LED Lighting Bulkheads Market Size

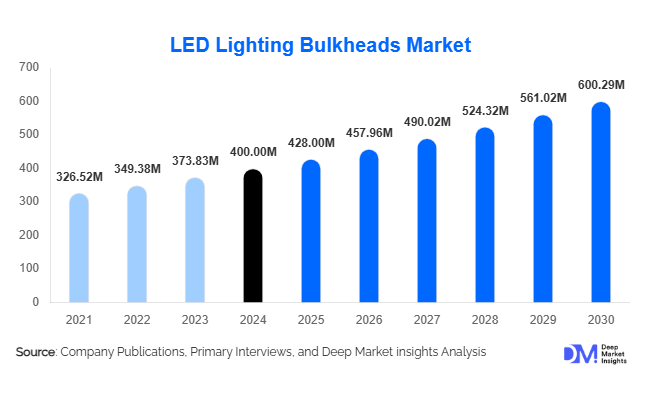

According to Deep Market Insights, the global LED lighting bulkheads market size was valued at USD 400 million in 2024 and is projected to grow from USD 428 million in 2025 to reach USD 600.29 million by 2030, expanding at a CAGR of 7% during the forecast period (2025–2030). The market growth is primarily driven by the increasing adoption of energy-efficient lighting, growing demand for durable and weather-resistant fixtures in industrial and public infrastructure, and the rising integration of smart and IoT-enabled features in lighting systems.

Key Market Insights

- Medium-output LED bulkheads dominate the market, offering an optimal balance of brightness, energy efficiency, and cost-effectiveness for commercial, residential, and public applications.

- Asia-Pacific leads the global demand, driven by rapid urbanization, industrial expansion, and infrastructure investments in China, India, and Southeast Asia.

- Smart and sensor-integrated bulkheads are emerging as high-growth segments, enabling energy savings and automation in commercial and industrial applications.

- Regulatory initiatives and energy efficiency standards in North America and Europe are promoting the adoption of LED bulkheads in public infrastructure and commercial buildings.

- Emerging markets in the Middle East & Africa are increasingly adopting durable, high IP/IK-rated bulkheads for outdoor, industrial, and coastal applications.

- Technological innovations, such as IoT-enabled control, emergency backup integration, and solar-powered solutions, are reshaping product offerings and creating new market opportunities.

What are the latest trends in the LED lighting bulkheads market?

Smart and Sensor-Enabled Fixtures

LED bulkheads are increasingly being equipped with motion sensors, daylight harvesting, and IoT connectivity, enabling automated lighting control and significant energy savings. These smart fixtures are particularly favored in commercial buildings, warehouses, and transit infrastructure, where operational efficiency and reduced energy consumption are priorities. Integration with building management systems (BMS) allows facility managers to monitor, schedule, and optimize lighting performance remotely, while also supporting emergency lighting protocols in case of outages. The trend is accelerating in smart city projects and modern commercial developments across the Asia-Pacific and North America.

Durability and High IP/IK Ratings

Industrial, outdoor, and coastal applications demand bulkheads that can withstand harsh environmental conditions. Manufacturers are offering fixtures with high IP (water/dust ingress) and IK (impact) ratings, corrosion-resistant materials, and rugged designs to meet stringent safety standards. This trend is particularly significant in the Middle East & Africa, where bulkheads are exposed to extreme heat, dust, and saline environments. Energy-efficient lighting combined with high durability is becoming a key differentiator among global suppliers.

What are the key drivers in the LED lighting bulkheads market?

Energy Efficiency and Cost Savings

LED bulkheads consume significantly less power than conventional lighting, offering substantial long-term energy savings. This factor is critical for industrial, commercial, and public infrastructure projects where operational costs are a priority. Longer lifespans and reduced maintenance costs further enhance the total cost of ownership, driving adoption across multiple end-use segments globally.

Regulatory Standards and Green Initiatives

Government regulations enforcing energy efficiency and green building standards are propelling LED bulkhead adoption. Incentives for energy-saving retrofits, minimum efficacy requirements, and mandatory emergency lighting standards in public buildings encourage facility managers to upgrade to LED bulkheads. Green certifications like LEED and BREEAM also prioritize efficient, long-lasting lighting fixtures, creating a steady demand pipeline in commercial and institutional sectors.

What are the restraints for the global market?

High Upfront Costs

Although LED bulkheads offer long-term energy savings, the initial purchase price remains higher than conventional lighting fixtures. Smaller construction projects and budget-constrained installations may delay adoption. Additionally, premium features such as sensors, emergency backup, or smart controls increase the capital expenditure required, limiting penetration in cost-sensitive regions.

Supply Chain and Component Constraints

Variations in raw material costs, LED chip supply, driver reliability, and sealing materials can affect product pricing and profitability. Inconsistent quality, warranty concerns, and challenges in meeting local certification standards can slow market growth, especially in emerging economies. Global logistics, import duties, and component shortages also influence market stability.

What are the key opportunities in the LED lighting bulkheads market?

Smart and IoT-Enabled Bulkheads

The integration of sensors and IoT technology offers energy efficiency, remote management, and automation capabilities. This segment provides opportunities for premium product development in commercial and industrial applications, including smart buildings, transit infrastructure, and public facilities. Companies that can combine durability with connectivity are expected to capture high-value contracts and recurring revenue streams through service models.

