Beauty Ingestible Market Size

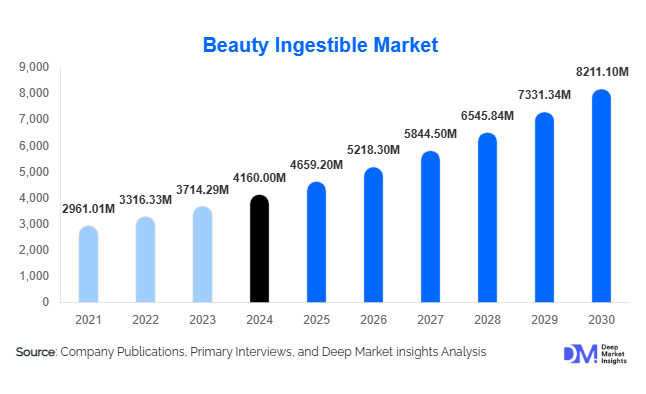

According to Deep Market Insights, the global beauty ingestible market size was valued at USD 4,160 million in 2024 and is projected to grow from USD 4659.20 million in 2025 to reach USD 8211.10 million by 2030, expanding at a CAGR of 12% during the forecast period (2025–2030). The beauty ingestible market growth is primarily driven by increasing consumer awareness of beauty-from-within, rising demand for clean-label and natural ingredients, innovation in delivery formats such as gummies and functional beverages, and the expansion of e-commerce and direct-to-consumer channels globally.

Key Market Insights

- Collagen-based products dominate the ingredient segment, benefiting from strong consumer recognition for skin, hair, and nail benefits and supported by increasing clinical evidence of efficacy.

- Skin care applications lead the market, with anti-aging, hydration, and brightening formulations representing the largest share due to widespread consumer focus on visible results.

- North America holds the largest market share, with the U.S. and Canada driving demand through high disposable incomes, wellness awareness, and established retail channels.

- Asia Pacific is the fastest-growing region, led by China, India, and South Korea, due to rising middle-class wealth, urbanization, and increased exposure to global beauty trends.

- Online retail and e-commerce platforms are rapidly expanding, providing consumers with greater access, convenience, and personalized product offerings.

- Technological innovation in formulation and personalized beauty solutions, including bioavailability enhancements and custom nutrition plans, is shaping product differentiation and consumer engagement.

What are the latest trends in the beauty ingestible market?

Clean-Label, Natural, and Sustainable Ingredients

Consumers increasingly demand clean-label, vegan, organic, and sustainably sourced ingredients. Products leveraging marine or plant-based collagen, antioxidant-rich botanicals, and probiotics are gaining traction. Early compliance with safety and labeling regulations, particularly in Europe and North America, enhances consumer trust. Brands that transparently communicate sourcing and certifications, such as organic, non-GMO, and vegan, are better positioned to capture premium segments and appeal to conscious consumers.

Innovative Delivery Formats and Personalized Solutions

Formats such as gummies, chewables, drink shots, functional beverages, and effervescent tablets are transforming consumer engagement. Personalized beauty ingestibles tailored to skin type, age, gender, or genetic markers are becoming increasingly popular. Integration with digital wellness tools, apps, and diagnostics enables consumers to adopt customized beauty regimens. Enhanced bioavailability, flavor masking, and multi-benefit combinations (e.g., skin plus immunity support) are key trends that differentiate premium offerings.

What are the key drivers in the beauty ingestible market?

Rising Consumer Awareness and Wellness Focus

Consumers are becoming more knowledgeable about the connection between nutrition and beauty. Increasing awareness of internal health’s impact on skin, hair, and nails, along with the influence of social media and influencers, is driving demand for ingestible beauty solutions. Anti-aging concerns, hair thinning, and skin hydration needs are particularly driving uptake among adults aged 26–50.

Innovation in Products and Distribution Channels

Technological advancements in formulations, such as hydrolyzed collagen, encapsulation, and antioxidant stabilization, improve efficacy and palatability. E-commerce and direct-to-consumer channels expand reach, allowing niche brands to access global consumers quickly. Subscription models and personalized services are enhancing customer retention and driving recurring sales.

Increasing Disposable Income and Urbanization in Emerging Markets

Emerging economies, particularly in the Asia Pacific, are witnessing growing middle-class populations with higher disposable incomes. Urban consumers exposed to global beauty trends are investing in premium ingestibles. Rising concerns about pollution, UV exposure, and lifestyle-related aging are further boosting demand in urban centers.

What are the restraints for the global market?

Regulatory and Safety Challenges

Beauty ingestibles face stringent regulations across different regions, including approval of health claims, ingredient safety, labeling, and permissible dosages. Misleading marketing claims and a lack of clinical evidence can delay product launches and increase compliance costs. Companies must navigate varying international standards to successfully scale products globally.

