High Ambient Light Rejecting (ALR) Screen Market Size

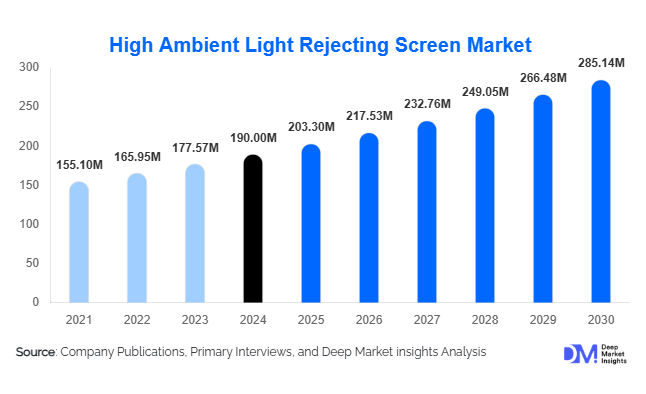

According to Deep Market Insights, the global high ambient light rejecting screen market size was valued at USD 190 million in 2024 and is projected to grow from USD 203.30 million in 2025 to reach USD 285.14 million by 2030, expanding at a CAGR of 7% during the forecast period (2025–2030). The market growth is primarily driven by rising adoption of ultra-short-throw projectors, increasing demand for premium home theaters, corporate AV infrastructure upgrades, and expanding commercial display applications in ambient light environments.

Key Market Insights

- Home entertainment applications dominate the market, as consumers increasingly invest in immersive, bright, and high-contrast viewing experiences at home.

- Corporate and educational sectors are rapidly adopting ALR screens, driven by digital transformation initiatives, hybrid learning, and improved presentation requirements in well-lit rooms.

- Optical ALR technology leads globally, due to its superior ambient light rejection, offering high contrast from multiple angles, especially in commercial and institutional spaces.

- North America holds the largest market share, supported by high disposable incomes, corporate AV upgrades, and a growing home theater segment in the US and Canada.

- Asia-Pacific is the fastest-growing region, with China and India driving demand due to urbanization, smart infrastructure investments, and rising middle-class disposable incomes.

- Technological innovation, including hybrid optical-coating screens, eco-friendly materials, and projector compatibility enhancements, is reshaping market dynamics and product offerings.

Latest Market Trends

Integration with Ultra-Short-Throw Projectors and Smart Home Systems

The growing popularity of ultra-short-throw projectors has intensified demand for ALR screens. These screens are optimized for environments with ambient light, allowing high-contrast, glare-free visuals in living rooms, corporate offices, and classrooms. Manufacturers are increasingly introducing hybrid optical-coating screens that combine multiple technologies for maximum light rejection and image quality. Integration with smart home systems, including voice controls and app-based projector calibration, is enhancing user convenience and driving adoption in residential and commercial sectors.

Sustainability and Energy Efficiency Focus

ALR screens contribute to energy savings by allowing projectors to operate at lower brightness while maintaining image clarity. Manufacturers are adopting eco-friendly, recyclable materials to meet increasing sustainability expectations from governments and environmentally conscious consumers. Screens designed with lower carbon footprints and reduced material waste are becoming key differentiators, particularly in Europe and North America. This trend aligns with global environmental standards and encourages adoption in both public infrastructure and private installations.

High Ambient Light Rejecting Screen Market Drivers

Rising Home Theater and Entertainment Adoption

Home entertainment is a critical growth driver, with consumers seeking bright, high-contrast visuals even in naturally lit rooms. The proliferation of 4K and 8K projectors, gaming setups, and immersive media consumption has fueled demand for high-performance ALR screens. In 2024, residential adoption contributed to approximately 38% of the overall market, highlighting its pivotal role in global growth.

Corporate and Educational Digital Transformation

Corporate offices and educational institutions are modernizing audiovisual infrastructure to support hybrid meetings, presentations, and digital learning environments. ALR screens ensure clarity in ambient light conditions, improving efficiency and engagement. The corporate segment contributed nearly 30% of total market demand in 2024, emphasizing its importance in commercial growth.

Expansion in Retail and Public Display Applications

Retail, hospitality, and public display sectors are increasingly deploying ALR screens for bright, high-contrast digital signage, showrooms, and interactive displays. This segment accounted for approximately 20% of market revenue in 2024. Adoption in high-traffic, well-lit areas ensures messaging visibility and enhances consumer engagement, boosting market growth globally.

Market Restraints

High Cost of Premium ALR Screens

Advanced ALR screens, particularly optical and hybrid models, are significantly more expensive than standard projection screens. High initial investment costs can deter adoption in price-sensitive regions, particularly in emerging economies. Affordability remains a challenge for widespread penetration, limiting market expansion among budget-conscious consumers.

