Black Hair Care Market Size

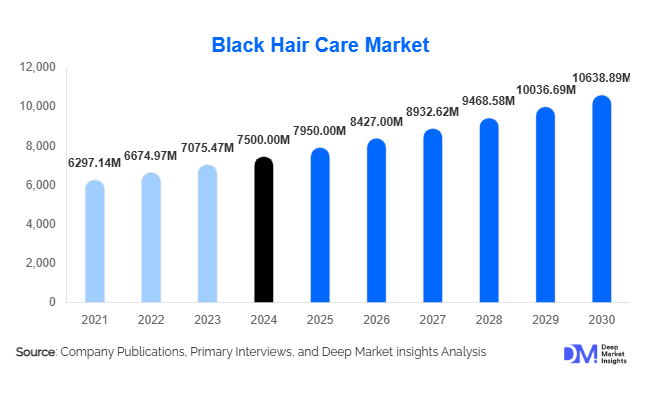

According to Deep Market Insights, the global Black hair care market size was valued at USD 7,500 million in 2024 and is projected to grow from USD 7,950 million in 2025 to reach USD 10,638.89 million by 2030, expanding at a CAGR of 6.0% during the forecast period (2025–2030). The market growth is primarily driven by the increasing adoption of natural hair care trends, rising awareness of hair health among Black consumers, and the expansion of specialized product offerings catering to textured hair types globally.

Key Market Insights

- Natural hair care adoption is accelerating, driving demand for shampoos, conditioners, styling creams, and treatments formulated specifically for Black hair textures.

- Technological integration in product development is creating personalized solutions, leveraging AI and advanced formulations to target individual hair concerns such as scalp health, curl maintenance, and damage repair.

- Emerging markets in Africa and the Asia-Pacific are expanding rapidly due to rising disposable incomes, urbanization, and increased exposure to global beauty trends.

- Social media and influencer marketing are amplifying awareness, shaping purchase decisions, and driving brand loyalty among younger demographics.

- Offline retail channels such as salons and beauty supply stores remain significant, but online platforms are gaining traction due to convenience and product variety.

- Inclusive marketing campaigns by major brands are positively impacting consumer trust, representation, and overall market penetration.

What are the latest trends in the Black Hair Care Market?

Embracing Natural Hair and Curl Diversity

The Black hair care market is increasingly influenced by the natural hair movement, which emphasizes healthy, chemical-free styling. Consumers are opting for products that promote hair growth, moisture retention, and curl definition without harsh chemicals like sulfates and parabens. Brands are responding with innovative formulations for specific curl patterns, protective styles, and hair treatments. Educational campaigns and social media tutorials are reinforcing these trends, encouraging consumers to experiment with natural textures. This movement has led to a surge in demand for hair oils, leave-in conditioners, and deep conditioning masks, creating both product innovation and category expansion opportunities.

Technology-Driven Personalization and Product Innovation

Advanced technology is being incorporated in product development and consumer engagement. AI-driven online diagnostics, hair type assessments, and personalized hair care regimens allow brands to recommend specific products for individual hair concerns. Companies are integrating natural ingredients backed by scientific research to enhance product efficacy, including botanicals, vitamins, and scalp-nourishing compounds. Mobile applications and virtual consultations are increasingly helping consumers select appropriate products, enhancing customer satisfaction and repeat purchases. These technological interventions are redefining consumer expectations for customized hair care solutions.

What are the key drivers in the Black Hair Care Market?

Increasing Cultural Empowerment and Representation

The celebration of natural hair textures and cultural identity has fueled consumer confidence in purchasing specialized Black hair care products. Marketing campaigns featuring diverse hair types resonate with the target audience, encouraging higher brand loyalty and repeat purchases. This cultural shift has also led salons to offer a wider array of professional treatments and styling services catering to natural curls and protective styles, thereby driving product consumption in both retail and professional channels.

Rising Influence of Social Media and Digital Communities

Platforms like Instagram, TikTok, and YouTube have created communities around hair care education, product reviews, and styling tutorials. Influencer-led marketing has a direct impact on consumer behavior, particularly among millennials and Gen Z, driving the adoption of both premium and mass-market products. Viral hair care challenges and tutorials stimulate trends such as DIY treatments, protective styling, and product experimentation, directly boosting sales across key product categories.

Growing Awareness of Inclusive Beauty Standards

Consumers increasingly demand products tailored to Black hair textures, pushing brands to innovate and diversify offerings. Inclusive marketing strategies, featuring models and ambassadors with textured hair, improve brand authenticity and appeal. Major beauty brands are investing in research and development to produce products that support curl definition, scalp health, and long-term hair growth, further driving the market forward.

