Child High-Back Booster Market Overview

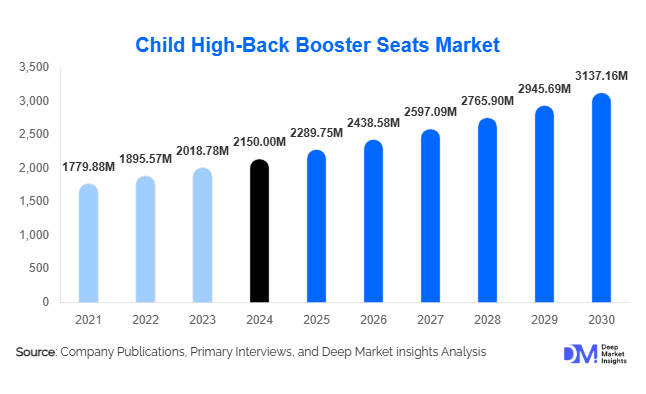

According to Deep Market Insights, the global Child High-Back Booster Seats Market was valued at USD 2,150 million in 2024 and is projected to grow from USD 2,289.75 million in 2025 to reach USD 3,137.16 million by 2030, expanding at a CAGR of 6.5% during the forecast period (2025–2030). The market’s expansion is primarily driven by rising child safety regulations, heightened parental awareness regarding vehicle safety, and growing adoption of premium, feature-enhanced booster seat models across both developed and emerging economies.

Key Market Insights

- Heightened global focus on child passenger safety has made high-back boosters the preferred choice over backless models due to superior side-impact and head protection.

- Premium high-back boosters with ISOFIX/LATCH compatibility and side-impact protection dominate product innovation pipelines in North America and Europe.

- Asia-Pacific is the fastest-growing regional market, fueled by rising vehicle ownership and tightening safety regulations in China and India.

- Online retail channels are witnessing double-digit growth, reshaping consumer access to certified safety products.

- Technological advancements such as smart sensors, installation alerts, and ergonomic materials are redefining comfort and compliance standards.

- The top five manufacturers command around 45% of global revenue share, highlighting moderate market concentration and ongoing innovation rivalry.

What are the latest trends in the Child High-Back Booster Seats Market?

Smart and Connected Booster Seats

Manufacturers are increasingly introducing smart features that improve both safety and user convenience. Sensors that detect improper installation, weight thresholds, or incorrect seatbelt positioning are being integrated into premium booster seat models. Mobile-app connectivity now allows parents to receive alerts or installation tutorials in real-time, improving correct usage rates. This digitalization trend appeals to millennial parents seeking technology-driven safety assurance and aligns with the growing adoption of Internet-of-Things (IoT) ecosystems in automobiles.

Lightweight and Sustainable Material Adoption

Rising environmental awareness has led to growing demand for lightweight, recyclable, and non-toxic materials in high-back booster seat manufacturing. Companies are exploring bio-based foams, energy-absorbing composites, and sustainable fabrics that enhance durability without compromising safety performance. These innovations reduce product weight, improve portability, and lower logistics costsimportant factors for online retail fulfillment. Sustainability-oriented differentiation is expected to drive brand loyalty and premium pricing in high-income markets.

What are the key drivers in the Child High-Back Booster Seats Market?

Stringent Global Safety Regulations

Increasingly strict child passenger safety laws across North America, Europe, and parts of Asia are mandating the use of approved restraint systems up to higher age or weight limits. Compliance with FMVSS 213, ECE R-129 (i-Size), and similar national standards favors the adoption of high-back booster seats that meet side-impact and head-protection requirements. This regulatory enforcement ensures sustained demand growth and continuous upgrades in safety technology.

Rising Parental Awareness and Lifestyle Shifts

Parents worldwide are becoming more conscious of road safety, seeking premium and user-friendly solutions for child protection. Social media safety campaigns and comparative crash-test data have boosted confidence in certified products. The trend toward smaller family sizes also means higher per-child spending on safety products, particularly in urban middle- and upper-income households. This shift significantly benefits mid-range and premium high-back booster seat segments.

Expanding Middle-Class and Vehicle Ownership in Emerging Markets

Rapid motorization in countries such as India, Indonesia, and Brazil is driving first-time purchases of child safety seats. Rising disposable incomes, coupled with the spread of global automotive brands, are introducing safety-aware consumer behavior. Manufacturers leveraging local assembly and affordable product lines are gaining significant traction, positioning emerging economies as the next high-growth frontier for booster seat demand.

What are the restraints for the global market?

High Product Cost and Affordability Constraints

Advanced high-back booster seats are costlier than backless versions, restricting access among lower-income consumers, particularly in developing regions. High testing, certification, and material costs contribute to elevated retail prices. In markets with limited government incentives or subsidies, affordability remains a key restraint, slowing mass adoption despite rising awareness.

Misuse and Lack of Installation Awareness

Incorrect installation and inconsistent seatbelt routing significantly reduce booster seat effectiveness. Surveys show a high rate of misuse even among safety-conscious parents. Limited education on proper installation, combined with variations in vehicle seat design, hinders consumer confidence. Manufacturers are addressing this with clearer labeling, mobile tutorials, and intuitive designs, but awareness gaps persist, particularly in emerging markets.

What are the key opportunities in the Child High-Back Booster Seats Industry?

