Aluminum Cookware Market Size

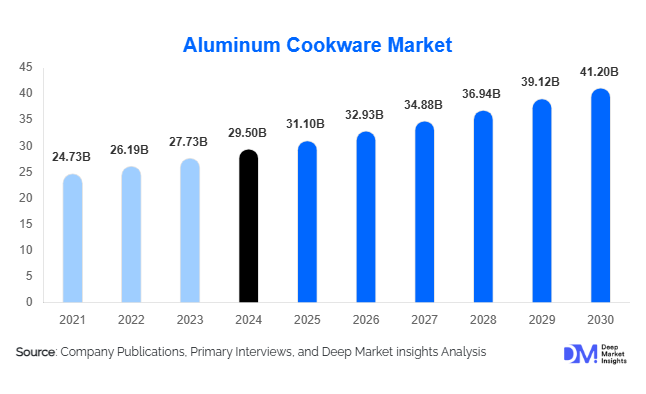

According to Deep Market Insights, the global aluminum cookware market size was valued at USD 29.5 billion in 2024 and is projected to grow from USD 31.1 billion in 2025 to reach USD 41.2 billion by 2030, expanding at a CAGR of 5.9% during the forecast period (2025–2030). The aluminum cookware market growth is primarily driven by rising consumer preference for lightweight and affordable cookware, growing urbanization and disposable incomes in emerging economies, and innovations in non-stick and anodized finishes that improve usability and safety.

Key Market Insights

- Non-stick and anodized aluminum cookware is increasingly preferred, driven by consumers’ desire for ease of cleaning, durability, and induction compatibility.

- The residential / household segment dominates, reflecting the growing trend of home cooking and kitchen upgrades across both developed and emerging markets.

- Asia-Pacific leads the global market in terms of volume and revenue, with China and India driving significant demand due to urbanization, rising incomes, and expanding middle-class households.

- Online retail channels are growing rapidly, enabling consumers to access a wider variety of cookware, compare prices, and select eco-friendly or premium options.

- Innovation in eco-friendly and induction-compatible cookware is creating new product differentiation opportunities, particularly in premium segments.

- Export-driven demand from low-cost manufacturing hubs such as China, India, and Southeast Asia is strengthening the global supply chain, meeting demand in North America, Europe, and the Middle East.

What are the latest trends in the aluminum cookware market?

Eco-Friendly and Sustainable Cookware

Manufacturers are increasingly adopting recycled aluminum and non-toxic coatings to cater to environmentally conscious consumers. Products marketed as PFOA-free, ceramic-coated, or anodized not only appeal to health-conscious users but also align with global sustainability trends. Several government initiatives incentivize the adoption of eco-friendly manufacturing processes, further encouraging companies to invest in green technologies. Sustainable cookware is particularly gaining traction in developed markets, where regulatory requirements for food safety and environmental compliance are strict.

Technological Advancements in Coatings and Thermal Performance

Innovation in non-stick coatings, hard-anodized surfaces, and induction-compatible bases is transforming product offerings. Cookware with improved heat distribution, lightweight designs, and durable finishes enhances user convenience and safety. Digital marketing, product demos, and e-commerce platforms are helping brands educate consumers about these advanced features. Additionally, ergonomic handles, modular cookware sets, and aesthetic finishes are becoming key differentiators in premium and mid-range segments.

What are the key drivers in the aluminum cookware market?

Rising Consumer Preference for Lightweight and Efficient Cookware

Aluminum’s superior thermal conductivity, light weight, and cost-effectiveness make it ideal for home and commercial use. Growing awareness of its energy efficiency, ease of handling, and compatibility with modern cooking appliances is driving adoption across households, restaurants, and institutional kitchens. Increasing demand for convenient, easy-to-clean cookware is further reinforcing growth in both mid-range and premium segments.

