Eye Makeup Market Size

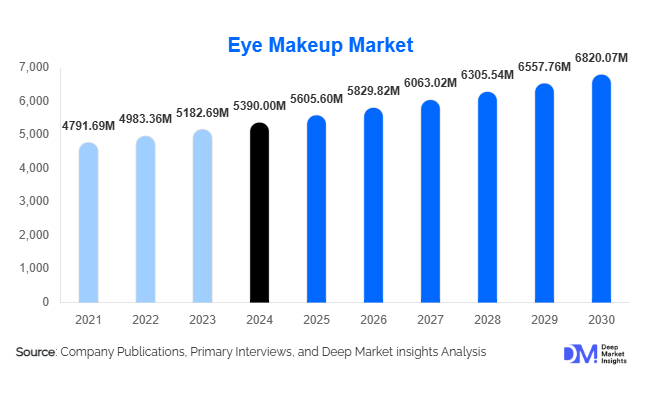

According to Deep Market Insights, the global eye makeup market size was valued at USD 5,390 million in 2024 and is projected to grow from USD 5,605.60 million in 2025 to reach USD 6,820.07 million by 2030, expanding at a CAGR of 4% during the forecast period (2025–2030). The market’s growth is primarily driven by the rising demand for premium and long-lasting cosmetic products, the growing influence of social media beauty trends, and the expansion of gender-inclusive makeup lines catering to diverse consumer segments.

Key Market Insights

- Rising preference for clean and cruelty-free formulations is shaping product innovation, with major brands reformulating mascaras, eyeliners, and eyeshadows using vegan and non-toxic ingredients.

- Online retail channels continue to dominate distribution, supported by influencer-driven marketing and AR-based virtual try-on technologies.

- Asia-Pacific leads global demand growth, driven by beauty-conscious younger demographics in China, India, Japan, and South Korea.

- North America and Europe remain mature markets characterized by high product penetration and strong brand loyalty.

- Premiumization trends are fueling the popularity of luxury and hybrid eye makeup products offering both aesthetic and skincare benefits.

- Innovations in packaging, such as recyclable components and refillable systems, are reinforcing brand sustainability commitments.

Latest Market Trends

Clean Beauty and Sustainable Packaging

The clean beauty movement is transforming the global eye makeup landscape, as consumers increasingly prioritize non-toxic and eco-friendly products. Brands are launching vegan mascaras, organic eyeliners, and talc-free eyeshadows formulated with natural pigments and plant-based waxes. Sustainable packaging initiatives such as biodegradable tubes, refillable palettes, and recyclable glass jars are becoming standard practice among both established and indie brands. This trend aligns with rising environmental consciousness and regulatory pressure to reduce cosmetic waste.

Technology-Driven Personalization

AI and AR technologies are redefining how consumers select eye makeup products. Virtual try-on tools allow users to experiment with colors and styles in real time, enhancing online engagement and purchase confidence. AI-powered skin tone analysis and personalized product recommendations are improving conversion rates on e-commerce platforms. Tech-integrated marketing strategies, such as virtual beauty assistants and digital shade-matching apps, are enabling brands to deliver customized experiences while collecting valuable consumer data insights.

Eye Makeup Market Drivers

Growing Influence of Social Media and Beauty Influencers

Social media platforms such as TikTok, Instagram, and YouTube are major catalysts for product discovery and trend adoption in the eye makeup category. Viral tutorials and influencer collaborations have accelerated demand for creative looks, from graphic eyeliners to bold color palettes. Celebrity beauty brands and limited-edition collaborations continue to attract younger consumers seeking novelty and authenticity. The democratization of beauty content has enabled niche brands to gain global visibility and compete effectively with established players.

Expanding Male and Gender-Neutral Makeup Adoption

Rising acceptance of makeup among men and non-binary consumers is broadening the market’s demographic base. Brands such as Chanel, Fenty Beauty, and MAC are introducing gender-inclusive eye makeup collections that emphasize self-expression over traditional gender norms. Marketing campaigns highlighting individuality and creativity are resonating strongly with Gen Z consumers. This inclusivity-driven expansion is opening new growth avenues, particularly in mature markets where traditional product segments have plateaued.

Market Restraints

Health Concerns and Ingredient Regulations

Increasing scrutiny over chemical ingredients such as parabens, phthalates, and microplastics is challenging manufacturers to reformulate without compromising product performance. Stricter global cosmetic regulations, including the EU’s Cosmetic Products Regulation and the U.S. FDA Modernization Act, require transparency in ingredient labeling and safety testing. Compliance costs and reformulation timelines may hinder smaller brands, potentially slowing product launches in key markets.

