Futsal Balls Market Size

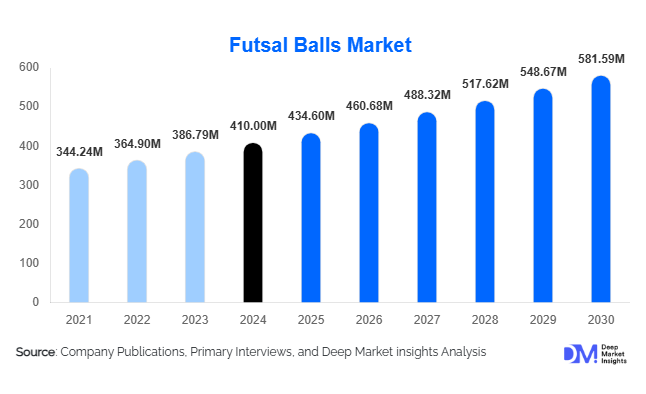

According to Deep Market Insights, the global futsal balls market size was valued at USD 410 million in 2024 and is projected to grow from USD 434.60 million in 2025 to reach USD 581.59 million by 2030, expanding at a CAGR of 6.0% during the forecast period (2025–2030). The market growth is primarily driven by rising participation in futsal at professional, amateur, and institutional levels, expansion of indoor sports infrastructure, and increasing adoption of technologically advanced and premium-quality futsal balls across global regions.

Key Market Insights

- Premium match balls dominate the market, driven by professional leagues, federations, and high-end recreational users seeking certified performance and durability.

- Polyurethane (PU) balls lead in material preference, offering optimal control, low bounce, and enhanced longevity for indoor futsal play.

- Asia-Pacific is the fastest-growing region, supported by expanding youth sports programs, government initiatives, and rising middle-class sports participation.

- Online distribution channels are increasingly preferred, allowing players and institutions to access a wide variety of futsal balls with convenient delivery and transparent pricing.

- Technological innovation, including smart balls with embedded sensors and hybrid panel designs, is creating new avenues for product differentiation and premiumization.

- Sustainability is shaping consumer demand, with eco-friendly materials and recycled manufacturing processes gaining traction among environmentally conscious players and institutions.

What are the latest trends in the futsal balls market?

Premiumization and Performance-Focused Designs

Manufacturers are increasingly offering high-performance futsal balls that meet FIFA and national futsal federation standards. Premium balls feature polyurethane construction, low-bounce properties for indoor play, advanced bladder technology, and enhanced durability. Limited-edition designs, customized graphics, and professional certifications help brands differentiate in competitive markets. These premium products appeal to professional players, leagues, and high-end recreational users, driving growth in the higher-value segments of the market.

Digital and E-Commerce Distribution

The rise of online sales has transformed the futsal balls market. Consumers and institutions now purchase directly from brand websites or e-commerce marketplaces, benefiting from product reviews, detailed specifications, and convenience. Digital channels also enable global reach for manufacturers, especially for export-focused markets. The trend supports rapid adoption of premium and customized products, while also allowing smaller brands to compete by leveraging digital marketing and direct-to-consumer sales strategies.

What are the key drivers in the futsal balls market?

Rising Futsal Participation Worldwide

Futsal is gaining popularity as an indoor alternative to traditional football, particularly among youth, amateurs, and professional players. Its role in improving ball control, agility, and tactical skills has increased adoption by football academies and professional clubs. Governments and sports federations are promoting futsal leagues and tournaments, further accelerating demand for certified match and training balls.

Expansion of Indoor Sports Infrastructure

Urbanization and space constraints have driven the development of indoor sports facilities across major cities globally. Multi-purpose indoor courts in schools, community centers, and malls are increasing the demand for futsal balls. Regions such as Asia-Pacific and Latin America are witnessing strong investment in indoor sports, fueling market growth for both premium and mid-range balls.

Advancements in Ball Materials and Technology

Innovations in materials like PU, TPU, and hybrid composites enhance ball performance, durability, and user experience. Thermo-bonded panels, moisture-resistant coatings, and improved bladder technologies allow manufacturers to create premium products for professional and semi-professional use. Technological adoption in smart balls with embedded sensors is also emerging, offering data-driven insights for training and performance monitoring.

What are the restraints for the global market?

Price Sensitivity and Low-Cost Competition

High-quality futsal balls, especially premium match balls, face resistance in price-sensitive markets. Low-cost alternatives, counterfeit products, and generic brands limit penetration in developing regions, restricting growth for high-end players. Manufacturers must balance quality with affordability to expand reach.

Raw Material and Supply Chain Volatility

Futsal balls rely on materials like synthetic leather, PU, rubber, and adhesives. Fluctuating raw material costs and supply chain disruptions can impact manufacturing efficiency, margins, and product pricing. Manufacturers must maintain strategic sourcing and inventory management to mitigate these risks.

What are the key opportunities in the futsal balls industry?