Consumer Skepticism and Price Sensitivity

Many consumers remain uncertain about the efficacy of ingestible beauty products. High prices for premium ingredients such as marine collagen or specialized botanicals can limit adoption in price-sensitive markets. Education, credible claims, and visible results are critical for overcoming skepticism and achieving mass-market penetration.

What are the key opportunities in the beauty ingestible industry?

Premium Clean-Label and Ethical Product Development

Brands emphasizing natural, organic, and ethically sourced ingredients have a competitive advantage. Certifications such as vegan, non-GMO, and sustainably sourced marine collagen attract conscious consumers. Early compliance with evolving regulations ensures credibility and market access, particularly in Europe and North America, opening opportunities for premium positioning and higher margins.

Personalized and Multi-Benefit Beauty Solutions

Advances in diagnostics and digital health tools allow brands to offer personalized formulations targeting specific consumer needs. Multi-benefit products that combine skin, hair, nail, and wellness support (e.g., immunity, gut health) meet growing demand for holistic solutions. This trend enables premiumization and enhances customer loyalty.

Expansion in Emerging Markets and Export Potential

Asia Pacific is a key growth region, with China, India, and South Korea exhibiting high demand due to rising wealth and beauty awareness. Export opportunities exist from mature markets to emerging regions, particularly for premium and clinically backed products. Government initiatives supporting domestic manufacturing and regulatory harmonization also facilitate market expansion and export-driven growth.

Product Type Insights

Collagen-based products dominate the ingredient segment, offering multi-benefit solutions for skin, hair, and nails. Vitamins, minerals, carotenoids, and antioxidant supplements complement the product mix. Functional beverages and drinkable beauty shots are emerging as high-growth formats, particularly among younger, urban consumers seeking convenience and novelty.

Application Insights

Skin care applications represent the largest share, driven by anti-aging, hydration, and brightening formulations. Hair care products addressing hair thinning and growth are gaining traction, particularly in emerging markets. Nail care and combined wellness-beauty solutions are niche but growing rapidly. Products offering multiple benefits appeal to holistic wellness-focused consumers, driving multi-category adoption.

Distribution Channel Insights

Offline retail, including pharmacies, drug stores, and supermarkets, remains significant, accounting for over 50% of global revenue. E-commerce and direct-to-consumer channels are expanding rapidly, providing personalized product recommendations, subscription models, and wider reach for niche brands. Specialist stores and beauty clinics are also contributing to targeted distribution and premium positioning.

Consumer Demographics Insights

Adults aged 26–50 represent the largest consumer base, combining purchasing power with heightened interest in beauty and wellness. Younger consumers (18–25) drive demand for trendy formats such as gummies and drink shots. Older adults (51+) contribute to premium product adoption, particularly for anti-aging and holistic wellness formulations. Female consumers remain the primary demographic, though male-targeted products are growing.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America is the largest market, driven by the U.S. and Canada, accounting for approximately 40% of global revenue. Strong consumer awareness, high disposable incomes, and established retail networks support market dominance. The region favors premium collagen-based products and functional beverages with clinically backed claims.

Europe

Europe holds around 30% of the market, led by Germany, the UK, and France. Consumers prioritize clean-label, natural, and clinically validated products. Sustainability and ethical sourcing are critical factors in purchasing decisions. Growth is steady, with emerging interest in personalized and multi-benefit beauty ingestibles.

Asia Pacific

Asia Pacific is the fastest-growing region, with China, India, and South Korea leading demand. Rising middle-class populations, urbanization, and exposure to global beauty trends fuel growth. Premium, multi-benefit, and convenient formats such as gummies and drink shots are particularly popular. CAGR in the region is projected at 14%+, outpacing global averages.

Latin America

Latin America accounts for about 5% of global revenue, with Brazil and Argentina leading demand. Consumers prefer mid-range and premium multi-benefit products. Growth is supported by urban affluent populations and increasing awareness of wellness and beauty integration.

Middle East & Africa

MEA contributes roughly 2–3% of global market revenue. GCC countries, including the UAE and Saudi Arabia, drive premium product demand, while South Africa represents the leading African consumer market. High-income urban populations and interest in luxury beauty products are growth enablers, though regulatory and import costs remain considerations.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Beauty Ingestible Market

- Nature’s Bounty

- Vital Proteins LLC

- HUM Nutrition Inc.

- The Nue Co.

- The Beauty Chef

- Ceramiracle

- EVOLUTION_18

- Wholy Dose

- NeoCell

- NeoCica

- Nutrafol

- Garden of Life

- Reserveage Nutrition

- Imedeen

- Olivina

Recent Developments

- In January 2025, Vital Proteins launched a marine collagen drink targeting the Asia Pacific market, emphasizing sustainable sourcing and high bioavailability.

- In March 2025, HUM Nutrition introduced personalized beauty supplement packs using AI-driven skin analysis, targeting U.S. and European consumers.

- In June 2025, The Beauty Chef expanded its product line to include probiotic-based beauty ingestibles for gut-skin health, focusing on the Australian and New Zealand markets.