Sports Coaching Market Size

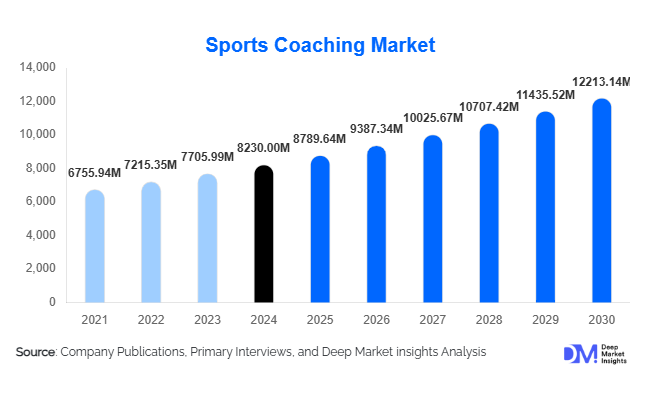

According to Deep Market Insights, the global sports coaching market size was valued at USD 8,230.00 million in 2024 and is projected to grow from USD 8,789.64 million in 2025 to reach USD 12,213.14 million by 2030, expanding at a CAGR of 6.8% during the forecast period (2025–2030). Market growth is driven by rising participation in organized sports, increasing health and fitness awareness, the professionalization of coaching roles, and growing investments in athlete development programs across schools, clubs, and elite sports organizations.

Key Market Insights

- Digital and hybrid coaching models are reshaping the sports training ecosystem, allowing coaches to reach global audiences through online and app-based platforms.

- Growing emphasis on youth development programs is boosting demand for certified and specialized coaches across multiple disciplines.

- North America remains the largest sports coaching market, supported by strong sports culture, collegiate systems, and government-backed training initiatives.

- Asia-Pacific is the fastest-growing region, led by surging investments in grassroots sports and national athlete development programs in China and India.

- Integration of performance analytics, AI, and wearable technologies is transforming athlete assessment, enabling data-driven coaching decisions.

- Private academies and online coaching platforms are expanding access to professional coaching beyond traditional institutional frameworks.

Latest Market Trends

Digital Coaching and Remote Training Platforms

The rapid adoption of digital platforms has revolutionized how athletes and coaches interact. Online coaching services, mobile apps, and subscription-based programs are democratizing access to personalized training. Video analytics, real-time feedback tools, and performance-tracking wearables are allowing athletes to train remotely while maintaining high levels of engagement and accountability. Companies are increasingly offering hybrid models that combine in-person sessions with digital monitoring to optimize performance outcomes.

Emphasis on Data-Driven and AI-Enhanced Coaching

Artificial intelligence and advanced analytics are enabling more precise performance measurement and injury prevention. Coaches are leveraging motion capture, biomechanical sensors, and AI-driven insights to refine training regimens. This data-centric approach enhances athlete longevity and skill development, especially in elite sports. Integration with cloud-based systems allows continuous tracking of athlete progress, fostering transparency and measurable improvement across coaching programs.

Sports Coaching Market Drivers

Rising Participation in Organized and Recreational Sports

Increasing global interest in fitness, sports, and recreational activities is fueling demand for professional coaching services. Governments and institutions are investing in community-level programs to encourage youth participation, while schools and colleges are expanding athletic departments to nurture talent. Corporate wellness initiatives and sports clubs are also boosting demand for certified coaches specializing in fitness, performance, and mental conditioning.

Growing Professionalization and Certification Standards

The coaching profession is becoming increasingly structured, with governing bodies introducing standardized certifications, training pathways, and ethical guidelines. Accredited programs offered by organizations such as the International Council for Coaching Excellence (ICCE) and National Governing Bodies (NGBs) are enhancing the credibility of the profession. This shift toward formalized qualifications is raising service quality and creating new career opportunities globally.

