Hip Protectors Market Size

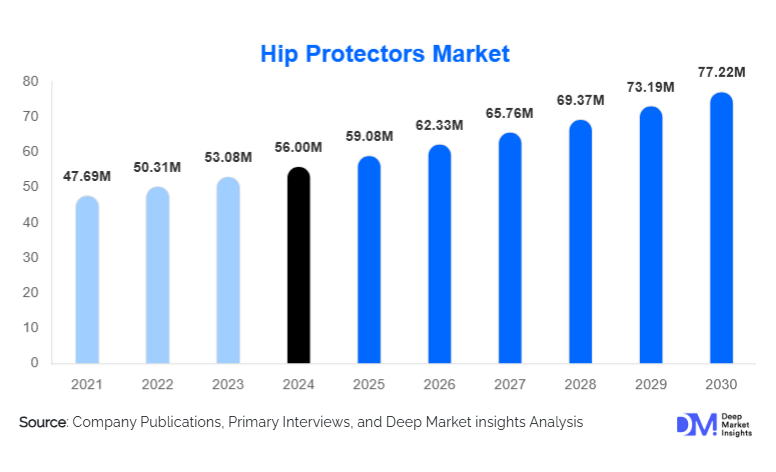

According to Deep Market Insights, the global hip protectors market size was valued at USD 56 million in 2024 and is projected to grow from USD 59.08 million in 2025 to reach USD 77.22 million by 2030, expanding at a CAGR of 5.5% during the forecast period (2025–2030). The hip protectors market growth is primarily driven by the aging global population, increasing fall-related injuries among elderly individuals, and rising adoption of preventive care devices in both institutional and home-care settings.

Key Market Insights

- Soft hip protectors dominate the market, owing to higher comfort, better compliance among elderly users, and cost-effectiveness compared to hard-shell or smart variants.

- Hospitals and nursing homes remain the leading application segment, accounting for the majority of institutional adoption due to regulatory pressure for fall prevention and patient safety programs.

- North America holds the largest market share, driven by a mature healthcare system, a high elderly population, and strong institutional adoption.

- Asia-Pacific is the fastest-growing region, supported by rising aging populations, increased healthcare infrastructure, and emerging home-care adoption.

- Consumer-focused and home-care segments are expanding, as older adults increasingly adopt hip protectors for aging-in-place and preventive care.

- Technological integration, such as smart sensor-enabled hip protectors and connected fall-monitoring devices, is gradually shaping product innovation and premium adoption.

Latest Market Trends

Shift Toward Home-Care and Consumer Adoption

With increasing focus on aging-in-place, hip protector adoption is expanding beyond hospitals and nursing homes into home-care and individual consumer segments. Manufacturers are introducing more ergonomic, discreet, and comfortable designs to improve daily wear compliance among elderly users. Online sales channels are growing rapidly, allowing consumers to purchase directly and benefit from subscription or delivery models, enhancing convenience and accessibility. This shift also encourages innovation in smart sensor technologies and lightweight protective materials suitable for home use.

Integration of Smart Technology

Emerging smart and sensor-enabled hip protectors are gaining traction by offering fall detection, near-fall alerts, and connectivity to healthcare monitoring platforms. These devices appeal to tech-savvy seniors and institutions seeking added value from preventive care products. Integration of IoT, mobile apps, and wearable sensors enhances monitoring and compliance while providing actionable data for caregivers. Companies are increasingly leveraging smart designs as a differentiator in a moderately fragmented market.

Hip Protectors Market Drivers

Aging Global Population and Increased Fall-Risk

The global aging population is a major growth driver for hip protectors. Older adults face a higher incidence of osteoporosis, reduced mobility, and balance impairments, leading to an increased risk of hip fractures. The adoption of hip protectors in hospitals, nursing homes, and home-care settings is rising as these devices reduce the impact of falls, prevent injuries, and help lower healthcare costs. Markets with high elderly populations, such as the U.S., Japan, and Germany, continue to drive demand.

Emphasis on Preventive Care and Cost Containment

Healthcare systems globally aim to reduce fall-related hospitalizations and long-term care costs. Hip protectors are increasingly recognized as effective preventive interventions. Institutional procurement is growing, aided by policies encouraging fall prevention, safety compliance, and reimbursement models that support preventive devices. This driver is particularly significant in North America and Europe, where cost containment and patient safety programs align with market adoption.

Innovations in Materials and Comfort

Recent product innovations, such as lightweight foam, ergonomic designs, breathable fabrics, and discreet hard-shell options, have enhanced user compliance. Improved comfort increases daily wear, particularly among elderly users, boosting adoption rates. Smart textile integration and sensor-enabled devices further differentiate products, providing premium options that attract both consumers and institutional buyers.

Market Restraints

Limited Awareness and Compliance

Awareness of the benefits of hip protectors remains low among certain consumer groups, particularly in emerging markets. Many elderly individuals resist wearing protective garments due to discomfort or perceived stigma. Low compliance reduces real-world effectiveness and limits adoption, posing a key restraint for market growth.

