Calcium Acetate Powder Market Overview

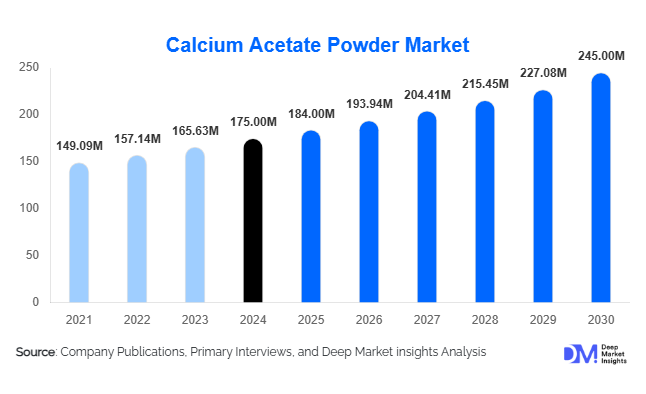

According to Deep Market Insights, the global calcium acetate powder market size was valued at USD 175 million in 2024 and is projected to grow from USD 184 million in 2025 to reach USD 245 million by 2030, expanding at a CAGR of 5.4% during the forecast period (2025–2030). The market growth is primarily driven by increasing demand in pharmaceutical applications for phosphate binding, expanding food and beverage usage as preservatives and acidity regulators, and growing industrial and environmental applications such as coatings, adhesives, and wastewater treatment.

Key Market Insights

- Pharmaceutical applications are the fastest-growing segment, driven by the rising incidence of chronic kidney disease and demand for high-purity phosphate binders.

- Food and beverage industry demand is increasing, particularly in bakery, dairy, and confectionery, due to clean-label trends and regulatory approvals for calcium acetate as a preservative and stabilizer.

- Industrial and environmental applications are expanding, with use in coatings, adhesives, water treatment, and emerging sustainable chemical processes.

- Europe holds the largest market share, supported by mature pharmaceutical and food processing sectors with strict regulatory compliance.

- Asia-Pacific is the fastest-growing region, driven by industrialization, rising healthcare infrastructure, and expanding processed food markets in China, India, and Southeast Asia.

- Technological adoption, including advanced purification processes, specialty granule development, and digital supply chain management, is reshaping production and distribution efficiency.

What are the latest trends in the calcium acetate powder market?

Pharma-Grade and High-Purity Focus

Manufacturers are increasingly prioritizing high-purity calcium acetate powder to meet stringent pharmaceutical standards and regulatory compliance. Enhanced purification methods and particle size control ensure better performance as phosphate binders in chronic kidney disease treatments. This trend is being reinforced by growing healthcare awareness and increasing CKD incidence worldwide. Additionally, pharmaceutical companies are investing in research for modified-release formulations to improve patient compliance and efficacy.

Clean-Label and Food Additive Demand

The food and beverage industry is adopting calcium acetate as a safe and natural preservative, acidity regulator, and stabilizer, aligning with clean-label and regulatory trends. The demand is particularly high in processed bakery, dairy, and confectionery products, where shelf-life and quality are crucial. Manufacturers are developing low-sodium variants and granulated forms for improved handling, catering to both consumer preference and industrial process efficiency.

What are the key drivers in the calcium acetate powder market?

Healthcare Demand and Rising CKD Cases

The increasing prevalence of chronic kidney disease globally is driving demand for calcium acetate as a phosphate binder in pharmaceutical formulations. Aging populations, rising diabetes and hypertension rates, and greater access to healthcare services contribute to growth in pharmaceutical-grade calcium acetate consumption. This segment commands higher margins and ensures steady revenue growth for manufacturers globally.

Growth of Food & Beverage Processing

The expansion of processed food, bakery, dairy, and confectionery industries globally has led to higher adoption of calcium acetate as a preservative, acidity regulator, and stabilizer. Rising awareness of food safety, stringent regulations, and clean-label consumer trends are further encouraging its use, particularly in Europe, North America, and emerging Asia-Pacific markets.

Industrial and Environmental Applications

Calcium acetate is increasingly used in coatings, adhesives, chemical intermediates, and wastewater treatment due to its buffering capacity and phosphate-binding properties. Stricter environmental regulations and sustainable industrial practices are driving adoption in these sectors, contributing to steady market growth and creating opportunities for environmentally friendly applications.

What are the restraints for the global market?

Stringent Regulatory Compliance and Costs

High-quality standards, particularly for pharmaceutical and food-grade calcium acetate, require compliance with GMP, FDA, EFSA, and other regional regulations. Achieving these standards increases production costs, limits new entrants, and can restrain adoption in cost-sensitive markets.

Raw Material Cost Fluctuations

The cost of calcium sources and acetic acid, along with energy and purification reagents, affects production economics. Price volatility, supply chain disruptions, and high waste from purification processes for high-purity grades may constrain profitability and market expansion.

