3D Printed Jewelry Market Overview

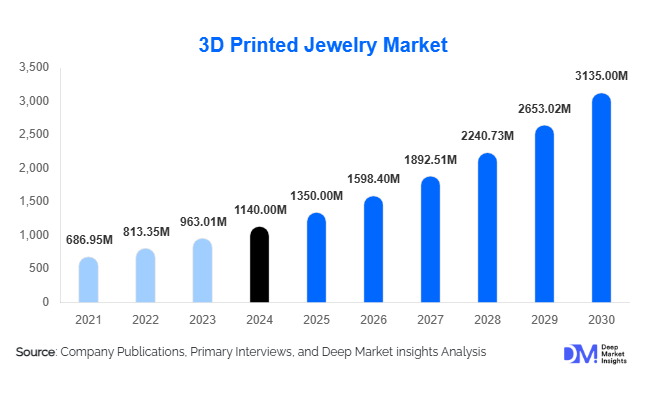

According to Deep Market Insights, the global 3D printed jewelry market size was valued at USD 1,140 million in 2024 and is projected to grow from USD 1,350 million in 2025 to reach USD 3,135 million by 2030, expanding at a CAGR of 18.4% during the forecast period (2025-2030). This growth is being driven by rising demand for customization, technological advances in metal and resin printing, expanding D2C and omnichannel sales, and increasing export activity from manufacturing hubs with strong jewelry heritage.

Key Market Insights

- Metal materials dominate revenue share, with precious metals such as gold, silver, and platinum commanding the highest ASPs, accounting for 45% of the total 3D printed jewelry market in 2024.

- Vat photopolymerization (SLA/DLP) leads in prototyping and pattern-making for casting workflows, and resin finished products, capturing 28% of the 2024 market.

- Rings are the most valuable product-type segment, driven by bridal, engagement, and bespoke requirements, representing 27% of the global market in 2024.

- Premium and luxury tiers capture about half the market revenue, as consumers pay for complex design, finishing, precious-metal content, and bespoke services.

- Direct-to-Consumer (D2C) online channels are a leading distribution route, accounting for 35% of market revenue in 2024, supported by design configurators, AR tools, and digital branding.

- Fashion & designer jewelry remains the largest end-use segment, contributing 40% of 2024 market revenues, with bridal & luxury segments growing rapidly.

What are the latest trends in the 3D printed jewelry market?

Hyper-personalization via digital experiences

Brands and ateliers are increasingly offering custom configurators and AR/VR try-on tools so customers can design rings, earrings, and pendants with bespoke geometry, engraving, and fit. This trend is reducing lead times, lowering inventory costs, and enabling higher average selling prices. Made-to-order workflows are replacing mass-inventory models, particularly in the premium and luxury tiers.

Metal AM is going mainstream for luxury and limited series

Advancements in metal additive manufacturing (SLM, DMLS) and better finishing (polishing, plating, stone-setting) are making direct metal-printed pieces viable for finished jewelry. Designers are leveraging complex geometries and structural designs previously impossible with traditional casting, which adds both design differentiation and value. Limited-edition and complexity-driven SKUs are now commercially feasible, especially in luxury segments.

What are the key drivers in the 3D printed jewelry market?

Rising demand for customization & shorter lead times

Consumers increasingly seek personalized, unique jewelry pieces. The ability to offer bespoke sizes, custom designs, and fast delivery is a strong differentiator. This is pushing brands to adopt 3D printing to reduce tooling costs, enable digital design workflows, and fabricate custom products quickly, driving higher conversion rates and reduced inventory risk.

Technological advancement and cost declines

Improvements in printer resolution, printable materials (especially metals and hybrid composites), and automated post-processing are reducing per-unit production costs and improving finish quality. Resin and metal printers are more accessible, and desktop & industrial models both see price declines. These advances are enabling smaller brands and service bureaus to enter higher-value segments.

What are the restraints for the global market?

High finishing costs & labor-intensive post-processing

Many metal printed or cast pieces require substantial manual work, polishing, plating, and setting stones to meet consumer expectations. These finishing steps are expensive, and for lower price tiers, they eat into margins significantly. Until finishing becomes more automated, it remains a key cost bottleneck.

Fragmented standards, IP, and certification concerns

There is no consistent global framework for certifying metal purity, printed metal hallmarks, or assay compliance in many regions. Designers also face risks of design copying due to digital CAD file sharing. These issues discourage entry into high-value segments unless trust, regulation, and IP protection improve.

What are the key opportunities in the 3D printed jewelry industry?

Regional manufacturing hubs & export potential

Countries with established jewelry craftsmanship (e.g., India, Italy) have a strong opportunity to become global hubs for printed jewelry. By upgrading to hybrid workflows (printed patterns, metal AM, local finishing), such hubs can serve international luxury/bridal markets with shorter lead times and lower MOQs. Export demand from North America and Europe for complex, customized jewelry is a strong pull factor.

