Cleats Market Size

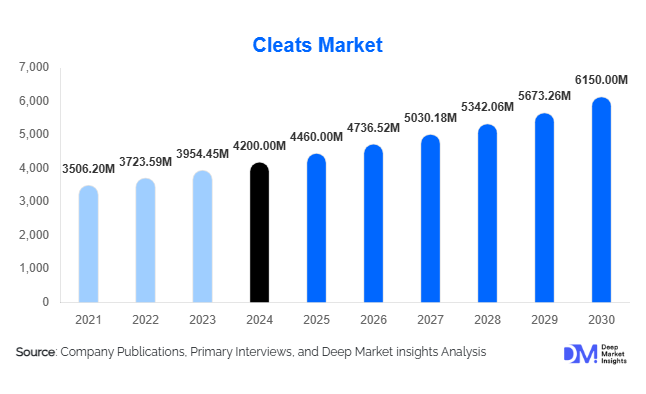

According to Deep Market Insights, the global cleats market size was valued at USD 4,200 million in 2024 and is projected to grow from USD 4,460 million in 2025 to reach USD 6,150 million by 2030, expanding at a CAGR of 6.2% during the forecast period (2025–2030). The cleats market growth is primarily driven by increasing participation in organized sports, rising adoption of performance-enhancing footwear, and expanding investments in sports infrastructure across professional, amateur, and recreational segments.

Key Market Insights

- Football and soccer cleats dominate the market globally, driven by high viewership, professional leagues, and growing youth participation in sports programs across North America, Europe, and Asia-Pacific.

- Technological innovation in cleats, including lightweight materials, ergonomic designs, and smart performance tracking, is enhancing player efficiency and safety, boosting adoption across professional and amateur athletes.

- North America holds the largest market share, with the U.S. and Canada leading demand for football, soccer, and baseball cleats, fueled by professional leagues and recreational sports participation.

- Asia-Pacific is the fastest-growing region, driven by increasing youth sports programs, rising disposable incomes, and urbanization in India, China, and Japan.

- Europe maintains a strong market presence, with football and rugby being key drivers and sustainability-focused cleats gaining traction.

- E-commerce and direct-to-consumer channels, coupled with digital marketing, are reshaping sales, improving accessibility of premium and performance cleats globally.

What are the latest trends in the cleats market?

Technologically Enhanced Cleats

Manufacturers are increasingly integrating sensors, smart insoles, and IoT-enabled features into cleats to provide real-time performance data such as speed, traction, and foot pressure. Such advancements appeal to professional athletes and performance-focused amateur players seeking competitive advantages. Ergonomic designs, lightweight synthetic materials, and customizable stud patterns are also becoming mainstream, improving safety and efficiency across different playing surfaces. Additionally, AR-based virtual try-on solutions allow consumers to select cleats digitally, enhancing the e-commerce experience.

Sustainable and Eco-Friendly Materials

The shift toward environmentally conscious sportswear is encouraging manufacturers to produce cleats using recycled plastics, biodegradable synthetics, and low-carbon-footprint materials. Sustainability certifications and green production practices are increasingly influencing purchase decisions, particularly in Europe and North America. This trend also allows brands to differentiate themselves in premium segments and align with global ESG initiatives.

What are the key drivers in the cleats market?

Rising Popularity of Organized Sports

The global expansion of professional leagues in football, soccer, baseball, and rugby has significantly increased cleat adoption. Youth programs and amateur leagues are expanding rapidly, particularly in emerging markets such as India and Brazil. Government initiatives promoting physical activity and sports infrastructure investments further support demand.

Innovation in Product Design

Cleats now incorporate advanced materials, ergonomics, and performance-enhancing features, providing superior traction, comfort, and injury prevention. Brands focusing on research and development have seen higher adoption rates among both professional and recreational players. Customized designs for different playing surfaces, including grass, turf, and indoor courts, are a key trend driving market growth.

Growth of E-Commerce Channels

Online retail platforms are transforming cleats distribution, enabling consumers to access multiple brands, compare features, and avail of personalized sizing. Digital marketing and influencer campaigns further increase awareness and drive purchases, particularly among younger demographics and urban populations.

What are the restraints for the global market?

High Production Costs

Advanced materials, technological integration, and research-driven designs increase manufacturing expenses. High production costs can limit affordability in price-sensitive markets, particularly in emerging economies.

