Facial Water Spray Market Size

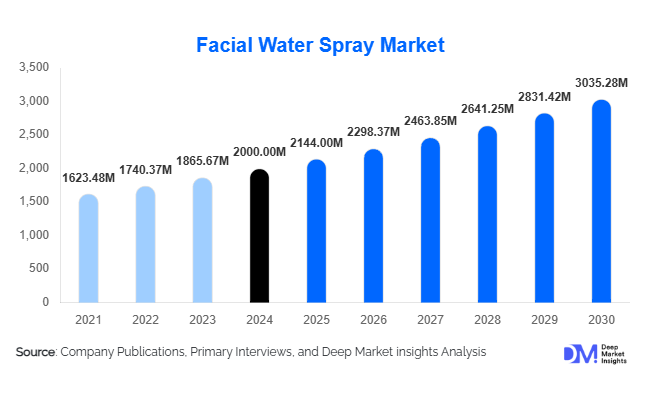

According to Deep Market Insights, the global facial water spray market size was valued at USD 2,000 million in 2024 and is projected to grow from USD 2,144.0 million in 2025 to reach USD 3,035.28 million by 2030, expanding at a CAGR of 7.2% during the forecast period (2025–2030). The growth of the facial water spray market is primarily driven by increasing consumer focus on skincare hydration, the rising influence of beauty influencers and social media marketing, and expanding product availability across both premium and mass-market retail segments.

Key Market Insights

- Rising consumer awareness about skincare hydration is fueling demand for facial water sprays enriched with minerals, antioxidants, and natural botanicals.

- Thermal and mineral-based sprays dominate the market due to their dermatological benefits and suitability for sensitive skin.

- Asia-Pacific leads the global market in both consumption and innovation, with strong demand from South Korea, Japan, and China.

- North America and Europe remain high-value markets, driven by premium brand adoption and dermatological endorsements.

- Online retail channels are expanding rapidly, with direct-to-consumer skincare brands leveraging social media and influencer marketing.

- Eco-conscious packaging and sustainable formulations are emerging as key differentiators for new product launches.

Latest Market Trends

Clean Beauty and Natural Ingredients Driving Product Innovation

Consumers are increasingly favoring facial sprays formulated with natural, vegan, and chemical-free ingredients. Brands are launching mineral-rich and organic variants featuring ingredients like aloe vera, rose water, green tea, and hyaluronic acid to align with the clean beauty movement. Moreover, consumers’ growing preference for hypoallergenic and dermatologist-tested products is driving R&D investments in non-irritant formulations. This trend is especially strong in Europe and Asia, where regulatory emphasis on product transparency is shaping brand strategies.

Technology-Infused Sprays and Smart Packaging

Advancements in skincare technology are introducing innovative spray mechanisms such as ultra-fine mist diffusers and smart hydration sensors that ensure even application. Some brands are incorporating nanotechnology to enhance ingredient absorption and long-lasting moisturization. Smart packaging solutions—such as refillable bottles and recyclable materials—are also gaining traction, aligning with sustainability goals and appealing to environmentally conscious consumers.

Facial Water Spray Market Drivers

Growing Demand for On-the-Go Hydration

With urban lifestyles and increased exposure to air pollution, consumers are increasingly using facial sprays as a quick hydration and refreshment solution throughout the day. Compact, travel-friendly packaging makes these products convenient for work, travel, and outdoor use. The rising adoption of facial mists as a makeup primer or setting spray is also expanding their multifunctional appeal among both men and women.

Expanding Male Grooming Segment

The growing popularity of male skincare routines is creating new demand for facial water sprays. Brands are launching gender-neutral or male-targeted variants that emphasize hydration, cooling, and post-shave soothing properties. This demographic shift is particularly notable in the Asia-Pacific region, where skincare adoption among men has risen significantly in recent years.

Market Restraints

Limited Product Differentiation

Intense competition and overlapping formulations among brands are leading to market saturation, making it challenging for new entrants to differentiate. The lack of distinct functional benefits beyond basic hydration may limit repeat purchases, pushing brands to innovate with added active ingredients and multifunctional benefits.

