Faux Pearls Market Size

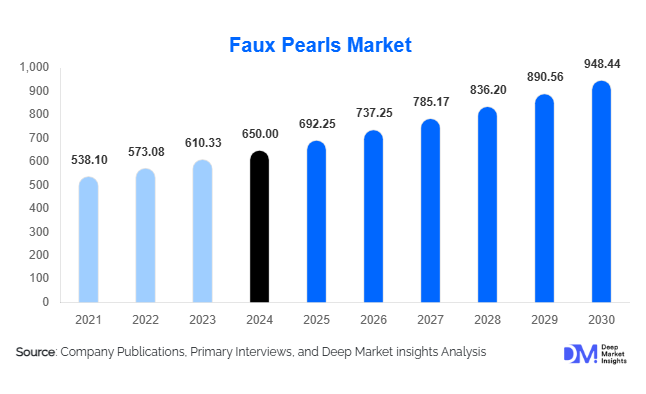

According to Deep Market Insights, the global faux pearls market size was valued at USD 650 million in 2024 and is projected to grow from USD 692.25 million in 2025 to reach USD 948.44 million by 2030, expanding at a CAGR of 6.5% during the forecast period (2025–2030). The market growth is primarily driven by increasing demand for affordable luxury in fashion jewelry, rising use of pearls in apparel and accessories embellishments, and the growing adoption of sustainable and customized faux pearl products across global markets.

Key Market Insights

- Faux pearls are increasingly integrated into fashion and accessory design, enabling consumers to access aesthetically appealing jewelry and garments at a lower cost compared to natural or cultured pearls.

- Technological improvements in coating and luster treatment are enhancing the visual appeal and durability of faux pearls, narrowing the gap with real pearls.

- Asia Pacific dominates production and consumption, led by China and India, where low-cost manufacturing and strong domestic demand drive growth.

- North America and Europe remain key import regions, with fashion jewelry and apparel embellishment driving demand for high-quality faux pearls.

- Online retail channels are expanding rapidly, allowing small and medium-sized manufacturers to reach global consumers directly.

- Eco-friendly and sustainable faux pearls are emerging as a differentiating factor, appealing to environmentally conscious buyers in Europe and North America.

What are the latest trends in the faux pearls market?

Premiumization and Customization

Market players are increasingly offering high-quality faux pearls with advanced luster, gradient color finishes, and customized sizes or shapes. Mass personalization, including bespoke necklaces, bracelets, and decorative assemblies, is gaining traction, particularly among young, trend-sensitive consumers. Direct-to-consumer brands leverage small-batch production and digital design tools to meet demand for unique, tailor-made products, increasing brand loyalty and enabling higher margins.

Sustainable and Eco-Friendly Faux Pearls

Manufacturers are adopting biodegradable polymers, non-toxic coatings, and recycled glass or plastic beads to reduce environmental impact. Regulatory pressure in Europe and North America drives innovation in green materials. Eco-labeled faux pearls allow brands to market products with both aesthetic appeal and environmental responsibility, targeting eco-conscious millennials and Gen Z consumers.

What are the key drivers in the faux pearls market?

Rising Demand for Affordable Luxury

Consumers are seeking cost-effective alternatives to cultured pearls without compromising on aesthetic appeal. Faux pearls provide the visual and tactile elegance of natural pearls at a fraction of the cost. Fast fashion, mid-tier jewelry lines, and seasonal collections fuel repeat purchases, further stimulating market growth. Increasing use in bridal, festival, and formal wear reinforces the segment's expansion.

Growth in Fashion and Apparel Embellishments

The apparel and accessories sector increasingly uses faux pearls for embroidery, trims, buttons, and appliqués. Rising demand for ornate garments, bridalwear, handbags, and footwear drives upstream demand for high-quality imitation pearls. Export-oriented apparel manufacturers incorporate faux pearls into garments bound for Europe, North America, and the Middle East, supporting global market growth.

Technological Advancements in Coating and Finishing

Innovations such as vacuum deposition, nano-layer coatings, and scratch-resistant finishes improve the appearance and durability of faux pearls. These advancements enhance consumer perception and increase acceptance across fashion jewelry and premium accessory segments.

What are the restraints for the global market?

Perception Gap Versus Real Pearls

Despite improvements in quality, some consumers perceive faux pearls as inferior to natural or cultured pearls. This limits adoption in premium and luxury jewelry segments, requiring brands to invest in marketing, design, and finishing to overcome skepticism.

Volatility in Raw Material Costs and Regulatory Compliance

Faux pearl production relies on polymers, glass, pigments, and specialized coatings, which are subject to price fluctuations. Additionally, regulations such as REACH and RoHS impose restrictions on hazardous chemicals, forcing manufacturers to innovate and comply, often at higher production costs.

