Carbon Fiber Bicycle Front Fork Market Size

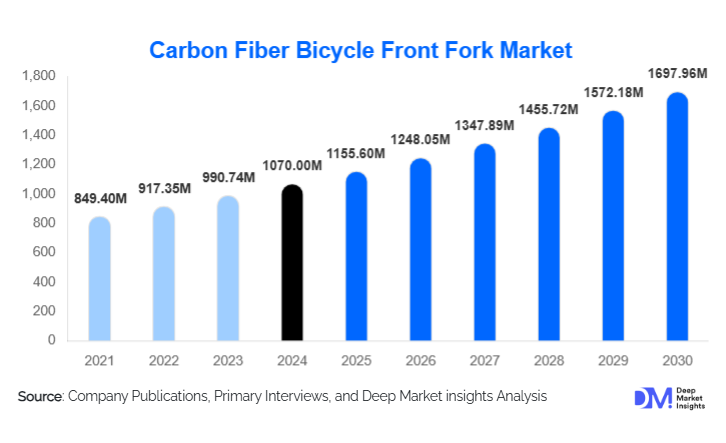

According to Deep Market Insights, the global carbon fiber bicycle front fork market size was valued at USD 1,070 million in 2024 and is projected to grow from USD 1,155.60 million in 2025 to reach USD 1,697.96 million by 2030, expanding at a CAGR of 8% during the forecast period (2025–2030). The market growth is primarily driven by increasing demand for lightweight, high-performance bicycle components, rapid adoption of e-bikes, and rising premiumization trends in the global cycling industry.

Key Market Insights

- Road and racing bicycles dominate the market, driven by professional and amateur cyclists prioritizing lightweight and aerodynamic forks for enhanced performance.

- Integration of smart sensors and IoT-enabled forks is emerging, offering real-time performance monitoring and predictive maintenance capabilities.

- Asia Pacific is the largest regional market, fueled by high-volume manufacturing hubs in China and Taiwan and increasing domestic e-bike adoption.

- Europe is among the fastest-growing regions, supported by robust cycling culture, urban mobility initiatives, and premium bicycle demand.

- Premium and high-end forks account for the largest revenue share, as consumers are willing to pay more for advanced composites, custom geometry, and aero designs.

- Technological innovations in composite manufacturing, such as prepreg layup, out-of-autoclave curing, and hybrid fiber integration, are shaping market competitiveness.

Latest Market Trends

Adoption of Lightweight and Aerodynamic Fork Designs

Manufacturers are increasingly focusing on lightweight, high-stiffness forks with aerodynamic shaping for road and racing bicycles. Innovations such as integrated aero fork-stem designs and optimized layup techniques enable improved handling and reduced rider fatigue. As cycling performance metrics become more critical in professional racing and enthusiast segments, these forks are also migrating into premium e-bikes and high-end recreational bicycles.

Smart and Connected Forks Gaining Popularity

The market is witnessing a rise in forks integrated with sensors and IoT capabilities to monitor stress, vibration, and riding dynamics in real time. These smart forks provide predictive maintenance insights, ride optimization, and data for cycling analytics. Integration of connected components appeals to professional cyclists, e-bike users, and performance enthusiasts seeking actionable feedback to improve efficiency and comfort.

Carbon Fiber Bicycle Front Fork Market Drivers

Lightweight Performance and Material Advantages

Carbon fiber forks offer a superior strength-to-weight ratio, enhanced vibration damping, and stiffness control compared to aluminum or steel alternatives. These performance benefits drive adoption among professional riders, competitive cycling teams, and premium bicycle enthusiasts, who prioritize lightweight and durable components for improved ride quality.

Growth of Premium and High-End Bicycle Segments

Premiumization in the global bicycle market is accelerating the adoption of carbon fiber forks. Consumers are increasingly willing to invest in high-end bicycles with advanced components. This trend is especially strong in road, racing, and e-bike segments, where performance, aesthetics, and brand value drive purchasing decisions.

Rapid Expansion of E-Bike Segment

Rising demand for e-bikes, particularly in Europe, North America, and the Asia Pacific, has created new opportunities for carbon fiber forks. Premium e-bikes require forks that can handle higher loads and provide enhanced vibration damping, making carbon fiber a preferred choice. Government incentives for sustainable mobility further bolster e-bike adoption, indirectly driving fork demand.

Market Restraints

High Manufacturing Costs

Production of carbon fiber forks, especially using prepreg and autoclave techniques, requires significant capital investment, skilled labor, and quality control. High manufacturing costs limit adoption in entry-level and cost-sensitive segments, constraining overall market growth.

