Infant Car Safety Seat Market Size

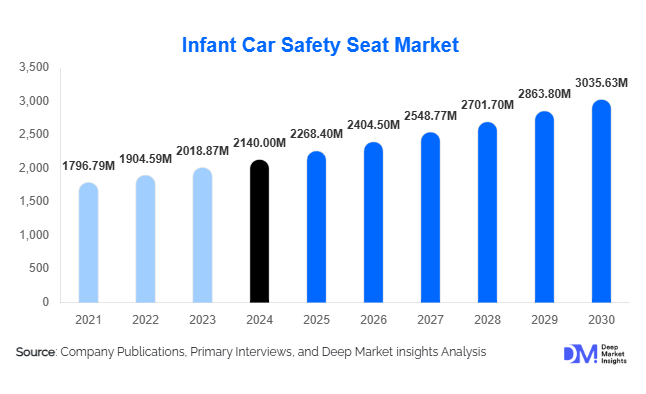

According to Deep Market Insights, the global infant car safety seat market size was valued at USD 2,140 million in 2024 and is projected to grow from USD 2,268.40 million in 2025 to reach USD 3,035.63 million by 2030, expanding at a CAGR of 6% during the forecast period (2025–2030). The market growth is primarily driven by increasing global awareness of child passenger safety, tightening regulatory mandates, rising vehicle ownership, and growing adoption of advanced, technology-integrated car seats among parents worldwide.

Key Market Insights

- Stringent safety regulations and government mandates are accelerating the adoption of certified infant car seats, compelling parents to prioritize compliant products for newborns and toddlers.

- Emerging markets, particularly Asia Pacific and Latin America, are witnessing rapid growth due to rising disposable income, expanding vehicle ownership, and increasing awareness of child passenger safety.

- Technological innovation, including smart sensors, app connectivity, and modular travel-system integration, is differentiating premium products and driving higher average selling prices.

- Offline retail channels dominate the market, as consumers prefer physical inspection and demonstration of safety features before purchase.

- Online e-commerce is growing, driven by digital-native parents seeking convenience, broader product selection, and door-to-door delivery services.

- Premiumization of products through features such as eco-friendly materials, extended rear-facing capability, and enhanced crash protection is reshaping consumer buying behavior.

Latest Market Trends

Extended Rear-Facing and Safety Compliance

Global safety guidelines now recommend extended rear-facing usage, encouraging parents to invest in compliant seats for longer durations. Governments across Europe, North America, and parts of Asia are implementing regulations that mandate certified infant car seats for newborns, with strict crash test requirements. This trend not only drives replacement cycles but also boosts demand for premium and technologically advanced car seats. Manufacturers are focusing on features like energy-absorbing foam, side-impact protection, and ISOFIX/LATCH installation systems to meet these evolving standards, thereby strengthening their market positioning.

Smart and Connected Car Seats

Integration of technology in infant car seats is gaining momentum. Smart seats equipped with installation sensors, motion alerts, temperature monitoring, and app connectivity offer convenience and peace of mind to parents. These features are particularly appealing in mature markets like North America and Europe, where consumers are willing to pay a premium for added safety and usability. Additionally, modular travel-system seats that integrate with strollers are increasingly popular, expanding the functionality of car seats beyond vehicle use.

Infant Car Safety Seat Market Drivers

Heightened Safety Awareness and Stringent Regulations

Parents and caregivers are increasingly aware of child passenger safety risks. Governments and regulatory bodies enforce strict standards, such as UN R129 in Europe and NHTSA FMVSS 213 in the U.S., which require certified car seats for newborns and young children. These regulations ensure high baseline demand for compliant products and encourage the adoption of advanced safety features, driving market growth.

Rising Vehicle Ownership in Emerging Markets

In regions such as China, India, and Southeast Asia, increasing vehicle ownership and rising disposable incomes are expanding the addressable market for infant car seats. As more families purchase cars, particularly SUVs and family vehicles, demand for certified and comfortable infant seats rises, creating opportunities for global manufacturers to penetrate new markets.

Product Innovation and Premiumization

Manufacturers are introducing innovative products with smart features, modular designs, premium materials, and ease-of-installation technologies. These value-added features encourage higher-priced purchases and replacement of older seats, contributing to revenue growth. The trend toward eco-friendly fabrics and connected seats also aligns with evolving consumer preferences for sustainable and technologically advanced products.

Market Restraints

High Production and Compliance Costs

Meeting advanced safety standards, conducting rigorous crash testing, and integrating smart technologies increase production costs. High retail prices may limit affordability, particularly in price-sensitive emerging markets, potentially slowing market adoption.

Limited Replacement Cycle and Compatibility Issues

Infant car seats are used for a short period (typically birth to 12–24 months), limiting replacement frequency. Additionally, compatibility with different vehicle seat types and installation complexity can hinder adoption, especially in regions with older car models lacking ISOFIX/LATCH systems.

