Facial Tissue Dispensers Market Size

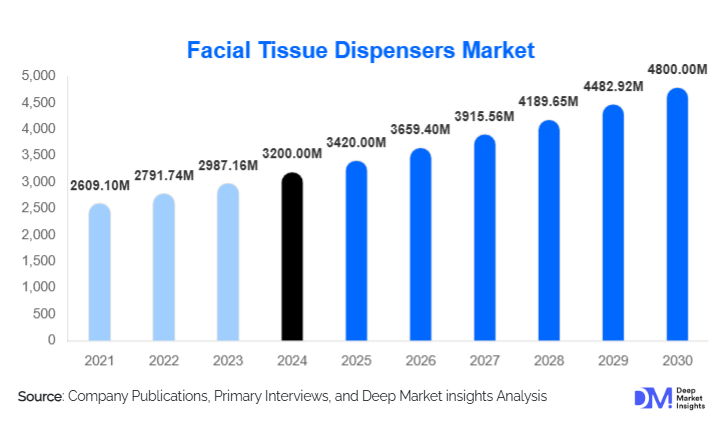

According to Deep Market Insights, the global facial tissue dispensers market size was valued at USD 3,200 million in 2024 and is projected to grow from USD 3,420 million in 2025 to reach USD 4,800 million by 2030, expanding at a CAGR of 7.0% during the forecast period (2025–2030). The market growth is primarily driven by increasing demand for hygienic, touchless solutions in healthcare, commercial, and public infrastructure, rising awareness of sanitation, and the adoption of smart and eco-friendly dispenser technologies.

Key Market Insights

- Automatic and touchless dispensers are gaining dominance, particularly in healthcare and commercial sectors, due to hygiene requirements and regulatory standards.

- Premium and designer dispensers are growing in commercial and hospitality applications, reflecting demand for aesthetic and durable solutions.

- North America holds the largest market share, driven by institutional procurement, stringent hygiene standards, and high disposable income.

- Asia-Pacific is the fastest-growing region, fueled by rapid urbanization, healthcare expansion, and rising awareness of hygiene practices.

- Eco-friendly and recycled materials are shaping product design, reflecting sustainability trends and regulatory compliance in multiple regions.

- IoT and smart technologies, including usage monitoring and refill alerts, are being integrated to enhance efficiency and reduce maintenance costs.

What are the latest trends in the facial tissue dispensers market?

Hygiene-First and Touchless Technology

The demand for automatic, sensor-based, and touchless dispensers is increasing globally, particularly in high-traffic areas such as hospitals, offices, airports, and malls. Touchless solutions minimize cross-contamination and are aligned with stricter hygiene regulations. Smart dispensers with usage tracking, refill alerts, and IoT connectivity are becoming more common, allowing facility managers to optimize maintenance and reduce waste.

Eco-Friendly and Sustainable Products

Manufacturers are increasingly introducing dispensers made from recycled plastics, metals, and biodegradable materials. Sustainability is influencing procurement decisions in both public institutions and commercial enterprises. Companies are also emphasizing modular and durable designs to extend the product lifecycle, reduce waste, and meet environmental compliance standards.

What are the key drivers in the facial tissue dispensers market?

Rising Awareness of Hygiene and Health

The global focus on sanitation, amplified by recent public health concerns, is driving demand for dispensers that reduce human contact and improve cleanliness. Hospitals, clinics, and commercial establishments are replacing manual dispensers with automatic units, boosting the adoption of premium and sensor-based products.

Growth in Commercial and Public Infrastructure

Expansion of offices, airports, shopping malls, hotels, and healthcare facilities has increased the need for high-capacity, durable dispensers. These settings prefer premium, long-lasting, and low-maintenance solutions, which contribute significantly to market revenue.

Technological Innovations and Product Differentiation

Advances such as sensor-based automation, IoT-enabled refill alerts, anti-microbial finishes, and aesthetic designs are driving adoption. Smart and modular products enhance convenience and operational efficiency, appealing to both institutional and commercial buyers.

What are the restraints for the global market?

High Cost and Maintenance of Automatic Dispensers

Automatic and smart dispensers require higher upfront investment and ongoing maintenance, including battery replacements and sensor calibration. This limits adoption in cost-sensitive regions and smaller commercial establishments.

