Consumer Electronics Repair & Maintenance Market Size

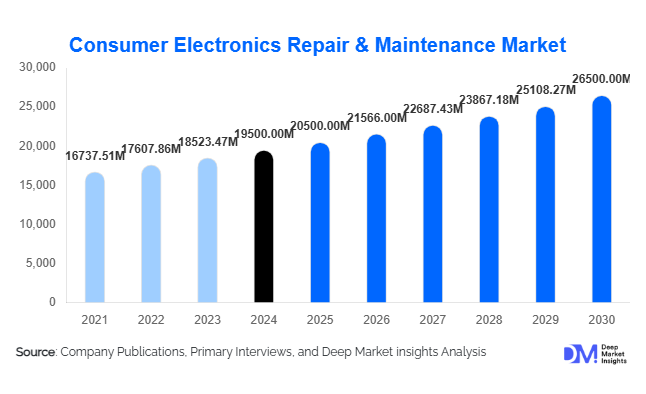

According to Deep Market Insights, the global consumer electronics repair & maintenance market was valued at USD 19,500 million in 2024 and is projected to grow from approximately USD 20,500 million in 2025 to reach USD 26,500 million by 2030, expanding at a CAGR of 5.2% during the forecast period (2025–2030). The market growth is being driven by rising device ownership and complexity, regulatory pushes for repairability, increasing cost of replacement, and growing demand in emerging markets.

Key Market Insights

- Mobile device repairs dominate the value and volume share, particularly smartphones and tablets, due to their ubiquity, frequent damage (screens, batteries), and relatively high replacement costs compared to repair.

- Out-of-warranty repair services constitute the largest service type, as a majority of devices in use are beyond warranty or under limited warranty, pushing consumers toward independent and authorized repair shops for break-fix repairs.

- Asia-Pacific leads regional demand, contributing over one-third (36-38%) of total global market share in 2024, driven by huge device penetration, large population base, rising incomes, and expanding repair infrastructure in nations like China, India, and Southeast Asia.

- Regulatory and environmental pressures are reshaping market behavior, with right-to-repair laws, product repairability mandates, and extended producer responsibility (EPR) requirements gaining traction in Europe, parts of North America, and APAC.

- Technological integration is improving efficiency and service offerings, including predictive diagnostics, AR-guided repairs, remote troubleshooting, modular design, and online/mail-in/on-site service channels, enabling service providers to lower turnaround time and improve customer convenience.

What are the latest trends in the consumer electronics repair & maintenance market?

Shift toward Proactive & Predictive Maintenance

Instead of purely reactive break-fix models, more repair service providers and OEMs are incorporating predictive diagnostics using IoT sensors and remote monitoring. Devices increasingly come with health-monitoring features (battery health, temperature sensors) that allow early detection of faults. Predictive maintenance helps reduce downtime, extend device lifespan, and improve customer satisfaction. In enterprise or business device fleets, preventive service plans are being sold alongside warranties, encouraging regular maintenance rather than waiting for failure.

Modular Design and Repairability by Design

Manufacturers are under pressure (from consumers and regulators) to design products that are easier to repair: modular components, easier access to spare parts, standardization of components, use of screws instead of adhesives, and clear repair documentation. Such shifts reduce repair time and cost, support independent repair shops, and can improve sustainability credentials. Companies offering self-repair kits or parts directly to consumers are growing in number.

Expansion of Service Channels & Delivery Models

New and hybrid service delivery modelsmail-in repair, at-home / on-site technician dispatch, online bookings, and mobile repair trucksare gaining ground. These models reduce inconvenience for consumers, especially in geographic areas with fewer authorized service centers. Also, refurbishment/reconditioning services (reselling repaired devices) are growing, driven by circular economy trends and consumer interest in lower-cost options.

What are the key drivers in the consumer electronics repair & maintenance market?

Rising Device Penetration and Increasing Device Complexity

More households globally own multiple consumer electronic devicessmartphones, tablets, smart TVs, wearables, smart home gadgets, etc. As these devices accumulate in volume, usage frequency rises, so does wear and tear, component or software failures. Complexity (more sensors, more components, interconnectedness) increases the risk of partial failures needing maintenance or repair, which supports market growth.

Regulatory Pushes and Environmental Awareness

Governments in several regions are enforcing or planning regulations around right-to-repair, repairability labeling, extended producer responsibility, and e-waste management. Consumers themselves are growing more aware of their environmental footprint; repairing instead of replacing helps reduce e-waste. These factors encourage manufacturers to provide spare parts, service manuals, and support to independent repairers, expanding the repair ecosystem.

