Luxury Towels Market Size

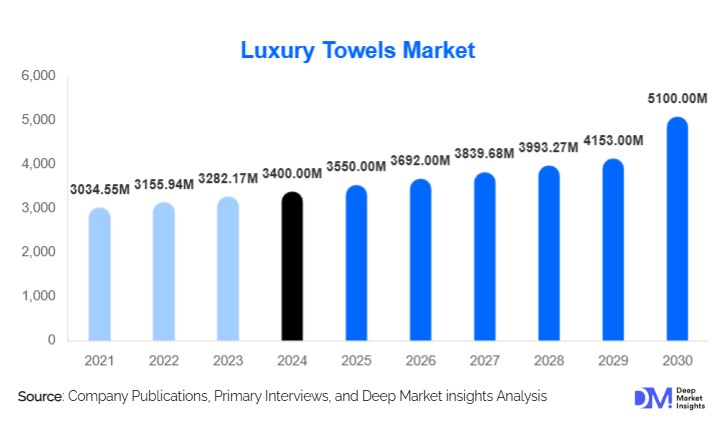

According to Deep Market Insights, the global luxury towels market size was valued at USD 3,400 million in 2024 and is projected to grow from USD 3536.00 million in 2025 to reach USD 4302.08 million by 2030, expanding at a CAGR of 4.0% during the forecast period (2025–2030). The luxury towels market growth is primarily driven by the rising consumer inclination toward premium home textiles, the expansion of the hospitality and wellness sectors, and increasing demand for sustainable and eco-certified fabrics across global markets.

Key Market Insights

- Premium long-staple cotton towels dominate the market, accounting for nearly 50% of global revenue in 2024, owing to their superior softness, absorbency, and durability.

- Sustainable and organic materials such as bamboo, organic cotton, and linen are emerging as the fastest-growing subsegments, driven by eco-conscious consumers and regulatory support.

- Residential demand leads globally, representing over 55% of total market share in 2024 as consumers seek hotel-like comfort at home.

- Hospitality and wellness sectors are experiencing rapid adoption of luxury towels, particularly in premium hotels, resorts, and spas.

- North America remains the largest regional market, while Asia-Pacific is the fastest-growing region, supported by rising disposable incomes and booming tourism infrastructure.

- Technological innovations in towel manufacturing as antimicrobial coatings, quick-dry weaves, and eco-friendly dyeingare redefining product differentiation and premium pricing.

What are the latest trends in the luxury towels market?

Sustainable and Organic Towels Gaining Momentum

The global shift toward eco-conscious living is reshaping the luxury towels market. Consumers increasingly prefer organic cotton, bamboo, and linen towels certified by GOTS, OEKO-TEX, and Fair-Trade standards. Manufacturers are integrating closed-loop water recycling, plant-based dyes, and biodegradable packaging to align with sustainability mandates. Hotels and spas are also transitioning toward eco-certified linens to meet their ESG goals. This trend not only supports environmental protection but also enhances brand image, as eco-luxury has become a defining factor in consumer purchasing decisions.

Customization and Designer Collaborations

Personalization is redefining luxury. Demand for monogrammed, embroidered, and designer-label towels is growing rapidly among affluent consumers seeking exclusivity. Collaborations between home textile producers and fashion designersoffering limited-edition color palettes and patternshave become a key differentiator. Digital tools allow consumers to design bespoke towel sets online, supporting direct-to-consumer (D2C) sales models. This convergence of luxury design and digital engagement is expanding profit margins while enhancing customer loyalty in mature markets.

Digital and E-Commerce Expansion

The online luxury retail ecosystem is transforming how towels are marketed and sold. Brands are using immersive product visualization, influencer partnerships, and virtual showrooms to replicate tactile in-store experiences. E-commerce now accounts for nearly 40% of luxury towel purchases in developed markets. Data-driven marketing and AI-powered recommendations have enabled brands to target niche segments, such as eco-conscious millennials and hospitality buyers, with precision. This digital-first approach is bridging global supply and demand while fostering brand discovery.

What are the key drivers in the luxury towels market?

Rising Disposable Incomes and Home Luxury Upgrades

Higher household incomes and growing interest in home aesthetics are fueling demand for luxury towels. Consumers are investing in premium bath linen as part of broader home décor upgrades, aiming to replicate the comfort of luxury hotels. The trend toward self-care, bathroom remodeling, and wellness-centric lifestyles has further boosted premium towel sales. Markets like the U.S., Japan, and Western Europe continue to lead in per capita spending, while Asia-Pacific consumers are increasingly adopting luxury lifestyle products.

Expansion of Hospitality and Wellness Sectors

Rapid growth in the global hospitality industrydriven by hotel construction, wellness tourism, and spa culture a major catalyst for luxury towel demand. Premium hotels, resorts, and health retreats require high-quality towels that withstand repeated washing while maintaining texture and softness. The rising number of boutique hotels and luxury cruise lines is creating consistent B2B demand for branded, customized, and sustainable towel solutions.

Growing Awareness of Hygiene and Health

Post-pandemic hygiene awareness has accelerated demand for antibacterial and quick-dry luxury towels. Innovations in fiber treatment, such as silver-ion finishing and moisture-wicking technologies, cater to consumers prioritizing cleanliness and durability. Health-conscious buyers now favor towels offering comfort, breathability, and odor resistance, expanding opportunities for performance-based luxury textiles.

What are the restraints for the global market?

Raw Material Price Volatility

The market’s profitability is vulnerable to fluctuations in cotton, bamboo, and linen prices. Climate change, crop yield variations, and trade restrictions influence raw material costs, thereby affecting manufacturers’ margins. Supply chain disruptionsranging from shipping delays to energy cost spikesfurther intensify cost pressures, making pricing stability a persistent challenge.

