption rates and market penetration.

Product Type Insights

Full breast forms dominate the market, accounting for approximately 45–55% of the global market in 2024. These forms are preferred for symmetry and aesthetic restoration post-mastectomy. Partial forms and temporary forms are gaining traction as complementary solutions, particularly in emerging markets and cost-sensitive segments. Custom and adjustable forms are emerging as high-growth niches due to technological adoption and personalized patient requirements.

Application Insights

Post-mastectomy rehabilitation remains the leading application, encompassing both full and partial compensation forms. Daily wear applications and activity-specific forms for swimming or sports are growing rapidly. Increasing awareness of psychological rehabilitation and aesthetic satisfaction drives adoption across these applications. Emerging use cases in transgender and non-binary patient segments also present untapped potential.

Distribution Channel Insights

Specialty boutiques and prosthetic fitting centers historically dominate the market, accounting for roughly 45% of revenue in 2024. Online and direct-to-consumer channels are rapidly expanding, offering convenience, virtual fitting, and customization options, currently representing around 25% of market share. Hospitals, clinics, and pharmacies contribute the remaining share, particularly in regions with strong medical insurance coverage.

End-User Insights

Post-mastectomy patients are the primary end-users. Growing segments include individuals purchasing directly online and users requiring activity-specific or customizable forms. The rise of wellness-oriented rehabilitation programs, coupled with telehealth guidance, is boosting adoption. Export-driven demand is increasing, particularly from emerging economies importing premium forms from North America and Europe.

| By Product Type | By Material Type | By End-Use/Application | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America leads the global market with approximately 40% share in 2024. The U.S. dominates due to its advanced healthcare infrastructure, insurance coverage, and awareness programs. Canada contributes moderately, with growing adoption in urban centers. Technological adoption and high patient affordability support sustained demand.

Europe

Europe accounts for 25–30% of the market in 2024, with Germany, the UK, France, and Italy leading. Strong insurance coverage, medical device standards, and awareness campaigns drive market penetration. Sustainable and high-quality silicone products are preferred, with growing interest in customized and adjustable forms.

Asia-Pacific

Asia-Pacific is the fastest-growing region, driven by countries like India, China, Japan, and South Korea. Rising breast cancer incidence, increasing healthcare infrastructure, and growing disposable income contribute to double-digit growth rates. E-commerce channels and awareness programs are further accelerating adoption.

Latin America

Latin America accounts for around 5–7% of global market share, with Brazil, Argentina, and Mexico as key countries. Adoption is increasing among affluent consumers, primarily for full breast forms and mid-range silicone products. Export dependency is high, and growth is driven by awareness and access improvements.

Middle East & Africa

These regions represent 2–5% of the market, with South Africa, UAE, and Saudi Arabia leading demand. Growth is gradual but steady, with luxury forms for high-income patients and increasing awareness campaigns driving adoption.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Mastectomy Breast Forms Market

- Amoena GmbH

- Anita Dr. Helbig GmbH

- American Breast Care

- Nearly Me Technologies

- TruLife

- ContourMed

- Ontario Breast Forms

- Cosima Medical

- LilyCare

- Hanna Prosthetics

- Allure Prosthetics

- Natural Form Breast Prosthetics

- Breast Forms International

- Advanced Prosthetic Designs

- Vitaform

Recent Developments

- In May 2025, Amoena GmbH launched a new range of adjustable, lightweight silicone breast forms, incorporating advanced 3D printing technology for personalized fit.

- In April 2025, American Breast Care expanded its online direct-to-consumer platform in India and China, integrating virtual fitting and telehealth consultation services.

- In February 2025, Nearly Me Technologies introduced eco-friendly, hypoallergenic breast forms designed for daily wear and sports applications, targeting emerging markets in the Asia-Pacific.