Infrastructure Expansion in Emerging Markets

Rapid urbanization and industrialization in the Asia-Pacific and the Middle East & Africa create high demand for robust LED bulkheads in new residential, commercial, and industrial projects. Investments in public infrastructure, ports, logistics hubs, and government-backed energy-efficient initiatives provide large-scale procurement opportunities. Localized manufacturing and supply chain optimization can help manufacturers capture market share in these high-growth regions.

Durable and Off-Grid Lighting Solutions

There is a rising demand for solar-powered, off-grid, and rugged bulkheads suitable for outdoor, industrial, and coastal applications. This presents opportunities for product innovation targeting regions with unreliable grid power or harsh environmental conditions. Emergency-ready and solar-integrated bulkheads are particularly attractive for municipalities and industrial operators looking for energy resilience and sustainability.

Product Type Insights

Standard LED bulkheads remain the largest product segment, catering to mainstream residential, commercial, and industrial needs due to affordability, reliability, and ease of installation. Sensor-integrated and emergency bulkheads are growing rapidly, particularly in commercial and institutional infrastructure, where safety and energy efficiency are critical. Decorative and architectural bulkheads are emerging in premium residential and hospitality projects, driven by aesthetics and design trends.

Application Insights

Residential applications account for a significant share of the market, with demand for durable, energy-efficient lighting in corridors, balconies, and stairwells. Commercial and industrial applications are the fastest-growing, driven by warehouses, factories, retail, and office infrastructure that require medium to high output bulkheads. Public and municipal applications, including hospitals, schools, transit facilities, and outdoor lighting, are expanding rapidly due to energy-saving mandates, regulatory requirements, and safety standards.

Distribution Channel Insights

Direct sales to contractors, OEMs, and public tenders dominate bulkhead procurement in industrial and municipal projects. Online sales and e-commerce platforms are growing steadily for residential and small commercial buyers, offering transparency, product comparison, and quick delivery. Wholesale and retail distribution channels continue to serve smaller-scale projects, while specialty lighting stores focus on premium and sensor-integrated solutions. The growing importance of project-based tenders and bulk procurement is influencing channel strategies for manufacturers.

End-Use Segment Insights

Industrial and warehouse applications are the fastest-growing end-use segment, driven by automation, operational efficiency, and 24/7 facility lighting requirements. Public infrastructure, including transit terminals, hospitals, and educational institutions, is also expanding rapidly due to government-led modernization initiatives. Residential demand remains substantial, fueled by urbanization, new housing construction, and retrofits. Emerging applications include marine/coastal, solar-powered off-grid solutions, and integration in smart buildings, offering new growth avenues.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds a market share of approximately 28% in 2024, driven by demand for energy-efficient and smart lighting in commercial buildings, industrial facilities, and public infrastructure. The United States dominates, with Canada following closely. Strict energy codes, retrofit programs, and public infrastructure upgrades are key growth factors. North America is projected to grow steadily, with replacement and retrofit driving consistent demand.

Europe

Europe accounts for around 23% of the global market in 2024. Germany, the U.K., and France lead in demand, driven by stringent energy efficiency regulations, green building certifications, and smart city initiatives. Adoption of high IP/IK-rated and emergency-ready bulkheads is particularly strong. Europe is the second-fastest-growing region, with increasing preference for sustainable and IoT-enabled solutions.

Asia-Pacific

Asia-Pacific is the largest and fastest-growing region, with a 30% share in 2024. China and India drive demand due to urbanization, industrialization, and infrastructure projects. Japan, South Korea, and Southeast Asia contribute through commercial and industrial installations. Rapid development in residential, commercial, and public infrastructure ensures sustained high demand. Local manufacturing hubs and cost advantages support global export to other regions.

Middle East & Africa

MEA represents 12% of the market in 2024. Demand is led by Gulf Cooperation Council countries (UAE, Saudi Arabia) and South Africa. Growth is fueled by infrastructure development, harsh environmental conditions necessitating durable lighting, and increasing adoption of smart and rugged bulkheads. Solar and off-grid solutions are particularly relevant in remote areas.

Latin America

Latin America accounts for 7% of the market, with Brazil and Mexico leading demand. Growth is moderate, supported by urban development, commercial construction, and government infrastructure projects. The market is gradually shifting from conventional to energy-efficient LED bulkheads, driven by cost savings and sustainability initiatives.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the LED Lighting Bulkheads Market

- Philips Lighting / Signify

- Osram Licht AG

- Acuity Brands Lighting

- Eaton Corporation

- Zumtobel Group

- Hubbell Lighting

- LEDVANCE

- Dialight plc

- Thorn Lighting

- Havells India

- Bajaj Electricals

- Syska LED

- Opple Lighting

- NVC Lighting

- Megaman

Recent Developments

- In March 2025, Signify launched a range of smart, sensor-integrated bulkheads for commercial and industrial applications in North America and Europe, enhancing energy efficiency and remote monitoring capabilities.

- In February 2025, Osram expanded its high IP/IK-rated LED bulkhead portfolio in Asia-Pacific, targeting infrastructure projects in India and Southeast Asia.

- In January 2025, Acuity Brands introduced solar-powered and off-grid LED bulkheads for remote industrial and municipal applications, aimed at emerging markets in Africa and South Asia.