Cervical Heating Collar Market Overview

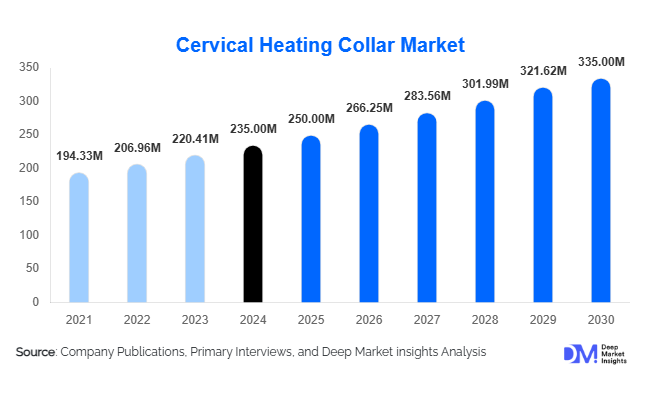

According to Deep Market Insights, the global cervical heating collar market size was valued at USD 235 million in 2024 and is projected to grow from USD 250 million in 2025 to reach USD 335 million by 2030, expanding at a CAGR of 6.5% during the forecast period (20252030). The market growth is primarily driven by rising cases of cervical spondylosis, neck strain from sedentary lifestyles, and the growing preference for non-invasive, drug-free pain management solutions at home and in clinical settings.

Key Market Insights

- The increasing prevalence of neck pain and cervical disorders due to sedentary work habits and digital device usage is driving strong consumer demand for heating collars.

- Electric and battery-operated cervical heating collars dominate the market, offering convenience, adjustable temperature control, and high therapeutic efficiency.

- Smart and connected collars are emerging rapidly, integrating app-based controls, heat sensors, and wearable analytics.

- Home-use applications account for over 50% of total sales, fueled by rising consumer focus on wellness and self-care.

- Asia-Pacific is the fastest-growing regional market, supported by increasing disposable incomes and healthcare awareness.

- Online retail distribution channels continue to expand, offering accessibility and a wide product variety to consumers globally.

What are the latest trends in the cervical heating collar market?

Smart and Connected Heating Collars

Technological innovation is reshaping the cervical heating collar market. Manufacturers are integrating smart sensors, Bluetooth connectivity, and mobile app controls to enhance user experience and treatment effectiveness. These devices allow temperature customization, real-time usage monitoring, and automatic shutoff features to improve safety. Some advanced models also offer heat distribution mapping and wearable analytics to track pain relief progress. This digitalization trend is aligning the market with the broader shift toward connected healthcare and home-based wellness technology, enabling remote physiotherapy and doctor-patient monitoring in the long term.

Adoption of Ergonomic and Sustainable Designs

Consumers increasingly value comfort, adjustability, and eco-friendly materials. Manufacturers are developing lightweight, breathable, and ergonomic collars using memory foam, soft neoprene, and skin-safe fabrics to improve usability during extended wear. Sustainable and recyclable materials are also being introduced to align with global environmental goals. Dual-mode collars offering both heating and cooling functionalities are gaining traction, catering to broader therapeutic use cases such as post-exercise recovery and inflammation control. This trend reflects a convergence of healthcare technology, design innovation, and environmental responsibility.

What are the key drivers in the cervical heating collar market?

Rising Incidence of Cervical and Musculoskeletal Disorders

The growing prevalence of cervical spondylosis, neck stiffness, and posture-related pain across working-age populations is a major growth driver. The World Health Organization estimates that musculoskeletal disorders affect over 1.7 billion people worldwide, many of whom suffer from neck-related complications. Cervical heating collars provide a convenient, affordable, and non-invasive means of managing chronic pain and muscle tension, driving steady product demand across age groups, particularly adults and the elderly.

Shift Toward Non-Invasive and Drug-Free Pain Relief

With concerns surrounding long-term painkiller use and opioid dependency, consumers are increasingly seeking safe, drug-free alternatives. Heating collars, as part of non-pharmacological therapy, have become a preferred choice among both patients and healthcare providers. They offer immediate comfort, improved blood circulation, and reduced muscle stiffness without clinical supervision, making them ideal for home care and outpatient use. This shift in treatment preference is significantly enhancing adoption rates globally.

Growth of E-Commerce and Direct-to-Consumer Distribution

The expansion of online retail and medical e-commerce platforms has democratized access to therapeutic devices. Consumers can now easily purchase cervical heating collars through major online marketplaces, allowing price comparison, reviews, and doorstep delivery. This has particularly benefited emerging economies where physical medical supply chains are limited. Online channels currently account for roughly 3545% of total global sales and continue to grow rapidly due to digital health awareness and online discount models.

What are the restraints for the global market?

Regulatory and Safety Compliance Challenges

Heating collars fall under regulated medical or wellness devices in many countries. Manufacturers must comply with stringent standards related to electrical safety, temperature control, and material safety. Non-compliance can lead to product recalls, brand damage, and limited market entry. Moreover, inconsistent regulatory classifications across regions create barriers for global distribution and increase certification costs, particularly for smaller firms.

High Competition and Price Sensitivity

The market faces intense competition from low-cost, unbranded products, especially in developing regions. While these products expand access, they often lack adequate safety features and durability, which undermines consumer trust in the category. Additionally, alternative therapies such as cold compresses, physiotherapy, and massage devices offer competitive substitutes. To sustain profitability, established brands must focus on innovation, quality assurance, and differentiated branding to offset pricing pressures.

What are the key opportunities in the cervical heating collar industry?