Urbanization and Rising Disposable Incomes in Emerging Economies

Emerging markets such as India, China, and Southeast Asia are witnessing rapid urbanization and an expanding middle class. These demographic shifts are creating significant demand for kitchen upgrades and high-quality cookware. Consumers are increasingly willing to invest in non-stick or anodized aluminum cookware that offers convenience, durability, and aesthetic appeal. This trend is a key driver of both domestic consumption and export-oriented manufacturing.

Advancements in Coating and Surface Treatment Technologies

Improved non-stick, ceramic, and anodized coatings are enhancing product longevity, safety, and thermal performance. Health and safety regulations in North America, Europe, and Asia are prompting manufacturers to adopt coatings free from harmful chemicals. These technological upgrades have enabled manufacturers to charge premium prices, expand product portfolios, and enter new markets, particularly in high-income regions where consumers value safety and durability.

What are the restraints for the global market?

Raw Material Price Volatility

Aluminum prices, coating chemicals, and energy costs can fluctuate significantly, affecting manufacturing costs and profitability. For budget segments, manufacturers face limited flexibility to absorb price increases, which may lead to higher consumer prices or reduced margins. Volatility in raw material prices remains a significant restraint, especially for producers reliant on imported aluminum or specialty coatings.

Health and Regulatory Concerns

Concerns regarding chemical leaching from non-stick coatings, heavy metals, and food safety standards may hinder growth in certain regions. Regulatory compliance requirements for coatings, anodization, and induction-compatible cookware necessitate additional investment in manufacturing technology and testing, creating barriers for smaller players and new entrants.

What are the key opportunities in the aluminum cookware industry?

Growth in Eco-Friendly and Sustainable Products

Increasing consumer awareness of health and environmental impact presents opportunities for manufacturers to develop products using recycled aluminum, non-toxic coatings, and sustainable manufacturing practices. This segment offers premium pricing potential and strengthens brand positioning in developed markets.

Induction-Compatible and High-Performance Cookware

The shift towards induction cooking and advanced stove technologies provides opportunities for aluminum cookware that combines lightweight design with improved heat conduction. Companies investing in R&D for induction-compatible bases and durable finishes can differentiate their products and gain market share.

Expanding Market in Emerging Economies

Urbanization, rising disposable income, and growing middle-class populations in Asia-Pacific, Latin America, and the Middle East create significant opportunities for both budget and mid-range cookware. Targeted distribution strategies, local manufacturing, and export-oriented production allow manufacturers to tap into underserved rural and semi-urban markets.

Product Type Insights

Frying pans and sauté pans dominate the aluminum cookware product segment, accounting for approximately 30–35% of the global market in 2024. Their versatility, ease of use, and widespread household adoption make them a core choice for both residential and commercial kitchens. Among surface treatment types, non-stick coated aluminum leads, capturing nearly 50% of the market, is driven by consumer preference for easy-to-clean, durable, and health-conscious cookware that allows cooking with less oil. Anodized aluminum cookware is gaining traction due to its superior durability, resistance to corrosion, and long-lasting performance, making it highly appealing to consumers seeking premium-quality products. Cookware sets and specialty items, including woks, Dutch ovens, and casserole dishes, are showing steady growth, particularly in premium and mid-range markets where home cooking trends and gifting occasions are driving demand.

Application Insights

The residential or household segment represents approximately 70% of global demand in 2024, fueled by increasing interest in home cooking, kitchen modernization, and lifestyle upgrades. Growing urbanization, rising disposable incomes, and a focus on health and nutrition are encouraging consumers to invest in high-quality cookware. The commercial and institutional segments are expanding steadily, driven by restaurants, hotels, catering services, schools, and hospitals that require durable, high-capacity aluminum cookware. Emerging applications, including outdoor cooking, mobile kitchens, and specialty dietary cookware for vegan, gluten-free, or low-oil cooking, are expanding overall market potential and offering growth opportunities for manufacturers targeting niche segments.