Low Penetration in Rural and Low-Income Areas

In many developing regions, awareness and infrastructure constraints limit the adoption of advanced dispensers. Manual units dominate, and distribution channels for automatic or premium products are underdeveloped.

What are the key opportunities in the facial tissue dispensers market?

Expansion in Emerging Markets

Countries in the Asia-Pacific, Latin America, and the Middle East are experiencing rapid urbanization and healthcare expansion. These regions offer significant growth potential for both automatic and eco-friendly dispensers, as institutional and commercial demand rises.

Integration of Smart Technologies

IoT-enabled dispensers, automated monitoring systems, and smart refill management present opportunities for manufacturers to offer value-added solutions. Large facilities and healthcare providers are increasingly adopting connected dispensers to improve hygiene management and operational efficiency.

Eco-Friendly Product Offerings

Manufacturers can capitalize on sustainability trends by producing dispensers from recycled or biodegradable materials, aligning with government regulations and corporate green procurement policies. Eco-friendly solutions also allow for premium pricing and differentiation in competitive markets.

Product Type Insights

Automatic and touchless dispensers dominate revenue in the market due to their premium pricing and high adoption in healthcare and commercial sectors. Manual dispensers remain prevalent in cost-sensitive residential and low-traffic settings. Smart IoT-enabled dispensers are a growing niche, particularly in large commercial facilities that require usage monitoring and maintenance alerts.

Application Insights

Commercial applications, including healthcare, hospitality, offices, and public infrastructure, account for the largest market share. Healthcare facilities are the primary adopters of automatic dispensers due to hygiene standards. Residential use is growing steadily, particularly in premium households seeking touchless or designer dispensers. Emerging applications include automotive interiors and institutional contracts with maintenance service packages.

Distribution Channel Insights

Direct institutional sales and B2B procurement dominate the commercial segment, while retail and online e-commerce channels are significant for residential and small business purchases. Increasing adoption of online ordering and subscription-based refill services is reshaping the distribution landscape.

End-Use Insights

Healthcare facilities remain the largest end-use segment, followed by hospitality and offices. Public infrastructure, such as airports and shopping malls, is driving rapid growth in commercial deployments. Residential and automotive applications are emerging niches, with demand driven by premiumization and convenience.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds the largest share (35–40%) of the global market. Strong institutional procurement, high disposable incomes, and strict hygiene standards drive demand for automatic and premium dispensers. The U.S. leads in both volume and revenue, followed by Canada.

Europe

Europe accounts for approximately 25–30% of the market. Germany, the U.K., France, Italy, and Spain are key markets, driven by healthcare and hospitality adoption of touchless and premium dispensers. Eastern Europe is emerging, with growing commercial infrastructure fueling demand.

Asia-Pacific

APAC is the fastest-growing region, driven by China, India, Japan, and Southeast Asia. Rapid urbanization, healthcare expansion, and rising awareness of hygiene practices are fueling adoption, particularly of automatic and eco-friendly dispensers.

Latin America

Brazil, Mexico, and Argentina are key markets, with growing demand from the commercial and hospitality sectors. Manual dispensers remain dominant, but premium and automatic units are gradually increasing in adoption.

Middle East & Africa

GCC countries (UAE, Saudi Arabia) lead in the adoption of automatic and premium dispensers. Africa’s demand is primarily concentrated in South Africa and key urban centers, with institutional procurement driving market growth. Public health initiatives and tourism infrastructure expansion are supporting uptake.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Facial Tissue Dispensers Market

- Kimberly-Clark

- Georgia-Pacific

- SCA (Essity)

- Bobrick Washroom Equipment

- San Jamar

- American Specialties

- Franke

- Jaquar

- Cascades

- Cintas

- Dolphin Solutions

- Palmer Fixture

- Bradley Corporation

- Mediclinics

- ASI Group

Recent Developments

- In March 2025, Kimberly-Clark launched a new line of automatic touchless dispensers with IoT monitoring for hospitals in North America and Europe.

- In February 2025, SCA (Essity) expanded production of eco-friendly dispensers in APAC to meet rising demand for sustainable commercial solutions.

- In January 2025, San Jamar introduced modular premium dispensers for hotels and corporate offices, featuring antimicrobial surfaces and enhanced durability.