Integration of IoT and Smart Health Technologies

The convergence of wearable technology and medical devices presents a major growth avenue. IoT-enabled cervical heating collars can record temperature data, duration of use, and therapy frequency, transmitting the information to companion apps or cloud-based health platforms. This data integration supports personalized treatment recommendations, preventive monitoring, and remote healthcare. Partnerships with telehealth providers and insurance companies can expand adoption in the long run.

Expanding Presence in Emerging Economies

Developing markets such as India, China, Brazil, and Southeast Asian nations offer substantial untapped potential. Rising middle-class incomes, increasing healthcare expenditure, and growing awareness of ergonomic wellness are driving demand. Local manufacturing incentives under initiatives such as “Make in India” and “Made in China 2025” are reducing import dependencies and production costs, enabling domestic brands to compete with global players. This regional expansion is expected to add significantly to overall market revenue.

New Applications in Sports and Rehabilitation

Beyond clinical pain relief, cervical heating collars are gaining acceptance in sports medicine and physiotherapy. Athletes and fitness enthusiasts use these devices for post-exercise muscle recovery and stiffness prevention. Rehabilitation centers are integrating heating collars as part of musculoskeletal therapy programs. This diversification into performance and wellness applications expands addressable demand, particularly in the growing global fitness industry valued at over USD 80 billion.

Product Type Insights

Electric and battery-operated collars dominate the market, accounting for approximately 4550% of total revenue in 2024. Their convenience, rapid heating, and adjustable temperature settings make them the preferred choice among consumers. Infrared and rechargeable variants are gaining traction in the premium segment due to longer battery life and enhanced therapeutic effects. Passive gel or microwavable collars continue to serve the low-cost segment, particularly in developing markets. The introduction of smart, app-controlled collars is expected to reshape the competitive landscape by 2030.

Application Insights

The home care and personal wellness segment represents the largest application, contributing over 55% of market revenue in 2024. Consumers increasingly prefer at-home therapy devices for convenience and affordability. Clinical and therapeutic applications in hospitals and rehabilitation centers hold around 30% share, while sports and travel-oriented use cases are expanding rapidly. The growing trend of remote health management and physiotherapy-at-home programs continues to strengthen the home use category.

Distribution Channel Insights

Online retail and e-commerce platforms such as Amazon, Flipkart, and medical device web stores dominate sales, contributing nearly 40% of total revenue in 2024. Offline retail—including pharmacies, medical supply stores, and specialty clinics—retains importance for clinical-grade devices. Direct institutional sales to hospitals and physiotherapy chains are expanding as companies build B2B partnerships. The omnichannel strategy, combining digital and in-store touchpoints, is expected to drive future growth by improving accessibility and customer engagement.

End-Use Insights

The cervical heating collar market serves multiple end-use sectors, including home consumers, healthcare institutions, sports rehabilitation, and corporate wellness. Home use is the fastest-growing end-use segment, projected to grow at a CAGR of 78% through 2030. Hospitals and physiotherapy centers represent steady institutional demand, while fitness centers and wellness spas are emerging secondary users. Rising export-driven demand from developing manufacturing bases in Asia, especially China and India, supports growth in both industrial and consumer export markets.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds the largest market share at approximately 3035% in 2024, driven by strong consumer purchasing power, advanced healthcare systems, and wide product availability. The United States dominates regional demand with a robust e-commerce infrastructure and growing awareness of home-based pain therapy devices. Canada also contributes significantly through clinical rehabilitation and sports therapy adoption. Regulatory emphasis on device safety and innovation encourages premium product offerings.

Europe

Europe accounts for roughly 2530% of global sales, led by Germany, the U.K., and France. High healthcare standards, preference for certified medical devices, and aging populations are key drivers. Reimbursement programs and supportive government policies toward non-invasive therapies encourage consumer adoption. Sustainable materials and ergonomic product designs are gaining popularity, reflecting Europe’s emphasis on eco-conscious healthcare products.

Asia-Pacific

Asia-Pacific is the fastest-growing region, holding about 2535% of global market share in 2024 and projected to grow at a CAGR of 79%. China and India lead demand due to rising middle-class incomes, increasing awareness of musculoskeletal health, and growing online retail penetration. Japan and South Korea represent mature markets with high adoption of premium smart collars. Domestic production capabilities and favorable government initiatives are strengthening regional competitiveness.

Latin America

Latin America contributes around 68% of global market revenue, with Brazil and Mexico as primary contributors. Economic recovery, expanding healthcare access, and urban lifestyle changes are supporting steady demand. E-commerce channels are helping consumers in remote areas access affordable heating collars. The region’s growing physiotherapy and wellness industries are also fueling product adoption.

Middle East & Africa

The Middle East and Africa together account for 35% of global revenue but represent growing opportunities. Gulf countries such as the UAE and Saudi Arabia are witnessing increased adoption of premium healthcare and wellness devices. Africa’s market potential lies in urban centers like South Africa and Kenya, where awareness of non-invasive pain relief is rising. Regional growth will depend heavily on pricing strategies, awareness programs, and distribution partnerships.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Cervical Heating Collar Market

- Sunbeam

- GENIANI

- Calming Comfort

- Comfytemp

- RENPHO

- ThermaCare

- Homedics

- PhysioNatural

- Relief Expert

- Arris

- MyCare

- InvoSpa

- Carex

- Snailax

- Nature Creation

Recent Developments

- In June 2025, RENPHO launched a next-generation smart cervical heating collar integrating Bluetooth connectivity and AI-based heat control algorithms.

- In April 2025, Sunbeam introduced an eco-friendly collar line using biodegradable fabrics and low-energy heating elements to reduce its carbon footprint.

- In February 2025, Comfytemp expanded its manufacturing base in India under the “Make in India” initiative to cater to local and export markets.