Electric Wine Bottle Openers Market Size

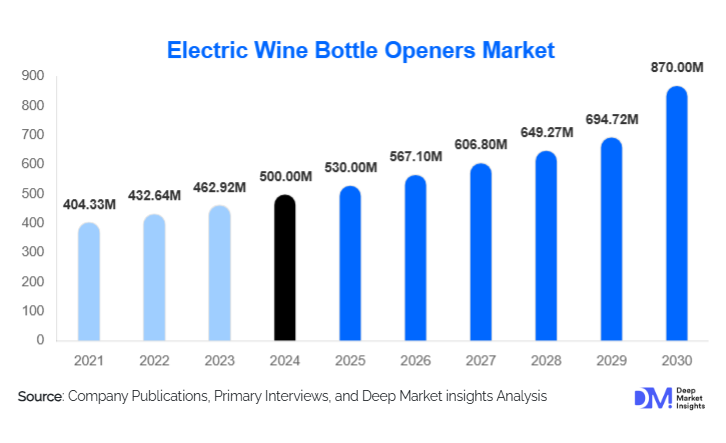

According to Deep Market Insights, the global electric wine bottle openers market size was valued at USD 500 million in 2024 and is projected to grow from USD 530 million in 2025 to reach USD 870 million by 2030, expanding at a CAGR of 7.0% during the forecast period (2025–2030). The market growth is primarily driven by rising preferences for convenience among consumers, increasing adoption of advanced features (such as rechargeable batteries, automatic or one-touch opening, LED indicators), and growing demand in emerging markets with expanding wine culture and disposable incomes.

Key Market Insights

- Cordless electric wine bottle openers dominate the product type segment, offering enhanced usability and flexibility, especially for residential users and gifting purposes.

- Materials and aesthetics are playing a bigger role, with stainless steel / metallic finishes and multi-function accessories becoming major differentiators in premium and mid-tier models.

- Residential / household end use leads the market, though the commercial / hospitality sector is gaining importance for high-performance, durable models.

- Online retail/e-commerce is the standout distribution channel, capturing a majority of sales due to its reach, variety, and consumer convenience.

- Asia-Pacific and Latin America are among the fastest-growing regions, driven by increasing wine consumption, lifestyle shifts, and rising incomes.

- Smart features and sustainability trends improved battery life, eco-friendly materials, and features like sensors, automatic openers, or foil cutters are shaping product innovation.

What are the latest trends in the electric wine bottle openers market?

Premiumization & Feature Proliferation

Consumers are increasingly expecting more from electric wine bottle openers than mere cork removal. Features such as automatic one-touch operation, built-in foil cutters, aerators, LED indicators, and quieter motors are becoming standard in mid-premium and premium offerings. Product design aesthetics, including metallic finishes, stainless steel bodies, and gift-worthy packaging, are major selling points. Brands are also differentiating through improved battery performance (longer life, quicker charge), ergonomics, and reliability. Such feature proliferation allows higher average selling prices and helps brands stand out in a crowded market.

Sustainability & Eco-Friendly Design

Environmental concerns are pushing both consumers and manufacturers toward more sustainable options. Rechargeable battery systems, rather than disposable batteries, are in greater demand. Manufacturers are exploring recycled materials or woods, durable construction, and designs optimized for long lifecycle and repairability. Packaging is also under scrutiny, with preferences for reduced plastic, recyclable materials, and minimalistic but attractive packaging increasing. These shifts are not just in developed markets; emerging markets are also showing growing interest in eco-friendly products, especially among younger consumers.

What are the key drivers in the electric wine bottle openers market?

Convenience & Changing Consumer Lifestyles

Modern lifestyles see more people entertaining at home, hosting gatherings, and enjoying wine with meals. Electric openers reduce effort and time compared to manual corkscrews, especially for users with limited hand strength or mobility. Urban living with compact kitchens also favors compact, cordless models. Gifting culture further drives purchases around holidays, celebrations, and special occasions.

Technological Innovation & Product Differentiation

Innovation in battery technology (improved capacity, faster charging), motor performance (stronger, quieter), smart indicators (LEDs, battery-life indicators), safety, and multi-functionality (foil cutter, aerator, vacuum stopper) are strong growth enablers. These allow brands to justify higher prices and meet consumer demand for higher value for money. Early adopters or premium offerings benefit most.

Expansion of Distribution Channels, Especially Online

Online channels (marketplaces, D2C e-stores) are enabling wider reach, better variety, competitive pricing, and enhanced visibility of newer or niche brands. Retailers specializing in kitchenware or wine accessories also contribute, but the speed and convenience of online shopping are causing shifts in consumer purchasing behavior.

What are the restraints for the global market?

Price Sensitivity & Manual Alternatives

Although electric openers offer features and convenience, many consumers in price-sensitive markets prefer traditional manual corkscrews, which are much less expensive and simpler to maintain. The higher initial cost, combined with potential costs of battery replacement or servicing, can be a deterrent.

