Cordless Electric Hair Clippers Market Size

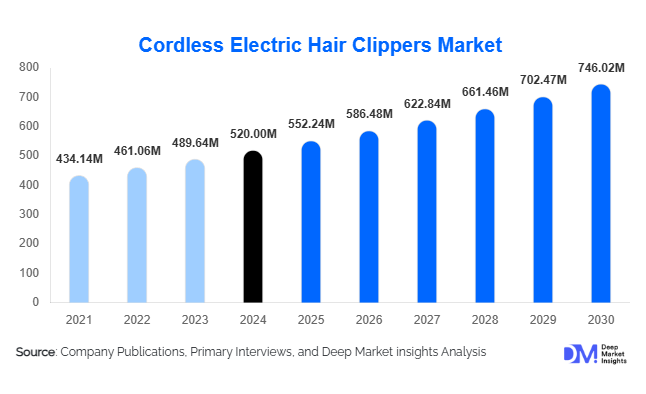

According to Deep Market Insights, the global cordless electric hair clippers market size was valued at USD 520 million in 2024 and is projected to grow from USD 552.24 million in 2025 to reach USD 746.02 million by 2030, expanding at a CAGR of 6.2% during the forecast period (2025–2030). The cordless electric hair clippers market growth is primarily driven by the increasing consumer preference for battery-powered grooming devices, rising adoption of professional cordless tools in salons and barber shops, and the expansion of online and direct-to-consumer retail channels that enable premium cordless models to scale globally.

Key Market Insights

- Battery-powered cordless convenience is shifting the market away from traditional corded models, with advanced Li-ion batteries and brushless motors enabling longer runtime and improved portability for both consumers and professionals.

- Premium and professional-grade cordless models are expanding, offering higher ASPs thanks to brushless motors, longer battery life, high-quality blades, and accessory ecosystems tailored for salons and barbers.

- Asia-Pacific dominates the market share, capturing approximately 35 % of global cordless clippers revenue in 2024, driven by large unit demand and growing grooming spend in China, India, and Southeast Asia.

- North America remains a high‐ASP region, with approximately 28 % of the cordless market in 2024, led by premium consumer and professional channels in the U.S. and Canada.

- Online retail and D2C channels are critical growth drivers, with online accounting for around 46 % of global cordless clippers revenue in 2024 as consumers increasingly research and purchase premium grooming devices via e-commerce.

- Technological integration—such as Li-ion fast charging, brushless motors, and modular blades—is reshaping product differentiation, allowing brands to command higher margins and build accessory ecosystems around cordless models.

Latest Market Trends

Premiumization of Cordless Grooming Devices

Manufacturers are increasingly shifting focus to mid- and premium-tier cordless electric hair clippers. These features include advanced lithium-ion battery stacks with extended runtime, brushless motors that deliver professional-grade torque and quieter operation, and high-quality blade systems including titanium or ceramic coatings. Rather than competing only on price, many brands now differentiate on ergonomics, runtime, accessory bundles (spare batteries, charging docks, comb sets), and professional endorsements. This premiumization trend drives higher ASPs and improved margins, particularly as home users upgrade and salon professionals adopt cordless tools for portability and hygiene.

Direct-to-Consumer & Subscription Models Gaining Traction

Online channels have unlocked new business models in cordless clippers. Brands are leveraging D2C websites, social-media marketing, and influencer reviews to convert grooming enthusiasts into purchasers of premium cordless tools. Additionally, subscription-based services (e.g., quarterly blade/comb replacements, battery trade-ins, extended warranties) are emerging. These models deepen lifetime value per user, encourage brand loyalty, and create recurring revenue beyond the one-time purchase. The flexibility of online retail also enables rapid global expansion and targeted regional launches in growth markets.

Market Drivers

Portable, High-Performance Battery Technology

One of the strongest drivers of the cordless electric hair clippers market is the maturation of battery and motor technology, making cordless units truly viable alternatives to corded machines. Lithium-ion batteries now offer longer runtimes, faster charging, and improved reliability, while brushless motors deliver higher torque with less heat and vibration. Together, these advances meet the expectations of both home users and professional stylists, making cordless appliances increasingly attractive and dependable.

Growth of At-Home Grooming & Professional Channel Recovery

The home grooming trend accelerated during the pandemic and continues to persist, driving demand for easy-to-use cordless tools. At the same time, professional barbershops and salons are recovering and increasingly adopting cordless models for operational flexibility, hygiene (no cords to clean), and mobility (wireless tools in multi-station setups). This dual pull from consumer DIY and professional usage provides a strong tailwind for cordless clippers.

Online Channel Expansion and Premium Upgrade Cycles

E-commerce proliferation has significantly broadened access to premium cordless grooming products, enabling consumers worldwide to compare features, read reviews, and purchase without geographic constraints. As a result, upgrade cycles have shortened: consumers are more willing to trade up to cordless models with better features, and brands can introduce multiple tiered cordless lines globally. This dynamic is boosting revenue growth and ASPs in the cordless segment.

Restraints

Price Sensitivity and Competitive Low-Cost Imports

Despite premiumization, much of the global grooming market remains price-sensitive, especially in emerging regions. Low-cost imports and white-label cordless clippers create pricing pressure and thin margins for brands unless they can differentiate. This competition makes it challenging for many companies to capture premium segment share without strong branding or distribution advantages.

Battery-Safety, Regulatory, and Lifecycle Challenges

Cordless models dependent on lithium-ion batteries face regulatory hurdles (transportation, import/export controls, recycling), safety concerns (battery thermal events), and lifecycle limitations (non-replaceable battery packs reducing usable lifetime). Manufacturers must invest in compliance, battery management systems, and after-sales service, increasing cost and complexity, and potentially slowing adoption in regions with stricter regulations or less developed servicing ecosystems.