Infant Car Safety Seat Market Opportunities

Expansion in Emerging Markets

Asia Pacific and Latin America present high-growth opportunities due to increasing family vehicle ownership and growing awareness of child safety. Early entry into these markets can help manufacturers establish brand loyalty and capture market share before saturation. Localized products and affordable yet compliant options can accelerate adoption in these regions.

Technological Integration and Value-Added Services

Smart sensors, mobile app connectivity, and travel-system integration are emerging as key differentiators. Manufacturers can capitalize on these innovations to offer premium products, enhance brand loyalty, and explore rental or subscription models, particularly in urban areas and for families who travel frequently.

Regulatory-Driven Product Upgrades

Governments are progressively updating child passenger safety regulations, creating opportunities for manufacturers to launch next-generation car seats. Compliance with stricter safety standards encourages replacement cycles, positions brands as safety leaders, and allows premium pricing for upgraded products.

Product Type Insights

Infant-only car seats dominate the market, accounting for approximately 34% of global revenue in 2024. Their leading position is driven by mandatory usage for newborns, hospital discharge recommendations, and high replacement demand. Convertible and booster seats are also growing, but infant-only seats remain the primary entry point for new parents, particularly in developed regions where safety awareness is high.

Installation / Use Type Insights

Rear-facing car seats lead the market with a 43% share of the 2024 global market. Extended rear-facing recommendations and mandatory compliance with safety standards in Europe and North America drive this trend. Parents increasingly prioritize longer rear-facing usage to maximize child safety, contributing to segment growth.

Distribution Channel Insights

Offline mass-retail channels, including hypermarkets, supermarkets, and department stores, dominate with a 58% share in 2024. Physical inspection, installation demonstration, and certified sales personnel make offline retail the preferred choice for safety-critical purchases. Online channels are rapidly growing, particularly in emerging markets, as digital-native parents seek convenience and a wider product selection.

End-Use Insights

The primary end-use is private passenger vehicles, particularly for families with infants. Emerging growth is observed in rental and transport services, including airport transfers and ride-hailing fleets, which require portable infant seats. Export-driven demand is increasing, with manufacturers in East and Southeast Asia producing for global markets. End-use demand is closely tied to vehicle ownership trends and growing safety awareness, particularly in the Asia Pacific and Latin America.

| By Product Type | By Installation / Use Type | By Distribution Channel | By End-Use |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds the largest share (40%) of the global market in 2024, driven by high disposable income, stringent safety regulations, and consumer preference for premium products. The U.S. dominates the region due to extensive vehicle ownership and enforcement of certified car seat usage. Canada follows closely, with similar regulatory frameworks and awareness levels supporting market growth.

Europe

Europe accounts for 34% of the global market, with Germany, the UK, France, and Italy leading demand. Strong regulation, consumer preference for high-safety products, and established retail infrastructure drive adoption. Younger demographics are particularly interested in eco-friendly and technologically advanced car seats, supporting market expansion.

Asia-Pacific

APAC is the fastest-growing region (20% share in 2024). China, India, Japan, and Australia are key markets, with rising vehicle ownership, expanding middle-class income, and increasing awareness of child safety driving demand. Social media influence and urbanization are further accelerating the adoption of premium and mid-range car seats.

Latin America

LATAM holds 5–10% of the market. Brazil, Argentina, and Mexico are emerging markets with growing outbound demand for premium and mid-range car seats. Increased awareness, urbanization, and family-oriented travel are driving adoption, though regulatory enforcement is less stringent than in North America and Europe.

Middle East & Africa

MEA accounts for 5–10% of the market, with Gulf countries such as the UAE, Saudi Arabia, and Qatar leading demand due to high-income populations and increasing safety awareness. Africa, as a region of vehicle expansion, is gradually adopting certified infant car seats in urban centers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Infant Car Safety Seat Market

- Britax Child Safety Inc.

- Graco Children’s Products Inc.

- Dorel Industries Inc.

- Goodbaby International Holdings Ltd.

- Artsana S.p.A.

- Peg Perego S.p.A.

- Clek Inc.

- Diono LLC

- RECARO Holding GmbH & Co. KG

- UPPAbaby Inc.

- Chicco (Artsana Group)

- Joie Baby Ltd.

- Evenflo Company Inc.

- Maxi-Cosi (Dorel)

- Safety 1st (Dorel)

Recent Developments

- In May 2025, Goodbaby International launched a smart rear-facing seat in China with app connectivity and real-time installation alerts.

- In April 2025, Britax upgraded its convertible car seat line in North America with ISOFIX compatibility and improved side-impact protection.

- In February 2025, Graco introduced a modular travel-system car seat in Europe, integrating stroller and infant seat functionality for convenience and safety.