Artificial Fur Market Size

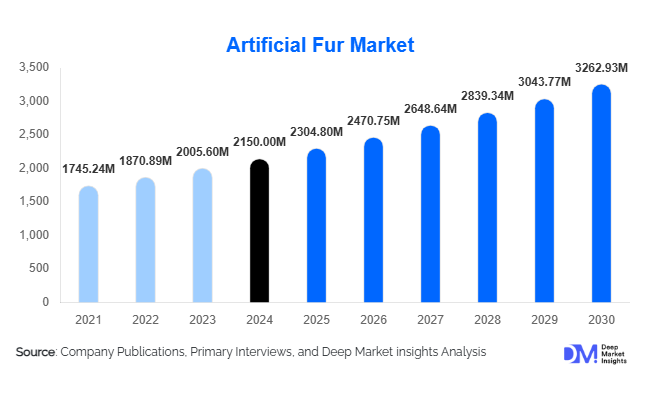

According to Deep Market Insights, the global artificial fur market size was valued at USD 2,150 million in 2024 and is projected to grow from USD 2,304.80 million in 2025 to reach USD 3,262.93 million by 2030, expanding at a CAGR of 7.2% during the forecast period (2025–2030). The artificial fur market growth is primarily driven by increasing consumer preference for ethical and sustainable fashion, technological advancements in synthetic fibers that closely mimic natural fur, and growing adoption in home décor and automotive applications.

Key Market Insights

- Consumer demand is increasingly favoring cruelty-free and sustainable fur alternatives, enabling brands to align with ethical fashion trends and expand their market share.

- Fashion and apparel remain the leading end-use segment, particularly in Europe and North America, where high disposable incomes support premium synthetic fur products.

- Asia-Pacific is emerging as a critical growth region, driven by rising urbanization, growing middle-class populations, and expanding domestic fashion and home décor industries.

- Technological innovation is enhancing product quality, with realistic textures, durable fibers, and custom designs making artificial fur more appealing across applications.

- Integration into non-traditional sectors, such as automotive interiors and luxury home furnishings, is creating new revenue streams for manufacturers.

- Online retail channels are expanding, offering consumers direct access to diverse product ranges and enabling manufacturers to strengthen brand presence globally.

What are the latest trends in the artificial fur market?

Sustainable and Ethical Fashion

With rising awareness about animal welfare, fashion brands are increasingly adopting artificial fur to replace natural fur in garments, accessories, and footwear. Recycled synthetic fibers, low-impact manufacturing processes, and eco-friendly dyes are becoming standard. Consumers now actively seek brands promoting sustainability certifications and cruelty-free production, making ethical considerations a critical purchase driver.

Technological Advancements Enhancing Realism

Artificial fur manufacturers are integrating cutting-edge fiber technology to create products that closely mimic natural fur in texture, shine, and durability. Innovations include acrylic-modacrylic blends, improved pile density, and multi-tonal color effects. These developments not only boost consumer adoption but also expand use in high-end applications such as automotive interiors and luxury home décor.

What are the key drivers in the artificial fur market?

Rising Demand for Ethical and Sustainable Fashion

The shift toward cruelty-free alternatives is a major growth driver. Consumers, particularly in North America and Europe, prefer products that are animal-friendly without compromising on style or comfort. Fashion brands and designers are increasingly using artificial fur in high-end collections and fast-fashion lines, fueling global demand.

Expansion of Non-Traditional Applications

Artificial fur is finding new applications in automotive seat covers, steering wheel trims, plush toys, and interior décor. This diversification increases market adoption beyond traditional apparel and accessories, providing steady revenue growth opportunities for manufacturers.

Technological Advancements and Product Innovation

Enhanced fiber blends, better color fastness, and realistic textures are increasing product appeal. Advanced manufacturing techniques allow customization for specific client requirements, further driving growth across multiple industries.

What are the restraints for the global market?

High Production Costs for Premium Textures

While artificial fur is generally cheaper than natural fur, high-end products with ultra-realistic textures and eco-friendly materials involve higher production costs. This limits affordability for certain consumer segments, particularly in price-sensitive regions.

Regulatory and Environmental Compliance

Stringent regulations regarding chemical usage in synthetic fibers and environmental standards in manufacturing can constrain production expansion. Companies must invest in eco-compliant processes, which may increase operational costs and slow growth in emerging markets.

What are the key opportunities in the artificial fur market?

