Cosmetic Kaolin Powder Market Size

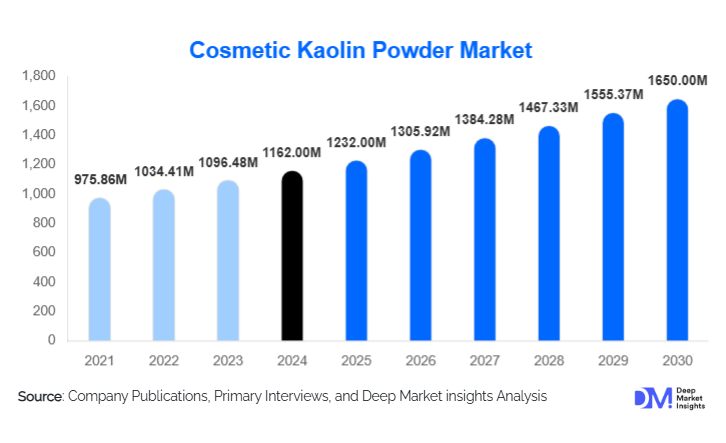

According to Deep Market Insights, the global cosmetic kaolin powder market size was valued at USD 1,162 million in 2024 and is projected to grow from USD 1,232 million in 2025 to reach USD 1,650 million by 2030, expanding at a CAGR of 6.0% during the forecast period (2025–2030). The market growth is primarily driven by increasing consumer demand for natural and clean-label cosmetic ingredients, rising skincare and mineral makeup adoption, and technological advances in kaolin processing that allow for functionalized and premium cosmetic-grade products.

Key Market Insights

- Face care products dominate cosmetic kaolin usage, with facial masks and cleansers accounting for the largest application share due to high per-unit consumption of kaolin and premiumization trends.

- Functionalized and specialty kaolin powders are gaining traction, enabling new applications in long-wear makeup, dry shampoos, and hybrid formulations with improved oil absorption and texture.

- Asia-Pacific leads the regional demand, driven by rapid growth in China, India, South Korea, and Japan, coupled with a thriving cosmetic manufacturing industry.

- North America remains a key market, with the U.S. and Canada showing a strong preference for natural and certified cosmetic ingredients.

- Regional processing and near-source finishing are emerging as strategic trends to reduce lead times, ensure quality, and meet sustainability expectations from brands.

- Technological integration, including surface functionalization, micronization, and digital traceability, is enhancing product differentiation and enabling higher margins for suppliers.

What are the latest trends in the cosmetic kaolin powder market?

Premium & Certified Cosmetic Kaolin

Suppliers are increasingly focusing on traceable and certified cosmetic-grade kaolin to meet the rising consumer demand for natural, vegan, and clean-label products. Certifications such as organic, halal, and ISO-compliant mining and processing practices allow formulators to position their products as safe, high-quality, and environmentally responsible. Premium certification also allows suppliers to charge higher prices, especially for niche indie and private-label brands. Companies are investing in low-dust milling, advanced micronization, and third-party quality verification to maintain consistent particle size, brightness, and heavy-metal compliance, which are critical for cosmetic applications.

Functionalized Kaolin for Innovative Formulations

Technologically advanced kaolin, including surface-treated, micronized, and hydrophobic grades, is gaining adoption in the market. These specialty powders enhance performance in formulations such as long-wear foundations, dry shampoos, and oil-absorbing skincare products. Formulators prefer functionalized kaolin because it allows for consistent performance, superior texture, and enhanced stability in complex cosmetic matrices. Collaborative R&D and co-development initiatives between suppliers and contract manufacturers are helping expand these high-margin applications globally.

What are the key drivers in the cosmetic kaolin powder market?

Growing Demand for Natural & Clean-Label Cosmetics

Consumers increasingly prefer products with minimal synthetic ingredients, driving brands to adopt naturally derived kaolin powders. The demand is especially strong in skincare products like masks and mineral makeup, where gentle, non-irritating ingredients are prioritized. This trend encourages formulators to source high-quality cosmetic-grade kaolin and enables suppliers to expand volume and value simultaneously.

Expanding Skincare & Mineral Makeup Markets

Rapid growth in premium skincare and mineral makeup, particularly in APAC and North America, has amplified kaolin demand. Products such as clay masks, face cleansers, compact powders, and foundations rely heavily on cosmetic kaolin for oil control, smoothness, and color neutrality. Rising disposable incomes and increasing brand proliferation in these regions are further accelerating consumption.

Technological Advancements in Processing

Innovations in kaolin processing, including fine milling, surface treatments, and controlled particle distribution, have broadened application potential. These improvements allow kaolin to perform effectively in high-end cosmetics while maintaining stability and sensory appeal, creating opportunities for premium pricing and differentiation in competitive markets.

What are the restraints for the global market?

Volatility in Raw Material and Processing Costs

Fluctuations in mining, energy, and logistics costs can impact the pricing of cosmetic kaolin. While premium grades command higher margins, cost pressures can compress profitability if suppliers cannot pass expenses to formulators, particularly for commoditized kaolin products.

