Dive Helmet Market Summary

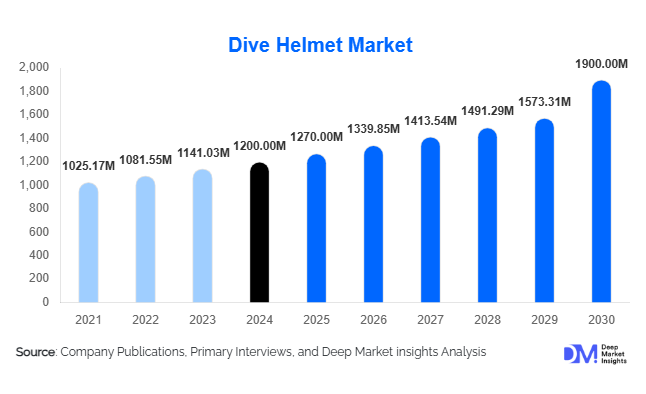

According to Deep Market Insights, the global dive helmet market size was valued at USD 1,200 million in 2024 and is projected to grow from USD 1,270 million in 2025 to reach USD 1,900 million by 2030, expanding at a CAGR of 5.5% during the forecast period (2025–2030). The market growth is primarily driven by increasing offshore oil and gas exploration, technological advancements in diving helmets, and rising recreational diving activities across the globe.

Key Market Insights

- Technological innovation is reshaping the dive helmet market, with smart helmets integrating real-time communication, air monitoring, and ergonomic designs to enhance diver safety and comfort.

- Commercial diving applications dominate globally, driven by underwater construction, inspection, and maintenance requirements, particularly in offshore industries.

- North America holds a major share due to extensive oil and gas operations and advanced marine research facilities.

- Asia-Pacific is the fastest-growing region, fueled by expanding recreational diving, offshore infrastructure projects, and industrial investments in countries like China and Australia.

- Regulatory standards and environmental compliance are creating opportunities for advanced helmet solutions with integrated safety features.

- Metallic helmets remain preferred globally, especially those made of bronze and brass, due to their durability and corrosion resistance in deep-sea environments.

What are the latest trends in the dive helmet market?

Smart and Connected Dive Helmets

Dive helmet manufacturers are increasingly integrating smart technologies, including real-time diver monitoring, communication systems, and telemetry features. These enhancements allow commercial divers to perform complex underwater tasks safely while improving operational efficiency. Smart helmets also cater to recreational divers, offering enhanced safety and comfort. Manufacturers are adopting lightweight materials and ergonomic designs to reduce diver fatigue during prolonged underwater operations, which is shaping product development and competitive differentiation.

Adoption of Durable Materials and Advanced Design

There is a clear shift toward metallic helmets made from corrosion-resistant materials such as bronze and brass, which are ideal for high-pressure and saltwater environments. Designs now focus on modularity, allowing divers to replace parts, integrate communication devices, and attach auxiliary tools. These trends are particularly significant for deep-sea and industrial diving operations, driving higher adoption of premium helmets with longer lifespans and improved performance.

What are the key drivers in the dive helmet market?

Expansion of Offshore Activities

Growing offshore oil, gas, and underwater construction projects require highly reliable diving equipment. Dive helmets provide critical life support and communication capabilities for divers, making them indispensable in these environments. The increase in underwater infrastructure projects, particularly in North America, Europe, and the Middle East, is fueling demand for robust commercial dive helmets.

Technological Advancements in Diving Equipment

Advancements such as integrated communication systems, lightweight materials, ergonomic designs, and real-time monitoring capabilities have significantly enhanced diver safety and operational efficiency. These innovations are boosting adoption across both commercial and recreational diving segments.

Rising Popularity of Recreational Diving

Recreational diving is growing in regions such as Asia-Pacific and Europe, contributing to demand for high-quality diving helmets. Divers increasingly prefer helmets that offer comfort, safety, and ease of use, encouraging manufacturers to develop premium and user-friendly designs.

What are the restraints for the global market?

High Production Costs

Advanced dive helmets with integrated communication and safety features are expensive to manufacture. This higher cost limits affordability for smaller diving operators and recreational users, slowing market penetration in price-sensitive regions.