Growth in Emerging Regions

Asia-Pacific and Latin America present untapped potential, driven by urbanization, rising disposable income, and increasing fashion-conscious populations. Manufacturers can leverage regional partnerships, local production facilities, and targeted marketing to capture these markets.

Integration into Automotive and Home Décor Sectors

Artificial fur is increasingly used in premium automotive interiors and luxury home furnishings. Partnerships with OEMs, interior designers, and furniture brands can create new high-value revenue streams, allowing companies to diversify beyond apparel and accessories.

Technological Innovation for Product Differentiation

Advanced manufacturing techniques, including high-density fiber weaving, blended synthetic materials, and eco-friendly coloring processes, offer differentiation opportunities. Customized textures and color patterns can cater to designer collections, automotive customization, and luxury home décor trends.

Product Type Insights

Plush fur leads the market with a 35% share of 2024 demand due to its soft, dense texture suitable for high-end fashion and home décor applications. Acrylic-based fur dominates the material segment (40% share) because of affordability and durability, making it popular across mass-market and premium applications. Short pile fur is preferred for linings and accessories due to its compact structure and ease of manufacturing, contributing 20% of the product mix.

Application Insights

Apparel and fashion accessories remain the largest application segment, representing approximately 45% of the 2024 market. Footwear follows closely at 15%, driven by growing demand for cruelty-free boots and slippers. Home furnishings account for 20%, fueled by luxury interior décor trends, while automotive interiors and toys contribute 10% and 5%, respectively, reflecting emerging non-traditional applications.

Distribution Channel Insights

Offline retail remains dominant, contributing 50% of sales due to specialty stores and boutique presence. Online channels are rapidly growing, representing 35% of 2024 sales, supported by D2C e-commerce platforms and social media marketing. B2B supply to fashion brands and OEMs contributes 15%, emphasizing bulk purchases for industrial applications.

End-Use Industry Insights

Fashion & apparel remain the primary end-use, driving demand for high-quality synthetic furs. Interior design & home décor is growing rapidly, particularly in North America and Europe, due to rising luxury home trends. Automotive interiors are emerging as a niche growth driver, with premium vehicle manufacturers integrating artificial fur trims. Toy manufacturing remains a steady, though smaller, contributor. Export-driven demand is significant, with European and North American brands sourcing synthetic fur from the APAC and LATAM regions.

| By Product Type | By Material | By Application | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds approximately 30% of the 2024 market, with strong demand from the U.S. and Canada for ethical fashion and luxury décor. Growth is driven by rising sustainability awareness, higher disposable income, and strong e-commerce adoption. Premium apparel and home décor segments are key contributors.

Europe

Europe accounts for 28% of the 2024 market, led by France, Italy, and Germany. Consumers prioritize eco-friendly and luxury products, fostering the adoption of high-quality artificial fur in fashion and interior applications. Demand for cruelty-free apparel is particularly high, supporting sustained market growth.

Asia-Pacific

Asia-Pacific is the fastest-growing region, driven by China, India, and Japan. Urbanization, increasing middle-class populations, and the expansion of domestic fashion brands contribute to a rising CAGR of approximately 8%. The region is a hub for manufacturing and exports, supporting global supply chains.

Latin America

Brazil and Mexico are driving gradual adoption, with niche luxury and fashion applications emerging. Growth is supported by increasing disposable incomes and fashion-conscious consumers seeking cruelty-free alternatives.

Middle East & Africa

Demand in the Middle East, led by the UAE and Saudi Arabia, is rising due to luxury fashion adoption and growing high-income populations. Africa primarily serves as a sourcing region, though local fashion brands are gradually adopting artificial fur for apparel and home décor.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Artificial Fur Market

- Avril Group

- Kaneka Corporation

- Uni-Fur

- Tokuyo

- Haining Foshan Fur

- Yarntex Corporation

- Furs International

- Stevenson Leather & Fur

- Artilux

- Shandong Longxin Fur

- Jiangsu Furs & Textiles

- Dongguan Shunfa Fur

- LuxFur

- Beijing Leizheng Fur

- Hanwha Fur

Recent Developments

- In March 2025, Avril Group launched a new range of eco-friendly acrylic-modacrylic fur for premium fashion brands, enhancing durability and color retention.

- In January 2025, Kaneka Corporation introduced blended fiber fur with superior flame-retardant properties, targeting children’s apparel and outerwear.

- In December 2024, Uni-Fur expanded its manufacturing facility in China to meet growing export demand in Europe and North America.