Market Restraints

High Cost of Professional Training and Certifications

Despite rising demand, the cost of acquiring advanced coaching certifications and continuous professional development remains high. Many aspiring coaches, particularly in developing regions, face financial barriers to entering the field. The cost of specialized tools, analytical software, and facility rentals further limits scalability for independent trainers and small academies.

Lack of Infrastructure and Uneven Access

In many emerging economies, limited access to quality training facilities, equipment, and educational resources restricts the growth of the sports coaching market. Rural and low-income regions often lack structured coaching programs, leading to uneven athlete development. Addressing these disparities remains a key challenge for governments and sports federations aiming to broaden participation and talent pipelines.

Sports Coaching Market Opportunities

Expansion of e-Learning and Virtual Coaching Programs

The integration of e-learning technologies is opening new revenue streams for sports coaching providers. Virtual classrooms, interactive video modules, and gamified learning experiences allow coaches to scale globally and offer specialized programs across multiple disciplines. Platforms combining AI-driven assessments with remote mentorship are rapidly gaining popularity, particularly among amateur and youth athletes seeking affordable access to professional coaching.

Women’s Sports and Inclusion Initiatives

The global surge in women’s sports presents major opportunities for coaching expansion. National federations, sponsors, and educational institutions are investing in women’s leagues and development programs, driving demand for female coaches and gender-inclusive training environments. Initiatives promoting equal pay, safety, and representation are fostering a more inclusive sports ecosystem, broadening the market’s demographic reach.

Sport Type Insights

Team sports such as football, basketball, cricket, and rugby dominate the market, supported by large participant bases, strong sponsorship ecosystems, and recurring contracts with clubs and leagues. Institutional budgets and established competition structures continue to sustain demand for qualified team coaches. Individual sports, including tennis, golf, athletics, and martial arts, are witnessing accelerated adoption of data-driven and one-on-one technical coaching, driven by athletes’ willingness to pay for performance optimization and competition readiness. Emerging sports such as esports and adventure racing are creating niche digital coaching opportunities due to fast-growing online communities and scalable, tech-assisted training models.

Service Type Insights

Individual coaching is experiencing robust growth as athletes increasingly seek personalized performance programs and are willing to pay premium rates for tailored, analytics-backed instruction. Group coaching continues to appeal to recreational participants and schools for its cost efficiency and social engagement benefits. Team coaching benefits from institutional budgets and structured league systems, ensuring recurring contracts for multi-sport academies. Corporate wellness coaching is gaining traction as employers integrate wellness initiatives to improve productivity and retention through measurable ROI-driven fitness programs.

Delivery Mode Insights

In-person coaching remains the preferred mode for skill-intensive sports and youth development due to its hands-on feedback and quality perception. Online and remote coaching is expanding rapidly, driven by convenience, affordability, and geographic reach, particularly among amateur and youth athletes. Hybrid coaching models, which blend in-person trust with digital scalability, are emerging as high-conversion formats. Meanwhile, app-based asynchronous programs are unlocking mass-market potential with low marginal costs and recurring subscription revenue opportunities.

End-User Insights

Professional and elite athletes represent the largest revenue segment, supported by rising investments in sports science, data analytics, and high-performance training. Youth and school athletes form a rapidly expanding category, driven by parental willingness to invest in development and the proliferation of school–club partnerships. Collegiate programs in North America and Europe are major growth enablers, emphasizing scholarship pathways and performance-based recruitment. Amateur and recreational users continue to drive volume demand through flexible, affordable online coaching models, while corporate clients are emerging as a valuable segment as employers invest in employee wellness and engagement programs.

Pricing & Business Model Insights

Subscription-based coaching models are gaining popularity for their recurring revenue and high customer lifetime value (CLTV). Pay-per-session models appeal to casual users and serve as effective conversion funnels into higher-tier offerings. Program-based packages provide predictable seasonal revenues, particularly in pre-season training, while revenue-sharing models between coaches and academies align incentives for long-term athlete development and retention.

