Camera Bracket Market Size

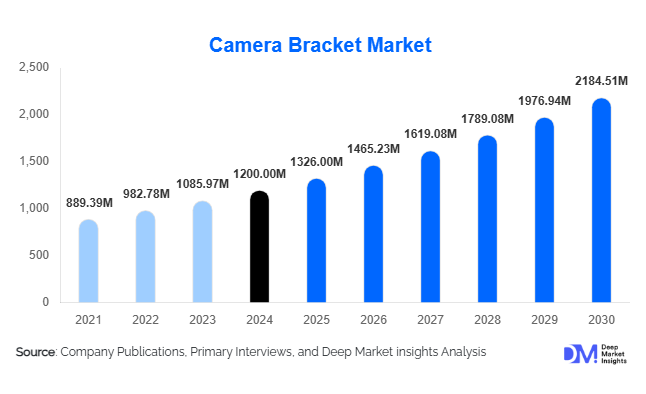

According to Deep Market Insights, the global camera bracket market size was valued at USD 1,200 million in 2024 and is projected to grow from USD 1,326 million in 2025 to reach USD 2,184.51 million by 2030, expanding at a CAGR of 10.5% during the forecast period (2025–2030). The market growth is primarily driven by the increasing demand for stable camera setups in content creation, rising adoption of surveillance and security systems, and the growing need for durable mounting solutions across automotive and consumer electronics applications.

Key Market Insights

- Surveillance and security applications dominate the demand for camera brackets, fueled by smart city initiatives, urban infrastructure growth, and rising security concerns globally.

- Integration with advanced camera technologies, including high-resolution, 360-degree, and multi-camera setups, is driving product innovation and adoption across industries.

- Online retail channels are emerging as the leading distribution platform, providing convenience, wide product selection, and competitive pricing for both professional and consumer segments.

- Metal camera brackets, particularly aluminum and stainless steel, remain preferred due to durability and the ability to withstand harsh environmental conditions.

- Asia-Pacific is the fastest-growing region, supported by rapid urbanization, infrastructure development, and rising demand for security solutions in countries like China and India.

- Technological adoption in design, such as lightweight, modular, and adjustable camera brackets, is reshaping end-user preferences and product development strategies.

What are the latest trends in the camera bracket market?

Integration with Advanced Camera Technologies

Camera bracket manufacturers are increasingly focusing on compatibility with next-generation cameras, including 360-degree systems, high-resolution imaging devices, and automotive driver-assistance setups. Adjustable, modular, and lightweight bracket designs are being developed to support complex camera configurations while maintaining stability. This trend is further supported by the growth of content creation, streaming platforms, and professional photography/videography, which require versatile mounting solutions to accommodate varied shooting angles and environments.

Shift Toward Online and E-Commerce Distribution

The expansion of e-commerce platforms has made it easier for consumers and businesses to purchase camera brackets with transparent pricing and faster delivery. Online retail channels provide opportunities for manufacturers to showcase innovative designs, cater to niche markets, and offer customization options. Increasing digital adoption by professional photographers, vloggers, and hobbyists is driving the shift from traditional retail to online platforms, expanding market reach globally.

What are the key drivers in the camera bracket market?

Growth in Content Creation and the Media Industry

The proliferation of user-generated content across platforms like YouTube, Instagram, and TikTok is fueling demand for high-quality, stable camera setups. Professionals and hobbyists increasingly require brackets that can support flexible positioning, multiple camera angles, and heavy equipment, resulting in significant adoption across media production, photography studios, and online content creation segments.

Expansion of Surveillance and Security Systems

Governments and private enterprises are investing heavily in smart city infrastructure and surveillance networks. Camera brackets play a critical role in ensuring that cameras are properly mounted, stable, and positioned to maximize monitoring efficiency. Rising security concerns in public and private spaces drive consistent demand for durable and reliable mounting solutions, particularly in North America and Europe.

Technological Advancements in Materials and Design

Innovations in lightweight metals, composites, and modular bracket designs are enabling manufacturers to offer more durable, versatile, and user-friendly solutions. Brackets with adjustable angles, foldable structures, and compatibility with multiple camera types are increasingly preferred by professionals and hobbyists alike, expanding market adoption and product differentiation.

What are the restraints for the global market?