Regulatory and Certification Challenges

Differing safety standards and certification requirements across regions complicate production and distribution. Manufacturers must invest in compliance, which can delay product launches and restrict market expansion.

What are the key opportunities in the dive helmet industry?

Expansion in Emerging Markets

Asia-Pacific and Latin America offer high growth potential due to increasing offshore activities, recreational diving interest, and expanding industrial infrastructure. Establishing local manufacturing and distribution networks can help companies tap into these emerging markets effectively.

Integration of Advanced Technology

The adoption of smart helmets with IoT capabilities, real-time monitoring, and enhanced communication presents an opportunity to differentiate products and improve diver safety. Innovations like AI-assisted dive monitoring and telemetry systems are poised to become standard in commercial operations.

Regulatory Compliance and Environmental Alignment

Stricter environmental and safety regulations in offshore operations create demand for helmets that ensure compliance. Helmets meeting these standards provide market participants with a competitive advantage and open opportunities in regulated markets worldwide.

Product Type Insights

Commercial dive helmets dominate the market, accounting for approximately 55% of global demand in 2024. They are widely used in offshore oil and gas, underwater construction, and inspection projects due to their robustness and integrated safety features. Recreational helmets account for around 30%, driven by increasing diving tourism and hobbyist diving. Military and specialized helmets make up the remainder, often used in defense, scientific research, and extreme deep-sea operations.

Material Insights

Metallic helmets, particularly those made of bronze and brass, hold around 60% of the global market in 2024 due to their durability and corrosion resistance in deep-sea environments. Composite helmets are gaining traction for recreational use because of their lightweight design and comfort advantages.

End-Use Insights

The commercial diving segment is the largest end-use category, valued at approximately USD 660 million in 2024, driven by offshore oil, gas, and marine infrastructure projects. Recreational diving is growing at a CAGR of 6.2% due to increasing diving tourism in the Asia-Pacific and Europe. Emerging applications include scientific research, underwater robotics support, and marine conservation, which are expected to expand demand in specialized sectors.

| By Product Type | By Material Type | By Application | By End-Use Industry | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for roughly 35% of the global market in 2024, led by the United States and Canada. High demand is driven by offshore oil and gas exploration, commercial diving operations, and marine research. Safety standards and regulatory enforcement are strong, encouraging the adoption of technologically advanced helmets.

Europe

Europe contributes approximately 25% of global demand, with Norway and the U.K. being major markets due to extensive offshore activities. Demand is bolstered by underwater construction projects, recreational diving tourism, and strict compliance requirements, which favor high-quality helmets.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with China, Australia, and Japan leading adoption. Growth is driven by industrial offshore projects, recreational diving, and increasing investment in marine infrastructure. The CAGR for this region is projected at 6.1% through 2030.

Latin America

Brazil and Mexico are emerging markets, benefiting from recreational diving and expanding offshore oil projects. Although smaller in market share, growth opportunities exist through industrial investments and tourism development.

Middle East & Africa

Saudi Arabia, the UAE, and Nigeria are the key contributors, with strong demand linked to the oil and gas industries. Market growth is supported by government investment in marine infrastructure and increasing adoption of advanced diving helmets for safety compliance.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Dive Helmet Market

- Kirby Morgan Dive Systems, Inc.

- DESCO Corporation

- James Fisher and Sons PLC

- DSSI International

- Oceaneering International, Inc.

- Subsalve USA

- Interspiro AB

- Heinke Diving Systems

- Siebe Gorman

- Divex Ltd.

- Oxy-Dive International

- Helmet Diving Technologies

- Hydro Diving Systems

- Seal Diving Systems

- Global Diving Solutions

Recent Developments

- In March 2025, Kirby Morgan launched a smart dive helmet with integrated telemetry and air monitoring, targeting offshore industrial divers.

- In January 2025, DESCO Corporation expanded production capacity in the Asia-Pacific to meet rising recreational and commercial diving demand.

- In July 2024, James Fisher and Sons PLC introduced lightweight composite helmets for recreational diving, enhancing comfort and usability.