Market Saturation and Counterfeit Products

The eye makeup market is highly saturated, particularly in developed regions, where consumers are inundated with product options. Intense competition has led to price wars and brand dilution. Furthermore, counterfeit cosmetics, especially counterfeit mascaras and eyeliners, sold online pose safety risks and erode consumer trust. Regulatory authorities and major brands are increasingly adopting authentication technologies and blockchain-based tracking to combat counterfeit proliferation.

Eye Makeup Market Opportunities

Hybrid Cosmetics with Skincare Benefits

The rising convergence of skincare and makeup is creating new opportunities for hybrid eye products that nourish and beautify simultaneously. Innovations such as mascaras infused with peptides, vitamin E–based eyeliners, and eyeshadows formulated with hyaluronic acid are gaining traction. Consumers seeking multifunctional beauty solutions are driving this shift, positioning hybrid eye makeup as a premium growth segment with strong repeat purchase potential.

Emerging Market Expansion

Rapid urbanization, rising disposable incomes, and evolving beauty standards in emerging economies are expanding the consumer base for eye makeup products. In markets such as India, Indonesia, and Brazil, increasing female workforce participation and exposure to Western beauty trends are fueling market penetration. Localization strategies, including region-specific shades, halal-certified formulas, and an affordable price tier, are enabling global brands to capture new demographics and strengthen market share.

Product Type Insights

Mascaras dominate the global eye makeup category, accounting for the largest share due to consistent innovation in waterproof, volumizing, and lash-lengthening formulations. Eyeliners represent a fast-growing segment, driven by demand for smudge-proof and precision applicators. Eyeshadows are increasingly popular in both compact palettes and single pots, reflecting the rising influence of social media tutorials. Eyebrow products, including gels, pencils, and tint, are also experiencing notable growth as consumers emphasize brow definition as part of daily beauty routines.

Distribution Channel Insights

Online retail platforms lead global eye makeup sales, supported by product accessibility, influencer marketing, and real-time consumer reviews. Direct-to-consumer (D2C) brands leveraging e-commerce and subscription models are gaining traction, particularly among digitally native consumers. Brick-and-mortar channels such as specialty beauty stores and department stores remain vital for experiential engagement and product testing. The growing popularity of omnichannel strategies, combining online convenience with in-store consultations, is further enhancing customer reach.

| By Product Type | By Application | By Distribution Channel | By Price Range |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America remains a dominant market for eye makeup, driven by high per-capita spending, product innovation, and influencer-led marketing ecosystems. The U.S. continues to lead regional demand, with clean beauty and luxury eye makeup products gaining strong traction. Expanding inclusivity campaigns and digital-first retail strategies are further supporting market resilience.

Europe

Europe represents a mature yet evolving market, with consumers emphasizing sustainability, transparency, and ethical sourcing. Major beauty hubs such as France, Germany, and the U.K. are witnessing growing demand for organic and cruelty-free eye makeup. The EU’s stringent cosmetic safety regulations are also pushing innovation toward safer, traceable ingredients and recyclable packaging.

Asia-Pacific

Asia-Pacific is the fastest-growing region, supported by rising disposable incomes, expanding e-commerce penetration, and strong beauty culture in countries like South Korea, Japan, and China. The region’s younger population drives frequent experimentation with bold colors and trends, boosting demand for eyeshadows and eyeliners. Local brands leveraging K-beauty and J-beauty aesthetics are challenging global competitors through innovation and affordability.

Latin America

Latin America shows steady growth, led by Brazil and Mexico, where beauty is closely tied to cultural expression. Increasing urbanization, local influencer marketing, and the availability of affordable international brands are fueling expansion. However, economic fluctuations and price sensitivity remain key challenges for sustained premium segment growth.

Middle East & Africa

The Middle East and Africa region offers emerging opportunities for international brands, driven by rising youth populations and luxury-oriented consumer behavior. Demand for long-lasting and high-coverage products suited to warm climates is particularly strong. Premium retail formats and influencer collaborations in markets like the UAE and Saudi Arabia are positioning the region as a high-value growth hub.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Eye Makeup Market

- L’Oréal S.A.

- Estée Lauder Companies Inc.

- Coty Inc.

- Shiseido Company Limited

- Revlon Inc.

- LVMH Moët Hennessy Louis Vuitton SE

- e.l.f. Beauty Inc.

Recent Developments

- In August 2025, L’Oréal Paris launched a new line of vegan, refillable mascaras under its “Green Lash” initiative, targeting environmentally conscious consumers.

- In June 2025, Estée Lauder introduced AR-based shade-matching for eyeliners and eyeshadows on its global e-commerce platforms to enhance digital engagement.

- In March 2025, e.l.f. Beauty partnered with TikTok creators to co-develop limited-edition eyeshadow palettes inspired by viral makeup trends.