Coach Type & Credentialing Insights

Certified professional coaches are increasingly preferred across institutions and private academies due to regulatory mandates and parental trust in credentialed professionals. Independent coaches provide flexibility and affordability, vital in emerging and fragmented markets. Club and academy coaches secure stable employment through long-term contracts and structured talent funnels, while tech-assisted coaches leveraging AI and algorithmic analytics are enabling scalable coaching solutions and expanding reach across geographies.

Customer Age Group Insights

Children and adolescent segments lead participation growth, driven by parental investment in early development, safety assurances, and competitive advancement opportunities. Adults represent a key commercial demographic motivated by fitness, lifestyle, and social engagement, favoring flexible scheduling and convenient digital programs. Seniors form a smaller yet growing niche, emphasizing health maintenance, mobility, and low-impact fitness coaching supported by tailored in-person programs.

| By Service Type | By Delivery Mode | By End-User | By Sport Type | By Coach Type / Credentialing |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America remains the largest market for sports coaching, underpinned by a strong college and university sports ecosystem, extensive club networks, and well-funded youth academies. Robust institutional investment supports a deep pool of certified coaches specializing in performance analytics, conditioning, and athlete development. High adoption of sports technology, data analytics, and wearable devices continues to elevate coaching precision and athlete outcomes. Additionally, strong consumer spending on recreational fitness and structured league systems ensures recurring demand across both professional and community levels.

Europe

Europe represents a mature and structured sports coaching ecosystem, bolstered by established club systems, grassroots participation, and robust regulatory oversight. Government and municipal sports programs actively promote skill development and inclusivity, while widespread certification and accreditation standards elevate coaching quality. Countries such as the U.K., Germany, and France are driving market growth through continuous investments in talent development and knowledge-sharing across federations. The continent’s deeply rooted sports culture and integration of analytics tools into performance training further strengthen its position as a global hub for coaching excellence.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, fueled by a large youth population, rising disposable incomes, and significant government investment in sports infrastructure and elite athlete programs. Rapid expansion of private academies in cricket, badminton, and soccer is transforming access to structured coaching. China and India, in particular, are prioritizing Olympic-focused development pathways, creating robust demand for certified and data-trained coaches. Japan and Australia contribute to the region’s sophistication through advanced sports science and wellness-focused training models. This convergence of population growth, investment, and technology adoption positions Asia-Pacific as the epicenter of future volume growth in sports coaching.

Latin America

Latin America offers growing potential, driven by the region’s deep-rooted passion for team sports, especially soccer, and the rising number of private academies in Brazil, Argentina, and Mexico. Expanding middle-class income levels and community sports initiatives are stimulating grassroots engagement. Underserved rural regions present opportunities for franchised academies and low-cost digital coaching platforms. Increasing collaboration between local governments and private investors is improving access to quality coaching education, creating a foundation for sustainable market expansion.

Middle East & Africa

The Middle East and Africa are witnessing accelerating growth supported by rapid infrastructure development, hosting of major international sporting events, and national diversification strategies emphasizing sports investment. Governments in Saudi Arabia, the UAE, and Qatar are establishing flagship sports academies and partnerships with global coaching organizations to nurture talent. Meanwhile, Africa’s market remains fragmented but promising, with initiatives in South Africa, Kenya, and Nigeria focused on youth development and coach training. Digital coaching platforms and hybrid learning models are emerging as key enablers to address regional coach shortages and expand access across geographically dispersed communities.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Sports Coaching Market

- CoachUp Inc.

- UK Coaching

- Challenger Sports

- EdTech Coach LLC

- Coach Logic

- Huddol

- Peaks Coaching Group

- SportsEdTV

Recent Developments

- In August 2025, CoachUp launched an AI-driven athlete development platform that integrates wearable data and video analytics to deliver personalized coaching feedback.

- In June 2025, UK Coaching expanded its certification offerings through a new digital learning hub, enabling coaches to access training modules online.

- In March 2025, Challenger Sports introduced community-based grassroots coaching programs across Asia-Pacific, focusing on youth football development.