Technological Complexity and Compatibility Issues

Not all projectors are fully compatible with high-end optical ALR screens. Ensuring optimal performance requires calibration and sometimes additional components. Small businesses and first-time users may find installation and setup challenging, which can slow market adoption in certain segments.

High Ambient Light Rejecting Screen Market Opportunities

Emerging Markets in Asia-Pacific

APAC offers significant growth potential due to urbanization, infrastructure modernization, and rising disposable income. Countries such as China, India, and Southeast Asian nations present untapped demand for premium home entertainment and corporate AV solutions. Government initiatives supporting smart classrooms and office digitization further accelerate adoption.

Integration with Interactive and Smart Technologies

ALR screens are increasingly being combined with touch-sensitive, interactive projectors and AI-enabled presentation systems. This integration opens new opportunities in corporate, education, and retail sectors, enabling value-added services, higher customer engagement, and increased revenue per unit.

Sustainability and Energy-Efficient Solutions

Eco-friendly and energy-saving ALR screens are gaining traction due to lower projector brightness requirements and the use of recyclable materials. Companies adopting sustainable practices can differentiate themselves in competitive markets and align with regulatory and consumer-driven environmental goals, creating a strategic advantage for both new entrants and established players.

Product Type Insights

Fixed-frame ALR screens dominate the market, preferred for premium home theaters and corporate installations due to durability and consistent tensioning. Optical ALR screens lead in commercial applications, providing superior ambient light rejection across multiple angles. Portable and motorized screens are gaining popularity in educational and training environments for their flexibility and ease of deployment. Mid-range screens (USD 500–1500) account for the majority of sales, balancing performance and affordability.

Application Insights

Home entertainment is the largest application segment, reflecting widespread adoption of ultra-short-throw projectors, gaming setups, and home theaters. Corporate and educational sectors follow closely, driven by AV infrastructure upgrades in well-lit rooms. Retail, hospitality, and public displays are emerging applications, leveraging high-contrast ALR screens for signage, exhibitions, and interactive experiences.

Distribution Channel Insights

Online platforms dominate ALR screen sales, allowing consumers to compare features, pricing, and compatibility. Direct B2B sales are significant in corporate, education, and retail sectors, while specialty AV distributors continue to serve premium segments. Increasing manufacturer websites, subscription models, and influencer-driven marketing campaigns are shaping customer engagement and driving adoption globally.

End-Use Insights

Residential demand is growing steadily due to the home theater and gaming boom, while corporate and educational adoption is accelerating. Emerging applications in retail signage, museums, and hospitality are creating additional growth opportunities. Export-driven demand is strong, particularly to the US, Germany, and Japan, supporting overall market expansion.

| By Product Type | By Application | By Technology | By Screen Size | By End-Use Industry |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America is the largest market, accounting for 38% of global demand in 2024. High disposable income, corporate AV modernization, and widespread home theater adoption in the US and Canada drive growth. Demand is particularly strong for optical and hybrid ALR screens, which offer superior ambient light rejection for office and residential environments.

Asia-Pacific

APAC is the fastest-growing region, with 32% market share in 2024 and a projected CAGR of 12% through 2030. China and India are the primary drivers due to urbanization, smart classroom initiatives, and increased home entertainment adoption. The region presents significant opportunities for both domestic manufacturers and global exporters.

Europe

Europe holds 20% of the market, led by Germany and the UK. Corporate and educational sectors are key growth areas, with high adoption of eco-friendly and energy-efficient screens. Rising interest in interactive learning solutions and premium home theaters contributes to steady growth.

Middle East & Africa

This region contributes 6% of the market, with the UAE and Saudi Arabia leading commercial and residential adoption. High-income populations and luxury home theater installations are key demand drivers.

Latin America

LATAM accounts for 4% of the market, with Brazil and Mexico leading adoption. While still developing, the region is witnessing gradual growth in corporate and educational deployments.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the High Ambient Light Rejecting Screen Market

- Elite Screens

- Draper Inc.

- Stewart Filmscreen

- Screen Innovations

- Seymour AV

- Da-Lite

- Vividstorm

- Epson Visual Products

- Optoma

- Grandview

- ViewSonic

- Panasonic Visual Solutions

- BenQ

- Vivitek

- Solyx Films

Recent Developments

- In June 2025, Elite Screens launched a new hybrid optical ALR series optimized for ultra-short-throw projectors, targeting high-end home theater applications.

- In May 2025, Screen Innovations expanded its commercial ALR product line in Europe, focusing on energy-efficient and eco-friendly materials for corporate offices and educational institutions.

- In March 2025, Draper Inc. announced the integration of smart calibration technology in motorized ALR screens, enhancing usability in bright environments and interactive learning spaces.