Heat-Not-Burn Tobacco Product Market Size

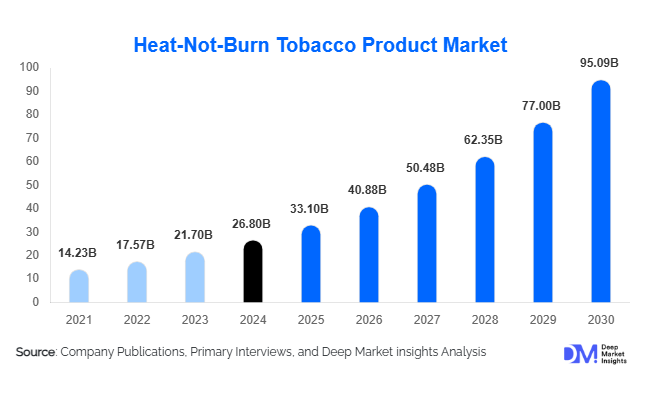

According to Deep Market Insights, the global heat-not-burn (HNB) tobacco product market was valued at USD 26.8 billion in 2024 and is projected to grow from USD 33.10 billion in 2025 to reach USD 95.09 billion by 2030, expanding at a CAGR of 23.5% during the forecast period (2025–2030). The market growth is primarily driven by the rising demand for reduced-risk alternatives to conventional cigarettes, technological innovations in heating devices, and increased regulatory support in favor of harm-reduction products globally.

Key Market Insights

- Consumer preference is shifting towards smoke-free alternatives, leading to significant adoption of HNB products among adult smokers seeking less harmful options compared to traditional tobacco products.

- Technological innovation in HNB devices, including more efficient heating mechanisms, smart-device integration, and improved user experience, is enhancing market adoption.

- Japan and Europe dominate the HNB market, driven by high awareness, stringent anti-smoking regulations, and government support for reduced-risk products.

- Asia-Pacific is the fastest-growing region, with rising demand in emerging markets such as China, South Korea, and India, fueled by increasing disposable incomes and health-conscious smokers.

- R&D investments and product diversification are encouraging expansion, including new tobacco formulations and customizable device options.

What are the latest trends in the Heat-Not-Burn tobacco market?

Regulatory Support for Reduced-Risk Products

Governments in regions such as Europe and the Asia-Pacific are increasingly recognizing HNB products as less harmful alternatives to conventional cigarettes. Policies favoring reduced-risk products, including lower taxation and simplified approval pathways, are helping manufacturers accelerate market penetration. This trend is especially pronounced in countries with high smoking prevalence and strict anti-smoking campaigns, where regulators aim to provide alternatives for adult smokers. Initiatives such as standardized labeling, nicotine content restrictions, and safety certifications are also contributing to consumer confidence and wider adoption.

Technological Advancements Driving Adoption

Continuous innovation in HNB devices is reshaping the market. Smart, rechargeable devices with precise temperature control, improved battery life, and ergonomic designs are enhancing user experience. Companies are also integrating digital features such as app connectivity to monitor usage patterns, offer personalized recommendations, and maintain device hygiene. Tobacco stick variations with flavor enhancements and low-smoke emissions are attracting both traditional smokers and new users. These advancements are positioning HNB products as a modern, socially acceptable alternative to conventional smoking.

What are the key drivers in the HNB tobacco market?

Rising Health Consciousness Among Smokers

Awareness of smoking-related health risks has accelerated the adoption of HNB products. Consumers seeking harm-reduction solutions prefer devices that heat rather than burn tobacco, which reduces the formation of harmful chemicals typically associated with combustion. Health campaigns, anti-smoking policies, and growing availability of HNB options in retail and online channels have collectively contributed to sustained market growth.

Product Innovation and Diversification

Manufacturers continue to introduce new devices, tobacco sticks, and flavors to cater to diverse consumer preferences. Advanced heating technology ensures consistent nicotine delivery, better taste, and reduced odor. These innovations attract tech-savvy and urban consumers, further expanding the user base and boosting market penetration in both mature and emerging markets.

Supportive Regulatory Frameworks

Favorable government regulations in regions such as Japan and the EU, including recognition of reduced-risk claims and streamlined product approvals, are enabling faster adoption and market expansion. Regulations that differentiate HNB products from combustible cigarettes reduce entry barriers, encourage innovation, and increase consumer trust.

What are the restraints for the global market?

Regulatory Inconsistencies

While some countries support HNB adoption, regulatory restrictions in other regions limit product availability. Variations in labeling requirements, import duties, taxation, and safety standards complicate global expansion and create compliance challenges for manufacturers.

