Couture Millinery Market Size

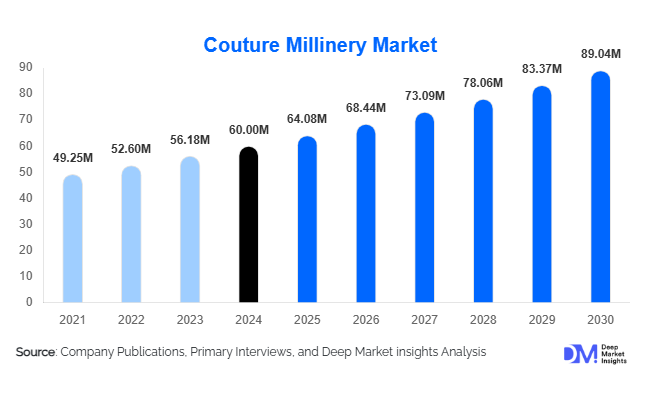

According to Deep Market Insights, the global couture millinery market size was valued at USD 60 million in 2024 and is projected to grow from USD 64.08 million in 2025 to reach USD 89.04 million by 2030, expanding at a CAGR of 6.8% during the forecast period (2025–2030). The couture millinery market growth is primarily driven by the rising demand for bespoke and personalized luxury fashion, the growing influence of social media and celebrity culture, and increasing disposable income in emerging markets, which fuels premium accessory consumption.

Key Market Insights

- Bespoke and artisanal craftsmanship are at the core of couture millinery, attracting consumers seeking unique and exclusive fashion statements.

- Women dominate demand, with bridal, ceremonial, and fashion event applications driving the largest segment of the market.

- Europe remains the largest regional market, driven by heritage fashion hubs in the UK, France, and Italy, with established luxury ateliers and couture houses.

- Asia-Pacific is the fastest-growing region, fueled by rising wealth in China, Japan, and India, coupled with increasing cultural adoption of luxury accessories.

- Digital and online channels are gaining traction, with virtual fittings, online customization, and social media marketing reshaping consumer engagement and global reach.

- Sustainability and ethical sourcing, including eco-friendly fabrics and responsible feather sourcing, are becoming key differentiators among premium milliners.

What are the latest trends in the couture millinery market?

Sustainability and Ethical Craftsmanship

High-net-worth consumers are increasingly prioritizing ethical and sustainable fashion choices. Couture millinery brands are responding by sourcing organic, recycled, and vegan materials, ensuring responsible feather and fabric use, and emphasizing transparency in artisanal production. Storytelling around heritage techniques and zero-waste production has become a marketing differentiator, attracting environmentally conscious buyers willing to pay premium prices for sustainable, handcrafted designs. Some ateliers have also adopted traceability systems for raw materials, which enhances credibility and brand value among discerning clients.

Digital Augmentation and Customization

Emerging digital tools, including 3D design software, virtual fittings, and AR/VR try-on experiences, are enabling clients worldwide to co-create bespoke hats without physically visiting ateliers. Online customization platforms, social media previews, and influencer collaborations are reshaping demand patterns, particularly among younger consumers who seek interactive, immersive shopping experiences. Digital marketing campaigns allow milliners to reach luxury consumers in Asia, the Middle East, and North America while maintaining exclusivity and personal attention.

What are the key drivers in the couture millinery market?

Rising Demand for Personalized Luxury Fashion

Consumers increasingly prefer unique, one-of-a-kind accessories that express individuality and social status. Couture millinery, with bespoke designs, limited editions, and high-quality materials, satisfies this demand. The bridal, ceremonial, and fashion event sectors further amplify the market, as women globally seek exclusive headwear for weddings, red carpet events, and high-profile social gatherings. Personalized luxury experiences command higher willingness-to-pay, which supports premium pricing and revenue growth for milliners.

Influence of Celebrity Culture and Social Media

Celebrities and influencers play a critical role in shaping couture millinery trends. Red carpet appearances, royal events, and fashion shows featuring distinctive headpieces generate widespread visibility, fueling consumer demand. Platforms such as Instagram, TikTok, and Pinterest amplify this effect, encouraging aspirational buyers to invest in bespoke millinery. Milliners strategically collaborating with high-profile personalities gain brand recognition and expand market share globally.

Rising Affluence in Emerging Markets

Rising disposable incomes in regions such as Asia-Pacific and the Middle East are creating new consumer bases for luxury accessories. High-net-worth individuals in China, India, the UAE, and Saudi Arabia increasingly seek premium fashion items, including bespoke millinery. Growing wedding industries, fashion shows, and cultural events in these regions further support demand for unique, high-quality headwear.

What are the restraints for the global market?

High Production Costs

Couture millinery is labor-intensive and uses premium materials, including wool felt, silk, velvet, and ethically sourced feathers. Atelier overheads, artisan salaries, and limited-batch production elevate costs, resulting in high retail prices that restrict consumer accessibility. Fluctuating raw material prices and shipping expenses can also impact margins.

