Fuel Home Generator Market Size

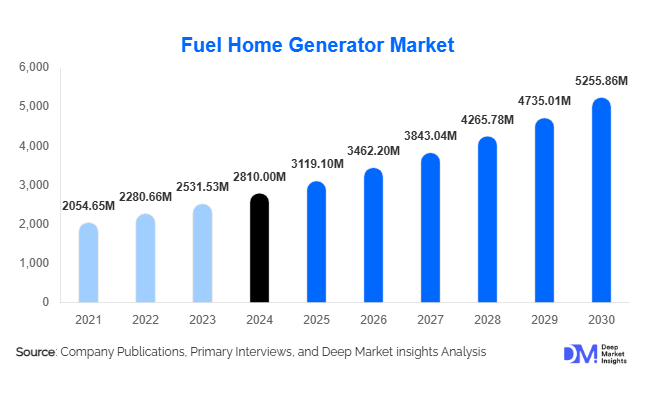

According to Deep Market Insights, the global fuel home generator market size was valued at USD 2,810 million in 2024 and is projected to grow from USD 3,119.10 million in 2025 to reach USD 5,255.86 million by 2030, expanding at a CAGR of 11% during the forecast period (2025–2030). The market growth is primarily driven by the increasing frequency of power outages, rising urbanization, and the growing demand for reliable backup power solutions in residential and small business applications.

Key Market Insights

- Integration of renewable energy with home generators is gaining traction, allowing hybrid systems that are environmentally friendly and fuel-efficient.

- Advancements in generator technology have led to quieter, more compact, and fuel-efficient models, improving consumer adoption globally.

- North America dominates the market, with high adoption of home generators in the U.S. and Canada due to frequent power outages and stringent reliability requirements.

- Asia-Pacific is the fastest-growing region, driven by urbanization, industrialization, and government initiatives in China, India, and Southeast Asia.

- Government policies and incentives to promote backup power solutions and domestic manufacturing are shaping market growth.

- Technological adoption, including IoT-enabled monitoring, fuel optimization, and low-noise designs, is enhancing customer experience and market competitiveness.

What are the latest trends in the fuel home generator market?

Hybrid Energy Generators

There is a rising trend of integrating fuel-based generators with renewable energy sources such as solar or wind. These hybrid solutions reduce dependency on fossil fuels, improve energy efficiency, and align with consumer demand for sustainable energy options. They also support smart energy management systems, allowing homeowners to switch seamlessly between fuel and renewable sources.

Compact and Silent Operation Technologies

Modern fuel home generators are being designed for minimal noise emissions and compact installation footprints. Soundproofing, inverter technology, and advanced engine designs are now common in residential-grade models, making them suitable for urban households and small offices. These improvements are addressing long-standing complaints about noise pollution and ease of installation, thereby driving adoption.

What are the key drivers in the fuel home generator market?

Increasing Power Outages

Frequent power outages due to natural disasters, aging infrastructure, and grid unreliability are major drivers of the home generator market. Residential households and small businesses require uninterrupted power for appliances, security systems, and critical equipment, fueling sustained demand for fuel home generators.

Urbanization and Residential Electrification

Rapid urbanization in emerging economies, coupled with increasing residential electrification, has significantly increased demand for backup power solutions. High-rise residential complexes and remote homes are increasingly relying on home generators to ensure energy reliability.

Technological Advancements

Innovations in engine efficiency, inverter-based systems, and fuel management technologies have improved performance and reduced operational costs, making fuel home generators more attractive to end users.

What are the restraints for the global market?

High Initial Investment

The upfront cost of purchasing and installing a home generator, including fuel supply systems, can be high. This limits market penetration among price-sensitive consumers, particularly in emerging economies.

Environmental Concerns

Fossil fuel-powered generators contribute to air pollution and greenhouse gas emissions. Increasing environmental awareness and regulations regarding emissions are challenging market growth, prompting a shift toward hybrid or cleaner energy solutions.

What are the key opportunities in the fuel home generator market?

