Lock Cores Market Size

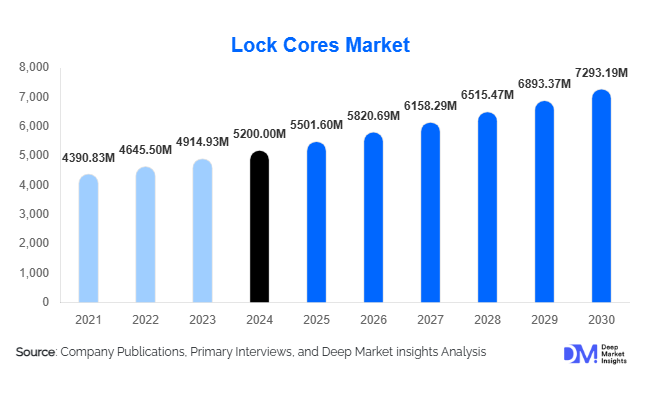

According to Deep Market Insights, the global lock cores market size was valued at USD 5,200 million in 2024 and is projected to grow from USD 5501.60 million in 2025 to reach USD 7293.19 million by 2030, expanding at a CAGR of 5.8% during the forecast period (2025–2030). The lock cores market growth is primarily driven by increasing security concerns across residential, commercial, and industrial sectors, technological advancements in electronic and smart locks, and the rising demand for high-security access control solutions globally.

Key Market Insights

- Mechanical lock cores remain the dominant segment, due to their reliability and cost-effectiveness, accounting for approximately 60% of the market share in 2024.

- Electronic and smart lock cores are rapidly growing, fueled by the adoption of IoT-enabled smart homes and commercial security systems.

- North America leads globally, with the U.S. holding the largest market share (35% in 2024) due to high security awareness and advanced infrastructure.

- Asia-Pacific is the fastest-growing region, driven by rapid urbanization, industrialization, and rising residential construction in China and India.

- Integration with IoT and biometric technologies is redefining security standards, providing remote monitoring and keyless access solutions.

- Government initiatives and regulations, such as stricter building codes and safety mandates, are accelerating demand for high-quality lock cores.

What are the latest trends in the lock cores market?

Smart Lock Integration and IoT Adoption

Lock core manufacturers are increasingly incorporating electronic and smart functionalities into traditional mechanical locks. IoT-enabled lock cores allow users to monitor and control access remotely via mobile apps, offering real-time alerts and keyless entry options. These innovations appeal to both residential and commercial customers, particularly in urbanized regions where security and convenience are top priorities. Smart lock integration also enables compatibility with other smart devices such as surveillance cameras, alarm systems, and building management systems, driving cross-sector adoption.

Material Innovation and Durability Enhancements

Manufacturers are developing lock cores using high-durability materials such as stainless steel and advanced alloys to resist tampering, corrosion, and environmental wear. Brass remains a popular material due to its long-lasting performance, while stainless steel is preferred for industrial and high-security applications. The trend toward premium materials enhances product life cycles and strengthens consumer trust, particularly in high-value residential and commercial properties.

What are the key drivers in the lock cores market?

Rising Security Concerns

Global increases in theft, break-ins, and unauthorized access are driving demand for advanced locking systems. Consumers and businesses are investing in high-quality lock cores that offer robust mechanical and electronic security features. The residential segment, in particular, is adopting smart locks to enhance safety and convenience, contributing to market growth.

Technological Advancements

Innovations such as electronic, biometric, and smart lock cores are reshaping the security landscape. These technologies provide enhanced access control, audit trails, and remote management, making them attractive to both commercial and residential customers. Adoption of these technologies is growing steadily, especially in developed economies with high security standards.

Growth in Construction and Industrial Sectors

Expansion of residential, commercial, and industrial infrastructures is fueling demand for lock cores. New buildings and industrial facilities require secure access solutions, leading to increased sales. Urbanization in the Asia-Pacific and the Middle East regions is particularly contributing to this trend.

What are the restraints for the global market?

High Manufacturing Costs

Advanced lock cores, especially electronic and biometric variants, require significant R&D investment and costly components. This drives up the end-user price, limiting adoption in cost-sensitive markets. Smaller manufacturers may struggle to compete with established players in the premium segment due to these high costs.

Complex Installation and Maintenance

Some smart and electronic lock cores require professional installation and regular maintenance, which can hinder market adoption. Residential and small commercial customers may be reluctant to pay additional service fees, slowing penetration in certain segments.

What are the key opportunities in the lock cores industry?

