Commercial Router Market Size

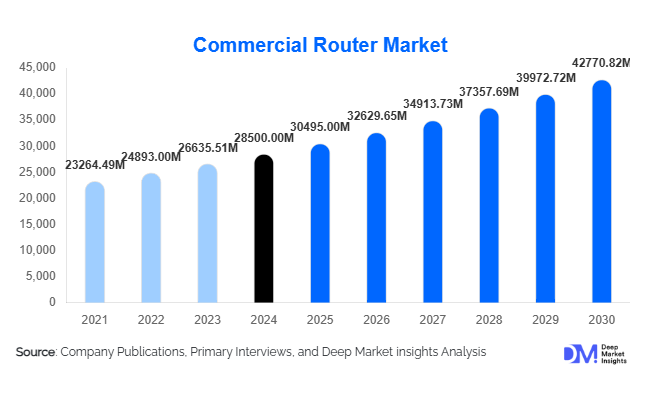

According to Deep Market Insights, the global commercial router market size was valued at USD 28,500 million in 2024 and is projected to grow from USD 30,495.0 million in 2025 to reach USD 42,770.82 million by 2030, expanding at a CAGR of 7.0% during the forecast period (2025–2030). The commercial router market growth is primarily driven by the increasing adoption of SD-WAN and cloud-managed networking, rising demand for high-capacity enterprise and service provider edge/backbone routers, and the expansion of industrial and private 5G networks across global enterprises.

Key Market Insights

- SD-WAN and cloud-managed routers are rapidly gaining adoption, enabling enterprises to optimize multi-cloud connectivity, simplify branch deployments, and reduce network operational complexity.

- Service providers and telecom operators dominate high-capacity router demand, driven by 5G transport, backbone upgrades, and edge computing requirements.

- North America leads globally in absolute market value, supported by high cloud adoption, enterprise branch upgrades, and carrier network modernization.

- Asia-Pacific is the fastest-growing region, driven by expanding broadband programs, industrial digitalization, and private 5G network deployments, particularly in India and China.

- Industrial and utility networks are emerging as critical growth segments, requiring ruggedized, secure routers for OT/IT convergence and critical infrastructure protection.

- Technological integration, including AI-enabled routing, virtualized and cloud-native routers, and secure SD-WAN orchestration, is reshaping customer adoption patterns and increasing average selling prices.

Latest Market Trends

SD-WAN and Cloud-Managed Routing Driving Network Transformation

Enterprises and SMBs are rapidly adopting SD-WAN and cloud-managed routers to enhance network flexibility, simplify branch deployment, and optimize traffic routing to multi-cloud environments. Zero-touch provisioning, application-aware routing, and centralized cloud control are increasingly standard features. Vendors offering integrated security, analytics, and automated network optimization are capturing higher margins, while recurring subscription services improve vendor revenue predictability. Adoption is particularly strong among financial services, technology enterprises, and multi-location retail chains seeking cost-effective, secure WAN upgrades.

Industrial IoT and Private 5G Networks

Industrial and manufacturing sectors are modernizing operations with private 5G and IIoT deployments, requiring ruggedized routers capable of low-latency connectivity and secure edge data management. Industrial routers with integrated security, remote management, and support for OT/IT protocols are in demand. These deployments are supported by government initiatives for smart cities, critical infrastructure modernization, and national broadband expansion. Vendors providing solutions for private 5G transport and edge compute orchestration are capturing high-value contracts and long lifecycle revenue.

Commercial Router Market Drivers

Growing Multi-Cloud and Enterprise Connectivity Needs

Enterprises are increasingly adopting multi-cloud architectures, AI/ML workloads, and remote operations. This drives demand for high-performance routers to ensure low-latency, secure connectivity between branches, data centers, and cloud platforms. Devices with cloud integration, analytics, and automated traffic management are highly preferred, resulting in increased hardware sales and software attach rates.

Service Provider Backbone Upgrades

Telecom operators are upgrading aggregation and core networks to support 5G transport, network slicing, and high-bandwidth services. Edge and backbone routers with high-capacity interfaces, segment routing, and enhanced security features are required. This replacement cycle fuels demand for high-margin routers in the commercial segment.

Rise of SD-WAN and Managed Networking Services

Security convergence, branch simplification, and remote management requirements are increasing the adoption of SD-WAN appliances. Cloud-based orchestration and subscription services provide recurring revenue streams for vendors. Enterprises are willing to pay premiums for devices that combine routing, security, and analytics in a single platform.

Market Restraints

Price Pressure on Branch and SMB Routers

Lower-end commercial routers are increasingly commoditized, leading to price erosion and margin compression. White-box hardware options and competitive offerings from low-cost vendors exacerbate this trend, forcing manufacturers to differentiate via software, cloud services, and integrated features.

Supply Chain and Component Volatility

High-performance ASICs, optical modules, and semiconductor supply fluctuations can delay production and increase costs. These factors affect delivery timelines for enterprise and service provider projects, potentially slowing market growth.

