Escape Hammer Market Size

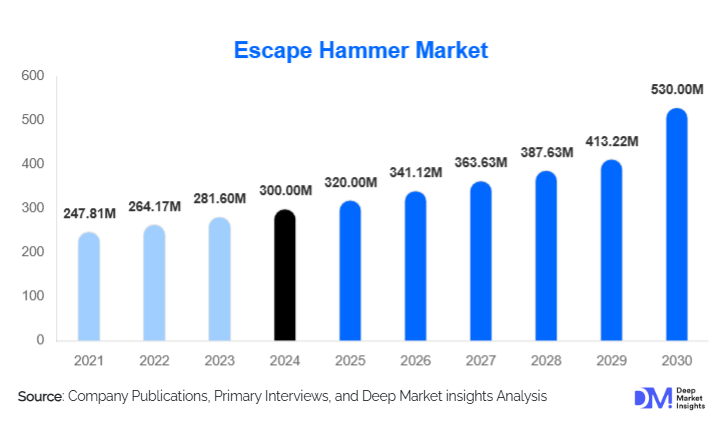

According to Deep Market Insights, the global escape hammer market size was valued at approximately USD 300 million in 2024 and is projected to grow from USD 320 million in 2025 to reach nearly USD 530 million by 2030, expanding at a CAGR of 6.6% during the forecast period (2025–2030). Market growth is driven by increasing automotive safety awareness, stringent regulatory standards mandating in-vehicle and building emergency tools, and rising consumer adoption of multi-functional, ergonomically designed safety devices worldwide.

Key Market Insights

- Safety regulations are tightening globally, with many regions mandating escape tools in vehicles, public buildings, and transportation fleets.

- Multi-function escape hammers dominate due to integrated features like seatbelt cutters, LED lights, and alarms that improve usability during emergencies.

- North America leads the market with a 34% share in 2024, followed by Europe (~28%), owing to strong regulatory enforcement and consumer awareness.

- Asia-Pacific is the fastest-growing region, projected to expand at a 7–8% CAGR, supported by vehicle ownership growth and industrial safety reforms in China and India.

- E-commerce channels are rapidly gaining traction, representing over 30% of global 2024 sales as online platforms enable wide accessibility and transparent pricing.

- Product innovation and material enhancementincluding the use of alloys, composites, and ergonomic polymers reshaping competitive differentiation.

What are the latest trends in the escape hammer market?

Multi-Functionality and Smart Safety Integration

Modern escape hammers are evolving from basic glass breakers into advanced multi-tool safety devices. Newer designs combine seatbelt cutters, high-lumen LED flashlights, audible alarms, and magnetic mounts for in-car or wall installation. Some manufacturers are exploring smart sensors that activate lighting automatically in impact scenarios. This technological shift enhances utility, encourages household adoption, and positions escape hammers as comprehensive emergency solutions rather than single-function accessories.

Regulatory Standardization and Certification Focus

Global alignment of safety standardssuch as CE, UL, and ISO certifications becoming critical for market entry, especially for exporters to North America and Europe. Regulatory convergence ensures product reliability and increases consumer confidence. Governments are encouraging standardized testing for impact resistance, blade safety, and durability, leading to a formalized supply chain and reduced counterfeit penetration. Certified products command premium pricing and are increasingly favored in public tenders and OEM partnerships.

Rise of Online and Direct-to-Consumer (D2C) Channels

Digital commerce is transforming the escape hammer industry. Online marketplaces and brand-owned e-stores enable a broad reach across emerging markets. Consumers can compare models, verify certifications, and access reviews before purchase, driving informed buying decisions. Subscription-based fleet safety kits and online safety bundles are emerging, offering recurring revenue for manufacturers. Influencer-led safety awareness campaigns are also increasing visibility of emergency preparedness tools among younger demographics.

What are the key drivers in the escape hammer market?

Stringent Vehicle and Building Safety Regulations

Government mandates for public transportation, fleet vehicles, and commercial buildings to carry certified escape tools are accelerating adoption. In North America and Europe, building codes increasingly require emergency evacuation tools, while emerging economies such as India and China are adding similar clauses within their road-safety frameworks. Regulatory standardization ensures steady, policy-driven demand across both institutional and consumer channels.

Increasing Safety Awareness and Preparedness Culture

Public awareness of emergency response readiness has risen following high-profile accidents and climate-related incidents. Consumers now proactively purchase escape hammers for cars and homes, viewing them as essential safety accessories. Social media education campaigns, automobile safety blogs, and government awareness initiatives further fuel this behavioral shift toward preventive safety investment.

Automotive Industry Expansion and Aftermarket Growth

Global vehicle ownership continues to rise, especially in Asia-Pacific and Latin America, generating consistent aftermarket demand for safety tools. Automotive OEMs are beginning to include escape hammers in emergency kits or as optional accessories, while aftermarket channels remain robust. The confluence of growing car sales and safety-conscious consumers creates sustainable growth momentum for escape hammer manufacturers.

What are the restraints for the global market?

Low Awareness and Compliance in Developing Economies

In several emerging markets, escape hammers are still perceived as non-essential accessories. Lack of enforcement, limited distribution networks, and price sensitivity hinder adoption. Without regulatory compulsion or public safety campaigns, awareness penetration remains low, restraining potential market expansion.