What are the key opportunities in the calcium acetate powder industry?

Expansion in Emerging Markets

Asia-Pacific, Latin America, and the Middle East offer substantial growth potential due to rising industrialization, healthcare infrastructure development, and expanding food processing industries. Local production and partnerships can reduce import dependency and logistics costs, offering a competitive advantage to global and regional players.

Specialty Grades and Product Innovation

Development of ultra-high purity pharmaceutical-grade, low-sodium food-grade, and specialty industrial forms of calcium acetate can differentiate offerings. Innovative granules, modified release forms, and bio-based sources align with consumer trends for sustainability and clean-label products, opening new revenue streams.

Regulatory and Environmental Adoption

Stringent regulations for food safety, pharmaceutical standards, and environmental protection are creating opportunities for calcium acetate as a safer alternative. Adoption in wastewater treatment, phosphate removal, and circular economy initiatives can drive industrial and municipal demand while supporting sustainability objectives.

Product Type Insights

Industrial grade dominates globally, representing approximately 45% of the 2024 market, due to extensive use in coatings, adhesives, and water treatment. Pharmaceutical grade is the fastest-growing segment (30–35% market share) because of increasing CKD incidence and healthcare infrastructure expansion. Food-grade calcium acetate holds a 25–35% share, benefiting from clean-label trends and widespread adoption in bakery, dairy, and confectionery products.

Application Insights

Pharmaceutical applications remain the most profitable and fastest-growing, driven by CKD treatment demand. Food additive use continues to expand, particularly in processed bakery, dairy, and confectionery items. Industrial and environmental applications, including coatings, adhesives, and wastewater treatment, provide steady growth, with emerging opportunities in agriculture, feed, and specialty chemical sectors.

Distribution Channel Insights

Direct B2B sales dominate bulk orders for pharmaceutical, food, and industrial users. Distributors and industrial suppliers facilitate medium-sized and regional orders. Retail and online channels are increasingly used for smaller pharmaceutical and research lab purchases. Digital platforms enable real-time supply tracking, regulatory compliance checks, and convenient ordering, enhancing overall market efficiency.

End-User Insights

The pharmaceutical sector is the fastest-growing end-user, particularly in regions with high CKD prevalence. Food processing and bakery industries are steadily expanding adoption, while industrial and environmental sectors provide consistent demand. Emerging applications in water treatment, agriculture, and specialty chemicals are creating additional growth avenues. Export-driven demand is significant, with high-purity grades often imported into developing regions to meet regulatory and quality requirements.

| By Product Type / Grade | By Application | By End-Use Industry | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds 25–30% of the global market, driven by the U.S. and Canada. Healthcare demand for phosphate binders and food industry adoption, combined with strong regulatory frameworks, support growth. The region focuses on high-purity pharmaceutical and food-grade calcium acetate, with steady adoption in industrial applications.

Europe

Europe represents 35–40% of global demand, with Germany, France, and the U.K. leading consumption. Mature pharmaceutical and food processing industries, strict regulatory compliance, and environmental initiatives drive high adoption rates. Growth is moderate but profitable due to premium pricing and regulatory enforcement.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with China and India leading demand. Expansion of food processing industries, healthcare infrastructure, and industrialization are major drivers. Japan and South Korea contribute to high-purity pharmaceutical demand. Rapid urbanization and rising middle-class incomes accelerate growth in both food and pharma applications.

Latin America

Brazil, Argentina, and Mexico represent key markets. Outbound demand for high-purity imports is growing in the pharmaceutical and food segments, while industrial adoption is modest. Growth is supported by improving food safety regulations and healthcare infrastructure.

Middle East & Africa

Demand is lower compared to other regions but growing due to import reliance for high-purity pharmaceutical and food-grade products. Key countries include the UAE, Saudi Arabia, and South Africa. Water treatment and environmental applications provide additional growth opportunities, alongside increasing healthcare investment.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Calcium Acetate Powder Market

- Niacet Corporation

- Macco Organiques Inc.

- Akshay Group

- Amsyn Inc.

- Daito Chemical Co., Ltd.

- Plater Group

- Jiangsu Kolod Food Ingredients

- Wuxi Yangshan Biochemical

- Tengzhou Zhongzheng Chemical

- Alemark

- Shandong Luyang Chemical

- Gujarat Alkalies & Chemicals

- Zhejiang Juhua Co., Ltd.

- Hubei Xingfa Chemicals

- Oriental Chemicals

Recent Developments

- In March 2025, Niacet Corporation expanded its pharmaceutical-grade production facility in the U.S., increasing high-purity output for phosphate binders.

- In January 2025, Macco Organiques announced a new low-sodium food-grade calcium acetate product line targeting bakery and confectionery applications in Europe and Asia-Pacific.

- In February 2025, Akshay Group invested in advanced purification technologies at its India plant to meet growing demand for pharmaceutical and food-grade calcium acetate in Asia.