Fire Ready Range Hood Market Size

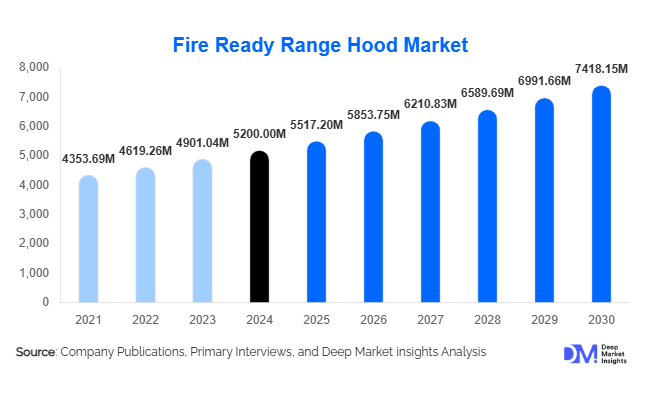

According to Deep Market Insights, the global fire-ready range hood market size was valued at USD 5,200 million in 2024 and is projected to grow from USD 5,517.20 million in 2025 to reach USD 7,418.15 million by 2030, expanding at a CAGR of 6.1% during the forecast period (2025–2030). The market growth is primarily driven by increasing awareness of kitchen safety, rising demand for smart and energy-efficient kitchen appliances, and the adoption of advanced fire suppression technologies in both residential and commercial kitchens.

Key Market Insights

- Smart and technologically advanced range hoods are gaining popularity, with features such as remote control, voice activation, and integration with home automation systems enhancing consumer convenience and safety.

- Residential applications dominate the market, driven by increasing home renovations, rising disposable incomes, and awareness of fire safety standards in kitchens.

- North America holds a significant share, supported by stringent safety regulations, high consumer awareness, and widespread adoption of smart kitchen appliances.

- Asia-Pacific is the fastest-growing region, fueled by rapid urbanization, rising middle-class income, and increased demand for modern kitchen appliances in countries such as China and India.

- Energy efficiency and sustainability are becoming key purchasing criteria, pushing manufacturers to adopt eco-friendly materials and designs in fire-ready range hoods.

- Commercial kitchens continue to drive demand, particularly in the hospitality and foodservice industries, where fire safety regulations are stringent.

What are the latest trends in the fire-ready range hood market?

Integration of Smart Technologies

Manufacturers are increasingly incorporating smart home technologies into fire-ready range hoods. Features like remote operation, automatic fire detection, and connectivity with IoT-enabled kitchen systems are becoming standard in premium models. These advancements improve both convenience and safety, appealing to tech-savvy consumers seeking modern, automated kitchens. Integration with AI-enabled controls and mobile applications allows homeowners to monitor and manage their kitchen appliances remotely, reducing the risk of kitchen fires.

Focus on Energy Efficiency and Sustainability

Energy-efficient and eco-friendly range hoods are gaining traction as consumers and regulatory bodies demand appliances that reduce energy consumption. Manufacturers are incorporating sustainable materials, low-energy motors, and recyclable components to meet environmental standards. These features also enhance product appeal among environmentally conscious buyers, strengthening brand differentiation and market adoption.

What are the key drivers in the fire-ready range hood market?

Stringent Safety Regulations

Government regulations worldwide mandate fire suppression capabilities in commercial and high-end residential kitchens. Compliance with these standards drives the adoption of fire-ready range hoods, as traditional hoods without safety features fail to meet legal requirements. This regulatory push creates sustained demand, particularly in North America and Europe.

Technological Advancements

Continuous innovation in fire detection and suppression technologies has significantly enhanced the functionality and reliability of range hoods. Wet chemical suppression systems, heat sensors, and automated extinguishing mechanisms are becoming industry standards. Manufacturers leveraging these technologies are able to provide safer and more efficient products, which boosts market growth.

Increasing Consumer Awareness

Awareness of kitchen fire hazards has grown due to media campaigns and education programs. Consumers are proactively investing in fire-safe appliances, especially in urban areas where kitchen fire incidents are more common. This trend is particularly pronounced in high-income countries with greater access to information.

What are the restraints for the global market?

High Initial Cost

Advanced fire-ready range hoods come with higher initial prices compared to standard models. This can limit adoption in price-sensitive markets, particularly in developing countries where cost is a primary purchase consideration.

