Dishwasher Detergent Actionpacs Market Size

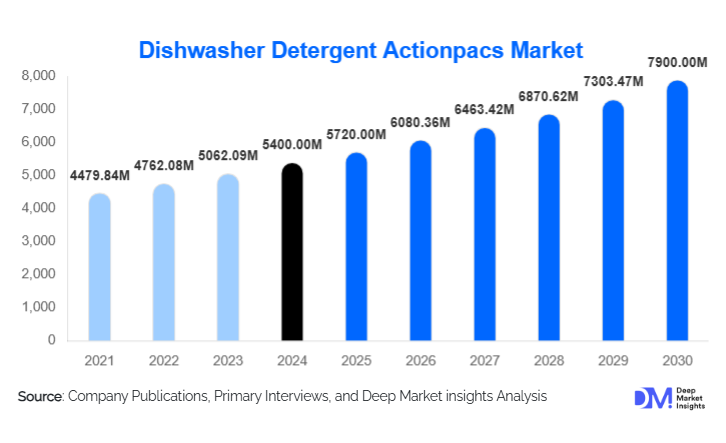

According to Deep Market Insights, the global dishwasher detergent actionpacs market size was valued at USD 5,400 million in 2024 and is projected to grow from USD 5,720 million in 2025 to reach USD 7,900 million by 2030, expanding at a CAGR of 6.3% during the forecast period (2025–2030). The market growth is primarily driven by increasing consumer preference for convenient, pre-measured cleaning solutions, rising adoption of dishwashers in residential and commercial sectors, and growing demand for premium and eco-friendly formulations across developed and emerging markets.

Key Market Insights

- Eco-friendly and sustainable formulations are gaining popularity, with phosphate-free and biodegradable actionpacs attracting environmentally conscious consumers.

- Premium multi-layered actionpacs are expanding globally, offering enhanced cleaning performance, anti-limescale properties, and rinse aid integration, especially in North America and Europe.

- North America dominates the market, accounting for approximately 32% of global demand in 2024, driven by high dishwasher penetration and preference for convenient household cleaning products.

- Asia-Pacific is the fastest-growing region, fueled by urbanization, rising disposable incomes, and increasing adoption of modern kitchen appliances in China, India, and Southeast Asia.

- E-commerce and online retail channels are rapidly gaining market share, enabling direct-to-consumer sales and subscription-based delivery models.

- Technological innovations in actionpacs, including smart dosage features and multi-functional formulations, are reshaping consumer preferences and driving product differentiation.

What are the latest trends in the dishwasher detergent actionpacs market?

Eco-Friendly and Sustainable Actionpacs

Manufacturers are increasingly focusing on biodegradable, phosphate-free, and low-toxicity actionpacs to meet growing environmental regulations and consumer demand. Products designed with recyclable packaging and plant-based surfactants are gaining traction in Europe, North America, and APAC. Government incentives and regulations promoting green household products further reinforce this trend. Leading brands are investing in research and development to create high-performance formulations that maintain cleaning efficacy while reducing environmental impact, offering a competitive edge for both new entrants and established players.

Premiumization and Value-Added Formulations

Premium actionpacs featuring multi-layered designs with enzymes, rinse aids, and anti-limescale agents are increasingly adopted in developed markets. Consumers are willing to pay higher prices for products that offer convenience, superior cleaning, and dishwasher longevity. This trend has led to a shift from basic powder or gel detergents to concentrated actionpacs, particularly in North America and Europe. Multi-functional formulations also appeal to urban households seeking simplified cleaning routines and reduced machine maintenance.

What are the key drivers in the dishwasher detergent actionpacs market?

Increasing Dishwasher Penetration

The rising number of households equipped with dishwashers globally, especially in urban areas, is a primary driver. In North America, over 70% of households own dishwashers, creating a stable demand for actionpacs. Similarly, in APAC, urban middle-class households are adopting modern kitchen appliances, which boosts demand for pre-measured, mess-free detergents. This trend is expanding the residential end-use segment and reinforcing recurring purchase behavior.

Convenience and Time-Saving Solutions

Consumers increasingly prefer ready-to-use actionpacs over powders and liquids due to their pre-measured dosage, ease of storage, and minimal handling. This convenience factor is a key driver in developed markets and among urban households in emerging economies. Busy lifestyles and the need for efficient cleaning solutions in households and commercial kitchens are contributing to higher adoption rates.

Technological Innovation and Product Differentiation

Manufacturers are integrating smart technologies such as enzyme optimization, time-release cleaning agents, and hybrid multi-layer formulations. These innovations enhance cleaning efficiency, reduce residue, and extend dishwasher life. Brands investing in R&D are gaining a competitive edge, particularly in premium segments and regions where consumers prioritize performance over cost.

What are the restraints for the global market?

Higher Pricing Compared to Conventional Detergents

Actionpacs are typically priced higher than powders and liquid detergents, which may limit adoption in price-sensitive markets such as LATAM and MEA. Cost-conscious consumers often opt for traditional detergents, particularly in rural or lower-income areas, restricting market penetration.