What are the restraints for the global market?

High Product Costs

Premium formulations and specialized ingredients increase product pricing, limiting accessibility for budget-conscious consumers. This pricing barrier can slow adoption in emerging markets and among younger demographics, who may opt for lower-cost alternatives or home remedies. Additionally, salon services and professional treatments often carry high fees, further restricting market penetration.

Regulatory and Compliance Challenges

Differences in regulations across regions—related to cosmetic ingredients, product labeling, and safety testing—pose challenges for global expansion. Companies must navigate these varying standards, which can increase time-to-market, operational costs, and compliance risks, particularly for natural and organic products targeting multiple international markets.

What are the key opportunities in the Black Hair Care Industry?

Expansion of Natural and Organic Product Lines

The growing demand for chemical-free, natural, and organic products presents a key opportunity for brands to expand their offerings. Products using plant-based ingredients, oils, and butters that cater to curl care, moisture retention, and scalp health are gaining popularity. This trend allows companies to capture environmentally conscious consumers while building premium brand value.

Technological Innovation and Personalized Hair Care

AI-driven hair care solutions and mobile applications for personalized recommendations are increasingly attracting tech-savvy consumers. Startups and established brands can leverage these tools to provide individualized solutions, build loyalty, and collect data for product improvement. Personalized subscription models and diagnostic tools are emerging as highly engaging channels for customer retention.

Rapid Growth in Emerging Markets

Rising disposable income in Africa, Latin America, and parts of Asia provides an opportunity for market expansion. Urbanization and increasing exposure to global beauty trends are driving awareness and willingness to purchase specialized hair care products. Brands that localize formulations and distribution strategies for these regions are positioned to capture significant growth potential.

Product Type Insights

Shampoos lead the market, accounting for 35% of the global market share in 2024, owing to their essential role in cleansing and maintaining scalp health. Conditioners and styling products follow closely, catering to moisture retention and curl definition. Specialized products such as leave-in conditioners, hair oils, and deep treatment masks are gaining traction, reflecting increased consumer focus on hair health and natural styling techniques.

Application Insights

Individual consumers represent the largest end-use segment, driven by daily hair care routines and growing preference for at-home treatments. Salons and professional stylists account for a significant portion of demand for high-performance products and styling treatments. Export-driven demand is increasing, particularly from the U.S. and Europe to Africa and Asia-Pacific, fueled by diaspora communities seeking high-quality, culturally relevant hair care solutions.

Distribution Channel Insights

Offline retail channels dominate, with beauty supply stores, salons, and department stores accounting for most sales. However, e-commerce platforms and direct-to-consumer (D2C) websites are rapidly growing due to convenience, wider product selection, and access to niche brands. Social media marketing and influencer collaborations are boosting online penetration, particularly among younger demographics.

| By Product Type | By Application / End-Use | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

The U.S. dominates, holding approximately 40% of the 2024 market share. A large Black consumer base, strong purchasing power, and established salon culture drive demand. Canada also shows steady growth, fueled by multicultural populations and increasing product availability.

Europe

The U.K. and France lead demand, accounting for 20% of the global market. Growth is driven by rising awareness of hair health, multicultural populations, and the adoption of natural hair trends. Germany and the Netherlands are emerging as rapidly growing markets.

Asia-Pacific

Emerging demand in countries with African diaspora communities, such as Japan and India, is expanding niche markets. Urbanization and increased exposure to global beauty trends support growth, though the overall market size remains smaller compared to North America and Europe.

Latin America

Brazil, Mexico, and Argentina are emerging markets, driven by rising disposable income and increased exposure to global beauty trends. Outbound demand for U.S. and European products also supports growth.

Middle East & Africa

Africa presents strong growth potential, particularly in Nigeria, South Africa, and Kenya, due to rising urbanization and demand for culturally relevant products. The Middle East, led by the UAE and Saudi Arabia, is emerging as a high-value market, with affluent consumers seeking premium hair care products.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Black Hair Care Market

- Procter & Gamble

- Unilever

- L’Oréal

- Johnson & Johnson

- Henkel

- CurlMix

- Carol’s Daughter

- SheaMoisture

- Dark & Lovely

- Mielle Organics

- Pattern Beauty

- As I Am

- Camille Rose

- Creme of Nature

- Kinky-Curly

Recent Developments

- In 2025, SheaMoisture launched a new line of sulfate-free shampoos and conditioners targeting natural hair care, leveraging social media campaigns for awareness.

- In 2024, Carol’s Daughter expanded its distribution into African markets, partnering with local salons to increase accessibility.

- In 2025, Pattern Beauty introduced AI-driven personalized hair care consultation tools, offering customized product recommendations for consumers.