Agedcare Furniture Market Size

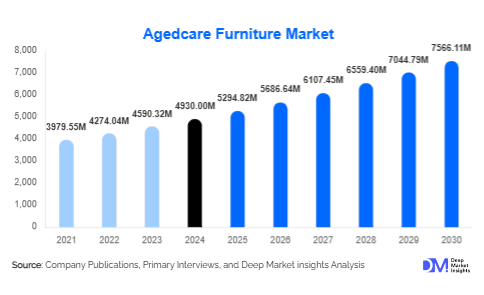

According to Deep Market, the global agedcare furniture market size was valued at USD 4,930 million in 2024 and is projected to grow from USD 5294.82 million in 2025 to reach USD 7566.11 million by 2030, expanding at a CAGR of 7.4% during the forecast period (2025–2030). The aged care furniture market is experiencing growth primarily driven by the rising elderly population, the increasing prevalence of chronic diseases, and a growing focus on home-based care. The increasing demand for ergonomic, safe, and multifunctional furniture solutions tailored to older adults is also propelling global market expansion.

Key Market Insights

- Rising demand for home care solutions is fueling the growth of furniture designed to improve comfort, mobility, and safety for elderly individuals preferring independent living.

- Technological integration in agedcare furniture, such as sensor-based monitoring, adjustable mechanisms, and smart connectivity, is enhancing user experience and attracting tech-savvy caregivers and seniors.

- Government initiatives promoting aging-in-place and public investments in nursing homes and assisted living facilities are driving the adoption of specialized furniture solutions.

- Europe and North America dominate the market in terms of market share, owing to established healthcare systems, higher elderly population ratios, and strong purchasing power.

- Asia-Pacific is emerging as the fastest-growing region due to increasing urbanization, life expectancy, and rising awareness of elderly care products.

- Sustainability and customization trends are influencing product development, with eco-friendly materials and personalized furniture designs becoming increasingly popular among consumers.

What are the latest trends in the agedcare furniture market?

Smart and Connected Furniture

Manufacturers are integrating advanced technologies into agedcare furniture, including IoT-enabled monitoring, adjustable reclining mechanisms, and health tracking sensors. These smart solutions enhance safety, monitor vital signs, and provide caregivers with real-time data, reducing the need for constant supervision. Technology adoption is becoming a key differentiator in the market, attracting both healthcare facilities and home care users seeking convenience, comfort, and increased functionality. Products with embedded safety features like fall detection, emergency alerts, and automated position adjustment are gaining significant traction, particularly in developed regions such as North America and Europe.

Sustainable and Eco-Friendly Materials

Environmental concerns are reshaping furniture design, with an increasing emphasis on eco-friendly, non-toxic, and recyclable materials. Wooden, bamboo-based, and recycled materials are becoming popular among consumers and healthcare facilities alike. Sustainability-focused initiatives are helping manufacturers differentiate their products, meet regulatory compliance, and tap into environmentally conscious customer segments. This trend also supports government incentives for green and sustainable construction in elderly care facilities, boosting adoption rates.

What are the key drivers in the agedcare furniture market?

Aging Global Population

The growing elderly population worldwide is the most significant driver of agedcare furniture demand. Older adults require furniture that supports mobility, comfort, and independence, such as recliners, lift chairs, and adjustable beds. Rising life expectancy and the prevalence of chronic diseases have increased the need for specialized care products, making agedcare furniture an essential component of both institutional and home care settings.

Home Healthcare Services Expansion

With the rise of home-based care services, demand for furniture that facilitates in-home assistance has surged. Adjustable, lightweight, and easy-to-maintain furniture solutions are preferred by caregivers for managing mobility issues, reducing strain, and improving patient comfort. This segment is witnessing rapid growth as families increasingly prefer caring for elderly members at home, driven by government programs supporting aging-in-place initiatives.

Government Policies and Initiatives

Public spending on agedcare infrastructure, including nursing homes, assisted living facilities, and senior care centers, has expanded, supporting market growth. Policy measures encouraging elderly independence, healthcare funding, and subsidies for senior-friendly furniture have incentivized market expansion. Programs such as “Make in India” and “Made in China 2025” have indirectly bolstered domestic manufacturing of agedcare furniture, improving supply and affordability.

What are the restraints for the global market?

High Production and Retail Costs

Specialized agedcare furniture incorporating advanced technology and ergonomic design incurs higher manufacturing costs, which can lead to premium pricing. These costs may limit adoption among price-sensitive consumers and restrict market penetration in developing regions where affordability is a critical factor.

Regulatory Compliance Challenges

Manufacturers face stringent safety and quality standards in different countries, including certifications for fire safety, material toxicity, and mechanical reliability. Navigating these regulatory requirements can be complex and costly, slowing down new product launches and limiting market entry for smaller players.

What are the key opportunities in the agedcare furniture industry?

