Golf Putting Green Market Size

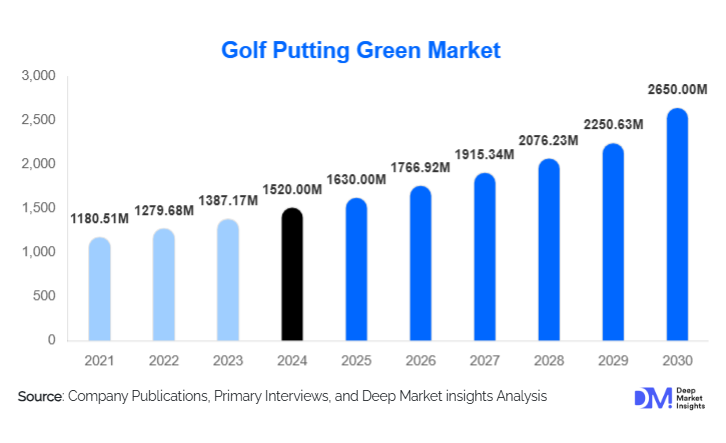

According to Deep Market Insights, the global golf putting green market size was valued at USD 1,520 million in 2024 and is projected to grow from USD 1,630 million in 2025 to reach USD 2,650 million by 2030, expanding at a CAGR of 8.4% during the forecast period (2025–2030). The market growth is primarily driven by the increasing popularity of golf as a recreational and professional sport, the expansion of residential and commercial golf facilities, and the growing demand for synthetic and eco-friendly turf solutions that require minimal maintenance.

Key Market Insights

- Rising interest in home-based putting greens is transforming golf from a leisure activity into an accessible lifestyle trend among affluent homeowners and urban golfers.

- Commercial golf courses and resorts continue to dominate installations, supported by tourism growth, sports infrastructure investment, and event-based demand.

- Artificial putting greens are gaining traction due to lower water usage, durability, and improved ball-roll performance.

- North America leads the global market, with the U.S. driving the majority of residential and professional installations.

- Asia-Pacific is the fastest-growing region, propelled by rapid golf course development in China, Japan, South Korea, and emerging markets such as Thailand and Vietnam.

- Technological advancements in turf materials, drainage systems, and 3D contour design are enhancing realism and customization in putting green installations.

What are the latest trends in the golf putting green market?

Surge in Home and Backyard Installations

Growing interest in personal wellness and leisure spaces has spurred the installation of backyard putting greens. Homeowners are investing in custom synthetic turf greens to practice golf conveniently while adding aesthetic and property value. Manufacturers are responding with modular kits, smart irrigation systems, and customizable turf textures. The pandemic further accelerated this shift toward at-home recreation, making residential greens one of the most dynamic market segments.

Eco-Friendly and Sustainable Turf Innovations

The demand for sustainable landscaping solutions is reshaping product development. Artificial putting greens now feature recyclable backing materials, lead-free fibers, and reduced infill requirements. Companies are investing in bio-based polymers and renewable manufacturing to meet green building standards. Water conservation initiatives and government incentives promoting drought-resistant landscaping are boosting the adoption of synthetic greens over natural grass alternatives.

What are the key drivers in the golf putting green market?

Growing Global Golf Participation

According to industry associations, golf participation worldwide continues to rise, especially among younger demographics and women players. This trend fuels demand for accessible practice spaces and smaller golf installations beyond traditional courses. The expansion of golf academies, community clubs, and corporate recreational facilities contributes significantly to putting green market growth.

Technological Advancements and Customization

Modern putting green systems are integrating advanced materials and digital design tools. 3D laser contour mapping, automated slope calibration, and portable indoor greens enable precise replication of professional course conditions. These innovations appeal to both amateur golfers seeking realistic practice and professional venues aiming for consistent play quality. Smart sensors and performance analytics embedded in greens are also enhancing player training and engagement.

What are the restraints for the global market?

High Installation and Maintenance Costs

Despite reduced upkeep compared to natural turf, the initial cost of synthetic putting greens remains high due to premium materials, drainage engineering, and installation labor. This limits market penetration among middle-income households and small-scale commercial facilities. Additionally, periodic resurfacing and infill replacement add to lifecycle costs, particularly in high-usage or extreme-climate areas.

Space Limitations and Urban Constraints

In densely populated cities, limited outdoor space poses a challenge for large-scale putting green installations. Indoor alternatives exist but often involve trade-offs in size and realism. Urban development restrictions and competition for land use in prime areas can further hinder new golf facility projects, particularly in Europe and parts of Asia.