Raw Material Price Volatility

Fluctuations in surfactant, enzyme, and polyphosphate prices impact production costs and profit margins. Manufacturers must optimize supply chains and formulation strategies to mitigate these effects, especially as premium and multi-layered formulations rely on multiple high-cost ingredients.

What are the key opportunities in the dishwasher detergent actionpacs industry?

Expansion in Emerging Markets

Rising urbanization, disposable income, and modern kitchen adoption in China, India, Brazil, and Mexico offer significant growth potential. Establishing localized production facilities and marketing affordable yet high-performance actionpacs can capture this expanding consumer base. Emerging markets represent a strategic opportunity for both global incumbents and new entrants.

Integration of Smart and Subscription-Based Solutions

Manufacturers can explore digital engagement through subscription models, automated reordering, and partnerships with IoT-enabled dishwashers. Smart formulations that adjust dosage based on water hardness or dishwasher cycles can appeal to tech-savvy consumers seeking convenience and efficiency, enabling higher brand loyalty.

Eco-Friendly Product Development

With growing environmental awareness and regulatory pressures, sustainable formulations present a key opportunity. Eco-friendly products can command premium pricing and strengthen brand differentiation, particularly in Europe, North America, and APAC markets, where consumers prioritize green and health-conscious products.

Product Type Insights

Standard actionpacs dominate globally, accounting for approximately 48% of the 2024 market, due to broad affordability and ease of use. Premium actionpacs, representing 32% of the market, are growing rapidly in developed regions where consumers value multi-layered cleaning performance. Specialized actionpacs, including high-efficiency and hard-water formulations, hold around 20% of the market and are expanding in regions with specific water quality challenges, such as APAC and parts of Europe.

Formulation Insights

Gel-based actionpacs lead with 42% market share in 2024, favored for easy dissolution and superior cleaning performance. Powder formulations remain significant at 35%, particularly in price-sensitive regions. Tablet/hybrid multi-layer PACS are emerging rapidly with a 23% share, driven by premiumization and multi-functional performance benefits.

Distribution Channel Insights

Supermarkets and hypermarkets account for 55% of sales, serving as the primary channel for household purchases. Online retail is expanding quickly, contributing 28% of global revenue, fueled by subscription services and e-commerce convenience. Specialty stores and institutional sales collectively hold 17%, supporting niche and bulk demand segments.

End-Use Insights

The residential segment dominates with a 60% share in 2024, driven by household dishwasher adoption and preference for convenient cleaning solutions. Commercial and institutional use together account for 40%, with hotels, restaurants, and hospitals increasing consumption of multi-layered, high-performance actionpacs. Export-driven demand is rising in emerging markets, particularly from manufacturers in Europe exporting premium actionpacs to APAC and LATAM.

| By Product Type | By Formulation Type | By Distribution Channel | By End-Use |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America leads with 32% market share in 2024, primarily due to high dishwasher penetration in the U.S. and Canada. Consumers favor premium and eco-friendly actionpacs, with strong adoption in urban households. E-commerce and large retail chains dominate distribution.

Europe

Europe accounts for 28% of the global market, with Germany, France, and the UK leading demand. Eco-conscious consumers and regulatory compliance drive premium and biodegradable product adoption. The region also sees significant institutional use in hospitality and healthcare.

Asia-Pacific

APAC is the fastest-growing region, led by China, India, and Japan, driven by rising urbanization, disposable income, and expanding dishwasher ownership. Premiumization and e-commerce adoption are accelerating growth, making this region a strategic priority for global manufacturers.

Latin America

LATAM, with Brazil and Mexico as key markets, is gradually increasing ActionPacs adoption. Middle-class urban households are driving residential demand, particularly for convenience-oriented products, though price sensitivity remains a factor.

Middle East & Africa

MEA markets, led by the UAE, Saudi Arabia, and South Africa, are witnessing steady growth in high-income urban areas. Institutional demand from hotels, hospitals, and large kitchens supports premium and multi-functional ActionPac sales, contributing to overall regional market expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Dishwasher Detergent Actionpacs Market

- Procter & Gamble

- Reckitt Benckiser

- Henkel AG & Co. KGaA

- Unilever

- Colgate-Palmolive

- Church & Dwight

- SC Johnson

- Seventh Generation

- Amway

- Kao Corporation

- Clorox

- ECOVER

- Method Products

- Groupe Bel

- Godrej Consumer Products

Recent Developments

- In March 2025, Procter & Gamble launched a new line of eco-friendly multi-layered actionpacs in Europe with biodegradable packaging and enhanced enzyme technology.

- In January 2025, Henkel expanded its dishwasher actionpacs production capacity in APAC to cater to growing demand in China and India.

- In December 2024, Reckitt Benckiser introduced smart subscription models for dishwasher actionpacs in North America, integrating auto-reorder and water hardness customization features.