Cost Sensitivity and Reimbursement Gaps

Price remains a barrier, particularly for premium hard-shell and smart variants. In many regions, hip protectors are not reimbursed under healthcare or insurance programs, restricting uptake in cost-sensitive markets. Institutional buyers may opt for lower-cost options, and high prices can slow penetration in emerging economies, limiting overall market growth.

Hip Protectors Market Opportunities

Expansion in Home-Care and Direct-to-Consumer Channels

The aging-in-place trend provides opportunities for companies to tap into home-care segments. Manufacturers can design comfortable, aesthetically appealing hip protectors for daily consumer use. Online sales, subscription services, and telehealth partnerships allow companies to expand reach, increase adoption, and create new revenue streams beyond institutional procurement.

Growth in Emerging Markets

Asia-Pacific, Latin America, and parts of the Middle East are experiencing rapid growth due to rising elderly populations, expanding healthcare infrastructure, and increasing awareness of fall prevention. Companies can leverage local manufacturing, targeted marketing, and institutional partnerships to establish early presence in these high-potential regions.

Smart and Connected Device Integration

Integration of sensors, IoT platforms, and fall-monitoring capabilities enables premium product differentiation. These devices appeal to tech-savvy consumers and institutions seeking actionable health data. Companies developing smart hip protectors can explore subscription models, caregiver notifications, and integration with telehealth platforms to expand adoption and revenue potential.

Product Type Insights

Soft hip protectors dominate the market, accounting for 60% of global revenue in 2024, due to superior comfort, compliance, and cost-effectiveness. Hard-shell and smart variants, though smaller in share, are growing at a higher CAGR, driven by institutional demand for enhanced protection and consumer preference for technology-enabled solutions. Soft protectors remain the preferred choice across hospitals, nursing homes, and home-care applications.

Application Insights

Hospitals lead the application segment, representing 40% of the market in 2024, due to regulatory mandates, patient safety programs, and high fall-risk populations. Nursing homes add further institutional share (25%). Home-care use is the fastest-growing application, with older adults increasingly adopting protective devices for independent living. Sports rehabilitation and active elderly applications represent niche opportunities for growth.

Distribution Channel Insights

Offline retail dominates, accounting for 65% of the market in 2024, primarily through pharmacies, medical supply stores, and institutional procurement. Online platforms are growing rapidly, offering convenience for consumer adoption and enabling subscription or direct-to-consumer sales. Institutional direct sales remain significant for bulk procurement of soft and hard hip protectors.

End-User Insights

Institutional care (hospitals + nursing homes) accounts for 65% of the market, driven by regulated fall-prevention programs and bulk purchasing. Home-care and individual consumers are the fastest-growing segments, fueled by aging-in-place trends and online availability. Sports rehabilitation centers and active-lifestyle seniors represent emerging end-use opportunities.

| By Product Type | By Application | By End-User | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America leads with 38% market share (USD 17.5 billion in 2024), driven by a large elderly population, established institutional adoption, and high per-capita healthcare spending. Growth is moderate due to market maturity, but demand for smart and premium products continues to rise.

Europe

Europe holds a 30% share (USD 13.8 billion in 2024), led by Germany, the UK, France, and Italy. A high elderly population and a strong institutional infrastructure support market demand. Growth is steady, with increasing penetration into home-care segments and consumer adoption of ergonomic designs.

Asia-Pacific

Asia-Pacific represents a 20% share (USD 9.2 billion in 2024) and is the fastest-growing region (CAGR 6–8%), driven by China, Japan, India, and Southeast Asia. Increasing healthcare investment, a rising aging population, and emerging home-care adoption support significant growth opportunities.

Latin America

Latin America accounts for 8% (USD 3.7 billion) with moderate growth. Brazil and Argentina lead adoption, primarily in institutional settings, while outbound exports from North America and Europe supplement local supply.

Middle East & Africa

MEA accounts for 4–5% (USD 2.3 billion), with growth pockets in Gulf countries (UAE, Saudi Arabia) and South Africa due to rising elderly populations and improved healthcare infrastructure.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Hip Protectors Market

- Tytex

- Medline

- Kaneka

- Patterson Medical

- Bort

- AliMed

- HipSaver

- Suprima

- Skil-Care

- Plum Enterprises

- Hornsby Comfy Hips

- Impactwear

- Prevent Products

- Personal Safety Corporation

- Vital Base

Recent Developments

- In March 2025, Medline launched a new ergonomic soft hip protector line in the U.S., designed to improve comfort and compliance for elderly users at home and in institutions.

- In January 2025, Kaneka introduced sensor-enabled smart hip protectors in Japan, featuring fall detection and connectivity with telehealth platforms for enhanced patient monitoring.

- In February 2025, Tytex expanded production in Germany to meet rising demand from Europe and Asia-Pacific, with upgraded facilities for smart and hard-shell variants.