Sustainable and Eco-Friendly Materials

Growing environmental awareness is driving demand for balls manufactured with recycled or biodegradable materials. Manufacturers investing in green production processes can capture new market segments, particularly institutional buyers and environmentally conscious consumers. Eco-certified futsal balls are gaining prominence in tenders and school procurement programs, providing differentiation in competitive markets.

Emerging Regional Markets

Regions such as India, Southeast Asia, and parts of Latin America are witnessing rapid growth in futsal participation. Investments in indoor sports infrastructure, youth sports programs, and local futsal leagues create opportunities for new entrants and existing players to expand market share. Tailored pricing and localized marketing strategies can further accelerate adoption.

Technological Integration

Smart balls with sensors for speed, spin, and trajectory, along with hybrid and low-bounce designs, offer enhanced training and performance analytics. Incorporating technology allows brands to command premium pricing, attract professional players, and differentiate in crowded markets.

Product Type Insights

Match and official futsal balls dominate the market, accounting for approximately 45–50% of global revenue in 2024. These balls are certified for competitive play, preferred by professional leagues, academies, and high-end recreational users. Training balls follow closely, offering a balance of durability and affordability, while promotional and mini balls cater to niche recreational and marketing segments. Trends indicate steady growth in premium and certified balls, supported by institutional purchases and professional league requirements.

Application Insights

The primary application of futsal balls remains competitive and professional play, particularly in leagues, tournaments, and academies. Recreational and amateur usage is expanding, driven by community programs, school sports, and urban indoor facilities. Emerging applications include smart training balls for data-driven coaching, event and promotional balls, and customized balls for branding or limited editions. Institutional and recreational demand, combined with professional usage, creates a balanced growth profile for the market.

Distribution Channel Insights

Online platforms are the dominant channel for futsal ball sales, enabling direct-to-consumer purchases, detailed product information, and access to global brands. Specialty sports stores and retail chains continue to play a significant role, particularly for institutions and bulk buyers. Direct sales to clubs, academies, and schools account for a stable revenue stream. Social media marketing and digital campaigns increasingly influence consumer preference, especially among younger demographics.

End-User Insights

Professional clubs and leagues lead in value-based demand due to the requirement for high-quality, certified match balls. Amateur and recreational players represent the largest volume segment, contributing to widespread market adoption. Institutional users such as schools, academies, and community centers drive consistent bulk purchases. Emerging applications, including corporate sports programs and promotional campaigns, are adding incremental demand.

Age Group Insights

Players aged 15–30 years represent the largest volume segment, driving growth in amateur and recreational futsal. Ages 31–50 contribute significantly to premium and professional usage, often investing in certified match balls. Younger participants also adopt technologically advanced and customized balls, while older demographics tend to purchase durable training and recreational balls.

| By Product Type | By Material | By End-User | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 15–20% of the global market in 2024. The U.S. leads demand due to rising youth participation and institutional adoption in schools and sports academies. Online and specialty retail distribution channels drive accessibility. Professional leagues and amateur clubs are contributing to steady growth, with expected CAGR near the global average.

Europe

Europe holds 25–30% of the global market share in 2024, with Spain, Portugal, Germany, and Italy leading due to established futsal leagues and widespread recreational play. Premium match balls dominate, and replacement cycles for training balls support consistent demand. Sustainability initiatives and eco-friendly product adoption are increasing, with a moderate growth rate relative to emerging regions.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with approximately 30–35% market share in 2024. India, China, Japan, and Southeast Asian countries drive demand through youth leagues, government sports programs, and rapid indoor sports infrastructure development. Growth in both premium and mid-range segments is accelerating adoption, supported by online channels and export opportunities from regional manufacturers.

Latin America

Latin America accounts for 10–12% of the market, led by Brazil, Mexico, and Argentina. Cultural affinity for futsal, combined with established recreational programs and growing club participation, supports demand for training and match balls. Price sensitivity moderates premium segment growth, though mid-range and institutional purchases remain strong.

Middle East & Africa

MEA contributes 5–8% of the global market. Growth is driven by government investment in indoor sports facilities, high-income populations in Gulf countries, and rising recreational participation. Africa’s established futsal hubs, including South Africa and Egypt, generate steady demand for both training and match balls, with gradual adoption of premium products.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Futsal Balls Market

- Adidas AG

- Nike, Inc.

- Puma SE

- Select Sport

- Molten Corporation

- Joma Sport

- Miter Sports International

- Umbro

- Nivia Sports

- Baden Sports

- Voit

- Wilson Sporting Goods

- Senda Athletics

- Derbystar

- Gala Sports

Recent Developments

- In June 2025, Adidas launched a new PU-based premium futsal ball series designed for indoor leagues in the Asia-Pacific region, integrating enhanced low-bounce technology and eco-friendly materials.

- In March 2025, Select Sport expanded its distribution network in India and Southeast Asia to supply certified match balls for professional and institutional buyers.

- In January 2025, Molten Corporation introduced hybrid composite futsal balls with smart sensor capabilities for training analytics, targeting professional clubs and academies in Europe and North America.