Brand Dilution and Counterfeit Products

The proliferation of counterfeit or low-quality imitations in online and unregulated markets undermines consumer trust and damages established luxury brands. Such products, often mislabeled as “premium,” erode price integrity and confuse customers. To maintain exclusivity, major brands are increasing investments in authentication technologies, premium packaging, and direct sales channels.

What are the key opportunities in the luxury towels industry?

Eco-Certified and Circular Manufacturing

The next growth frontier lies in achieving circular productionrecycling water, using renewable energy, and employing biodegradable inputs. Governments and consumers are rewarding sustainable producers through incentives and premium pricing. Eco-certified towel ranges not only meet rising ESG expectations but also open export opportunities to regions with stringent environmental regulations, such as the EU and North America.

Emerging Markets and Hospitality Expansion

Asia-Pacific, the Middle East, and Latin America offer untapped potential for luxury towel producers. Rapid hotel and resort construction in these regions, combined with the rising affluence of middle-class consumers, is boosting B2B and B2C sales. Manufacturers establishing regional production or distribution centers stand to benefit from reduced logistics costs and proximity to emerging demand hubs.

Personalized Luxury and Smart Textiles

The convergence of technology and personalization presents an emerging opportunity. Smart towels featuring embedded sensors for moisture tracking, antibacterial coatings, or adaptive texture finishes are under development. Luxury brands adopting personalization software and 3D design visualization tools will enhance customer experience while increasing retention in digital channels.

Product Type Insights

Bath towels and bath sheets dominate the luxury towels market, accounting for nearly 45% of global revenue in 2024. Their large surface area, frequent household use, and high aesthetic appeal make them the cornerstone of premium collections. Hand towels and spa towels represent fast-growing niches, fueled by demand from hotels, gyms, and wellness centers. Beach towels and designer vanity towels occupy smaller but profitable segments, catering to seasonal and fashion-driven consumers.

Material Insights

Long-staple cottonincluding Egyptian, Pima, and Turkish varietiesremains the material of choice, commanding approximately 50% market share in 2024. Its exceptional softness and durability justify premium pricing. Organic and bamboo fibers are growing at over 6% annually, attracting environmentally conscious consumers and luxury hospitality buyers. Linen and blended fabrics are niche categories, valued for quick-dry and lightweight properties suitable for spa and travel applications.

Distribution Channel Insights

Offline retail continues to lead with around 60% share in 2024, as luxury consumers prefer tactile evaluation and brand experience offered by boutiques and department stores. However, online and D2C channels are expanding rapidly, capturing affluent digital buyers through personalized recommendations, virtual showrooms, and influencer-driven marketing. B2B contracts with hotels and spas represent a stable, recurring revenue stream for established brands.

End-Use Insights

The residential segment leads with over 55% market share in 2024, reflecting growing home renovation and lifestyle-upgrade trends. The hospitality and wellness segment is the fastest-growing, driven by luxury hotel expansions, wellness retreats, and tourism infrastructure development in emerging economies. Corporate and institutional usesincluding premium offices, airlines, and luxury cruisesare niche but steadily expanding end-use applications.

| By Product Type | By Material | By Distribution Channel | By End-Use |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounted for approximately 33% of the global luxury towels market in 2024. The region’s dominance stems from high per capita income, mature retail infrastructure, and strong demand from the hospitality industry. The U.S. leads in imports of premium towels, with consumers emphasizing organic and designer brands. Digital retail penetration and a culture of home luxury upgrades further sustain market leadership.

Europe

Europe holds around 27% market share, supported by established textile craftsmanship, strong sustainability regulations, and widespread eco-label adoption. The U.K., Germany, and France are leading markets for premium and organic towel products. European consumers prioritize ethical sourcing and minimalistic aesthetics, fostering innovation in sustainable luxury materials.

Asia-Pacific

Asia-Pacific represents roughly 22% of the market in 2024 and is projected to register the highest CAGR (5–6%) through 2030. China, India, and Japan drive growth through expanding hospitality projects, increasing disposable incomes, and domestic production capacity. India and Turkey also serve as major exporters supplying global premium brands, leveraging cost-effective but high-quality textile manufacturing.

Middle East & Africa

MEA captures about 9% of the global market, with GCC countriesparticularly the UAE and Saudi Arabialeading demand due to luxury tourism and high-end hotel development. South Africa shows emerging potential, balancing domestic production with tourism-driven imports. Rising hospitality investments under “Vision 2030” initiatives are expected to further strengthen regional demand.

Latin America

Latin America accounts for approximately 6% of global revenue. Brazil and Mexico are the key markets, showing increasing appetite for premium home textiles among affluent consumers. Growth is supported by the expansion of luxury hotel chains and rising imports of European and Asian premium towel brands.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Luxury Towels Market

- Welspun India Ltd.

- Trident Group

- Springs Global

- Frette

- Matouk

- Sferra

- Ralph Lauren Home

- Brooklinen

- Boll & Branch

- Christy

- 1888 Mills

- Loftex

- Thomas Ferguson Irish Linen

- Frontgate

- Hammam Linen

Recent Developments

- In May 2025, Welspun India announced its new eco-friendly towel line featuring 100% organic long-staple cotton, manufactured through water-efficient processes to achieve GOTS certification.

- In April 2025, Trident Group unveiled a luxury towel collection co-branded with designer labels, emphasizing customization and sustainable packaging.

- In February 2025, Frette introduced its “Resort Wellness” series targeting five-star hotel chains, using antibacterial silver-infused fibers for hygiene-focused hospitality clients.

- In January 2025, Boll & Branch expanded into Asia-Pacific through a strategic e-commerce launch in Japan and India, strengthening its global D2C presence.