Consumer Perception and Acceptance

Despite growing awareness, skepticism about long-term health impacts continues to limit adoption in some markets. Educating consumers and overcoming misconceptions remains a significant barrier, particularly among older smokers who are accustomed to traditional cigarettes.

What are the key opportunities in the HNB tobacco market?

Expansion into Emerging Markets

Emerging economies in Asia, Latin America, and the Middle East present untapped potential due to rising disposable incomes, growing urban populations, and increasing awareness of reduced-risk alternatives. Tailoring products to local preferences, distribution channels, and regulatory frameworks can unlock significant revenue streams for market participants.

Integration of Smart Technology

HNB devices embedded with IoT-enabled monitoring, temperature control, and app-based recommendations offer enhanced consumer experiences. This opens opportunities for premium product differentiation and recurring revenue through device upgrades and tobacco stick sales. Technology-driven personalization can attract younger and tech-oriented consumers, expanding market penetration.

Government Initiatives for Harm Reduction

Governments focusing on public health strategies and harm-reduction programs encourage the transition from combustible cigarettes to HNB products. Collaborations with regulatory agencies, anti-smoking campaigns, and incentives for reduced-risk products can accelerate adoption and market growth.

Product Type Insights

Device-type HNB products, particularly portable, rechargeable models, dominate the market due to convenience and ease of use, accounting for approximately 42% of the 2024 market share. Tobacco-type sub-segments such as heat sticks with flavor enhancements are also gaining traction, driven by consumer preference for taste and lower odor emissions. Retail and online distribution channels capture over 50% of sales, highlighting the importance of accessibility and omnichannel strategies in market expansion.

Application Insights

The primary application of HNB products is for adult smokers seeking alternatives to traditional cigarettes. Usage in social settings and workplace environments is increasing, as HNB devices produce less odor and smoke. Additionally, some users explore these products as an initial step in quitting smoking, representing a growing sub-segment. Export-driven demand is rising, particularly from Japan and Europe, creating opportunities for cross-border trade and international market expansion.

Distribution Channel Insights

Retail outlets, including convenience stores and specialty tobacco shops, dominate market sales, supported by online platforms providing direct-to-consumer availability. E-commerce penetration is expanding rapidly, with subscription models and app-based ordering facilitating recurring sales. Online reviews and influencer-led marketing are increasingly shaping purchase decisions, particularly among younger, tech-savvy consumers.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

The U.S. and Canada are witnessing steady adoption of HNB products, with a 2024 market share of approximately 27%. Consumers are drawn by health-conscious trends and convenience, while supportive regulations enable easier access to reduced-risk alternatives. Product availability through retail and online channels is driving growth, particularly in urban centers.

Europe

Europe accounts for roughly 33% of the 2024 market, led by the U.K., Germany, and Italy. Regulatory frameworks favoring reduced-risk products, alongside public awareness campaigns, are encouraging consumer adoption. The region is highly mature, with sustained demand for premium and flavored HNB products, making it a stable revenue contributor.

Asia-Pacific

Asia-Pacific is the fastest-growing region, led by Japan, South Korea, and China. Japan alone represents a significant portion of the market due to early adoption and strong regulatory support. Rapid urbanization, rising disposable incomes, and shifting cultural perceptions of smoking contribute to accelerated growth. Emerging markets such as India are expected to witness double-digit CAGR during the forecast period.

Latin America

Brazil, Mexico, and Argentina are showing increasing interest in HNB products, with a focus on urban, health-conscious consumers. While still a smaller share of the global market, growth potential is significant as awareness and availability expand.

Middle East & Africa

Market penetration in the Middle East and Africa is currently limited, but awareness campaigns and rising disposable incomes in countries like the UAE, Saudi Arabia, and South Africa present opportunities for future expansion. Regulatory harmonization and localized marketing strategies are key to capturing demand in these regions.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Heat-Not-Burn Tobacco Market

- Philip Morris International

- British American Tobacco

- Japan Tobacco International

- Imperial Brands

- Altria Group

- KT&G Corporation

- Swedish Match

- China Tobacco International

- BAT Japan

- ITC Limited

- Fontem Ventures

- Japan Tobacco Inc.

- Philip Morris Japan

- KT&G Corp – Export Division

- British American Tobacco South Africa

Recent Developments

- In June 2025, Philip Morris International launched new IQOS devices in Europe, featuring advanced heat-control technology and flavor customization to enhance user experience.

- In April 2025, British American Tobacco expanded HNB product distribution across Southeast Asia, targeting urban millennials with smart-device-enabled offerings.

- In March 2025, Japan Tobacco International introduced innovative flavored heat sticks in Japan, supporting continued adoption among adult smokers seeking alternatives to combustible cigarettes.