Facial Wipes Market Size

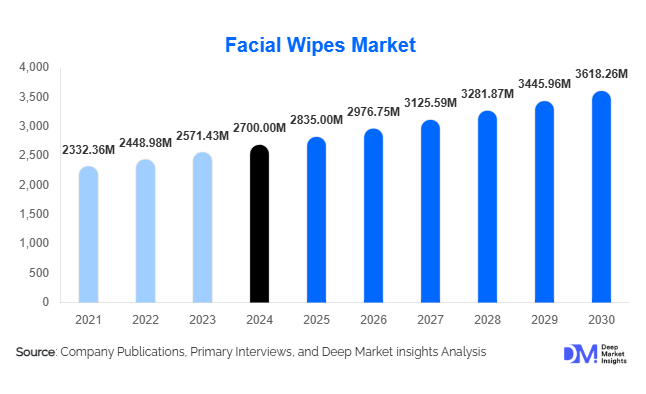

According to Deep Market Insights, the global facial wipes market size was valued at USD 2,700 million in 2024 and is projected to grow from USD 2,835.00 million in 2025 to reach USD 3,618.26 million by 2030, expanding at a CAGR of 5% during the forecast period (2025–2030). The market growth is primarily driven by the rising demand for convenient, on-the-go skincare solutions, increasing awareness of personal hygiene, and the expanding availability of eco-friendly and biodegradable wipe variants across global retail and e-commerce channels.

Key Market Insights

- Eco-friendly and biodegradable wipes are gaining traction as sustainability becomes a defining factor in consumer purchase decisions, especially among Gen Z and millennial consumers.

- Makeup removal and cleansing wipes remain the dominant product categories, driven by growing skincare routines and beauty industry expansion.

- Asia-Pacific is the fastest-growing regional market, fueled by urbanization, rising disposable incomes, and higher personal care spending in China and India.

- North America continues to lead the market share due to mature retail infrastructure, product innovation, and premium brand positioning.

- Online retail and D2C sales channels are transforming product accessibility and consumer engagement, especially for niche organic brands.

- Growing demand for multifunctional and dermatologically tested wipes is encouraging R&D investment and premiumization across product lines.

Latest Market Trends

Sustainability and Biodegradable Innovations

The facial wipes market is rapidly evolving toward sustainable materials and compostable packaging. Manufacturers are replacing plastic-based non-wovens with bamboo, cotton, and other plant-based substrates to meet tightening environmental regulations. Several global brands have pledged to eliminate non-biodegradable wipes by 2030. Product labels emphasizing “biodegradable,” “vegan,” or “plastic-free” attributes are now key marketing differentiators. Retailers are allocating dedicated shelf space for green personal-care products, while online marketplaces are introducing eco-certification badges to help consumers make informed choices. This trend is particularly pronounced in Europe and North America, where legislation and consumer activism are reshaping the category.

Premiumization and Skincare Integration

Facial wipes are increasingly viewed as an extension of skincare regimens rather than mere convenience products. Premium wipes infused with active ingredients such as hyaluronic acid, vitamin E, or botanical extracts are gaining popularity. Brands are launching dermatologist-approved, pH-balanced, and fragrance-free wipes tailored for sensitive skin. Social media marketing and influencer campaigns are amplifying awareness of premium wipe collections that promise both cleansing and hydration benefits. This convergence of skincare and convenience is driving category value growth despite volume maturity in developed markets.

Facial Wipes Market Drivers

Rising Hygiene Awareness and Health Consciousness

Post-pandemic hygiene consciousness has significantly elevated demand for facial wipes as consumers seek portable, quick-use products for skin cleansing and germ removal. Increased public focus on health and safety standards in workplaces, hospitality, and travel has reinforced the role of wipes in daily hygiene routines. Healthcare and corporate sectors are adopting wipes for employee and patient use, further expanding institutional demand.

Convenience and On-the-Go Lifestyle Adoption

Urbanization, longer working hours, and frequent travel have boosted the preference for disposable, travel-friendly skincare products. Facial wipes offer time efficiency and practicality, appealing especially to commuters, gym-goers, and business travelers. The surge in travel retail sales and single-use sachets illustrates how convenience has become a decisive purchasing factor in both developed and emerging markets.

Natural and Organic Product Demand

Consumer preference for toxin-free, dermatologically safe formulations is steering the market toward natural ingredients and chemical-free preservatives. Brands leveraging herbal, hypoallergenic, and alcohol-free formulations are witnessing stronger brand loyalty and repeat purchases. The organic personal-care movement has catalyzed product diversification, with wipes infused with aloe vera, tea tree oil, and chamomile leading innovation pipelines.

Market Restraints

Rising Raw Material and Manufacturing Costs

Volatile prices of non-woven fabrics, cotton, and packaging materials continue to pressure profit margins. Transitioning to biodegradable substrates further elevates production costs, compelling companies to adjust pricing strategies. Smaller manufacturers face entry barriers due to capital-intensive sustainable production processes and compliance requirements.