Seasonality and Event-Driven Demand

Demand for couture millinery is highly dependent on weddings, fashion events, royal ceremonies, and social occasions. Outside peak seasons, market activity slows, limiting consistent revenue flow. Economic downturns or disruptions to event-based activities can further constrain growth, posing challenges for small-scale ateliers and manufacturers.

What are the key opportunities in the couture millinery industry?

Sustainable and Ethical Luxury

Brands focusing on sustainable fabrics, ethical feather sourcing, and transparent artisan practices can differentiate themselves and capture growing consumer preference for eco-conscious fashion. Limited-edition sustainable collections attract affluent, socially responsible buyers and can command higher pricing, supporting profitability.

Emerging Markets and Export Expansion

Growing disposable income and luxury consumption in the Asia-Pacific and the Middle East present strong opportunities. Milliners can expand exports from Europe and North America or establish regional ateliers to serve these markets. Cultural adaptation of designs for local ceremonial and fashion events can further enhance acceptance and revenue potential.

Collaborations with Haute Couture and Luxury Fashion Houses

Partnerships with established luxury brands or fashion houses allow milliners to gain visibility through runway shows, capsule collections, and celebrity endorsements. Such collaborations can increase brand value, justify premium pricing, and attract new clientele globally.

Product Type Insights

Fascinators and decorative headpieces dominate the market, representing approximately 28% of the 2024 market share (USD 17 million). Their popularity is driven by weddings, ceremonial events, and fashion shows, offering versatile, lightweight, and customizable designs. Structured hats like fedoras and bowlers also maintain a strong presence due to tradition and material durability.

Material Insights

Felt and wool felt lead material usage, accounting for roughly 32% of the market (USD 19 million), is favored for its ability to hold shape, durability, and luxury appeal. Silk, velvet, and embellished fabrics follow, often used in bespoke, high-value headpieces for events.

End-User Insights

Women account for approximately 72% of market demand (USD 43 million), primarily due to weddings, bridal events, and fashion applications. Men and children remain niche segments, with limited adoption in ceremonial or fashion-focused contexts.

Application Insights

Weddings and ceremonial occasions are the largest applications, representing 38% of the 2024 market (USD 23 million). Fashion shows, runway events, and luxury streetwear constitute growing segments, while everyday luxury accessories are emerging for fashion-conscious consumers seeking statement pieces.

Distribution Channel Insights

Boutiques and couture ateliers account for approximately 55% of 2024 sales (USD 33 million), emphasizing personalized service, fittings, and bespoke designs. E-commerce and online platforms are expanding their reach, particularly in Asia-Pacific and the Middle East, providing virtual customization and direct-to-consumer engagement.

| By Product Type | By Material | By End-User | By Application | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Europe

Europe holds the largest market share, 43% in 2024 (USD 26 million), with the UK, France, and Italy leading due to established luxury ateliers, cultural adoption of headwear, and fashion heritage. Demand is stable, supported by weddings, royal events, and fashion weeks.

North America

North America represents 27% of the 2024 market (USD 16 million), driven by the U.S. and Canada. Luxury consumption, red carpet events, and fashion influencers are key drivers. The region demonstrates moderate but steady growth.

Asia-Pacific

Accounting for 17% of the 2024 market (USD 10 million), Asia-Pacific is the fastest-growing region, particularly in China, Japan, India, and Australia. Rising disposable income, influencer culture, and increasing acceptance of Western luxury fashion support growth.

Middle East & Africa

Representing 8% of the 2024 market (USD 5 million), high-income consumers in the UAE, Saudi Arabia, and Qatar drive demand for bespoke ceremonial and fashion headwear. Growth is strong due to luxury events, weddings, and cultural adoption.

Latin America

Latin America contributes 5% (USD 3 million) of the market, with Brazil and Mexico leading. Demand is limited but growing among affluent consumers seeking bespoke and luxury fashion experiences.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Couture Millinery Market

- Philip Treacy

- Stephen Jones

- Jane Taylor London

- Rachel Trevor Morgan

- Diana Cavagnaro

- Leah C

- Suzanne Couture

- Emma Moscari

- Rebecca

- Victoria Grant

- Gigi Burris

- Jacques Azagury (hats line)

- Emily London

- Caron McBride

- Katie Rowland

Recent Developments

- In March 2025, Philip Treacy launched a sustainable luxury headwear collection using vegan felts and recycled embellishments, targeting the Asia-Pacific market.

- In January 2025, Stephen Jones collaborated with a major fashion house to design a limited-edition runway collection, boosting international visibility.

- In December 2024, Jane Taylor London expanded its e-commerce platform, enabling virtual fittings and customization for clients across the Middle East and North America.