Durability and Safety Concerns

Carbon fiber components can be prone to damage under misuse or impact, leading to consumer apprehension regarding long-term durability. Repairability challenges and safety concerns may limit adoption among casual or urban cyclists, restricting penetration in certain market segments.

Carbon Fiber Bicycle Front Fork Market Opportunities

Smart and IoT-Integrated Forks

Integrating sensors and connectivity into carbon fiber forks presents a high-growth opportunity. These forks can monitor vibration, structural stress, and fatigue, offering predictive maintenance and performance optimization. This appeals to performance cyclists, e-bike manufacturers, and tech-savvy enthusiasts, allowing differentiation in a competitive market.

Expansion in the E-Bike Performance Segment

High-performance e-bikes require durable, lightweight forks to handle added weight and torque. Carbon fiber forks tailored for e-bike specifications can capitalize on the rapid adoption of e-mobility solutions. Collaborations with OEMs and product lines dedicated to e-bikes offer substantial market potential.

Localized Manufacturing in Emerging Markets

Emerging markets like India, Southeast Asia, and Latin America currently import premium forks, presenting an opportunity for local manufacturing. Regional production reduces lead times, tariffs, and costs, while allowing customization for local cycling conditions. Government initiatives promoting local production of high-performance components further support this opportunity.

Product Type Insights

Rigid carbon forks dominate, accounting for approximately 60% of the market value in 2024. Their simplicity, lightweight structure, and reliability make them the preferred choice for road, racing, and gravel bicycles. Suspension and adjustable forks are growing, particularly in MTB and e-bike segments, driven by demand for shock absorption and terrain adaptability.

Application Insights

Road and racing bicycles represent the largest application segment, capturing nearly 35–40% of the market in 2024. E-bikes are emerging as the fastest-growing application, especially in Europe and the Asia Pacific, due to rising urban mobility initiatives and premium segment adoption. Mountain and gravel bikes contribute to moderate growth, particularly in niche performance and adventure segments.

Distribution Channel Insights

OEMs remain the primary distribution channel, supplying forks directly as part of complete bicycle assemblies. Aftermarket sales are growing, particularly for upgrade-focused cyclists. Online platforms and direct-to-consumer channels are increasingly important for premium forks, providing customization options, real-time availability, and global reach.

End-User Insights

Professional and elite cyclists are the primary end users, influencing technology adoption and brand prestige. Recreational enthusiasts and amateur riders are expanding in volume, driven by fitness trends and interest in performance upgrades. Premium e-bike users are an emerging segment, contributing to faster market growth and higher-margin sales.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America accounted for approximately 18–22% of the global market in 2024, led by the U.S. High disposable incomes, strong cycling culture, and e-bike adoption support demand. Customized packages and performance-oriented forks drive growth, with the region expected to grow at a CAGR above the global average.

Europe

Europe holds 25–30% of the market, with Germany, France, Italy, and the U.K. leading demand. Urban mobility initiatives, premium bicycle adoption, and cycling culture contribute to growth. Europe is among the fastest-growing regions due to regulatory support and e-bike penetration.

Asia Pacific

APAC is the largest regional market (30–35% of global value), led by China and Taiwan. The region is both a manufacturing hub and a high-volume demand center, driven by e-bike adoption, rising incomes, and urban cycling growth. APAC is also the fastest-growing region, with significant investment in local manufacturing and composites technology.

Latin America

Latin America holds 5–8% of the market, with Brazil, Argentina, and Mexico driving demand. Growth is modest but positive, focusing on recreational and adventure cycling. Imports dominate due to limited local manufacturing.

Middle East & Africa

The region contributes 4–7% of the global market. South Africa and the UAE are key consumers, while Africa remains a core manufacturing hub for select premium bicycles. Adoption is limited but growing in urban and affluent areas.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Carbon Fiber Bicycle Front Fork Market

- Giant Manufacturing

- SRAM Corporation

- Specialized Bicycle Components

- Trek Bicycle Corporation

- Cannondale

- Cervélo

- Merida

- Bianchi

- Canyon Bicycles

- Scott Sports

- Orbea

- Lapierre

- YT Industries

- Topkey

- Carbotec Industrial

Recent Developments

- In March 2025, Giant Manufacturing expanded its carbon fork portfolio with aero-integrated models for premium e-bikes and road bicycles.

- In April 2025, Specialized launched smart forks with embedded sensors for real-time performance analytics and predictive maintenance.

- In May 2025, SRAM Corporation invested in automated prepreg manufacturing lines to reduce production costs and increase output for high-end forks.