Smart Home and Building Automation

The rise of smart homes and automated commercial buildings presents opportunities for manufacturers to integrate lock cores with IoT platforms. These products can be controlled remotely, monitored in real-time, and connected with other security systems, providing comprehensive security solutions. The growing consumer preference for convenience, security, and energy-efficient solutions is further boosting demand.

Expansion in Emerging Markets

Rapid urbanization and industrialization in regions such as Asia-Pacific, Latin America, and parts of the Middle East are driving demand for lock cores. Infrastructure projects, residential developments, and commercial buildings in countries like China, India, Brazil, and the UAE are creating new growth opportunities for manufacturers.

Regulatory and Safety Standards

Governments are implementing stricter safety and building regulations, mandating high-security locking systems for commercial and public infrastructure. Compliance with these regulations offers opportunities for manufacturers to introduce certified, premium lock cores, strengthening market trust and driving sales.

Product Type Insights

Mechanical lock cores dominate the market due to their cost-effectiveness and reliability, representing 60% of market share in 2024. Electronic and smart lock cores are witnessing faster growth, particularly in residential and commercial applications requiring keyless entry, remote monitoring, and IoT integration. Biometric-enabled lock cores are emerging as a niche high-security solution, especially in industrial and government sectors. Brass remains the most commonly used material due to its durability, while stainless steel lock cores are gaining traction for premium and industrial applications.

Application Insights

Residential applications lead demand, accounting for 45% of market share in 2024, as homeowners increasingly adopt advanced security solutions. Commercial applications are also growing rapidly due to the need for secure offices, institutions, and public facilities. Industrial and institutional applications are emerging, driven by factories, warehouses, and government infrastructure adopting high-security lock cores. The growing integration of electronic and smart locks in these sectors is creating opportunities for innovation and cross-selling.

Distribution Channel Insights

Direct sales and online platforms dominate the lock cores market, with manufacturers increasingly offering e-commerce options for residential customers. Industrial and commercial customers often rely on specialized distributors and security system integrators. Emerging trends include subscription-based security solutions, bundled smart home packages, and partnerships with construction companies to integrate lock cores in new projects. Online reviews and digital marketing are playing a critical role in influencing customer purchasing decisions.

End-Use Insights

The residential sector is the largest end-user of lock cores, driven by home security concerns and the adoption of smart locks. Commercial and industrial sectors are growing steadily, particularly in office complexes, manufacturing units, and high-security facilities. New applications are emerging in smart buildings, co-working spaces, and healthcare facilities, where access control and integrated security solutions are critical. Export-driven demand is increasing, with Asia-Pacific importing high-end lock cores from North America and Europe.

| By Product Type | By Application | By Material | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America, led by the U.S., accounted for 35% of the global market in 2024. Strong adoption of smart home technologies, high security awareness, and strict safety regulations drive demand. Canada also contributes to the market with increased residential and commercial construction projects requiring advanced locking solutions.

Europe

Europe held 30% of the global market share in 2024, with Germany, the U.K., and France being the largest contributors. High adoption of electronic and biometric lock cores and regulatory mandates for building security support growth. The region emphasizes high-quality materials and innovation, further strengthening market penetration.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with countries like China, India, and Japan driving demand. Rapid urbanization, industrialization, and increased residential developments create a strong need for both mechanical and smart lock cores. CAGR for the region is projected at 8.2% from 2025–2030.

Latin America

Latin America, including Brazil, Mexico, and Argentina, is experiencing steady growth, driven by urban infrastructure and rising commercial investments. Demand is primarily focused on mechanical lock cores and mid-range security solutions.

Middle East & Africa

The Middle East, led by the UAE and Saudi Arabia, is witnessing growing adoption of high-security and smart lock cores, particularly in commercial and government buildings. Africa’s demand is concentrated in urbanized areas and industrial hubs, supported by infrastructure expansion and private security investments.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Lock Cores Market

- Assa Abloy

- Allegion

- Schlage

- Yale

- Godrej & Boyce

- Hafele

- Kaba

- Kwikset

- Master Lock

- Emtek

- Dorma

- SimonsVoss

- Mul-T-Lock

- Medeco

- STANLEY Security

Recent Developments

- In March 2025, Assa Abloy launched a new line of IoT-enabled lock cores integrating biometric authentication for commercial buildings.

- In January 2025, Allegion expanded its electronic lock portfolio in Asia-Pacific, targeting smart home developers and large-scale residential projects.

- In November 2024, Godrej & Boyce introduced high-security stainless steel lock cores with tamper-resistant designs for industrial applications.