Ancient Harvest Quinoa Market Size

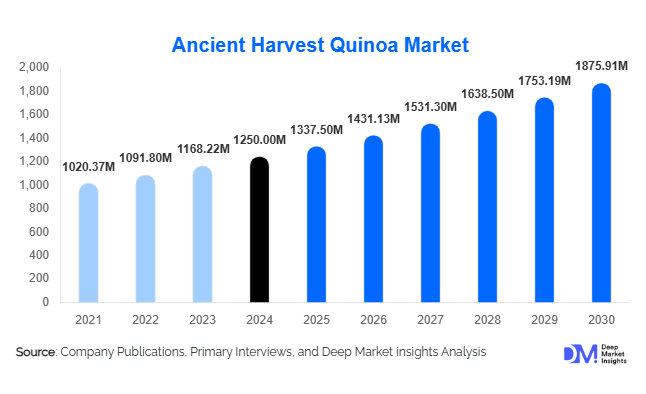

According to Deep Market Insights, the global Ancient Harvest quinoa market size was valued at USD 1,250 million in 2024 and is projected to grow from USD 1,337.50 million in 2025 to reach USD 1,875.91 million by 2030, expanding at a CAGR of 7% during the forecast period (2025–2030). The market growth is primarily driven by rising consumer preference for plant-based, gluten-free, and nutrient-dense foods, coupled with increasing health consciousness and growing demand for convenient, ready-to-eat products.

Key Market Insights

- Whole grain quinoa remains the dominant product type, offering superior nutritional benefits and versatility in culinary applications, accounting for 60% of the global market in 2024.

- Ready-to-eat quinoa products are rapidly gaining traction, driven by consumer demand for convenience, with online retail channels expanding accessibility globally.

- North America dominates the market, contributing approximately 40% of global demand in 2024, supported by high consumer awareness and adoption of health-focused diets.

- Europe holds 30% of the market share, led by Germany and the UK, driven by health-conscious consumers and premium organic product preferences.

- Asia-Pacific is the fastest-growing region, fueled by rising middle-class income, increasing awareness of superfoods, and expanding quinoa-based product launches in India and China.

- Technological adoption in processing and packaging, including advanced milling, fortification, and ready-to-eat formats, is enhancing product quality and shelf life, reshaping consumer choices.

What are the latest trends in the Ancient Harvest quinoa market?

Health and Wellness Integration

Quinoa is increasingly being positioned as a “superfood” across meal kits, snacks, and beverages. Consumers are seeking high-protein, gluten-free, and plant-based options, driving product innovation. Ready-to-eat quinoa salads, cereals, and quinoa-based snacks are expanding market penetration. Brands are focusing on fortified products with added vitamins, minerals, and probiotics to enhance appeal to health-conscious consumers.

Convenience-Driven Product Innovation

With busy lifestyles and rising demand for ready-to-cook or pre-packaged meals, companies are introducing microwavable quinoa meals, frozen quinoa products, and snack bars. This trend is especially pronounced in North America and Europe, where consumers value time-saving solutions without compromising nutrition. Online retail platforms are playing a significant role in promoting these convenient formats, contributing to overall growth.

What are the key drivers in the Ancient Harvest quinoa market?

Rising Health and Nutritional Awareness

Quinoa’s high protein content, essential amino acids, fiber, and micronutrients appeal to health-conscious consumers. Increasing adoption of plant-based diets, weight management trends, and functional foods is driving consumption globally. Nutritional studies highlighting quinoa’s benefits further reinforce its market demand.

Growth of Plant-Based and Gluten-Free Diets

The surge in vegan, vegetarian, and gluten-free diets has positioned quinoa as a preferred alternative to traditional grains. Consumers increasingly opt for quinoa-based products in cereals, snacks, baked goods, and meat substitutes, enhancing product diversification opportunities.

Expansion of Online and Retail Accessibility

The proliferation of e-commerce and supermarket availability is making quinoa products more accessible. Consumers can now purchase premium, organic, and international quinoa brands online, enhancing reach and market adoption.

