Color Negative Films Market Size

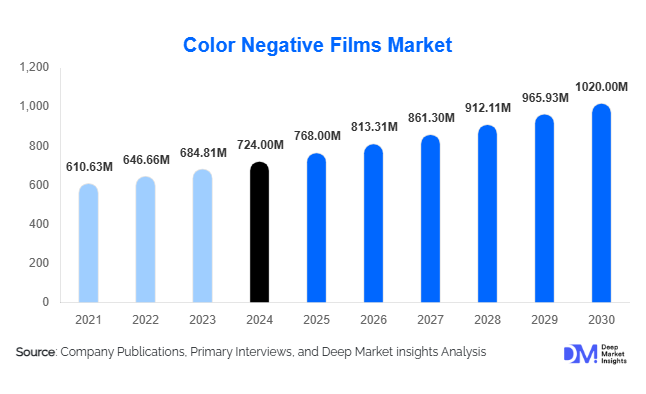

According to Deep Market Insights, the global color negative films market size was valued at USD 724 million in 2024 and is projected to grow from USD 768 million in 2025 to reach USD 1,020 million by 2030, expanding at a CAGR is 5.9% during the forecast period (2025–2030). The market growth is primarily driven by the resurgence of analogue photography among hobbyists and professionals, increased demand for premium and limited-edition film stocks, and the expansion of value-added services such as processing, scanning, and hybrid workflows incorporating digital integration.

Key Market Insights

- 35 mm consumer rolls dominate the product format landscape, capturing over half of the global market value, due to broad access, compatibility, and repeat purchases by hobbyists and entrants into analog photography.

- Mid-to-high ISO (200-400) stocks lead in sensitivity segments as they provide versatility for general photography without compromising too much on grain or exposure latitude.

- E-commerce and direct-to-consumer channels are increasingly important distribution routes, enabling niche and boutique film producers to reach global audiences without the constraints of traditional retail shelf space.

- Processing & scanning services form a major value-added stream, contributing significantly to overall market value beyond mere film roll and pack sales.

- The Asia-Pacific region is emerging as the fastest-growing geographic market, driven by rising creative culture in countries such as South Korea, China, Japan, and increasing interest among younger, urban consumers.

- Premiumization and limited-edition film stocks are reshaping pricing, pushing average selling prices higher, especially for enthusiasts and professionals seeking specialty emulsions and unique color renditions.

What are the latest trends in the color negative films market?

Limited-Edition & Specialty Emulsion Releases

Manufacturers are increasingly launching specialty film stocks or limited-edition emulsions with distinctive color profiles, grain structure, or heritage appeal. These releases are often tied to creative campaigns, collaborations with artists or influencers, or retro branding, and help differentiate products in a crowded market. Even though these specialty lines represent smaller unit volumes, their higher prices and strong margins make them very attractive to both manufacturers and collectors. Such offerings also build brand loyalty and social media visibility.

Hybrid Analog-Digital Workflow Integration

One of the strongest recent trends is the merging of analog film with digital services. Film roll purchases increasingly come with bundled scanning, color correction, cloud-based delivery of images, or even mobile apps that allow users to preview analog-style edits. Processing labs are upgrading their scanning/digitization technologies, providing higher resolution, better color profiles, and more convenient mail-in services. The friction of analog adoption is reduced when these digital supports are present, expanding the addressable customer base.

What are the key drivers in the color negative films market?

Analog Revival & Increased Hobbyist Engagement

The resurgence of interest in analog photography among hobbyists, content creators, and artists is a fundamental driver. Analog film is now appreciated not just for nostalgia, but for its aesthetic qualities, color rendering, grain, and imperfect “organic” look that many digital filters attempt to imitate. Communities, social media, and the proliferation of analog-photography influencers and tutorials contribute to repeat film roll purchases, especially of 35 mm format and premium stocks.

Premiumization & Differentiation

Because unit growth is constrained, manufacturers are turning to premiumization as a key growth lever. This includes higher-quality emulsions (lower grain, special color rendition), limited edition runs, signature packaging, artist collaborations, and higher-quality finishing. These differentiated offerings allow brands to command higher ASPs (average selling prices) and margins, even if unit sales grow more slowly. This helps offset cost pressures from raw materials and small-batch production.

Growth of Value-Added Services & E-Commerce

Services such as professional C-41 processing, high-quality scanning, color correction, and print-oriented products are expanding. The rise of online labs, mail-in and subscription-style film + scan bundles, and better e-commerce infrastructure (global shipping, specialty retailers online) enable broader access, especially in regions where local lab infrastructure is weak. These services not only add revenue streams but also reduce buyer friction, enhancing adoption.

What are the restraints for the global market?

Limited Processing Infrastructure & Chemical Supply Constraints

One of the biggest impediments to growth is the uneven availability of quality processing labs, especially in emerging regions. Some labs have closed in the past decades, leaving coverage gaps such that users must rely on distant labs, increasing cost, shipping time, and risk of damage. Additionally, the chemicals and processes required (C-41, etc.) have regulatory, environmental, or handling safety constraints, making expansion costly. Disruptions in chemical supply chains or regulatory tightening over chemical handling could raise costs or delay production.

