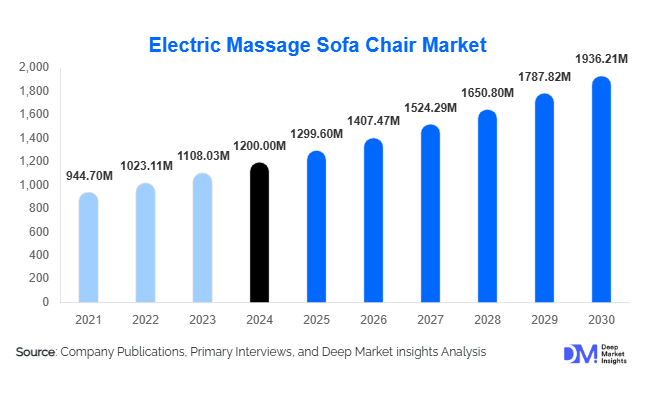

Electric Massage Sofa Chair Market Size

According to Deep Market Insights, the global electric massage sofa chair market size was valued at USD 1,200 million in 2024 and is projected to grow from USD 1,299.60 million in 2025 to reach USD 1,936.21 million by 2030, expanding at a CAGR of 8.3% during the forecast period (2025–2030). The market growth is primarily driven by increasing consumer awareness of home wellness, rising demand for premium home comfort solutions, and the proliferation of smart, AI-integrated massage chair features that enhance relaxation and therapeutic benefits.

Key Market Insights

- Residential users dominate demand, as urban lifestyles, remote working, and health-conscious consumers increasingly invest in home-based wellness solutions.

- Technological integration is transforming product offerings, with features like zero-gravity recline, heat therapy, smart sensors, and app/Bluetooth connectivity driving adoption.

- Asia-Pacific is the fastest-growing regional market, led by China, India, and Southeast Asia, due to rising disposable incomes and growing wellness awareness.

- North America maintains a strong market share, with the U.S. and Canada accounting for high-value premium sales and early adoption of advanced features.

- Online sales channels are increasingly dominant, enabling manufacturers to reach broader audiences directly and offer personalized models, contributing significantly to market growth.

- Premiumization and diversification of product lines are driving revenue growth, with luxury and mid-range models incorporating advanced massage mechanisms and smart features.

What are the latest trends in the electric massage sofa chair market?

Smart and Connected Massage Solutions

Manufacturers are integrating AI-powered massage programs, body-scanning sensors, and app-controlled customization, allowing users to receive personalized therapeutic experiences. Bluetooth-enabled audio, voice command functionalities, and adaptive massage intensity further enhance the convenience and luxury appeal. These innovations not only attract premium buyers but also encourage mid-range consumers to upgrade, thereby expanding the overall market.

Compact and Multi-functional Designs

There is increasing demand for space-efficient, portable, and dual-purpose chairs suitable for urban homes with limited space. Compact single-seat, loveseat, and convertible models are gaining traction. Additionally, chairs that combine massage, heat therapy, and ergonomic recline functionalities appeal to multi-demographic households, contributing to higher adoption rates.

What are the key drivers in the electric massage sofa chair market?

Growing Health and Wellness Awareness

Increasing sedentary lifestyles, aging populations, and rising back and musculoskeletal issues are driving consumers to invest in massage chairs. Electric massage sofa chairs provide a non-invasive, convenient, and continuous method to relieve stress and improve physical well-being, making them a sought-after home wellness solution.

Premiumization and Feature Innovation

Advanced features such as zero-gravity recline, 3D/4D massage mechanisms, heat therapy, and smart app integration allow manufacturers to position products in higher price brackets. Consumers seeking comfort and therapeutic benefits are willing to pay a premium, contributing to market revenue growth.

Expansion of E-commerce and Direct Sales Channels

Online sales platforms enable manufacturers to reach broader consumer bases and offer customized models. The rise of digital marketing, influencer collaborations, and direct-to-consumer sales has accelerated adoption, especially in emerging markets where offline retail infrastructure may be limited.

What are the restraints for the global market?

High Cost of Advanced Models

The incorporation of complex massage mechanisms, smart sensors, and premium materials increases manufacturing costs, resulting in higher retail prices. This limits adoption among price-sensitive consumers and restricts penetration in developing regions.

Consumer Price Sensitivity and Economic Constraints

As a discretionary purchase, electric massage sofa chairs are sensitive to economic downturns, inflation, and fluctuations in disposable income. In emerging markets, import duties and logistics costs further limit widespread adoption.