Renewable Integration and Hybrid Systems

The integration of solar and wind power with fuel-based generators presents a significant opportunity for companies to offer eco-friendly, hybrid systems. These solutions reduce operating costs, comply with environmental regulations, and appeal to environmentally conscious consumers, enabling companies to expand their market share in urban and suburban regions.

Expansion in Emerging Markets

Regions such as Asia-Pacific and Latin America, where grid reliability is limited and urbanization is rapid, offer substantial growth opportunities. Companies can tap into the growing demand by localizing production, offering affordable products, and collaborating with regional distributors or government initiatives.

Technological Innovations

Advanced fuel efficiency, IoT-based monitoring, and smart energy management systems are transforming the fuel home generator market. Manufacturers investing in R&D for quieter, more compact, and intelligent systems are likely to differentiate themselves and capture a larger share of the premium market.

Product Type Insights

Portable generators dominate the market, accounting for a significant share due to their flexibility, ease of use, and suitability for residential and small commercial applications. Stationary generators, while less common, are preferred in larger homes and critical infrastructure due to higher power capacity and continuous operation capabilities. The portable segment accounted for approximately 55% of the market in 2024, driven by growing adoption in urban households and seasonal emergency use cases.

Application Insights

Residential households remain the largest end-use segment for fuel home generators, followed by small commercial businesses and remote establishments. The residential segment is growing fastest, driven by increasing awareness of power reliability and the need for uninterrupted electricity during outages. Export-driven demand is rising in regions with unstable electricity grids, boosting market penetration in developing nations.

Distribution Channel Insights

Online platforms, including direct-to-consumer websites and e-commerce portals, are increasingly used for generator sales due to convenience and availability of detailed specifications. Traditional retail stores, electrical appliance distributors, and specialty home improvement outlets also play a crucial role in reaching local markets. Emerging subscription-based models and rental services are gaining attention, particularly for high-capacity generators.

| By Product Type | By Fuel Type | By Power Rating | By End-Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America is the largest market, with the U.S. and Canada accounting for 40% of global revenue in 2024. High adoption is driven by frequent storms, aging infrastructure, and strong consumer preference for reliable backup power. Government incentives and robust distribution networks support widespread availability of residential generators.

Europe

Europe holds approximately 25% of the market, with Germany, the U.K., and France leading adoption due to stringent energy reliability requirements, technological innovations, and environmental regulations encouraging hybrid solutions. Growth is steady, driven by high urbanization and premium product adoption.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with China, India, and Southeast Asia leading the demand surge. Rapid urbanization, industrialization, and frequent power outages are driving strong adoption in residential and commercial segments.

Latin America

Brazil, Mexico, and Argentina are key markets, with increasing demand in urban areas facing grid instability. Market growth is moderate but gaining momentum due to infrastructure expansion and government incentives for reliable power solutions.

Middle East & Africa

These regions are witnessing growth due to power grid instability and extreme weather conditions. High-income households and commercial facilities in countries such as the UAE, Saudi Arabia, and South Africa are adopting fuel home generators to ensure an uninterrupted electricity supply.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Fuel Home Generator Market

- Honda Motor Co., Ltd.

- Generac Holdings Inc.

- Briggs & Stratton Corporation

- Cummins Inc.

- Yamaha Motor Co., Ltd.

- Kohler Co.

- Atlas Copco AB

- Wacker Neuson SE

- Chicago Pneumatic

- MTU Onsite Energy

- Himoinsa

- Hyundai Electric & Energy Systems Co., Ltd.

- STANDBY Power

- Green Power Solutions

- FG Wilson

Recent Developments

- In March 2025, Honda launched a new line of hybrid home generators integrating solar capabilities for residential use, reducing fuel dependency and noise levels.

- In January 2025, Generac introduced a smart IoT-enabled home generator series, allowing remote monitoring and predictive maintenance to enhance user convenience.

- In December 2024, Cummins expanded its residential generator offerings in India and Southeast Asia, targeting rapidly urbanizing regions with high demand for an uninterrupted power supply.