Cricket Turf Shoes Market Size

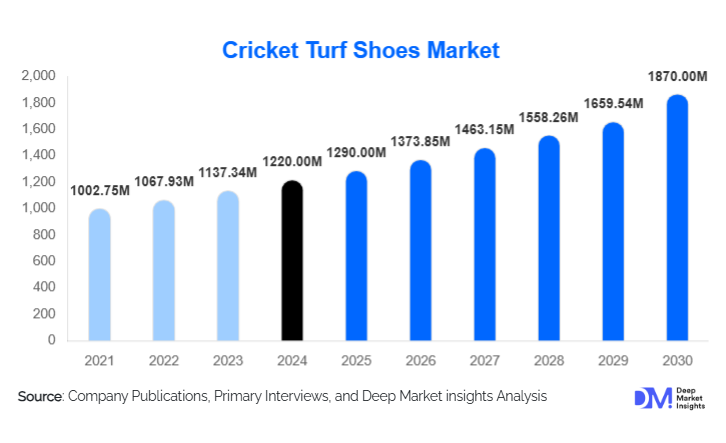

According to Deep Market Insights, the global cricket turf shoes market size was valued at USD 1,220 million in 2024 and is projected to grow from USD 1,295 million in 2025 to reach USD 1,870 million by 2030, expanding at a CAGR of 6.5% during the forecast period (2025–2030). The market growth is primarily driven by the rising popularity of cricket leagues worldwide, increasing participation in youth and amateur cricket, and continuous advancements in sports footwear technology, including lightweight materials, improved spike designs, and enhanced performance features.

Key Market Insights

- Professional cricket leagues are the primary demand drivers, with bulk purchases of spiked and hybrid turf shoes for players in leagues like IPL, BBL, and PSL.

- Asia-Pacific dominates the market, led by India and Australia, due to high cricket participation rates, school and academy programs, and extensive domestic leagues.

- Synthetic and hybrid turf shoes are gaining traction, offering affordability, durability, and versatility for amateur players across varied pitch surfaces.

- North America and the Middle East are emerging markets, fueled by growing cricket academies and amateur leagues.

- Technological adoption in shoe design, such as advanced spike configurations, ergonomic cushioning, and lightweight composites, is enhancing player performance and safety.

- E-commerce and online retail channels are rapidly expanding, enabling manufacturers to reach global consumers directly and efficiently.

What are the latest trends in the cricket turf shoes market?

Performance-Driven Shoe Technology

Manufacturers are increasingly incorporating advanced technologies into cricket turf shoes, including lightweight composites, ergonomic sole designs, moisture-wicking liners, and specialized spike configurations for grip and stability. These innovations enhance player performance and reduce injury risk, attracting both professional and amateur players. Customized shoes for professional athletes are also gaining popularity, creating premium segments within the market.

Synthetic and Hybrid Material Adoption

While traditional leather shoes remain relevant, synthetic and hybrid materials are trending due to their durability, moisture resistance, and lower price points. These materials are particularly popular in regions with humid climates or artificial turf surfaces, allowing players at all levels to access reliable, performance-oriented footwear at competitive prices.

What are the key drivers in the cricket turf shoes market?

Global Cricket Leagues Driving Demand

High-profile tournaments such as IPL, BBL, PSL, and international competitions generate consistent demand for turf shoes. Players require durable, high-performance shoes, and professional teams often procure them in bulk. The popularity of televised cricket and social media coverage encourages youth and amateur players to emulate professional choices, boosting overall market adoption.

Rising Youth and Amateur Participation

Schools, colleges, and cricket academies worldwide are actively promoting the sport, increasing demand for turf shoes among younger players. Entry-level and mid-range shoes are particularly in demand, supporting market growth in emerging cricket regions, including North America, the Middle East, and Latin America.

Technological Advancements and Innovation

Integration of new technologies in footwear design, including lightweight composites, enhanced cushioning, and optimized spike patterns, is attracting players seeking both comfort and performance. Companies investing in R&D are capturing premium market segments and differentiating their offerings in a competitive environment.

What are the restraints for the global market?

High Cost of Premium Shoes

Professional-grade cricket turf shoes can be expensive, limiting accessibility for amateur players and youth in price-sensitive regions. Affordability constraints can restrict market penetration, particularly in emerging economies.