Regulatory Compliance and Quality Standards

Cosmetic-grade kaolin must adhere to strict heavy-metal limits, microbiological control, and regional regulations. Smaller processors often face challenges meeting these requirements, which can restrict market entry and expansion. Non-compliance may lead to product recalls or loss of market access, especially in the EU and North America.

What are the key opportunities in the cosmetic kaolin powder industry?

Premium, Traceable Kaolin for Indie and Private Label Brands

Suppliers can capture high-margin opportunities by offering traceable, certified, and sustainably sourced cosmetic kaolin. Smaller batches and specialized certifications appeal to indie and private-label brands, enabling suppliers to differentiate themselves and secure repeat contracts.

Functionalized Kaolin for Advanced Cosmetic Applications

Surface-treated, micronized, and hydrophobic kaolin is increasingly adopted in long-wear makeup, dry shampoos, and high-performance skincare formulations. Suppliers investing in R&D and co-development with formulators can tap into high-margin product categories and build long-term customer loyalty.

Regional Processing and Near-Source Production

Establishing regional finishing facilities reduces lead times, lowers logistics costs, and supports sustainability initiatives. Near-source processing appeals to formulators seeking fast delivery, smaller MOQs, and traceable quality, creating strategic advantages in competitive markets.

Product Type Insights

Soft, natural cosmetic-grade kaolin dominates the market, favored for its high brightness, low abrasivity, and versatility in skincare and makeup formulations. Calcined and surface-treated kaolin are growing in specialty applications, enabling functional benefits in long-wear and hybrid products. Bulk fine powders remain the primary commercial format, supplying large cosmetic manufacturers and contract formulators, while packaged blends are gaining traction among indie and private-label brands.

Application Insights

Face care products, including masks and cleansers, remain the largest application segment, accounting for approximately 45% of the 2024 market. Mineral makeup and foundation powders are rapidly growing due to premiumization trends and consumer demand for natural formulations. Emerging applications include dry shampoos, single-use facial strips, and spa-grade products, expanding market potential across personal care categories.

Distribution Channel Insights

B2B direct supply dominates the distribution landscape, representing roughly 70% of the global market. Industrial distributors and specialty suppliers serve mid-size formulators, while online and offline retail channels are increasingly leveraged by private-label and indie brands. Digital marketing, traceability platforms, and e-commerce are becoming critical tools to reach smaller buyers and expand market presence.

End-User Insights

Large cosmetic manufacturers account for about 62% of the 2024 market, driving bulk consumption and maintaining long-term contracts with kaolin suppliers. Indie brands and contract manufacturers are growing in prominence due to the rise of e-commerce and specialty formulations, creating additional demand for premium, certified kaolin. Professional spa and salon segments are emerging niches, particularly in premium skincare and wellness applications.

| By Product Type | By Application | By End-User | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds 24% of the 2024 market, led by the U.S. and Canada. High consumer awareness, preference for natural cosmetics, and strong private-label markets drive demand. The region continues to adopt certified and functionalized kaolin products, particularly in premium face care and mineral makeup applications.

Europe

Europe accounts for 22% of the 2024 market, with the U.K., Germany, and France leading demand. Regulatory compliance and sustainability requirements favor certified cosmetic-grade kaolin. Growth is steady, fueled by premiumization and eco-conscious formulations, with younger demographics driving innovation adoption.

Asia-Pacific

APAC leads global demand at 38% of the market, with China, India, South Korea, and Japan as primary contributors. Rapid expansion of skincare, mineral makeup, and e-commerce channels, combined with rising middle-class affluence, is driving the fastest regional growth (CAGR 7–9%).

Latin America

LATAM represents 11% of the market, with Brazil, Mexico, and Argentina showing growing interest in premium skincare and mineral makeup. Outbound and domestic cosmetic manufacturing demand are increasing, supported by mid-range and adventure-driven formulations.

Middle East & Africa

MEA holds 5% of the market, with the UAE, Saudi Arabia, and South Africa as key markets. Demand is concentrated in high-income consumer segments seeking luxury and certified cosmetic ingredients. Intra-regional trade and African-based manufacturing contribute modest growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Cosmetic Kaolin Powder Market

- Imerys S.A.

- SCR-Sibelco N.V.

- BASF SE

- KaMin LLC

- Thiele Kaolin Company

- 20 Microns Limited

- Ashapura Group

- EICL Limited

- Quarzwerke GmbH

- LASSELSBERGER Group

- LB Minerals Ltd.

- I-Minerals Inc.

- Maoming Xingli Kaolin Co., Ltd.

- Sedlecký Kaolin a.s.

- W.R. Grace & Co.

Recent Developments

- In 2025, Imerys announced expansion of cosmetic-grade kaolin production lines in China and India to meet rising APAC demand for premium face care and mineral makeup applications.

- In early 2025, KaMin LLC launched a functionalized, surface-treated kaolin product line for long-wear makeup and oil-control formulations in North America and Europe.

- In 2024, BASF SE expanded its cosmetic-grade kaolin R&D capabilities in Germany, focusing on micronization and eco-friendly processing to enhance product performance and traceability.