Cost Pressures & Replacement vs Repair Trade-Offs

Inflation, rising cost of new devices (due to component shortages, tariffs, shipping), make replacements more expensive. Many consumers find repairing to be more cost-effective than buying new, especially for high-end devices. Also,o supply chain delays make waiting for new device availability less attractive. Repair often offers faster turnaround and lower sunk cost, further motivating consumers to choose repair over replacement.

What are the restraints for the global market?

Scarcity of Genuine Spare Parts & Proprietary Constraints

Many manufacturers keep spare parts, repair tools, firmware, and diagnostic information proprietary, making it difficult for independent service providers to deliver high-quality repairs. Products designed with glued or sealed components, or with limited modularity, increase repair difficulty and cost. In many regions, obtaining genuine parts involves high import duties or long lead times, adding to cost and reducing service availability.

Consumer Perception, Costs & Replacement Incentives

Consumers sometimes distrust independent repair shops, worrying about part quality, warranty loss, or inferior workmanship. When repair costs approach a significant fraction of the replacement price (especially for low-cost devices), they often prefer to replace. Also, marketing and incentives (e.g., trade-in offers, bundled replacement deals) by OEMs sometimes favor replacement over repair. Time taken for repair and inconvenience also deters consumers.

What are the key opportunities in the consumer electronics repair & maintenance industry?

Leveraging Regulatory Momentum & Right-to-Repair Legislation

The increasing adoption of right-to-repair laws in Europe, parts of North America, and other jurisdictions creates legal requirements for manufacturers to support repairs: supplying parts, manuals, diagnostic tools, etc. Repair service providers and OEMs who proactively comply or lead in making products repairable will gain market trust and regulatory advantage. New entrants can also design repair-friendly product lines to differentiate.

Technology-Enabled Services & Remote Repair Models

Integrating AR/VR for guided repair, AI-based diagnostics, remote firmware/ software troubleshooting, and predictive maintenance via IoT is opening new service models. Companies offering remote support, subscription maintenance, or using mobile repair vans can scale into underserved geographies. These technological innovations can reduce service costs, speed up repairs, and increase customer satisfaction.

Growth in Emerging Markets & Circular Economy / Refurbishment Segments

Emerging economies in Asia-Pacific, Latin America, the Middle East & Africa offer large untapped demandboth in volume and valuefor repair & maintenance, especially for out-of-warranty devices. Also, refurbishment/reconditioning businesses are growing: repaired devices re-entering the market at a lower cost appeal to cost-sensitive consumers and help environmental goals. Exporting refurbished electronics, cross-border repair hubs, and spare part logistics in these regions are promising opportunities.

Device Type Insights

Mobile devicesincluding smartphones, tablets, and wearablesdominate both volume and value in the consumer electronics repair & maintenance market. Their frequent usage, high fragility (screens, batteries), and the strong consumer preference to extend device life make them the leading device type segment. Laptops, premium home entertainment systems, and smart appliances, though fewer in number, contribute disproportionately to revenue due to higher repair complexity, specialized skills required, and expensive replacement parts. Cameras and other imaging devices form a niche but growing segment, driven by demand for advanced repairs such as sensor, lens, and board-level replacements. Trends toward modular design, standardized components, and advanced repair tools are helping reduce repair time and cost across all device types. Segment Driver: For mobile and personal devices, frequent daily usage and data sensitivity are key factors driving high repair demand, as users prioritize quick service and secure data recovery.

Service Type Insights

Out-of-warranty and corrective repairs represent the bulk of service-type demand. Break-fix services, including screen, battery, and connector replacements, are highly frequent, while preventive and scheduled maintenance is gradually gaining traction, particularly for enterprise, government, and educational device fleets. Software and firmware updates, diagnostics, and calibration services are increasingly bundled with hardware repairs, adding value and encouraging repeat engagement. Authorized service centers typically lead in warranty repairs and access to genuine OEM parts, while independent repair shops excel in cost-effective, rapid solutions for basic hardware and software faults. Segment Driver: The growth in out-of-warranty repairs is fueled by consumers’ preference to avoid replacement costs, particularly for high-end laptops, TVs, and smart appliances.

