Handheld Device Accessories Market Size

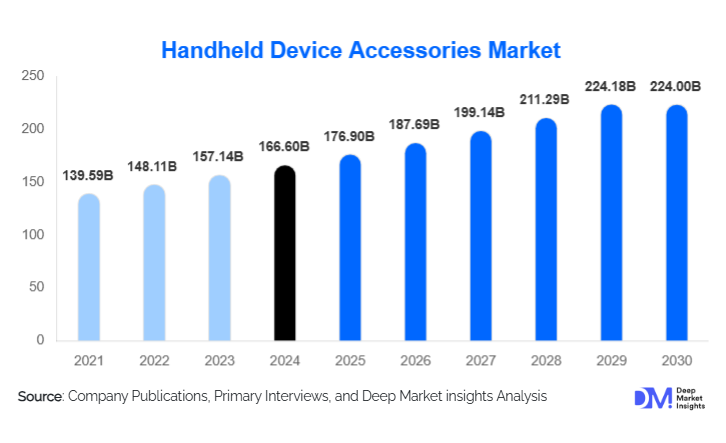

According to Deep Market Insights, the global handheld device accessories market size was valued at USD 166.6 billion in 2024 and is projected to grow from USD 176.76 billion in 2025 to reach USD 237.67 billion by 2030, expanding at a CAGR of 6.1% during the forecast period (2025–2030). The market growth is primarily driven by rising smartphone and tablet adoption, increasing consumer preference for wireless audio and premium charging solutions, and growing demand for personalized and enterprise-grade accessories worldwide.

Key Market Insights

- Protective and aesthetic accessories dominate the market, with high demand for cases and screen protectors driven by device replacement cycles and personalization trends.

- Wireless audio and fast-charging solutions are rapidly growing, fueled by the adoption of TWS earbuds, GaN chargers, and multi-device charging ecosystems.

- APAC leads the market in volume, while North America captures the highest premium revenue share.

- Online sales channels dominate, with marketplaces and D2C platforms enabling wide SKU availability and global distribution.

- Enterprise adoption is expanding, particularly in logistics, retail POS, and healthcare sectors, supporting demand for ruggedized and certified accessories.

- Technological integration, including wireless charging, MagSafe-compatible accessories, and app-based power management, is shaping consumer purchasing behavior and driving premium ASP growth.

What are the latest trends in the handheld device accessories market?

Wireless and Power Ecosystem Integration

Accessory manufacturers are increasingly integrating wireless charging, fast-charging technologies, and device management apps into their products. This convergence allows consumers and enterprises to manage multiple devices with one ecosystem while enhancing convenience, battery health, and safety. Such integrated solutions are particularly attractive for premium segments, where customers are willing to pay more for certified, feature-rich accessories. This trend also opens opportunities for subscription-based services, such as warranty programs or app-enabled performance monitoring, creating recurring revenue streams for manufacturers.

Premiumization and Personalized Design

The market is witnessing strong premiumization trends, particularly in APAC, where consumers are investing in high-quality, brand-certified accessories. Localized product designincluding regional color palettes, ergonomic mounts, and culturally relevant aesthetics, is increasingly used to capture specific consumer segments. Premium protective cases, MagSafe-compatible chargers, and high-end TWS earbuds have become aspirational purchases, leading to higher revenue per unit and improved margins for manufacturers. Personalization and design differentiation remain key strategies for both established and new players seeking competitive advantage.

Enterprise and Industrial Verticalization

Enterprise adoption is accelerating demand for ruggedized accessories, multi-device charging stations, and B2B lifecycle solutions. Industries such as logistics, healthcare, and retail POS are increasingly procuring certified, durable accessory kits. Companies providing end-to-end solutionsincluding bulk provisioning, warranty SLAs, and enterprise-grade supportbenefit from higher average order values and long-term client contracts. Verticalized offerings reduce competition from generic products and create differentiated value propositions in the B2B segment.

What are the key drivers in the handheld device accessories market?

High Smartphone Replacement and Premium Device Adoption

Frequent replacement cycles for flagship smartphones and tablets, especially in developed markets, drive ongoing demand for accessories. Consumers prefer OEM-certified or high-quality third-party products to complement their devices. Ecosystem lock-in strategies by leading brands (Apple, Samsung) encourage purchases of compatible cases, chargers, and audio accessories, increasing overall accessory spend.

Explosive Growth of Wireless Audio

True Wireless Stereo (TWS) earbuds and Bluetooth audio products are the fastest-growing segments in terms of revenue. Improvements in battery life, active noise cancellation, and device integration make wireless audio a high-value category. Bundled sales with flagship smartphones further stimulate adoption, reinforcing premium revenue growth.

Power and Fast-Charging Innovation

The increasing demand for portable, fast, and multi-device charging solutions drives accessory adoption. GaN chargers, wireless charging pads, and high-capacity power banks offer higher ASPs and support growing consumer needs for mobility, remote work, and travel. Enterprise segments benefit from bulk, certified solutions that ensure device uptime.

