Fleece Jackets & Vests Market Size

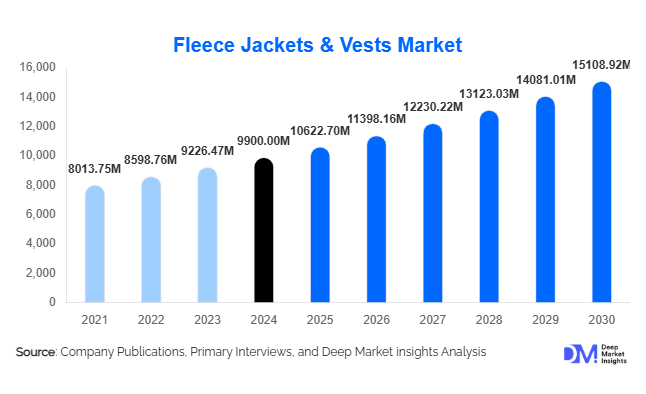

According to Deep Market Insights, the global fleece jackets & vests market size was valued at USD 9,900 million in 2024 and is projected to grow from USD 10,622.70 million in 2025 to reach USD 15,108.92 million by 2030, expanding at a CAGR of 7.3% during the forecast period (2025–2030). Market growth is primarily driven by rising outdoor recreation trends, the expanding appeal of casual and athleisure apparel, and surging consumer demand for sustainable, lightweight, and functional outerwear. The fleece segment has evolved beyond cold-weather gear into a lifestyle staple across climates and demographics.

Key Market Insights

- Global demand for recycled and eco-friendly fleece materials is accelerating, driven by sustainability mandates and conscious consumer preferences.

- Asia-Pacific is emerging as the largest and fastest-growing region, supported by rapid urbanization, rising disposable incomes, and expanding e-commerce retail penetration.

- Men’s fleece jackets lead the product category, accounting for over 40% of global revenue, with strong adoption in outdoor, workwear, and fashion applications.

- Online and direct-to-consumer channels dominate distribution, contributing nearly 45% of overall global sales in 2024 as brands strengthen digital footprints.

- Premium and performance fleece segments are expanding rapidly, integrating water resistance, wind protection, and hybrid insulation technologies.

- Global brands are intensifying investment in material innovation and circular design, introducing recycled polyester, anti-pilling treatments, and low-shed fibers to reduce environmental footprint.

What are the latest trends in the fleece jackets market?

Sustainable and Recycled Fabrics Driving Innovation

One of the most notable trends shaping the fleece jackets & vests market is the shift toward sustainable manufacturing and recycled materials. Brands such as Patagonia, Columbia, and The North Face are pioneering the use of post-consumer recycled polyester and low-impact dyeing technologies to reduce carbon and water footprints. The adoption of GRS-certified fabrics and closed-loop recycling systems is helping manufacturers align with tightening environmental standards in North America and Europe. Consumers increasingly value transparency in sourcing, and companies offering verifiable eco-credentials are achieving premium price positioning. As governments impose stricter waste and microplastic regulations, sustainable fleece production is becoming a strategic differentiator rather than a marketing add-on.

Performance-Enhanced and Hybrid Designs

Technical performance features are redefining fleece jacket design. Lightweight and stretchable fabrics combined with water- and wind-resistant membranes are increasingly common in mid- and high-range categories. Hybrid jackets that blend fleece with softshell or insulated layers provide greater adaptability across climates and activities. These innovations are especially attractive to outdoor enthusiasts and travelers seeking versatile, multi-season gear. Integrated ventilation zones, quick-dry linings, and odor-resistant coatings are also being used to extend comfort and longevity, ensuring functional appeal across both urban and outdoor use cases.

What are the key drivers in the fleece jackets market?