Price Sensitivity in Emerging Markets

While premium brands dominate Western markets, price sensitivity remains a barrier in developing economies. High costs of imported or branded products restrict penetration in lower-income consumer groups. Local manufacturers face challenges in achieving the same quality and branding appeal as international players.

Facial Water Spray Market Opportunities

Integration with Makeup and Skincare Routines

Facial sprays are increasingly positioned as multipurpose skincare products—serving as makeup primers, setting sprays, and toners. This integration offers brands opportunities to collaborate with cosmetic companies and beauty influencers for cross-promotional campaigns. Multi-benefit positioning is expected to significantly increase usage frequency and average consumer spend.

Sustainability and Refillable Packaging

Eco-friendly packaging is becoming a critical factor influencing consumer purchase decisions. Brands adopting biodegradable materials, refill stations, or aluminum canisters are gaining a competitive edge. The trend toward refillable packaging not only reduces plastic waste but also strengthens brand loyalty through sustainability-driven engagement.

Product Type Insights

Thermal water sprays dominate the market due to their mineral-rich compositions that calm and hydrate sensitive skin. Botanical and organic sprays are gaining traction among clean beauty enthusiasts, while makeup setting sprays are emerging as a fast-growing category in the cosmetics industry. Functional sprays infused with vitamins, probiotics, or SPF protection are expected to see strong adoption during the forecast period.

Distribution Channel Insights

Online retail leads global distribution, supported by e-commerce giants and direct-to-consumer skincare startups. Pharmacies and drugstores maintain a strong foothold in developed markets due to dermatologists' trust and medical endorsements. Supermarkets and hypermarkets contribute a growing share in emerging economies through increased visibility and affordability, while specialty beauty stores remain vital for premium and professional-grade products.

| By Product Type | By Application | By Distribution Channel | By End-User |

|---|---|---|---|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific dominates the global facial water spray market, accounting for the largest share due to high skincare adoption and strong innovation pipelines from Japan, South Korea, and China. K-beauty and J-beauty brands are pioneering multifunctional formulations and packaging innovations. Growing urbanization, rising disposable incomes, and the influence of social media trends continue to drive regional growth.

Europe

Europe is the second-largest market, led by France—the origin of several leading thermal water brands such as Avène, La Roche-Posay, and Vichy. The region’s strict cosmetic regulations and preference for dermatologically tested products support consistent demand. Sustainability and clean-label claims are particularly influential among European consumers.

North America

North America remains a major market driven by premium skincare consumption and the growing popularity of multifunctional sprays among millennials and Gen Z. The U.S. market shows robust growth in online and influencer-driven beauty segments, with brands focusing on hydration and makeup integration benefits.

Latin America

Latin America is witnessing steady market expansion, with Brazil and Mexico leading adoption. Growing middle-class awareness of skincare and the influence of global beauty brands are propelling regional demand. Affordable local brands and hybrid beauty products are expanding consumer reach.

Middle East & Africa

Rising urbanization and increasing disposable incomes in the Middle East and Africa are creating new opportunities for skincare products, including facial sprays. Hot and dry climates in the region make hydration-focused products particularly appealing. The market is seeing growth through duty-free retail and luxury brand penetration in countries like the UAE and Saudi Arabia.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Facial Water Spray Market

- Evian

- Avène (Pierre Fabre Group)

- La Roche-Posay (L’Oréal Group)

- Vichy Laboratories

- Caudalie

- Herbivore Botanicals

- Mario Badescu

- Clinique

- L’Occitane en Provence

- MAC Cosmetics

Recent Developments

- In July 2025, Avène launched its new Hydrating Mist Pro, featuring enhanced micro-spray technology and eco-friendly aluminum packaging.

- In May 2025, La Roche-Posay introduced its first probiotic-enriched facial mist to support skin barrier function and microbiome health.

- In February 2025, Vichy Laboratories announced its Thermal Boost+ line, combining volcanic water with hyaluronic acid for long-lasting hydration.

- In December 2024, Evian partnered with Sephora to introduce limited-edition designer spray bottles made from 100% recycled materials.