What are the key opportunities in the electric massage sofa chair market?

Technological Integration and Smart Features

Integrating AI, IoT, and sensor-based adaptive massage programs allows differentiation in a competitive market. Companies can offer personalized experiences that adjust massage intensity, duration, and pattern based on user needs, expanding the premium segment and increasing customer loyalty.

Expansion into Emerging Regions

Asia-Pacific, Latin America, and select Middle Eastern countries present untapped potential. Rising middle-class populations, increasing health consciousness, and urbanization drive demand for both mid-range and premium chairs. Localization of production and distribution can further accelerate growth in these regions.

Product Diversification and New Business Models

Introducing portable, compact, dual-seat, or convertible chairs, as well as subscription or rental models for commercial and corporate wellness, creates new revenue streams. These models cater to cost-sensitive users while expanding market reach into non-traditional segments such as corporate wellness, gyms, and public relaxation spaces.

Product Type Insights

Reclining massage chairs dominate the market, accounting for approximately 40–45% of 2024 global sales. These models balance affordability with functionality, offering multiple massage modes and ergonomic comfort. Zero-gravity and heat-function chairs are gaining popularity but remain niche segments due to higher costs. Mid-range chairs are increasingly incorporating premium features, reflecting a trend toward feature democratization across price tiers.

Application Insights

Residential/home use is the leading application, representing roughly 65–75% of global demand. Consumers are increasingly seeking in-home wellness solutions to alleviate stress, improve posture, and reduce musculoskeletal discomfort. Commercial applications, including spas, wellness centers, hotels, and corporate offices, contribute to the remainder of demand, with a focus on premium, feature-rich models. Healthcare facilities and rehabilitation centers are emerging as niche end users, integrating massage chairs for therapeutic applications.

Distribution Channel Insights

Online retail dominates, capturing approximately 50–60% of market share in 2024. E-commerce platforms allow manufacturers to showcase product features, facilitate customization, and provide customer support. Offline retail remains relevant for premium buyers who prefer in-store trials and personalized consultations. B2B/OEM channels serve commercial clients, including spas, hotels, and fitness centers, and are increasingly leveraging bulk procurement contracts and customized chair models.

End-User Insights

Residential consumers drive the fastest-growing demand, followed by commercial wellness and healthcare facilities. Corporate wellness programs and public relaxation spaces, such as airports and malls, are emerging applications. Export-driven demand is led by Asia-Pacific manufacturers supplying premium models to North America and Europe, leveraging lower production costs and high-quality features.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America, particularly the U.S. and Canada, holds a leading market share of approximately 35–45%. High disposable income, awareness of wellness products, and early adoption of advanced features support demand. Premium residential purchases dominate, supplemented by spa and hotel acquisitions.

Europe

Europe accounts for roughly 15–25% of the market. Countries such as Germany, the U.K., and France emphasize high-quality, ergonomic, and sustainable designs. The market is stable, with premium features and eco-conscious materials driving adoption.

Asia-Pacific

Asia-Pacific is the fastest-growing region, led by China, India, Japan, and South Korea. Rising middle-class populations, urbanization, and increasing health awareness contribute to strong residential and commercial demand. Manufacturers benefit from local production capabilities and cost advantages, driving both domestic consumption and exports.

Latin America

Latin America, including Brazil and Mexico, shows moderate growth potential. Affluent consumers are gradually adopting mid-range and premium chairs, with adventure wellness and lifestyle-focused products gaining attention. Import reliance and infrastructure challenges limit rapid adoption.

Middle East & Africa

The Middle East, led by the UAE and Saudi Arabia, shows increasing demand for premium wellness furniture, driven by high-income consumers and luxury hotel adoption. Africa serves as a growing regional market with emerging residential demand in urban centers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Electric Massage Sofa Chair Market

- Panasonic

- OSIM

- BODYFRIEND

- Ogawa

- Rotal

- Family Inada

- Fujiiryoki

- Osaki

- Human Touch

- Infinity

- Luraco

- Tokuyo

- OTO Bodycare

- Real Relax

- La-Z-Boy

Recent Developments

- In March 2025, OSIM launched a new AI-powered massage sofa chair series integrating body scanning and app-controlled personalization to target premium home wellness consumers.

- In January 2025, Panasonic expanded its global distribution network in Asia-Pacific and Europe, introducing mid-range massage chairs with heat and zero-gravity features.

- In February 2025, BODYFRIEND unveiled compact dual-seat massage chairs designed for urban apartments, focusing on portability and multifunctional use.