What are the key opportunities in the faux pearls industry?

Mass Personalization and Digital Design Integration

Manufacturers and brands can leverage 3D design, small-batch production, and digital ordering systems to offer customized faux pearls and jewelry sets. Personalized products enhance consumer loyalty, command higher margins, and differentiate brands from commodity suppliers.

Eco-Friendly Product Lines

There is an opportunity to develop sustainable faux pearls using biodegradable polymers, recycled materials, and non-toxic coatings. Eco-friendly offerings appeal to environmentally conscious buyers and provide a competitive edge in Europe and North America, where regulatory and consumer pressure favors sustainable products.

Expansion in Emerging Markets

Emerging economies in Southeast Asia, Latin America, and Africa present untapped demand. Increasing disposable incomes, growing fashion-conscious populations, and the adoption of fast fashion in tier-2 and tier-3 cities offer opportunities for both local and export-focused manufacturers. Distribution via mobile e-commerce platforms and regional boutiques can accelerate growth in these regions.

Product Type Insights

Plastic/polymer-based faux pearls dominate, accounting for 35–40% of global revenue in 2024, due to their cost efficiency, flexibility, and lightweight properties. Strung assemblies, including necklaces and bracelets, represent 25% of the market, offering higher margins due to value-added jewelry production. Glass-based and shell-composite pearls occupy the premium segment, providing enhanced luster and aesthetic appeal for mid-to-high-end jewelry applications.

Application Insights

Fashion jewelry is the largest application, accounting for 45–50% of revenue in 2024. Apparel and accessory embellishments hold 20%, with decorative and craft applications contributing 10%. Emerging applications include luxury packaging, smart accessories, and home décor, reflecting expanding utility beyond traditional fashion and jewelry segments.

Distribution Channel Insights

Online retail and e-commerce are the fastest-growing channels, accounting for 20–25% of revenue. Direct-to-consumer models allow small manufacturers to reach global audiences, while wholesale B2B channels remain important for bulk supply to fashion and apparel brands. Specialty retail continues to serve niche markets, particularly in Europe and North America.

Traveler Type Insights

The term "traveler" is not applicable; instead, key buyers include fashion jewelry brands, apparel manufacturers, craft wholesalers, and luxury accessory designers. Group purchases by brands dominate volume, while direct-to-consumer purchases from online platforms are rapidly increasing.

Age Group Insights

The primary consumer demographic is 18–45 years, encompassing millennials and Gen Z, who prioritize affordable luxury, trend-driven fashion jewelry, and customization. Older demographics participate in higher-end, branded faux pearl products that emphasize quality and design over cost.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America accounts for 25% of the market (USD 162.5 million in 2024). Strong demand comes from the U.S., driven by fashion jewelry, craft stores, and e-commerce. High disposable income and appreciation for quality costume jewelry support market growth at a 5–6% CAGR.

Europe

Europe holds a 17% share (USD 110 million in 2024). Germany, France, Italy, and the UK lead demand for eco-friendly, high-quality faux pearls. Growth is moderate (5–6% CAGR), but premiumization and sustainability focus enhance profit margins.

Asia-Pacific

Asia Pacific is the largest region (40% share; USD 260 million), led by China and India, which serve as both production hubs and growing consumer markets. The region is the fastest-growing, with a 7–8% CAGR, driven by apparel exports, domestic consumption, and e-commerce penetration.

Middle East & Africa

MEA represents 7% of the market (USD 45 million). UAE, Saudi Arabia, and Qatar are major importers, primarily for fashion jewelry and decorative applications. Growth is strong due to rising disposable incomes and cultural affinity for ornate accessories.

Latin America

Latin America contributes 8% (USD 52 million). Brazil and Mexico are key markets, with demand centered on fashion-driven and decorative faux pearls. Growth is 5–7% CAGR, primarily from urban centers and rising middle-class consumption.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Faux Pearls Market

- Swarovski

- Preciosa

- Matsuo Pearl

- Majorica

- Ibead

- Aya Pearls

- Tianjin Jiarui

- Qingdao Fine Pearl

- Guangdong Hemu

- Zhongshan Pearl

- Haridwar Pearls

- Pearl Art (China)

- Golden Pearl

- Pearlmaster

- Pearl World

Recent Developments

- In March 2025, Swarovski launched a premium faux pearl line with eco-friendly coatings targeting European and North American consumers.

- In February 2025, Majorica expanded production in Spain to include customizable pearl beads for fashion jewelry brands worldwide.

- In January 2025, Qingdao Fine Pearl introduced biodegradable polymer-based beads, enhancing sustainable offerings for international export markets.