Outdoor Recreation and Active Lifestyle Growth

Global participation in hiking, trekking, camping, and fitness activities continues to surge, driving steady demand for lightweight, insulating outerwear. Fleece jackets’ ability to deliver warmth, breathability, and portability makes them a preferred choice for multi-activity consumers. According to industry data, over 55% of fleece purchases are now tied to outdoor or sports-oriented activities. The expansion of adventure tourism and athleisure fashion is reinforcing fleece apparel’s relevance in everyday wear.

Expansion of E-commerce and D2C Retail

The rise of online retail has transformed the fleece apparel market landscape. Direct-to-consumer strategies allow brands to personalize marketing, reduce intermediary costs, and expand geographic reach. E-commerce accounted for roughly 45% of fleece jacket sales in 2024, with this share expected to surpass 55% by 2030. Improved logistics networks, AR-based try-on features, and rapid delivery models are enabling manufacturers to tap into emerging markets faster and more efficiently than traditional retail channels.

Growing Preference for Sustainable and Premium Apparel

Consumers are increasingly prioritizing environmental responsibility and performance over fast fashion. Premium fleece jackets made from recycled polyester and advanced blends are witnessing double-digit growth rates. Millennials and Gen Z consumers, in particular, are driving this shift—valuing durability, brand authenticity, and ethical sourcing. This evolution supports higher average selling prices and improved brand margins across leading manufacturers.

What are the restraints for the global market?

Raw Material Cost Volatility

The fleece apparel industry remains vulnerable to fluctuations in polyester and synthetic fiber prices, as well as logistics and energy costs. Supply chain disruptions and changes in trade tariffs can raise input costs, compressing margins for both manufacturers and retailers. The reliance on petroleum-derived raw materials also exposes the industry to price volatility tied to crude oil markets, creating uncertainty for long-term procurement planning.

Intense Competition and Market Saturation in Mature Regions

In mature markets like North America and Western Europe, the fleece jackets segment faces saturation due to the presence of numerous international and regional brands. Competitive pricing pressure, rapid product imitation, and the growing availability of substitute outerwear (down and synthetic-insulated jackets) limit margin expansion. Additionally, environmental concerns around microfiber shedding from synthetic fleece have prompted scrutiny, compelling brands to invest heavily in R&D and compliance measures.

What are the key opportunities in the fleece jackets industry?

Eco-Friendly and Circular Production Systems

Adopting circular economy practices represents a significant growth avenue. Manufacturers that implement closed-loop recycling, biodegradable packaging, and garment take-back programs can strengthen brand equity and customer loyalty. Government incentives for sustainable textile production, especially in Europe and Asia-Pacific, further support this opportunity. The ability to achieve carbon neutrality or zero-waste certification could serve as a key differentiator in the next decade.

Expanding Demand in Emerging Markets

Rising disposable incomes, rapid urbanization, and evolving climate patterns in Asia-Pacific, Latin America, and parts of the Middle East are driving demand for fleece apparel. India, China, and Southeast Asia collectively accounted for nearly one-third of global fleece consumption in 2024, with a projected CAGR above 8% through 2030. Localization of production, competitive pricing, and region-specific designs will be critical for brands targeting these high-growth markets.

Integration of Smart and Functional Technologies

Technological innovation offers a path to premium differentiation. The integration of smart heating elements, temperature regulation systems, and connectivity-enabled apparel is transforming high-end fleece jackets into performance wear. Such advancements are especially attractive for professional athletes, cold-chain workers, and tech-savvy outdoor consumers. Partnerships between apparel manufacturers and wearable-tech firms are expected to accelerate over the forecast period.

Product Type Insights

Full-zip fleece jackets dominate the product landscape, accounting for approximately 60–65% of total global sales in 2024. Their versatility for layering and all-weather adaptability makes them the most preferred style among consumers. Pullovers and half-zip variants appeal to the fashion and athleisure segment, while fleece vests hold niche demand for transitional weather. Heavyweight and hybrid fleeces are rapidly expanding in colder regions, driven by innovation in water-resistant and thermal insulation technologies.