Proliferation of Counterfeit Products

The availability of low-quality or fake cleats in certain markets undermines brand trust, impacts sales, and poses safety risks to consumers. Counterfeit products particularly affect emerging markets where regulatory enforcement is weaker.

What are the key opportunities in the cleats market?

Expansion into Emerging Sports Markets

Emerging economies, including India, Brazil, and Southeast Asia, are witnessing a surge in youth sports participation and recreational leagues. New entrants can tap into these regions with affordable, locally tailored cleats, supported by growing government investment in sports infrastructure and school-based programs.

Integration of Smart and Performance-Enhancing Technology

Advanced cleats equipped with sensors, IoT devices, and performance-tracking systems offer athletes data-driven insights to optimize performance. Brands integrating technology gain a competitive edge, appealing to professional teams, elite players, and fitness-conscious consumers.

Sustainable and Eco-Friendly Footwear

Brands producing cleats from recycled, biodegradable, or low-carbon materials can differentiate in the premium segment and attract environmentally conscious consumers. Sustainability initiatives are increasingly incentivized by regulations in Europe and North America, creating both compliance and marketing advantages.

Product Type Insights

Football cleats dominate the market globally, contributing to approximately 32% of 2024 revenue due to high professional and recreational demand across North America, Europe, and Asia-Pacific. Soccer cleats follow closely, particularly in Europe and South America. Baseball cleats are significant in North America, while golf and rugby cleats cater to niche markets. Demand trends show increased investment in professional-grade cleats for both athletes and organized leagues, driving technological and material innovations.

Application Insights

Professional athletes represent the highest-demand segment, contributing around 38% of the global market. Amateur players and youth sports programs are expanding rapidly in emerging markets, supported by school initiatives and recreational leagues. Recreational users, especially in North America and Europe, are increasingly purchasing cleats as part of fitness and athleisure trends. Export-driven demand remains strong, with North America and Europe importing cleats from Asia-Pacific manufacturers.

Distribution Channel Insights

Online retail, including brand e-commerce sites and digital marketplaces, accounts for approximately 28% of global sales, driven by convenience, personalized fitting solutions, and AR-based try-ons. Offline sports stores and specialty retailers remain relevant, particularly in regions with limited digital penetration. Direct-to-consumer sales and subscription-based services are emerging, providing curated offerings and loyalty incentives. Social media and influencer marketing strongly influence purchasing decisions among younger consumers.

| By Product Type | By Material | By End-Use | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 30% of the 2024 market. The U.S. leads demand for football, soccer, and baseball cleats, supported by professional leagues, school sports programs, and recreational fitness trends. Canada is also a key consumer, particularly for soccer and football cleats. Growth is projected at 5–6% CAGR, driven by technological adoption and rising sports participation.

Europe

Europe holds about 28% market share, led by the U.K., Germany, and France. Football cleats dominate, with rugby cleats contributing to niche demand. Sustainability and eco-friendly production influence purchasing decisions. Europe is characterized by high brand loyalty and technological adoption in performance footwear.

Asia-Pacific

Asia-Pacific is the fastest-growing region with an expected CAGR of 7–8%, driven by India, China, and Japan. Youth sports initiatives, rising disposable income, and expanding recreational sports programs are key growth drivers. Online retail penetration is accelerating the adoption of both performance and mid-range cleats.

Latin America

Brazil dominates Latin America due to football’s popularity, followed by Argentina and Mexico. Growth is driven by youth programs and recreational demand. CAGR is projected at 6%.

Middle East & Africa

Africa hosts key emerging markets and local football leagues, with South Africa, Kenya, and Nigeria leading demand. Middle East countries, including the UAE and Saudi Arabia, are increasingly purchasing premium cleats due to high-income populations and recreational sports adoption.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Global Cleats Market

- Nike

- Adidas

- Puma

- Under Armour

- New Balance

- Mizuno

- Asics

- Umbro

- Lotto

- Reebok

- Diadora

- Skechers Performance

- Joma

- Kelme

- Salming

Recent Developments

- In March 2025, Nike launched a new line of lightweight football cleats with IoT-enabled performance sensors, targeting professional athletes in Europe and North America.

- In January 2025, Adidas expanded its eco-friendly cleats line using recycled materials, focusing on sustainable sportswear in Europe and North America.

- In February 2025, Puma introduced AR-based virtual fitting solutions for soccer cleats, enhancing e-commerce sales and personalized consumer experience in the Asia-Pacific region.