Price Sensitivity in Emerging Markets

Although demand for camera brackets is growing, price-sensitive regions may limit the adoption of premium or high-end products. Manufacturers need to balance quality and affordability to penetrate these markets effectively. Competition from low-cost alternatives can also compress margins, especially in APAC and LATAM regions.

Compatibility Challenges Across Camera Models

The variety of camera types and mounting requirements poses compatibility issues for standardized brackets. End-users often require multiple brackets or model-specific solutions, which increases production complexity and inventory costs for manufacturers. Ensuring broad compatibility remains a persistent challenge.

What are the key opportunities in the camera bracket market?

Emerging Markets Expansion

Regions such as Asia-Pacific and Latin America present substantial growth opportunities due to urbanization, rising security infrastructure, and increasing adoption of content creation platforms. Tailoring camera bracket solutions to meet local preferences, climatic conditions, and cost expectations can capture these emerging market segments.

Customization and Modular Design Adoption

Manufacturers can differentiate themselves by offering modular, adjustable, and customizable brackets that cater to professional and consumer needs. Personalized solutions with flexible mounting options, material choices, and weight-bearing capacities can attract content creators, security system integrators, and automotive OEMs seeking tailored products.

Integration with Smart and Automated Systems

The growth of smart home, smart city, and automotive ADAS systems provides opportunities for camera brackets compatible with automated tracking, PTZ cameras, and multi-camera arrays. Collaborations with technology providers to integrate brackets with intelligent camera setups can position manufacturers as preferred suppliers in high-value markets.

Product Type Insights

Metal brackets dominate globally due to their durability, reliability, and environmental resistance, capturing nearly 60% of the market share in 2024. Plastic and composite brackets are gaining adoption in lightweight, budget, and portable applications. Specialty brackets for automotive ADAS systems are emerging, particularly in North America and Europe, driven by increasing smart vehicle deployments.

Application Insights

Surveillance and security applications account for the largest share, approximately 40% of the market in 2024, driven by smart city and infrastructure initiatives. Photography and videography follow closely, fueled by media content growth and professional adoption. Automotive applications are emerging rapidly, leveraging multi-camera systems for ADAS and vehicle monitoring.

Distribution Channel Insights

Online retail platforms account for over 50% of the sales in 2024, with B2B and B2C channels providing significant reach. Traditional retail remains relevant in emerging markets where professional networks and local distributors are important. Direct sales to enterprises and automotive OEMs are growing for specialized applications.

End-Use Insights

Media and entertainment industries remain the primary end-use segment, followed by surveillance and security, automotive, and consumer electronics. The fastest-growing demand is in automotive ADAS applications and professional content creation setups. Export-driven demand is strongest in North America and Europe, where local manufacturing is supplemented by imports from China, Germany, and Japan.

| By Product Type | By Application | By Distribution Channel | By End-Use Industry |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 35% of the global market in 2024. High adoption of surveillance systems, smart city infrastructure, and professional content creation drives growth. The U.S. dominates within the region due to its advanced media and security industries.

Europe

Europe contributes about 28% of the global market, led by Germany, the U.K., and France. Increasing automotive ADAS adoption and high security investment support demand. The region emphasizes technologically advanced and environmentally resilient products.

Asia-Pacific

APAC is the fastest-growing region, led by China and India, fueled by urban infrastructure development, rising surveillance installations, and growing content creation platforms. Local manufacturing hubs in China also support exports globally.

Latin America

Brazil, Mexico, and Argentina show emerging demand, largely in professional content creation and growing surveillance sectors. While smaller in volume, investments in infrastructure are boosting regional growth.

Middle East & Africa

The Middle East, particularly the UAE and Saudi Arabia, drives premium demand for surveillance and professional filming setups. Africa's market is smaller but growing in urban centers with security installations and tourism-related filming applications.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Camera Bracket Market

- Manfrotto

- Joby

- Arkon Mounts

- Vanguard

- SmallRig

- Oben

- Fotopro

- Benro

- Peak Design

- Kupo

- Avenger

- Neewer

- ProMaster

- CAMVATE

- Slik

Recent Developments

- In March 2025, Manfrotto launched a new series of modular aluminum brackets for professional filming setups, enhancing portability and load capacity.

- In January 2025, SmallRig introduced a universal multi-angle bracket system for automotive and surveillance cameras, expanding its industrial applications portfolio.

- In February 2025, Joby released lightweight, customizable brackets for content creators, integrating with action cameras and mobile devices.