Big Wheel BMX Bike Market Summary

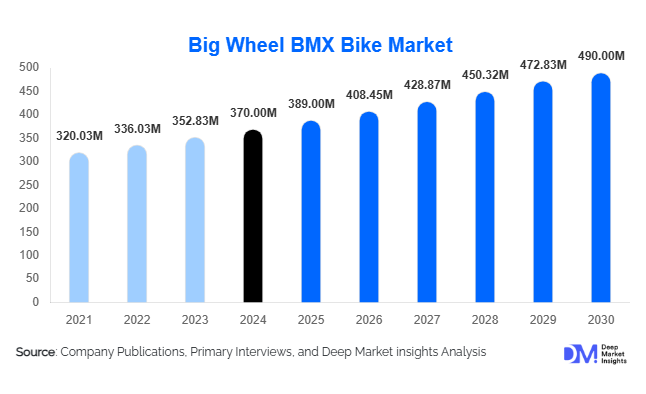

According to Deep Market Insights, the global Big Wheel BMX bike market size was valued at USD 370 million in 2024 and is projected to grow from USD 389 million in 2025 to reach USD 490 million by 2030, expanding at a CAGR of 5.0% during the forecast period (2025–2030). The market growth is primarily driven by increasing youth participation in extreme sports, expanding urban cycling infrastructure, rising adoption of high-performance and electric-assisted BMX bikes, and growing recreational cycling trends worldwide.

Key Market Insights

- Freestyle BMX bikes dominate global demand, offering versatility for tricks, stunts, and racing, making them the preferred choice among enthusiasts and athletes.

- Aluminum frame bikes are leading the market, valued for their lightweight, durability, and cost-effectiveness, driving preference over steel or carbon alternatives.

- North America holds a significant share of the market, with the U.S. and Canada contributing substantially due to established BMX culture, organized sports, and urban cycling programs.

- Asia-Pacific is the fastest-growing region, driven by rising disposable incomes, urbanization, and a growing interest in recreational and competitive cycling in countries like China and Japan.

- Technological innovation, including electric-assist integration, lightweight frames, and durable materials, is reshaping consumer expectations and boosting adoption.

- Emerging markets in Latin America and MEA show untapped potential, supported by increasing youth engagement in sports and government-backed urban cycling infrastructure projects.

What are the latest trends in the Big Wheel BMX Bike Market?

Integration of Electric-Assisted BMX Bikes

Manufacturers are increasingly incorporating electric-assist technology into BMX bikes, enabling a wider demographic to participate, including older riders and casual enthusiasts. Electric-assisted BMX bikes provide enhanced acceleration and maneuverability without compromising the traditional BMX experience. This innovation opens avenues in urban commuting and recreational segments, expanding market penetration. Additionally, rising interest in green mobility further positions electric BMX bikes as both recreational and sustainable transport solutions.

Lightweight and High-Performance Materials

The adoption of lightweight aluminum and composite frames has become a significant trend. Riders prefer bikes that offer durability and ease of maneuverability, particularly for freestyle tricks and racing. Advanced materials such as hydroformed aluminum, chromoly steel, and reinforced polymers are driving performance-oriented adoption. This trend not only improves riding experience but also increases the willingness of consumers to invest in premium models.

What are the key drivers in the Big Wheel BMX Bike Market?

Rising Youth Participation in Extreme Sports

The growing interest among younger demographics in BMX racing, freestyle competitions, and extreme sports events such as X-Games and the Olympics has strongly driven market demand. Increased media coverage, sponsorship programs, and organized BMX events provide exposure and motivation, fueling higher adoption of Big Wheel BMX bikes for both recreational and competitive purposes.

Expansion of Urban Cycling Infrastructure

Investment in bike lanes, parks, and urban trails is encouraging recreational cycling, including BMX biking. Cities across North America, Europe, and the Asia-Pacific are developing BMX parks and tracks to cater to both amateurs and professionals, thereby increasing accessibility and driving market growth.

Technological Advancements in Bike Design

Innovations such as electric-assist integration, shock-absorbing suspension systems, and ergonomic components have attracted enthusiasts seeking high-performance bikes. Enhanced durability, lightweight frames, and customizable features further appeal to both new entrants and seasoned riders, contributing to market expansion.

What are the restraints for the global market?

High Production and Retail Costs

High-quality BMX bikes, particularly those with advanced frames and electric assist, involve significant production costs. This leads to higher retail prices, limiting accessibility for price-sensitive consumers in both mature and emerging markets.