Cost Sensitivity & Volume Limitations

Despite increasing interest, film remains more expensive per image than many digital alternatives. Many consumers are price sensitive. Also, manufacturing film emulsions, coating, quality control, packaging, and shipping are capital and labor-intensive. Because mass-market volume is limited (film isn't mainstream for the majority of photographers), low volume increases cost per roll, constraining affordability. These factors could restrain growth, particularly for value/entry tier offerings.

What are the key opportunities in the color negative films industry?

Expansion in Emerging APAC Markets

Asia-Pacific markets like South Korea, China, India, and some Southeast Asian urban centers are seeing rising creative class incomes, strong interest in analog arts, film photography clubs, film cafes, and cultural festivals. This creates an opportunity for both premium and mainstream film roll sales, as well as associated services (processing, scanning). Local labs or regional distribution hubs can help lower delivery and service costs, enhancing growth.

Bundled Service Packages & Subscription Models

Providers can offer film + processing + scanning + digital deliverables as packaged offerings, or subscription models (e.g., month-by-month film + scan) targeting repeat buyers. This increases customer lifetime value and smooths cash flows. It also reduces friction around processing logistics, which is often a barrier for new or geographically remote buyers.

Sustainability & Eco-Friendly Packaging / Processes

Consumers are increasingly sensitive to environmental impact. There is room for film brands and labs to promote green chemistry, reduce or recycle chemical waste, use eco-friendly packaging, and offer take-back or recycling programs. Brands with credible sustainability credentials may win institutional contracts (educational, arts institutions) and loyalty among eco-conscious customers.

Product Type Insights

Within product types, 35 mm / 135 color negative rolls dominate the market, due to their compatibility with many cameras and their popularity among hobbyists and studio photographers. Premium stocks with special emulsions and limited edition color profiles are increasingly important in the premium and enthusiast tiers. Medium-format (120/220) negative films are growing in popularity among landscape, fine art, and fashion photographers seeking larger formats and finer tonal rendition.

Application Insights

The primary application driving volume is consumer/hobbyist photography, which also contributes most to recurring revenue via repeat purchases. Professional still photography (editorial, fashion, advertising) remains influential, especially for premium film stocks. Educational and institutional use is growing as schools/film programs integrate analog into curricula. Archival and heritage film restoration work also requires dependable color negative film stocks.

Distribution Channel Insights

E-commerce and direct brand stores are increasingly key channels, allowing niche film and boutique brands to reach global customers. Brick-and-mortar specialty stores still play discovery and local community roles. Wholesale lab supply distributors serve pro studios and labs. Online mail-in labs enhance reach where local processing is unavailable. The visibility and prestige of exclusive or limited-edition lines are often higher when sold via specialty online retailers or direct channels.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America is the largest single regional market, accounting for about 33% of global market value in 2024 (≈ USD 239M). The U.S. dominates, driven by a large base of hobbyists, a strong culture of collectible analog photography, many independent labs, and robust specialty retail. Canada contributes more modestly but benefits from proximity and a similar culture. Growth is stable, especially in premium stocks, boutique releases, and service-bundled offerings.

Europe

Europe holds approximately 28% of the global market in 2024 (≈ USD 203M). Germany, the UK, and France are leaders, both in consumption and boutique manufacture/import. Demand is supported by strong photo communities, film festivals, archival & heritage projects, and a high willingness to pay for premium emulsions and specialized processing.

Asia-Pacific

Asia-Pacific is the fastest-growing region in terms of percentage growth. In 2024, it accounted for about 25% (≈ USD 181M) of global value. Key markets like Japan (a mature market & production hub), South Korea, China, India, and Australia are showing strong increases in film photography culture, analogue interest, film cafes, and social media-driven demand. Infrastructure gaps (processing labs) exist in many places, so growth is helped where local labs or regional service providers step in.

Middle East & Africa

This region comprises about 6% of the global market value in 2024 (≈ USD 43M). Demand is niche and concentrated in creative centers (e.g., South Africa, some GCC countries). Growth is more modest, constrained by higher import/pricing costs and limited local processing infrastructure, but rising cultural/tourism & creative industry initiatives may help incremental expansion.

Latin America

Latin America holds roughly 8% of the global market value in 2024 (≈ USD 58M). Key countries include Brazil, Mexico, and Argentina. Demand is growing through hobbyist circles, online importation, and creative communities, though price sensitivity remains a concern, and gaps exist in local lab support and supply chain logistics.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Color Negative Films Market

- Fujifilm Holdings Corporation

- Eastman Kodak Company

- Agfa-Gevaert N.V.

- Cinestill, Inc.

- Lomography GmbH

- Film Ferrania SpA

- ORWO (Revived ORWO operations)

- Ilford Photo (Harman Technology Ltd)

- Rollei (brand operators)

- Adox GmbH

Recent Developments

- In early 2025, Fujifilm reinstated a premium low-grain color negative stock line, emphasizing heritage formulation and enhanced ISO 400 performance, responding to demand for finer grain and richer color fidelity among enthusiasts.

- In mid-2025, several boutique producers launched limited-edition emulsions with signature color profiles or packaging, often tied to artist collaborations or festival drops, pushing up the premium segment’s visibility and ASPs.

- Also in 2025, online labs and scanning services expanded their mail-in and subscription bundles, including film + processing + high-resolution scan + color correction workflows, lowering the total cost of ownership (time, shipping, effort) for remote or international buyers.