What are the restraints for the global market?

Price Compression and Commoditization

Low-cost OEMs and online marketplaces drive significant price pressure on commoditized categories such as cables and basic cases. Mid-tier manufacturers face thin margins and must differentiate through branding, design, or certification to maintain profitability.

Fragmented Standards and Interoperability Challenges

Despite standardization efforts like Qi and USB-C, the market still faces fragmentation in magnetic attachments, proprietary connectors, and device compatibility. This creates consumer confusion, increases returns and warranty claims, and raises compliance costs, slowing adoption of cross-brand accessories.

What are the key opportunities in the handheld device accessories industry?

Wireless and Integrated Power Solutions

Opportunities exist for accessories that combine fast charging, wireless power delivery, and management apps. Integrated solutions for consumer and enterprise use create high-value propositions, supporting recurring revenue models and ecosystem loyalty.

Localized and Premium Accessory Design

Regional customization in color, functionality, and cultural relevance enables brands to capture high-growth segments in APAC and emerging markets. Premium protective accessories, MagSafe-certified products, and high-quality TWS earbuds continue to see strong consumer demand.

Enterprise Verticalized Accessory Kits

Industries such as healthcare, logistics, and retail require rugged, certified, and multi-device-compatible accessories. Vendors offering complete lifecycle supportincluding bulk provisioning and warranty management, capture higher order values and secure long-term contracts.

Product Type Insights

Protective cases and screen protectors dominate the market by volume, driven by replacement cycles and personalization trends. Power accessories, including GaN chargers and wireless pads, are the fastest-growing product category in revenue. Wireless audio (TWS and Bluetooth headphones) is driving premium growth, while cables and low-cost accessories maintain high unit volume but lower margins.

Application Insights

Consumer and personal use remains the largest application segment, representing 82% of market revenue. Enterprise applicationslogistics, healthcare, and retail POS are growing fastest in percentage terms. Gaming and wearable companion accessories are emerging niches, providing additional revenue streams and promoting ecosystem integration.

Distribution Channel Insights

Online channels, including marketplaces and D2C websites, dominate unit sales due to wide SKU availability and competitive pricing. Offline branded stores and carrier retail outlets drive premium accessory sales. B2B procurement accounts for bulk sales of enterprise kits and certified accessories. Emerging subscription-based and membership channels are enhancing engagement with repeat customers.

End-User Insights

Consumer/personal users dominate accessory purchases, while enterprise segments show the fastest growth due to bulk adoption of ruggedized and certified solutions. Healthcare and logistics sectors increasingly require industrial-grade accessories. Mobile gaming, AR/VR companion devices, and smart mounts are creating additional high-value opportunities.

Age Group Insights

The 31–50 age group represents the largest revenue share due to high disposable income and premium product adoption. The 18–30 group drives growth in wireless audio, gaming, and mid-tier accessories. Older demographics (51–65) contribute to premium accessory demand, while the 65+ segments focus on comfort, safety, and certified products.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America captures 27% of global revenue, with strong premium accessory adoption in the U.S. and Canada. Demand is driven by brand-certified products, TWS adoption, and enterprise procurement. Premium-priced accessories dominate revenue due to high disposable income and brand loyalty.

Europe

Europe accounts for 18% of the market, with Germany, the U.K., and France as key contributors. Consumers favor sustainable, certified accessories, driving demand for premium and eco-friendly products. Younger demographics are increasingly purchasing wireless audio and high-tech charging solutions.

Asia-Pacific

APAC leads with 38% of global revenue, driven by high device volumes in China and India. Premiumization and localized design trends are accelerating growth. India shows the highest CAGR due to rising smartphone penetration and government incentives for local manufacturing.

Latin America

Latin America contributes 10% of the market. Brazil, Argentina, and Mexico are leading countries, with growing interest in wireless audio, gaming accessories, and mid-range protective products. Outbound imports remain critical for premium accessories.

Middle East & Africa

MEA accounts for 7% of market revenue. Gulf countries such as the UAE, Saudi Arabia, and Qatar drive premium accessory adoption. Africa’s local safari for mobile devices and regional e-commerce are supporting gradual growth in both consumer and enterprise segments.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Handheld Device Accessories Market

- Apple

- Samsung Electronics

- Xiaomi

- Anker Innovations

- Sony Corporation

- Bose Corporation

- Belkin International

- Logitech International

- Sennheiser

- Otter Products (OtterBox)

- Spigen Inc.

- Zagg Inc.

- SanDisk / Western Digital

- Panasonic Corporation

- JBL (Harman)

Recent Developments

- In 2025, Apple expanded its MagSafe accessory ecosystem with new magnetic chargers, protective cases, and premium TWS earbuds for global markets.

- In early 2025, Anker Innovations launched a next-generation GaN fast-charging portfolio, targeting both consumer and enterprise segments with multi-device support.

- In mid-2025, OtterBox introduced ruggedized industrial accessory kits for enterprise handheld devices, including multi-dock chargers and certified protective cases for logistics and healthcare applications.