Durability, Battery Reliability & Performance Issues

Concerns around battery degradation, motor failure, weak torque, parts breakage, or decreased performance over time can harm brand reputation and reduce repeat purchases. In regions with unstable power supply, dependence on recharge or electricity may be problematic. Quality control and after-sales services are important challenges for manufacturers to address to maintain customer confidence.

What are the key opportunities in the electric wine bottle openers market?

Growth in Emerging Wine-Consuming Markets

Emerging markets such as China, India, Brazil, and Southeast Asia represent high potential. As wine culture expands and disposable incomes rise, demand for wine accessories (including electric openers) is increasing. Localization in terms of design preferences, pricing, and distribution can help entrants succeed. Hospitality and event sectors in these regions are also growing, representing commercial demand.

Smart & Connected Product Innovations

Integrating smart features like battery indicators, app connectivity, sensor-based safety, or even IoT integration (for example, for wine lovers’ apps or smart kitchens) can be a differentiator. Premium and design-focused brands that invest in R&D in these domains are better positioned to capture higher margins and brand loyalty.

Sustainable & Eco-Friendly Products and Materials

Consumers are increasingly aware of environmental impact. Products that use rechargeable batteries, recyclable or biodegradable materials, durable construction, minimal packaging, and that comply with environmental regulations are gaining ground. Brands that proactively adopt sustainability practices, recycling programs, eco-certifications, and greener supply chains will have a competitive advantage.

Product Type Insights

Cordless electric wine bottle openers dominate the product type landscape, accounting for an estimated 65-70% share of the market value in 2024. Their portability, convenience, and suitability for residential and gifting uses make them more appealing than corded alternatives. Cordless models continue to be enhanced with better batteries, sleeker designs, and additional features, which help maintain their leadership.

Application Insights

The residential / household application remains the primary driver for market volume, representing roughly 60-65% of global sales in 2024. Gifting, home entertaining, and casual wine drinking are the main use cases here. However, the commercial and hospitality sectors are growing in influence, with demand for higher-performance, durable products for restaurants, hotels, bars, and event venues. Additionally, newer applications such as wine tourism centers, corporate gifting, and promotional accessory bundles are emerging, contributing to growth.

Distribution Channel Insights

Online retail (marketplaces, direct-to-consumer) is the dominant distribution channel, capturing 55-60% of market value in 2024. It offers consumers ease of comparison, variety, and often better pricing. Offline channels such as specialty kitchenware stores and home goods retailers remain important, especially for premium segments. Gift shops, department stores, and offline showrooms continue to play a role, particularly for high-end or design-oriented purchases.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America is the largest regional market, holding about 35-40% of the global market value in 2024. The U.S. leads, fueled by high wine consumption, a strong gifting culture, high disposable income, and willingness to pay for premium and feature-rich openers. Canada contributes, but to a lesser extent. Growth here is moderate but steady, with increasing demand for aesthetic design, reliability, and sustainability.

Europe

Europe accounts for roughly 25-30% of the market in 2024. Key countries include France, Italy, Germany, the U.K., and Spain. Premiumization is strong; consumers expect high build quality, safe electrical certifications, good design, and aesthetic appeal. Regulations around battery safety, materials, import duties, and environmental standards influence design and product offerings. Growth is steady; Southern and Eastern European countries may see higher growth percentages in the coming years.

Asia-Pacific

Asia-Pacific represents around 20-25% of the global market in 2024 and is among the fastest-growing regions. China and Japan are sizable markets already; India, South Korea, and Southeast Asian countries are showing quicker growth from smaller bases. Drivers include rising disposable incomes, western influence on lifestyle and entertainment, growing acceptability of wine culture, and expansion of e-commerce. In many APAC countries, CAGR is expected to exceed the global average.

Latin America

Latin America held about 5-8% of the market in 2024. Brazil, Argentina, and Chile are the major contributors. While lower overall volume compared to North America or Europe, growth in this region is noticeable, especially in mid-premium and premium product segments, driven by rising incomes, increasing wine consumption, and greater interest in lifestyle and home décor products.

Middle East & Africa

The Middle East & Africa held around 5-7% in 2024. Key markets include South Africa, the UAE, and some affluent GCC countries. Growth is constrained by regulatory, cultural, and import cost factors, but premium and luxury products (for gifting or upscale hospitality) are growing. South Africa’s local wine industry also contributes to accessory demand.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Electric Wine Bottle Openers Market

- Oster

- Cuisinart

- Secura

- OXO

- Ozeri

- Rabbit

- Wine Enthusiast

- Hamilton Beach

- Deik

- Chefman

- Tescoma

- Vinomax

- Mueller Living

- Famili

- Uncle Viner

Recent Developments

- In early 2025, several premium brands introduced models with extended battery life and Li-ion battery packs, aiming to open more bottles per charge + faster charging times to appeal to high-use and gift buyers.

- In mid-2025, more brands have started releasing electric openers made using recycled or sustainable materials, along with improved packaging standards, targeting eco-conscious consumers across Europe and North America.

- Also in 2025, e-commerce platforms and marketplaces will increase promotions and bundled offers (wine opener + accessory kits) to capture gift demand, especially around holidays and festival seasons.