Regulatory and Environmental Constraints

Government restrictions on single-use plastics and tightening EU directives on cosmetic preservatives have forced industry restructuring. Manufacturers must invest heavily in R&D and certification to meet eco-labeling and biodegradability standards. Non-compliance risks product recalls and bans, making sustainability not just a trend but a regulatory necessity.

Facial Wipes Market Opportunities

Sustainable and Eco-Conscious Product Development

Growing awareness of environmental pollution caused by synthetic wipes presents a strong opportunity for companies specializing in biodegradable solutions. Bamboo-based and compostable wipes can capture emerging eco-conscious segments. Investment in closed-loop manufacturing and recyclable packaging will appeal to both regulators and premium consumers.

Expansion in Emerging Economies

Rapid urbanization and income growth in Asia-Pacific, Latin America, and the Middle East are unlocking vast consumer bases. Increased hygiene awareness, expansion of modern retail formats, and e-commerce accessibility are fueling new product adoption. Affordable price points, local sourcing, and culturally tailored marketing will help brands penetrate deeper into tier-2 and tier-3 cities.

Technological and Formulation Innovation

Integrating skincare technology such as micellar formulations, time-release actives, and dermatologically tested ingredients creates value differentiation. Smart packaging with moisture retention technology and recyclable resealable lids improves usability. Data-driven personalization through online platforms and subscription models also offers opportunities for direct consumer engagement.

Product Type Insights

Makeup removal wipes dominate the product category, capturing around 30% of the global market share in 2024. The popularity of cosmetics and daily skincare routines has entrenched these wipes as essential products. Cleansing and moisturizing wipes follow, catering to both men and women seeking daily hygiene solutions. Antibacterial and exfoliating variants are emerging niche categories gaining traction within wellness and gym segments.

Material Insights

Non-woven fabric wipes account for approximately 65% of global production volume, driven by low cost and excellent absorbency. However, bamboo and plant-based fiber wipes represent the fastest-growing material segment (CAGR > 9%) as brands respond to sustainability expectations and upcoming plastic reduction mandates.

End-Use Insights

Individual/household consumption represents nearly 80% of total demand, underscoring the product’s mass-market positioning. However, the fastest-growing end-uses are healthcare facilities and hospitality sectors, supported by heightened hygiene protocols. Salons and spas are also expanding the consumption of specialty wipes for professional skincare treatments, further diversifying revenue streams.

Distribution Channel Insights

Supermarkets and hypermarkets remain the primary distribution channels, holding about 40% of the global sales share in 2024. Nonetheless, online retail and direct-to-consumer models are the fastest-growing channels (CAGR > 12%), supported by influencer marketing, subscription services, and product customization features on brand websites.

| By Product Type | By Fabric Type | By Skin Type | By End User | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads the global facial wipes market with a 32% market share in 2024. The United States dominates, driven by a mature skincare culture, high consumer spending, and widespread availability across major retail chains. Canada follows with a rising demand for organic and fragrance-free wipes. Market growth is projected at a steady 4–5% CAGR through 2030.

Europe

Europe represents about 27% of global market share, with Germany, the U.K., and France leading the adoption of biodegradable and dermatologist-tested products. EU environmental directives are accelerating innovation toward plastic-free packaging and plant-based materials. Premium and sensitive-skin wipes are outperforming conventional types, particularly in Western Europe.

Asia-Pacific

Asia-Pacific accounts for nearly 28% of the 2024 market and is expected to record the highest growth rate at 7–8% CAGR through 2030. China, India, Japan, and South Korea are the key growth hubs, supported by increasing disposable income, social media influence on skincare routines, and rapid retail expansion. Local brands are emerging strongly with competitive pricing and herbal formulations tailored to regional skin types.

Latin America

Latin America holds a 7% market share, with Brazil and Mexico dominating. Economic recovery, urban population growth, and expanding middle-class demographics are supporting market development. Local production of affordable facial wipes is rising, helping offset import dependency and price fluctuations.

Middle East & Africa

This region represents roughly 6% of global demand in 2024. The Gulf Cooperation Council (GCC) countries and South Africa lead consumption, driven by strong hygiene awareness and hospitality industry growth. Government initiatives promoting healthcare and tourism hygiene standards are expected to boost market penetration further.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Facial Wipes Market

- Procter & Gamble

- Unilever plc

- Johnson & Johnson

- Kimberly-Clark Corporation

- Beiersdorf AG

- Colgate-Palmolive Company

- Edgewell Personal Care

- Nice-Pak Products Inc.

- Rockline Industries

- Shiseido Company Ltd.

- Albaad Massuot Yitzhak Ltd.

- 3M Company

- Diamond Wipes International Inc.

- Essity AB

- L’Oréal S.A.

Recent Developments

- In August 2025, Unilever launched its new line of Love Beauty and Planet Biodegradable Wipes, made with bamboo fibers and compostable packaging, strengthening its eco-friendly personal care portfolio.

- In May 2025, Procter & Gamble announced a USD 50 million investment in a new biodegradable substrate manufacturing facility in the U.S. to support sustainable wipe production.

- In February 2025, Beiersdorf introduced NIVEA Naturally Clean Facial Wipes across European retail chains, featuring plant-based formulations and recyclable paper packaging.