Application Insights

Outdoor and adventure applications represent the largest share of fleece jacket use globally, contributing nearly 35% of total demand in 2024. Casual and lifestyle applications are the fastest-growing, with a CAGR exceeding 8% as fleece transitions into daily fashion wear. Sports and fitness applications, including running and cycling, are seeing robust uptake due to the material’s breathability and stretch. Industrial and workwear uses remain smaller but steady, supported by durability and cost efficiency in cold-storage and logistics sectors.

Distribution Channel Insights

Online retail remains the dominant sales channel, generating about 45% of total market revenue in 2024. Specialty outdoor retailers and branded stores continue to perform well in premium markets, offering high-touch customer experiences. Department stores and supermarkets cater mainly to mass and mid-tier consumers. Direct-to-consumer websites are growing rapidly, driven by brand control over storytelling, sustainability disclosure, and personalization features.

End-User Insights

The men’s category leads global demand with roughly 43% share of total market value in 2024, supported by high adoption in outdoor and lifestyle segments. The women’s category is expanding rapidly, particularly within fashion-forward and athleisure lines. Children’s fleece jackets represent a smaller but promising segment, with increasing parental focus on safety, warmth, and comfort. Gender-neutral collections and inclusive sizing are also emerging as differentiators in premium brands.

| By Product Type | By Application | By Distribution Channel | By End User |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds approximately 29% of the global market share, led by the U.S. and Canada. High outdoor participation rates, advanced retail networks, and consumer preference for performance apparel support sustained growth. Demand for sustainable and branded fleece products continues to rise, particularly among millennials and Gen Z consumers seeking versatile, eco-friendly clothing.

Europe

Europe commands about 25% of global revenue, with strong markets in Germany, the U.K., and France. Scandinavian countries exhibit high per-capita consumption driven by cold climates and sustainability awareness. The region’s strict environmental regulations are pushing manufacturers toward eco-certifications and recycled polyester adoption.

Asia-Pacific

Asia-Pacific accounts for the largest regional share at around 31% in 2024 and is the fastest-growing market through 2030. China dominates production and consumption, while India and Japan are expanding rapidly due to fashion and outdoor trends. Increasing online retail penetration, coupled with rising disposable incomes, is expected to propel the region’s CAGR above 8% during the forecast period.

Latin America

Latin America contributes an estimated 6–7% of global demand. Brazil and Mexico lead regional growth with rising adventure tourism and lifestyle apparel spending. Although price-sensitive, these markets present opportunities for mass and mid-tier fleece categories through online marketplaces and regional retailers.

Middle East & Africa

The Middle East & Africa collectively represent around 10% of global market revenue. The Gulf region’s premium consumer base drives demand for luxury and designer fleece apparel, while South Africa and Kenya show rising adoption for both lifestyle and outdoor use. Investments in retail infrastructure and tourism expansion continue to stimulate demand across the region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Fleece Jackets & Vests Market

- Columbia Sportswear Company

- The North Face (VF Corporation)

- Patagonia Inc.

- Jack Wolfskin

- Marmot

- Helly Hansen

- Outdoor Research

- Mountain Hardwear

- Eddie Bauer

- Arc’teryx (Amer Sports)

- Adidas AG

- Nike Inc.

- Under Armor Inc.

- Decathlon SA

- Uniqlo (Fast Retailing Co., Ltd.)

Recent Developments

- In May 2025, Patagonia announced its expanded line of 100% recycled polyester fleece jackets under its circular “ReCrafted” initiative, emphasizing product repair and reuse.

- In March 2025, Columbia Sportswear launched a new hybrid fleece series combining Omni-Heat™ reflective technology with recycled fibers for enhanced insulation performance.

- In February 2025, The North Face introduced its FutureFleece™ collection in Asia-Pacific, featuring lightweight, thermo-efficient fabrics designed for all-season versatility.