Integration of Alternative Safety Technologies

Modern vehicles increasingly feature laminated safety glass, automatic seatbelt releases, and built-in emergency breakers, which may reduce standalone hammer demand. As OEMs integrate safety functions, third-party accessory suppliers face pricing and positioning challenges. To remain competitive, vendors must emphasize multi-functionality and certified performance advantages.

What are the key opportunities in the escape hammer industry?

Government Safety Mandates and Public Procurement

Mandated inclusion of emergency tools in public buses, trains, and municipal buildings presents major institutional sales opportunities. Manufacturers that comply with procurement standards and maintain certification portfolios can secure long-term supply contracts. This segment also drives innovation toward tamper-proof mounting systems and vandal-resistant designs for public use.

Emerging Market Expansion and Localization

Rapid urbanization and motorization in Asia-Pacific and Latin America offer untapped potential. Localized manufacturing under initiatives such as “Make in India” and “Made in China 2025” can reduce costs, improve availability, and support exports to Western markets. Regional partnerships with OEMs and distributors can help global players establish strong local footprints while benefiting from growing safety awareness.

Innovation in Materials and Design

Advances in composite materials, reinforced ceramics, and ergonomic polymer handles allow for lightweight yet durable tools. Integration of smart electronics as motion sensors or Bluetooth connectivity for fleet tracking represents a nascent but promising frontier. Vendors investing in R&D for user-friendly, high-strength, and multi-functional designs will gain premium positioning in mature markets.

Product Type Insights

Multi-Function Escape Hammers lead the global market, accounting for approximately 45% of the total 2024 revenue. Their appeal stems from the combined utility of seatbelt cutting, glass breaking, and illumination in a single compact tool. Basic single-purpose hammers continue to serve cost-sensitive segments, while advanced smart models are gaining adoption in developed economies. The trend toward feature integration and ergonomic improvement is expected to sustain segmental leadership through 2030.

Application Insights

Automotive use dominates, contributing roughly 38% of the 2024 market value. Escape hammers are increasingly standard in personal vehicles, buses, and fleets. Commercial and public buildings follow as regulatory frameworks mandate emergency evacuation tools in schools, hotels, and offices. Emergency services and industrial sectors form smaller but high-margin niches demanding premium, durable products. Emerging marine and aviation safety applications represent future diversification areas.

Distribution Channel Insights

Online retail and e-commerce channels captured over 30% of global 2024 sales. Marketplaces like Amazon and automotive D2C sites enable global reach, especially across Asia and Europe. Offline retail outlets and automotive OEM dealerships remain vital for institutional buyers requiring certified procurement. The rise of hybrid sales modelscombining online marketing with authorized offline installationreflects the market’s omni-channel evolution.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America accounted for approximately 34% of the global 2024 escape hammer market. The U.S. drives regional dominance through stringent vehicular safety norms, high per-capita vehicle ownership, and a growing DIY safety culture. Canada’s public transport and residential safety initiatives further reinforce steady demand. The market is mature but stable, growing around 5–6% annually.

Europe

Europe holds nearly 28% market share, led by Germany, France, and the U.K. Strong EU-wide safety directives and preference for certified, eco-friendly materials support growth. European buyers value durability, design, and compliance labels, sustaining demand for mid-to-premium models.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at a 7–8% CAGR. China and India are primary growth engines, with booming automobile industries and improving safety legislation. Southeast Asia and South Korea are adopting stricter transport safety norms, while Japan’s mature market emphasizes technological innovation. Local production and exports from China and India fuel global supply chains.

Latin America

Representing about 6% of global 2024 revenues, Latin America’s marketanchored by Brazil and Mexico poised for steady growth through increased car sales and urban transport modernization. Government fleet safety programs are encouraging institutional adoption, though consumer awareness remains moderate.

Middle East & Africa

This region contributes roughly 6–7% of the global market. Gulf countries such as the UAE and Saudi Arabia are investing in safety modernization, while South Africa leads Sub-Saharan demand. Infrastructure expansion and import-based supply chains are driving future opportunities.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Escape Hammer Market

- Lifehammer BV

- Resqme Inc.

- Lustre Automotive Safety Products

- Bosen Safety Tools Co., Ltd.

- Hangzhou Sinat Safety Equipment Co., Ltd.

- Wuyi Sidanly Tools Manufacturing Co., Ltd.

- CarTool USA Inc.

- Utoolmart Industrial Tools Ltd.

- Drive Smart Safety Solutions

- LifeAxe Safety Systems

- EverSafe Industries Ltd.

- Trident Automotive Accessories

- Jiali Tools Manufacturing Co., Ltd.

- Yikai Safety Products Co., Ltd.

- SafeGrip Global Ltd.

Recent Developments

- In July 2025, Lifehammer launched its new “Smart ResQ Series,” integrating automatic lighting activation and improved ergonomic grip to enhance emergency usability.

- In May 2025, Resqme Inc. announced partnerships with European automotive OEMs to include compact escape tools in vehicle first-aid kits as standard safety equipment.

- In March 2025, Hangzhou Sinat Safety Equipment invested USD 4 million in a new manufacturing facility in Zhejiang Province to boost export capacity for North American and European markets.

- In January 2025, Lustre Automotive introduced a carbon-composite escape hammer line targeting premium fleet and aviation applications.