End-User Insights

Residential consumers account for approximately 70–75% of market demand in 2024, driven by personal electronics usage. SMEs are growing rapidly, especially in computing, business communication hardware, and AV equipment, as downtime is costly and repairs are economically attractive. Educational institutions and public sector organizations are increasing spending on device maintenance to support classrooms, labs, and service operations. Emerging end-uses, including IoT ecosystems, wearable health devices, and smart home applications, are driving demand for both hardware repairs and software maintenance. Segment Driver: For enterprises and government clients, minimizing operational downtime and protecting critical data are major motivators for repair and maintenance services.

| By Device Type | By Service Type | By End-User | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific accounts for approximately 36–38% of the global market in 2024. China leads in both device manufacturing and repair infrastructure, followed by India, Japan, South Korea, and Southeast Asia. Regulatory support promoting repairability, growing middle-class populations, and high urbanization rates are driving demand. In China and India, the expanding urban population is adopting multiple consumer electronics, increasing the need for authorized and independent repair services. Southeast Asia is witnessing growth through online repair platforms, mail-in services, and mobile/on-site repairs. Regional Drivers: Rapid urbanization, increased device penetration in urban centers, and growing disposable incomes among middle-class consumers are the primary growth factors.

North America

North America represents around 25–30% of the global market in 2024, with the U.S. being dominant and Canada contributing steadily. High per-capita device ownership, sophisticated authorized service networks, and a mature independent repair ecosystem support steady growth. Consumers increasingly demand faster turnaround times and high-quality service, particularly for premium devices. Remote and rural populations are driving the expansion of on-site and field repair services. Regional Drivers: High disposable income, coupled with government initiatives promoting repair over replacement, encourages consumers to invest in repair services rather than replacing expensive electronics.

Europe

Europe holds 20–25% of the global market share in 2024, with Germany, the U.K., France, and Italy as major contributors. Strict EU regulations on repairability, environmental laws, and extended producer responsibility foster market growth. Consumers show a strong preference for high-quality, genuine part repairs to extend product life. Eastern and Southern European countries are experiencing faster growth due to increasing device penetration and rising disposable incomes. Regional Drivers: Sustainability initiatives emphasizing e-waste reduction and circular economy adoption, along with high consumer awareness of environmental impact, drive repair demand.

Latin America

Latin America accounts for approximately 5–8% of the global market. Brazil and Mexico are the largest contributors, with price-sensitive consumers often favoring replacement for lower-cost devices. However, demand is improving due to higher smartphone penetration, increased affordability of electronics, and expanding access to online repair and parts supply chains. Chile, Colombia, and Argentina are projected to see faster growth as middle-class populations rise and online service adoption increases. Regional Drivers: Increasing smartphone adoption, expansion of online repair platforms, and growing awareness of affordable refurbishment options are boosting market growth.

Middle East & Africa

The Middle East & Africa region contributes roughly 5–7% of the global market share in 2024. UAE, Saudi Arabia, and South Africa lead demand for high-end appliances and consumer electronics, while sub-Saharan Africa is expanding from a smaller base. Challenges include limited repair infrastructure, logistics for spare parts, and trust in service quality. Growth potential is strong due to increasing urbanization, higher connectivity, and rising disposable incomes. Regional Drivers: Urbanization, improved connectivity, and rising income levels in major urban centers are driving adoption of repair and maintenance services across the region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Consumer Electronics Repair & Maintenance Market

- Apple Inc.

- Samsung Electronics

- Huawei Technologies

- Dell Technologies

- Xiaomi Corporation

- Asurion, LLC

- B2X Care Solutions

- Electronix Services

- Best Buy, Inc.

- iFixit

- uBreakiFix

- Redington Ltd.

- Geek Squad

- CDR (appliance repair specialists in key regions)

- EnviroServe / Other large refurbishment & servicing firms

Recent Developments

- In mid-2025, several major OEMs began releasing repairability scores/indices for their new device models, in advance of stricter regulations in Europe, enabling consumers to compare repair-friendly devices.

- Late 2024 to early 2025, independent repair shops in Asia-Pacific expanded into mail-in and on-site repair models to serve smaller cities, reducing turnaround time significantly.

- In early 2025, refurbished electronics markets grew sharply in Latin America and Southeast Asia, with major platforms increasing trade in repaired devices and offering service warranties for refurbished items.

- Also in 2025, several service providers began integrating augmented reality (AR)-based diagnostic tools and remote support to assist with software & firmware repairs, especially for wearables and IoT devices.