New technology integrations and software-service bundles

Opportunities lie in combining printing hardware with configurator software, AR/VR tools, sustainability provenance tracking (blockchain), and finishing services. Bundling these into end-to-end offerings (design → print → finish → deliver) offers a higher margin and better customer stickiness. Also, AI-driven generative design to optimize material usage and electric power, and sustainability credentials can command premium pricing.

Product Type Insights

Rings continue to lead the product-type revenue share at 27%, primarily driven by bridal and engagement demand, intricate geometries, and the high material value associated with precious metals. The ability to craft highly personalized, custom designs has further propelled the demand for rings. Necklaces & pendants, earrings, and bracelets follow in market share, but the premium margins and high-value nature of rings make this segment especially dominant. Fashion jewelry in resin or lower-cost materials is experiencing rapid growth in mid-range price tiers, while high jewelry using metal additive manufacturing (AM) and precious metals is increasingly prominent among luxury buyers. Overall, the product type segment benefits from consumer preference for customizable and intricate designs, which enhances adoption across both fashion and luxury tiers.

Material & Technology Insights

Metal materials dominate the market with a 45% share in 2024, primarily due to high average selling prices (ASPs) of precious metals like gold, silver, and platinum. Advancements in material science have enabled the development of durable and aesthetically appealing materials suitable for 3D printing, driving adoption across high-end and luxury jewelry segments. Resin and photopolymers, processed through SLA/DLP technologies (28% market share), are widely used for both finished resin pieces and casting pattern workflows. SLA/DLP and metal AM remain the leading technologies due to their precision, fine detail capabilities, and applicability across multiple jewelry categories. Polymer SLS and FDM are more commonly used for fashion or prototyping applications rather than precious-metal finished pieces. Technology adoption is further fueled by growing consumer demand for intricate customization, reduced lead times, and design flexibility.

| By Product Type | By Material | By Technology | By End Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America, accounting for 38% of the global market in 2024, remains the largest regional market. The U.S. drives growth through high technological adoption, robust D2C digital platforms, and consumer preference for personalized jewelry. The presence of service bureaus, finishing workshops, and advanced metal AM facilities enables brands to deliver premium and luxury 3D printed jewelry efficiently. Buyers increasingly utilize AR/VR try-on tools and custom configurators, willing to pay premium prices for personalized designs and precious-metal content. Continued growth is expected as 3D printing technologies become more accessible, omnichannel models expand, and consumer interest in limited-edition or bespoke pieces rises.

Europe

Europe holds 30% of the global market in 2024, supported by its long-standing luxury jewelry heritage in countries like Italy, France, and the U.K. Europe’s growth is driven by artisan craftsmanship, strong designer brand presence, and high-quality expectations among consumers. Italy serves both as a production hub and design leader, while the U.K. and France exhibit strong adoption of premium and luxury printed jewelry. Regulatory developments related to hallmarking, metal assay, and certification enhance market trust and encourage the adoption of 3D printed jewelry. Additionally, growing consumer interest in limited-edition and ethically produced jewelry is supporting regional expansion.

Asia-Pacific

Asia-Pacific, with a 20% share in 2024, is the fastest-growing regional market. Key growth drivers include low labor costs, a rich tradition of jewelry craftsmanship, increasing domestic and export demand, and government support for advanced manufacturing. India is emerging as a significant manufacturing and export hub, integrating traditional jewelry techniques with 3D printing workflows, while China is scaling domestic production and demand for premium and designer jewelry. Southeast Asia and Japan are showing rising interest in luxury and fashion 3D printed jewelry. The growth is further reinforced by rising middle-class income, digital marketplaces, and the adoption of advanced materials and technologies that enable intricate and customizable designs.

Middle East & Africa

MEA accounts for 6% of the market in 2024 and is characterized by a niche, high-value segment dominated by luxury and custom pieces. The Gulf countries, including the UAE and Saudi Arabia, drive demand for bespoke, high-end jewelry, while limited finishing capacity and certification standards moderate growth. The market benefits from wealthy consumers seeking exclusivity and superior craftsmanship. Adoption of 3D printing technology by designers and jewelers allows for the creation of unique, personalized pieces, enhancing competitiveness and market appeal in this region.

Latin America

Latin America also represents 6% of the 2024 market, with Brazil and Mexico as primary contributors. Rising interest among affluent consumers and designer brands fuels demand, particularly for fashion/resin jewelry, though luxury metal 3D printed pieces remain a smaller segment. Export opportunities and direct-to-consumer channels are supporting growth, while infrastructure limitations, import duties, and material costs remain constraints. Adoption of online retail platforms is helping overcome geographic and logistical barriers, enabling greater market penetration and access to global customers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|