What are the restraints for the global market?

Price Sensitivity

Quinoa is relatively expensive compared to conventional grains such as rice or wheat, limiting adoption among price-conscious consumers. Import costs and supply fluctuations further impact affordability, especially in developing regions.

Supply Chain Vulnerabilities

Quinoa cultivation is concentrated in the Andean region, and climatic variations or geopolitical disruptions can create supply shortages. These factors pose challenges for consistent availability and stable pricing in global markets.

What are the key opportunities in the Ancient Harvest quinoa industry?

Product Diversification and Innovation

Companies can expand into ready-to-eat meals, snack bars, breakfast cereals, and fortified quinoa products. Innovations in flavor, packaging, and convenience can attract a broader consumer base, particularly millennials and Gen Z, seeking health-focused snacks.

Sustainability and Ethical Sourcing

Consumers increasingly prefer ethically sourced and environmentally sustainable products. Companies emphasizing fair trade certifications, organic farming, and traceable sourcing can strengthen brand loyalty and differentiate themselves in a competitive market.

Market Expansion in Emerging Regions

Asia-Pacific, particularly India and China, presents significant growth potential due to rising awareness of superfoods. Strategic partnerships, local production, and market-specific marketing can accelerate adoption and create long-term demand.

Product Type Insights

Whole grain quinoa dominates the market, with a 60% share in 2024, due to its versatility and superior nutritional profile. Ready-to-eat quinoa products are gaining traction, particularly in North America and Europe, due to consumer preference for convenient and nutritious options. Quinoa flour and flakes are also growing, used in bakery and health-focused food segments.

Application Insights

Food and beverage applications remain the largest segment, driven by salads, snacks, and beverage formulations. Emerging applications include plant-based meat alternatives, functional foods, and nutraceuticals, highlighting expanding demand across industries. Export-driven demand is significant, with North America and Europe importing quinoa from South America for processing and retail distribution.

Distribution Channel Insights

Supermarkets and online platforms dominate distribution, with online channels experiencing the fastest growth. Direct-to-consumer models and e-commerce subscriptions are enabling greater accessibility, while specialty health stores and natural food retailers maintain relevance for premium and organic segments.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds a 40% share of the market, led by the U.S. and Canada. High health awareness, demand for gluten-free and plant-based foods, and strong online retail penetration support market growth. Ready-to-eat and convenience-focused products are particularly popular.

Europe

Europe accounts for 30% of the market, with Germany, the U.K., and France leading. Consumers prioritize organic, sustainable, and functional foods. Market expansion is fueled by increasing vegan and health-oriented diets.

Asia-Pacific

Asia-Pacific is the fastest-growing region, driven by rising middle-class incomes and growing awareness of superfoods in India, China, Japan, and Australia. The market is projected to experience high double-digit growth rates over the forecast period.

Latin America

Latin America holds 15% of the market, with significant exports from Peru, Bolivia, and Ecuador. Demand is rising domestically and from international markets seeking premium quinoa products.

Middle East & Africa

The region accounts for 5% of the market, with growing interest in health-focused foods. The UAE, Saudi Arabia, and South Africa are emerging as notable consumers, primarily for premium quinoa imports.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Ancient Harvest Quinoa Market

- Ancient Harvest

- Bob’s Red Mill

- Andean Dream

- Viva Naturals

- Inka Crops

- Nature’s Earthly Choice

- TruRoots

- BetterBody Foods

- Grainmillers

- Alter Eco

- Organic India

- NutriGold

- Peruvian Naturals

- Navitas Organics

- Earth’s Best

Recent Developments

- In March 2025, Ancient Harvest launched a line of ready-to-eat quinoa bowls targeting North American consumers seeking convenient, nutrient-dense meals.

- In January 2025, Bob’s Red Mill expanded its quinoa flour and flakes production, focusing on bakery and functional food applications in Europe and North America.

- In December 2024, Inka Crops implemented a sustainable sourcing initiative in Peru, ensuring fair trade practices and organic certification for its quinoa exports.