Competition from Multi-Sport Footwear

General sports shoes with moderate performance features sometimes compete with specialized cricket turf shoes. Players in regions with less professional cricket adoption may opt for these alternatives, slowing growth for dedicated cricket footwear manufacturers.

What are the key opportunities in the cricket turf shoes market?

Expansion into Non-Traditional Cricket Markets

Regions such as the USA, Canada, UAE, and parts of Europe are investing in cricket academies, leagues, and school programs. These emerging markets present substantial opportunities for both global and regional manufacturers to introduce performance turf shoes for youth and amateur players.

Integration of Advanced Shoe Technology

Innovations such as ergonomic designs, lightweight materials, improved spike systems, and moisture-resistant composites provide opportunities for companies to differentiate products. This allows premium pricing, enhances player performance, and strengthens brand reputation in competitive markets.

Government and Private Sports Initiatives

Government programs like India’s Khelo India and private investments in cricket leagues and training academies boost demand for cricket turf shoes. These initiatives create long-term opportunities for manufacturers to secure bulk institutional contracts and expand their product offerings.

Product Type Insights

Spiked turf shoes dominate the market, accounting for approximately 45% of 2024 sales, due to their superior grip on natural turf and widespread use in professional leagues. Rubber sole shoes and hybrid models are growing in popularity, particularly among youth and amateur players seeking versatility across pitch types.

Application Insights

Professional cricket leagues constitute the largest end-use segment, accounting for 55% of market share, driven by bulk purchases for players and teams. Domestic and amateur cricket, along with training academies, also contribute significantly to market growth, especially in emerging cricket nations. The export market is expanding, with India, Pakistan, and the UK serving as major exporters of cricket turf shoes to non-traditional cricket regions.

Distribution Channel Insights

Offline retail remains the primary channel, representing 50% of global revenue in 2024, led by sports specialty stores and brand outlets. Online retail is rapidly expanding, offering direct-to-consumer sales, broader geographic reach, and enhanced convenience. Institutional contracts with cricket academies and clubs are also a growing distribution channel for bulk sales.

Player Type Insights

Professional players account for 35% of the market due to high-performance requirements and bulk procurement by teams. Amateur and youth segments are growing steadily, driven by school, college, and academy participation, with mid-range and entry-level shoes catering to cost-sensitive consumers.

Age Group Insights

Players aged 18–30 are driving demand for mid-range and entry-level cricket turf shoes, particularly in youth and amateur segments. Players aged 31–50 dominate professional and semi-professional purchases, prioritizing high-performance footwear. Younger segments are highly influenced by professional league endorsements and social media trends.

| By Product Type | By Material | By Player Type / User | By Distribution Channel | By End-Use Industry |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific is the largest market, with 50% of the 2024 share, led by India (30%) and Australia (15%). Factors include high cricket participation, professional leagues, and youth development programs. Bangladesh represents the fastest-growing market in the region, with an 8–9% CAGR due to emerging leagues and academy growth.

Europe

Europe accounts for 20% of the market, dominated by the UK and Germany. Demand is driven by amateur leagues, clubs, and youth programs. Sustainability and innovation in shoe materials are gaining importance among European players, fueling moderate growth.

North America

North America shows rapid growth, particularly in the USA, driven by cricket academies and expat communities. CAGR is estimated at 10–12% due to increasing league participation and grassroots promotion.

Middle East & Africa

UAE, South Africa, and Kenya are key markets, together representing 10% of global demand. Expat-driven cricket participation and professional leagues in the Middle East support growth. Intra-African tourism and local tournaments also contribute to demand.

Latin America

Brazil and Argentina are emerging markets, collectively accounting for 5% of 2024 sales. Growth is driven by niche amateur leagues and increasing awareness of cricket.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Cricket Turf Shoes Market

- Nike

- Adidas

- Puma

- New Balance

- Asics

- Reebok

- Spartan Sports

- SG Cricket

- Kookaburra

- Gray-Nicolls

- MRF

- Canterbury

- Under Armour

- Bata

- Cosco

Recent Developments

- In May 2025, Nike launched a new range of lightweight turf shoes with advanced spike configurations for professional cricketers in the Asia-Pacific.

- In April 2025, Puma expanded its cricket footwear portfolio in India, introducing hybrid shoes for youth and amateur players.

- In February 2025, Adidas unveiled a synthetic turf shoe line optimized for humid climates and artificial pitches, targeting emerging cricket markets in North America and Europe.