Localization and Emerging Market Expansion

Untapped demand in Asia-Pacific, Latin America, and the Middle East offers major growth potential. Establishing local manufacturing facilities reduces costs and enables region-specific designs suited to smaller vehicles. Government programs promoting child safety and local content manufacturing as “Make in India” and China’s “Made in China 2025” further strengthen investment incentives for both global and domestic players.

Integration of Advanced Safety and Comfort Technologies

Development of adaptive side-impact systems, adjustable headrests, breathable temperature-control fabrics, and compact folding designs provides differentiation opportunities. The addition of smart sensors and connectivity functions enables premium pricing and enhances trust in product reliability. Technological innovation will likely be the main battleground for brand leadership between 2025 and 2030.

Growth in Ride-Sharing and Commercial Fleet Adoption

As governments tighten safety norms for passenger-carrying services, commercial fleets, taxis, and ride-share operators are adopting standardized child safety restraints. Fleet-ready, easy-to-install high-back boosters represent an emerging business segment, especially in North America and Europe. Manufacturers offering certified multi-use seats and quick-release mechanisms can capitalize on this new demand channel.

Product Type Insights

Belt-positioning high-back booster seats dominate the market, accounting for nearly 63% of global revenue in 2024. Their popularity stems from balanced pricing, ease of installation, and compliance with international standards. Combination boosters (harness-to-booster) occupy the next tier, favored by parents seeking extended use across multiple child growth stages. Integrated OEM boosters remain a niche, limited to premium vehicle trims but showing potential as automotive manufacturers embed more safety options directly into seat structures.

Age Group Insights

Children aged 6–12 years represent the largest consumer group, contributing around 48% of global demand in 2024. This age segment often transitions from forward-facing car seats, making high-back boosters essential for proper seatbelt positioning. The 3–6 year age group also shows consistent growth, primarily in markets where parents prefer extended use of combination seats with detachable harnesses.

Feature Insights

Models equipped with side-impact protection and adjustable headrests lead globally, representing nearly 58% of 2024 revenue. ISOFIX/LATCH compatibility, improved ergonomic padding, and crash-energy-absorbing foam are becoming baseline expectations in mid-to-premium tiers. The integration of lightweight structures and washable covers further boosts consumer appeal, particularly in online marketplaces where product comparison drives purchase decisions.

Distribution Channel Insights

Online retail has emerged as the fastest-growing distribution channel, accounting for about 28% of market value in 2024. Digital marketplaces, brand websites, and social media commerce enable parents to compare certified models and read verified reviews. Offline specialty stores continue to hold a strong base, especially for higher-priced models requiring in-person consultation. Direct-to-consumer (D2C) sales through branded websites are expanding as manufacturers enhance digital logistics and after-sales support.

| By Product Type | By Age Group | By Features | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America remains the leading regional market, holding approximately 38% of the global share in 2024. The United States dominates due to robust regulatory enforcement, high vehicle ownership, and strong consumer trust in certified brands such as Graco and Britax. Growth is steady at around 5% CAGR, supported by rising demand for technologically advanced and eco-friendly models.

Europe

Europe follows closely with about 27% market share, led by Germany, the U.K., and France. The adoption of ECE R-129 (i-Size) standards has accelerated upgrades to new, compliant high-back boosters. Consumers exhibit high brand loyalty and willingness to pay for comfort and safety enhancements. Eastern European countries are emerging as new growth pockets with rising incomes and increasing safety enforcement.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at a 9–10% CAGR. China and India are key growth engines, supported by urbanization, growing vehicle ownership, and government awareness campaigns. Japan and South Korea maintain steady demand for premium, compact designs suited to smaller cars. Regional e-commerce platforms are accelerating cross-border sales of global brands.

Latin America

Latin America contributes about 6% of global revenue, with Brazil, Mexico, and Argentina being the largest markets. Adoption is driven by safety-law harmonization with international standards and increased imports from Asia. Local assembly and distribution partnerships are improving affordability and access in major urban centers.

Middle East & Africa

This region accounts for around 4% of the global market in 2024 but shows promising growth potential. Gulf countries such as Saudi Arabia and the UAE are emphasizing road safety campaigns and premium automotive accessories. South Africa remains the regional leader in production and distribution. Growth is expected to exceed 8% CAGR as infrastructure and consumer education improve.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Child High-Back Booster Seats Market

- Graco Inc.

- Britax Child Safety Inc.

- Chicco (Artsana Group)

- Evenflo Company LLC

- Diono LLC

- Maxi-Cosi (Dorel Juvenile)

- Recaro Holding GmbH

- Peg Perego S.p.A.

- BeSafe (HTS Group)

- Combi Corporation

- Aprica Kassai Inc.

- Goodbaby International Holdings Ltd.

- Joyson Safety Systems

- Kiwi Baby Products Co. Ltd.

- Baby Trend Inc.

Recent Developments

- July 2025 – Britax launched its new “SmartSafe High-Back” series featuring Bluetooth-enabled installation verification and impact-alert sensors for enhanced parental assurance.

- June 2025 – Graco announced expansion of its ISOFIX-compatible product line in India and Southeast Asia, supported by local assembly partnerships under “Make in India.”

- April 2025 – Evenflo introduced eco-friendly booster seats utilizing recycled polymer frames and non-toxic, washable fabrics to meet sustainability goals.

- February 2025 – Maxi-Cosi opened a new R&D center in the Netherlands focused on developing lighter energy-absorbing foam composites for next-generation booster seats.