Market Opportunities

Battery & Motor Technology Premiumization

As battery and motor technologies advance, there is a significant opportunity to develop cordless tools with longer runtimes, faster charging, lighter form factors, and professional-grade performance. Brands that launch detachable-battery modules, modular accessories, and brushless motors can capture a greater share in the premium cordless segment. This also opens opportunities for spare-battery sales, battery-upgrade programs, and accessory ecosystems, boosting lifetime customer value.

Direct-to-Consumer Channel & Subscription Ecosystems

The expansion of D2C business models offers a strong opportunity for both incumbent and new players to reduce dependence on traditional retail, increase margin capture, and engage consumers directly. By offering bundled services (blade replacement, spare batteries, maintenance subscriptions) and global shipping, companies can monetize not just the initial sale but recurring consumables. New entrants can launch globally from Day 1 via e-commerce and target niche segments (premium grooming, professional barber kits) with digital marketing support.

Regional Expansion in Emerging Markets

Emerging markets in Asia-Pacific (India, China, Southeast Asia) and Latin America present fast-growing demand for cordless grooming tools due to rising middle-class incomes, expanding salon networks, and increasing online retail penetration. Local assembly, tailored regional feature sets (voltage-agnostic chargers, multilingual packaging), and regional influencer campaigns provide opportunities for brands to establish early leadership. The simultaneous manufacturing push in electronics in these regions further supports cost-competitive expansion and export-driven growth.

Product Type Insights

In the cordless electric hair clippers market, the battery-only cordless (Li-ion) segment clearly dominates because it offers portability and convenience without reliance on mains power. While hybrid (corded + cordless) units exist, the pure cordless category is the growth engine, favored by both consumers and professionals. Premium cordless units with advanced battery, motor, and blade tech are gaining share, making cordless the main product type in the segment.

Application Insights

The home / DIY segment remains the largest application for cordless clippers, led by consumers seeking convenience and an upgrade from corded versions. However, the fastest-growing application is the salon & barber professional channel: professionals are converting to cordless models to gain mobility, hygiene benefits, and premium performance. Adjacent applications such as pet grooming and institutional grooming (nursing homes, medical facilities) are emerging as peripheral growth areas, extending the product’s reach beyond traditional hair-cutting contexts.

Distribution Channel Insights

Online platforms (brand D2C stores, global marketplaces) dominate the cordless clippers distribution mix, enabling broader reach, easier price comparisons, and direct consumer engagement. The professional channel (barber supply houses, salon wholesalers) remains vital for high-end cordless models and trade programs. Offline retail (mass-retail electronics, specialty grooming stores) continues to serve unit-volume sales in emerging markets. The shift toward online and D2C is supporting higher ASPs and service-based models such as subscriptions and accessory bundles.

| By Product Type | By Battery Type | By Price Tier | By Application | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 28 % of the global cordless electric hair clippers market in 2024. The U.S. and Canada lead due to high consumer disposable incomes, strong professional barber and salon networks, and widespread e-commerce adoption. Premium cordless models are especially popular, with both home users and professionals upgrading from corded devices. The region offers high ASP and strong after-sales opportunities, making it a priority for global brands.

Asia-Pacific

Asia-Pacific is the largest regional market for cordless clippers, capturing about 35 % of global revenue in 2024 (~USD 158 million). Key countries include China (manufacturing base and rising domestic demand), India (fastest adoption growth for home grooming), Japan, and South Korea (mature grooming markets). Southeast Asia and Australia are also showing strong momentum. The high unit demand, rising middle-income households, and increasing online retail penetration contribute to the region’s leadership. India is noted as the fastest-growing country in percentage terms due to expanding grooming culture and e-commerce reach.

Europe

Europe holds roughly 18 % of the global cordless market in 2024. Germany, the U.K., France, Italy, and Spain are major markets. Demand is steady, driven by consumers who value brand reputation, premium features, and sustainability credentials. The professional channel remains important, particularly in Western Europe.

Middle East & Africa

The Middle East & Africa account for around 6-8 % of the global cordless market. Although starting from a smaller base, the region is among the fastest-growing in percentage terms due to rising urbanization, luxury spending (Gulf markets), and online retail expansion (especially in South Africa, Nigeria). Premium cordless models are gaining traction among affluent consumers.

Latin America

Latin America represents about 7-9 % of global cordless sales in 2024. Brazil, Mexico, and Argentina are the major markets. The region is characterized by growing grooming interest, but remains price-sensitive. Demand is increasing for mid-tier cordless models, and salon channel adoption is improving.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Cordless Electric Hair Clippers Market

- Wahl Clipper Corporation

- Koninklijke Philips N.V.

- Panasonic Corporation

- Andis Company Inc.

- Conair Corporation

- Spectrum Brands Holdings (Remington)

- Braun GmbH

- Oster (Sunbeam)

- Xiaomi Corporation

- Hatteker

- Syska India

- Havells India

- Brio (Asia)

- Flyco (Asia)

- Nova/Vega (Asia)

Recent Developments

- In Q2 2025, Wahl launched a new brushless-motor cordless clipper series targeted at professional barbers, marketing extended runtime and quiet operation under “barber-grade cordless”.

- In Q4 2024, a regional Asian grooming brand introduced a D2C subscription model in India, bundling cordless clippers with quarterly blade replacements, accelerating accessory revenue and customer retention.

- In Q1 2025, a major consumer-electronics OEM opened a new manufacturing/assembly facility in Southeast Asia dedicated to cordless grooming tools, reducing tariffs and improving lead-time for North American and European exports.