Market Saturation in Developed Regions

In mature markets like North America and Europe, the BMX bike segment faces limited growth opportunities due to saturation. Brands must explore product innovation, niche customization, and expansion into emerging regions to maintain growth trajectories.

What are the key opportunities in the Big Wheel BMX Bike Industry?

Emerging Market Expansion

Asia-Pacific and Latin America present significant opportunities for market expansion. Rising disposable income, urbanization, and growing interest in extreme sports and recreational cycling are driving demand. Localized production, partnerships, and targeted marketing can help manufacturers tap into these high-growth regions effectively.

Sustainable and Eco-Friendly Materials

Increasing consumer awareness of sustainability is encouraging manufacturers to adopt eco-friendly materials and green manufacturing practices. Aluminum, recycled composites, and sustainable paint processes enhance brand appeal while reducing environmental impact, creating competitive differentiation.

Electric-Assist Integration and Hybrid BMX Models

The integration of electric-assist technology opens a broader customer base, including casual riders, urban commuters, and older enthusiasts. The combination of traditional BMX design with e-assist functionalities can fuel demand, particularly in urban areas where cycling infrastructure is expanding.

Product Type Insights

Freestyle BMX bikes dominate the market, holding approximately 44.8% of global market share in 2024. Their adaptability for stunts, tricks, and competitive racing, along with broad consumer awareness, makes them the most preferred choice. Racing BMX bikes are the second-leading type, driven by professional sports adoption, while dirt and street BMX bikes are gaining traction in niche extreme sports segments.

Application Insights

Recreational cycling remains the largest application, accounting for a majority of the market, followed by competitive BMX sports. Urban commuting with e-assisted BMX bikes is emerging as a new application, particularly in Asia-Pacific cities. Adventure sports events and youth engagement programs also contribute to growing adoption.

Distribution Channel Insights

Specialty bike shops, online retail platforms, and direct-to-consumer websites dominate the distribution landscape. Online platforms are rapidly growing due to convenience, customization options, and detailed product reviews. Major retailers and specialty stores remain critical for high-value purchases, offering after-sales services, trial rides, and maintenance support.

End-Use Insights

Primary end-users include recreational riders, competitive athletes, and urban commuters. Recreational cycling is driving consistent demand, while competitive sports and urban commuting with e-assisted BMX bikes are growing rapidly. Emerging applications in urban sports parks and adventure programs are creating new demand avenues. Export-driven demand is significant, with North America, Europe, and the Asia-Pacific being major importers of high-performance BMX bikes.

| By Product Type | By Frame Material | By Wheel Size | By Distribution Channel | By End-Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds the largest market share (32% in 2024), driven by the established BMX culture in the U.S. and Canada. Demand is fueled by professional competitions, youth participation, and advanced retail and distribution networks.

Europe

Europe accounts for approximately 28% of the global market, with strong demand in the UK, Germany, and France. European consumers prioritize high-performance bikes and sustainable materials. The region also benefits from growing cycling infrastructure and organized BMX events.

Asia-Pacific

Asia-Pacific is the fastest-growing region due to rising disposable income, urbanization, and increasing interest in recreational sports. China, Japan, and Australia are key contributors, with electric-assisted BMX adoption accelerating urban cycling trends.

Latin America

Emerging adoption in Brazil and Mexico is driving market growth, supported by youth sports programs, middle-class expansion, and adventure sports awareness. Exported high-performance BMX bikes are in increasing demand.

Middle East & Africa

The market is nascent but shows potential due to rising urbanization, youth population, and recreational sports initiatives. GCC countries and South Africa are the main markets, with demand expected to grow steadily over the forecast period.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Big Wheel BMX Bike Market

- GT Bicycles

- Haro Bikes

- Mongoose

- Redline Bicycles

- WeThePeople

- Kink BMX

- Fit Bike Co.

- Eastern Bikes

- Sunday Bikes

- Cult Crew

- Colony BMX

- Radio Bikes

- BSD BMX

- Haro Racing

- Demolition Parts

Recent Developments

- In June 2025, GT Bicycles launched a new aluminum-frame freestyle BMX bike with integrated electric-assist, targeting urban and recreational riders.

- In April 2025, Mongoose expanded production in China, aiming to capture rising demand in the Asia-Pacific and Latin America with mid-range BMX models.

- In February 2025, Haro Bikes introduced a lightweight racing BMX bike series using chromoly steel, improving performance for professional athletes and competitive riders.