Maintenance and Operational Costs

The specialized components of fire suppression systems require regular maintenance and occasional replacement, increasing operational costs. This factor can deter consumers from upgrading existing appliances, slowing market penetration.

What are the key opportunities in the fire-ready range hood industry?

Expansion in Emerging Markets

Rapid urbanization and rising disposable incomes in the Asia-Pacific and Latin America are creating significant opportunities for fire-ready range hood manufacturers. Affordable, technologically advanced products tailored to local consumer preferences can capture high growth in these emerging markets. Companies expanding into these regions can gain first-mover advantages and establish brand presence early.

Smart Home Integration

The increasing adoption of connected home ecosystems presents opportunities for manufacturers to offer range hoods compatible with smart appliances. Integration with AI, voice assistants, and IoT platforms can improve convenience, safety, and energy efficiency, enhancing customer value and market competitiveness.

Eco-Friendly and Energy-Efficient Products

Environmental concerns and regulatory pressures are motivating manufacturers to develop sustainable, low-energy range hoods. Products with energy-saving motors, recyclable components, and reduced carbon footprints appeal to environmentally conscious consumers, enabling brands to differentiate and expand market share.

Product Type Insights

Under-cabinet range hoods dominate the market, accounting for approximately 40% of the 2024 market share. Their compact design, efficient performance, and compatibility with standard kitchen layouts make them the most widely adopted type globally. Wall-mounted and island hoods are also growing, driven by rising demand for premium kitchen aesthetics and customized designs.

Application Insights

The residential segment leads with a 60% market share in 2024, fueled by home renovations, smart kitchen adoption, and fire safety awareness. Commercial kitchens, including restaurants, hotels, and institutional kitchens, are significant adopters due to regulatory mandates and higher operational safety requirements. Growing hospitality and foodservice industries, particularly in Asia-Pacific and the Middle East, are driving consistent demand.

Distribution Channel Insights

Retail stores, specialty kitchen appliance outlets, and online platforms dominate distribution. E-commerce channels are gaining traction due to convenience, competitive pricing, and direct access to branded products. Direct sales to commercial establishments also represent a significant portion of the market, particularly in regions with strict fire safety regulations.

End-Use Insights

Residential demand is rising steadily, but commercial kitchens, including restaurants, hotels, and institutional kitchens, are the fastest-growing end-use segment due to strict fire safety requirements. Export-driven demand is notable in countries with stringent regulations, such as the U.S., Germany, and Japan, where imported fire-ready range hoods are preferred for quality and compliance.

| By Product Type | By Application | By Technology | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America dominates the market with a 28% share in 2024. The U.S. leads adoption due to high consumer awareness, smart kitchen trends, and regulatory compliance. Canada also contributes to market growth, particularly in urban residential segments.

Europe

Europe holds a 22% share of the 2024 market, with Germany, France, and the U.K. leading adoption due to safety regulations and high standards for kitchen ventilation. Energy-efficient and technologically advanced range hoods are particularly popular in Western Europe.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with countries like China and India driving growth due to urbanization, rising disposable incomes, and increasing construction of modern kitchens. Smart and affordable solutions are fueling adoption across residential and commercial sectors.

Latin America

Brazil and Mexico are emerging markets, driven by urban population growth and increased kitchen appliance penetration. Adoption remains moderate compared to North America and Europe, but is expected to grow steadily.

Middle East & Africa

The Middle East, led by the UAE and Saudi Arabia, is adopting premium and smart fire-ready range hoods in commercial and luxury residential segments. Africa’s demand is limited but growing in urban centers with modern construction projects.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Fire Ready Range Hood Market

- Broan-NuTone, LLC

- GE Appliances, a Haier Company

- Whirlpool Corporation

- Faber S.p.A.

- Miele & Cie. KG

- Bosch Home Appliances

- Elica S.p.A.

- Samsung Electronics

- LG Electronics

- Vent-A-Hood® Ltd.

- Zephyr Ventilation

- KOBE Range Hoods

- Proline Range Hoods

- Air King America

- Elica S.p.A.

Recent Developments

- In March 2025, Broan-NuTone launched a new series of smart fire-ready range hoods with IoT connectivity and voice-activated controls.

- In February 2025, Faber S.p.A. introduced energy-efficient range hoods for commercial kitchens, reducing operational costs and improving safety compliance.

- In January 2025, Miele rolled out a premium line of fire-ready range hoods with automatic wet chemical suppression systems for high-end residential kitchens.