Technological Innovation and Smart Furniture

Integrating IoT, AI, and sensor technologies presents immense opportunities for product differentiation. Smart furniture with fall detection, adjustable ergonomics, and health-monitoring capabilities not only improves safety but also aligns with the increasing preference for technology-assisted elderly care. Manufacturers investing in R&D can capture high-margin segments and establish brand leadership.

Sustainability and Eco-Friendly Offerings

Consumer preference for environmentally responsible products creates an opportunity for manufacturers to introduce furniture made from sustainable materials, such as bamboo, recycled plastics, and low-VOC finishes. Sustainability certifications and green marketing strategies can enhance market appeal, particularly in Europe and North America, where eco-conscious consumers are highly influential.

Customization and Personalized Solutions

Providing tailored furniture solutions to meet individual needs is gaining traction. Adjustable recliners, modular beds, and multi-functional furniture allow customization according to mobility requirements, space constraints, and aesthetic preferences. Collaboration with healthcare providers and senior care facilities to create personalized solutions further enhances market penetration and customer loyalty.

Product Type Insights

Recliners and lift chairs dominate the agedcare furniture product segment, accounting for approximately 30% of the 2024 market. Their popularity is driven by features that improve mobility, assist in standing, and provide superior comfort for elderly users. Adjustable beds and ergonomic seating are also experiencing growth, reflecting trends toward multifunctional furniture that supports health and convenience. The increasing adoption of smart mechanisms and sensor-based technology is expected to maintain this product segment’s leading position in the global market.

Material Insights

Wooden furniture holds the largest share, approximately 35% of the market in 2024, due to its durability, aesthetic appeal, and consumer familiarity. However, lightweight metals and molded plastics are rapidly gaining traction in institutional care settings because of ease of maintenance, hygienic properties, and cost-effectiveness. Emerging trends indicate a shift toward hybrid materials combining durability with ergonomic functionality, appealing to both home care and institutional buyers.

Distribution Channel Insights

Offline retail channels, including specialized medical supply stores and furniture outlets, account for nearly 55% of global sales in 2024. These channels allow consumers and institutional buyers to physically assess comfort and functionality, a critical factor for elderly users. Online platforms are growing steadily, driven by e-commerce convenience, product variety, and direct-to-consumer offerings. Integration of virtual demos, customization tools, and home delivery services are accelerating adoption in digital channels.

End-Use Insights

The home care segment represents the largest end-use category, comprising 60% of the market in 2024. Growing preference for aging-in-place and availability of home healthcare services are the key drivers. Institutional segments, including nursing homes and assisted living facilities, are expanding at a CAGR of 6.8%, reflecting rising demand for specialized, durable, and ergonomic furniture. Export-driven demand is particularly strong for developed countries sourcing furniture from Germany, China, and Japan, creating opportunities for global manufacturers targeting cross-border markets.

| By Product Type | By End-Use Application | By Material Type | Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounted for 28% of the global agedcare furniture market in 2024. The U.S. and Canada lead due to a high elderly population, robust healthcare infrastructure, and strong purchasing power. Demand is driven by both home care and institutional segments, with rising adoption of smart and ergonomic furniture. Aging-in-place policies and government incentives further support market expansion.

Europe

Europe contributed 26% of the market in 2024, with Germany, the UK, and France as key countries. Steady growth is fueled by aging demographics, advanced healthcare systems, and high consumer awareness regarding safety and comfort. Sustainability-focused furniture and technologically integrated solutions are driving demand in this region.

Asia-Pacific

Asia-Pacific is the fastest-growing region, led by Japan, China, and India. Rapid urbanization, longer life expectancy, and rising disposable incomes are driving demand. Home care adoption is increasing as families prefer in-home elderly support, while institutional care facilities are expanding in metropolitan areas. Government initiatives and domestic manufacturing investments further accelerate growth.

Latin America

Brazil and Mexico are the primary markets in Latin America, exhibiting moderate growth. Demand is driven by institutional care facilities in urban centers and increasing awareness of elderly safety. Economic development and healthcare investments are gradually boosting market adoption.

Middle East & Africa

Growth is observed in Saudi Arabia, the UAE, and South Africa, driven by improving healthcare facilities and an increasing elderly population. Adoption of modern and ergonomic furniture in private and institutional care settings is expanding steadily, although overall market share remains limited compared to developed regions.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Agedcare Furniture Market

- Arjo AB

- Hill-Rom Holdings, Inc.

- Invacare Corporation

- Stryker Corporation

- Sunrise Medical

- GF Health Products, Inc.

- Drive DeVilbiss Healthcare

- Joerns Healthcare

- Gendron, Inc.

- Stiegelmeyer

- Handicare Group

- Nuvo Group

- Reverie, Inc.

- Golden Technologies

- Span America

Recent Developments

- In June 2025, Hill-Rom launched a new line of smart recliners integrated with patient monitoring sensors for home care settings in North America.

- In April 2025, Arjo AB introduced sustainable lift chairs using eco-friendly materials in Europe, responding to rising demand for green products.

- In February 2025, Sunrise Medical expanded its manufacturing facility in China to cater to growing Asia-Pacific demand for ergonomic agedcare furniture.