Commercial Router Market Opportunities

Expansion of Cloud-Native and Virtualized Routing Solutions

Virtual routers and cloud-native routing functions are enabling enterprises and service providers to deploy flexible, scalable, and software-driven networks. Vendors offering subscription-based virtualized routers and integrated management platforms can capture recurring revenue while addressing emerging network transformation projects.

Industrial and Private 5G Network Deployments

Industrial sectors, utilities, and manufacturing are investing in private 5G and ruggedized networking solutions. Opportunities exist for routers supporting OT/IT convergence, real-time analytics, and secure edge compute, as industrial automation and smart factory adoption grow globally.

SD-WAN and Security Convergence

The convergence of SD-WAN with integrated security (SASE) provides high-margin opportunities for vendors. Enterprises are increasingly seeking unified networking and security stacks for branch and campus networks. Vendors that can provide seamless deployment, multi-cloud integration, and analytics-driven optimization will benefit from strong market adoption.

Product Type Insights

Edge and aggregation routers dominate the commercial router market, accounting for the largest share of spending due to their role in enterprise branch connectivity and service provider aggregation. Core/backbone routers, while high-margin, represent a smaller unit volume but continue to drive SP investment. Branch and access routers remain critical for SMB and enterprise deployments, especially when combined with SD-WAN and cloud-managed features. Industrial routers are a high-growth niche, benefiting from ruggedized and secure hardware adoption in manufacturing and critical infrastructure.

Application Insights

Enterprise branch connectivity and service provider edge/backbone networking remain the most significant applications. Industrial automation and private 5G networks are rapidly growing applications, particularly for OT/IT convergence, low-latency edge compute, and secure communications. Multi-cloud WAN optimization and SD-WAN deployment are increasingly popular, enabling enterprises to consolidate routing, security, and management into a unified solution.

Distribution Channel Insights

Direct sales dominate large enterprise and service provider purchases, particularly for high-value edge and backbone routers. Channel partners and system integrators are significant for SMB and branch network deployments. Online and subscription-based models for cloud-managed routers are emerging, enabling vendors to increase recurring revenue. Vendors increasingly leverage managed services and professional services as a key distribution channel for integration, deployment, and lifecycle management.

End-User Insights

Telecommunications and service providers account for the largest share of commercial router demand, particularly in edge and core upgrades for 5G and high-bandwidth transport. Large enterprises in finance, technology, and retail drive demand for multi-cloud connectivity and branch SD-WAN solutions. Industrial and utility networks are the fastest-growing end-use segment, investing in private 5G and OT/IT integrated routers. SMBs contribute significant volume growth through branch and campus deployments.

Age Group Insights

While not directly applicable to hardware, technology adoption patterns show that enterprises with younger IT leadership teams (age 30–50) are more likely to adopt SD-WAN, cloud-managed routers, and virtualized routing solutions, accelerating growth in advanced routing segments.

| By Product Type | By Technology Capability | By Deployment Model | By Bandwidth / Performance | By End-User Vertical |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America remains the largest market, with the U.S. and Canada leading in commercial router spending. High enterprise cloud adoption, multi-branch network modernization, and extensive 5G deployment drive strong demand. North America accounted for approximately 34% of global market share in 2024, representing USD 5,780 million in revenue.

Europe

Europe’s market is steady, with Germany, the U.K., and France leading demand. Cloud adoption, enterprise branch modernization, and regulatory compliance drive router purchases. Europe represents roughly 20% of the global market in 2024, with USD 3,400 million. Growth is fueled by sustainable and secure network solutions.

Asia-Pacific

Asia-Pacific is the fastest-growing region, led by China and India. Rapid industrial digitalization, broadband expansion, and private 5G deployments create high router demand. APAC accounted for 30% of global revenue (USD 5,100 million), with India being the fastest-growing national market.

Middle East & Africa

GCC countries, Israel, and South Africa are increasing investment in 5G transport and industrial networks. MEA contributes 8% of global market revenue (USD 1,360 million) and is growing steadily with national infrastructure projects.

Latin America

Brazil and Mexico lead regional demand, driven by carrier network upgrades and enterprise modernization. LATAM accounts for 8% of global market revenue (USD 1,360 million), with moderate growth influenced by macroeconomic conditions.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Commercial Router Market

- Cisco Systems

- Huawei Technologies

- Juniper Networks

- Nokia

- Hewlett-Packard Enterprise (HPE)

- Arista Networks

- ZTE

- Dell Technologies

- Fortinet

- Extreme Networks

- MikroTik

- Ciena

- Fujitsu

- Ribbon Communications

- ADVA

Recent Developments

- In May 2025, Cisco Systems expanded its cloud-managed routing portfolio with integrated SD-WAN and security features targeting enterprise and SMB markets.

- In April 2025, Huawei launched high-capacity backbone routers supporting 5G transport and edge computing for APAC and MEA service providers.

- In February 2025, Juniper Networks introduced AI-enabled routing platforms for intelligent traffic optimization and predictive network maintenance.