Distribution Channel Insights

Traditional retail dominates with roughly 60% market share in 2024, particularly for premium cookware, as customers prefer an in-store experience to evaluate product quality, handle materials, and examine finishes. Online retail channels are growing rapidly, driven by e-commerce platforms, direct-to-consumer websites, and digital marketing campaigns. Convenience, easy comparison, and home delivery have made online channels highly attractive, especially among younger consumers. B2B and institutional procurement channels remain significant for bulk orders, particularly for commercial kitchens, educational institutions, and healthcare facilities.

| By Product Type | By Surface/Coating Type | By End-Use | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounted for approximately 22% of the global aluminum cookware market in 2024. The U.S. leads in premium and mid-range cookware segments, driven by demand for non-stick, anodized, and induction-compatible aluminum products. The growth is supported by health-conscious consumers increasingly opting for lightweight cookware that promotes low-fat cooking. High disposable incomes, well-developed retail infrastructure, strict food safety regulations, and increasing interest in home cooking are further driving market expansion. Online retail platforms and specialty kitchenware stores are helping brands reach tech-savvy consumers, making convenience and digital availability a key growth driver.

Europe

Europe contributes around 24% of global demand, with Germany, France, and the U.K. leading consumption. The region is witnessing growth due to rising preference for sustainable, eco-friendly, and induction-compatible aluminum cookware. Consumers are increasingly adopting products that minimize environmental impact and comply with stringent food safety standards. High awareness regarding energy-efficient cooking, premium kitchen upgrades, and urbanization trends are supporting adoption in both residential and commercial segments. The availability of specialty retail stores and online marketplaces further facilitates consumer access, accelerating growth in the mid-range and premium segments.

Asia-Pacific

Asia-Pacific dominates the global aluminum cookware market with a 33–35% share, led by China and India. Rapid urbanization, expanding middle-class households, rising disposable incomes, and a strong home-cooking culture are key growth drivers. Consumers are increasingly investing in high-quality, non-stick, and anodized cookware to meet both convenience and health-focused requirements. Southeast Asian countries such as Indonesia, Vietnam, and Thailand are emerging as high-growth markets due to increasing kitchen modernization, urban lifestyle adoption, and the proliferation of online retail platforms. Government initiatives supporting domestic manufacturing and export-oriented production are also enhancing product availability and affordability, further boosting regional market growth.

Latin America

Latin America holds approximately 7–8% of the global aluminum cookware market. Brazil, Mexico, and Argentina contribute most of the demand, driven by urbanization, rising disposable incomes, and modern cooking trends. Consumers are gradually shifting toward premium, easy-to-clean cookware to support home cooking and health-conscious lifestyles. Infrastructure limitations and price sensitivity remain challenges; however, growth in online retail and urban household penetration is facilitating greater market access and encouraging gradual expansion of mid-range and premium cookware segments.

Middle East & Africa

The Middle East & Africa region accounts for 6–7% of the market. GCC countries, led by the UAE and Saudi Arabia, show strong demand for premium cookware, supported by high-income consumers, modern urban kitchens, and growing awareness of healthy cooking practices. Africa’s urban centers are gradually adopting modern aluminum cookware as disposable incomes rise and the hospitality sector expands. Government incentives, growing retail networks, and increasing exposure to international kitchen trends are key regional growth drivers. The trend toward non-stick and anodized cookware is particularly strong in metropolitan areas, where consumers value convenience, safety, and durability.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Aluminum Cookware Market

- Groupe SEB

- Meyer Corporation

- Newell Brands

- Fissler

- WMF

- TTK Prestige

- Hawkins Cookers

- Butterfly India

- GreenPan

- Scanpan

- Circulon

- Le Creuset

- Calphalon

- Farberware

- Cuisinart

Recent Developments

- In March 2025, Meyer Corporation launched a new range of induction-compatible non-stick cookware in India and Southeast Asia, focusing on eco-friendly coatings.

- In January 2025, Groupe SEB expanded its Tefal anodized cookware line in Europe, emphasizing durable, PFOA-free coatings for premium households.

- In November 2024, TTK Prestige introduced a budget-friendly recycled aluminum cookware series in India, targeting tier-2 and tier-3 urban markets and promoting sustainability.