What are the key opportunities in the golf putting green industry?

Expansion in Emerging Golf Markets

Countries such as China, India, and Vietnam are witnessing rapid golf infrastructure growth due to rising disposable incomes and increasing exposure to Western leisure trends. Government initiatives promoting sports tourism and foreign investment in golf resorts present lucrative opportunities for turf and design companies. Manufacturers that localize production and tailor offerings to regional climates are positioned to capture significant market share.

Integration of Smart and Connected Systems

The next generation of putting greens is being enhanced with embedded sensors, mobile connectivity, and AR/VR simulation technology. These “smart greens” can track shot data, analyze putting accuracy, and provide real-time feedback, making them attractive to training centers and luxury consumers. Integration with golf simulators and data analytics platforms will open new B2B and B2C revenue streams.

Product Type Insights

Artificial turf putting greens dominate the market due to their low maintenance requirements and all-weather usability. Natural grass greens remain preferred for premium golf clubs and professional events, but are declining in favor of eco-friendly synthetic alternatives. Modular and portable greens are growing rapidly among home users and corporate buyers, offering easy installation, relocation, and customization options. Hybrid systems, combining natural aesthetics with synthetic durability, are also gaining attention in high-end golf resorts.

Application Insights

Commercial applications account for the largest market share, covering golf clubs, resorts, hotels, and sports complexes. Residential applications are the fastest-growing segment, driven by home improvement trends and recreational landscaping. Indoor putting greens are increasingly being installed in gyms, offices, and entertainment venues, bridging the gap between leisure and fitness.

Distribution Channel Insights

Direct sales and specialized contractors dominate distribution, as buyers prefer professional design and installation services. Online retail platforms are gaining ground, offering modular DIY kits and turf rolls for residential users. Partnerships between turf manufacturers and home improvement retailers are expanding product visibility and accessibility, particularly in North America and Europe.

End-User Insights

Golf clubs and resorts remain the largest end-user group, continuously upgrading greens to meet tournament standards. Corporate and hospitality sectors are adopting putting greens as part of wellness and recreation facilities. Homeowners represent an expanding consumer base, especially in premium housing developments emphasizing outdoor leisure spaces.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America dominates the global market, led by the United States, where golf participation exceeds 25 million players annually. The region benefits from a mature golf culture, a strong presence of turf manufacturers, and widespread adoption of home putting greens. Canada is also witnessing growth in both commercial and residential segments, supported by demand for low-maintenance, weather-resistant turf systems.

Europe

Europe holds a significant market share, driven by golf popularity in the U.K., Germany, Spain, and France. Sustainability-focused consumers are increasingly choosing synthetic turf to reduce water usage and maintenance. Growth in mini-golf and entertainment golf venues, such as urban driving ranges and rooftop greens, is further contributing to market expansion.

Asia-Pacific

Asia-Pacific is the fastest-growing region in the global putting green market. Rapid urbanization, a growing middle class, and increasing exposure to global sports culture are driving adoption. China, Japan, and South Korea lead in installations, while Southeast Asia is emerging as a hotspot for golf tourism and resort development.

Middle East & Africa

The Middle East is witnessing increased installation of artificial greens in luxury resorts, hotels, and private estates, particularly in the UAE and Saudi Arabia. Africa’s market remains nascent but is expanding in South Africa, Kenya, and Morocco through golf tourism initiatives and international tournament hosting.

Latin America

Latin America shows steady growth, driven by increasing golf participation in Brazil, Mexico, and Argentina. Investment in sports facilities and resort developments supports putting green adoption, while local turf production capacity remains limited, presenting import opportunities for global players.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Golf Putting Green Market

- Southwest Greens International

- Celebrity Greens

- SYNLawn

- FieldTurf

- Tour Greens

- EasyTurf

- ForeverLawn

- Turfscape

- Back Nine Greens

- ProGreen Synthetic Turf

Recent Developments

- In July 2025, Southwest Greens launched its new “Champion Pro Series” turf line, offering enhanced realism and eco-friendly materials for high-end residential and resort installations.

- In May 2025, SYNLawn introduced a recyclable synthetic putting turf with improved UV stability, targeting sustainable golf course renovation projects.

- In February 2025, Celebrity Greens partnered with luxury property developers in Florida and California to integrate custom putting greens in premium residential communities.