Socks Market Size

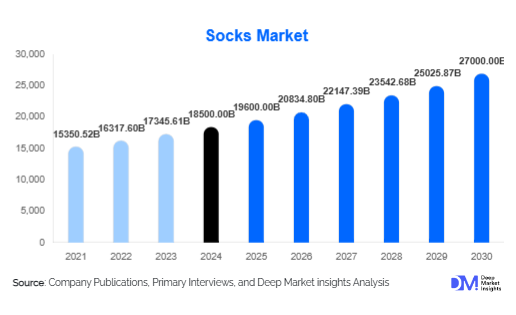

According to Deep Market Insights, the global socks market size was valued at USD 18,500 million in 2024 and is projected to grow from USD 19,600 million in 2025 to reach USD 27,000 million by 2030, expanding at a CAGR of 6.3% during the forecast period (2025–2030). The socks market growth is primarily driven by rising participation in sports and fitness activities, increasing consumer preference for fashion-forward and premium socks, and technological innovations in materials such as moisture-wicking, anti-odor, and eco-friendly fibers.

Key Market Insights

- Athletic and performance socks are leading the market globally, driven by higher fitness awareness, sports participation, and consumer demand for comfort and functionality.

- North America and Europe dominate the market, fueled by fashion trends, premium product adoption, and organized retail penetration.

- Asia-Pacific is emerging as the fastest-growing region, led by rising disposable incomes, urbanization, and increasing e-commerce penetration.

- Medical and compression socks are gaining traction, driven by aging populations, rising health consciousness, and expansion in healthcare applications.

- Online and D2C channels are reshaping distribution, enabling wider accessibility and direct engagement with consumers.

- Technological integration in materials and manufacturing, such as smart textiles, automated knitting, and sustainable fiber adoption, is driving product differentiation and market growth.

What are the latest trends in the socks market?

Premiumization and Fashion-Forward Designs

Consumers are increasingly treating socks as a fashion statement, driving demand for bold designs, patterns, and premium materials. Designer socks, limited-edition collections, and branded products are capturing urban consumer attention, particularly among men and younger demographics. The trend is further amplified by social media, where influencers showcase styled outfits incorporating statement socks, creating aspirational demand for novelty and luxury options.

Health-Oriented and Technical Socks

Medical and performance socks, including compression, diabetic, and thermal variants, are witnessing rapid adoption. Compression socks are widely used in sports and healthcare, while diabetic socks target an aging population with specific circulation needs. Technical fabrics such as moisture-wicking, anti-odor, and thermal materials are increasingly integrated, improving comfort and functionality for active and health-conscious consumers.

What are the key drivers in the socks market?

Rising Sports and Fitness Participation

The growth of organized sports, gyms, and recreational fitness activities has significantly increased demand for performance socks. Athletic socks with cushioning, anti-slip, and moisture-wicking features are gaining popularity among professional athletes, amateur players, and fitness enthusiasts. This segment represents the largest product type, capturing approximately 35% of global market share in 2024.

Fashion and Lifestyle Influence

Socks are no longer purely functional; they have become integral to lifestyle and fashion trends. Bright colors, bold patterns, and designer collaborations appeal to style-conscious consumers, particularly in North America and Europe. Fashion socks dominate 45% of global demand, highlighting the shift toward aesthetic and personal expression in everyday wear.

Expansion of E-Commerce Channels

Online sales of socks have grown rapidly due to convenience, a wider variety, and targeted marketing. Brands can sell directly to consumers through websites, subscriptions, and social media platforms. Online channels account for roughly 30% of global sales, with continued growth expected in Asia-Pacific and LATAM due to rising internet penetration and digital adoption.

What are the restraints for the global market?

Raw Material Price Volatility

Fluctuations in cotton, wool, and synthetic fiber prices impact manufacturing costs and profit margins. Manufacturers need to manage raw material procurement efficiently, as significant price swings can affect product pricing and overall competitiveness.

Counterfeit Products and Brand Dilution

Low-quality, counterfeit socks are prevalent in developing markets, affecting brand reputation and limiting the market potential of premium products. Companies need to ensure quality standards and invest in anti-counterfeit measures to maintain consumer trust.

What are the key opportunities in the socks market?

Expansion in Emerging Markets

Asia-Pacific, particularly India and China, offers high growth potential due to rising disposable incomes, urbanization, and the adoption of Western fashion trends. Local manufacturing initiatives, such as “Make in India,” enhance production capabilities and provide opportunities for global and regional brands to tap into these fast-growing markets.

Material Innovation and Technological Integration

Smart textiles, moisture-wicking fibers, and eco-friendly materials are creating differentiation opportunities. Automated knitting, 3D knitting, and sustainable fiber adoption allow brands to command premium pricing and appeal to environmentally conscious consumers.

Healthcare and Wellness Applications

Medical and compression socks are expanding due to aging populations and rising health awareness. Hospitals, clinics, and wellness centers are increasingly sourcing specialized socks, presenting both B2B and B2C opportunities for brands focusing on quality, certifications, and targeted marketing.

Product Type Insights

Athletic socks dominate the market, representing 35% of global demand, driven by fitness trends and e-commerce adoption. Casual socks are the second-largest segment, favored for everyday wear. Dress socks, though smaller in volume, maintain high-value margins. Specialty socks, including diabetic and thermal variants, are gaining traction due to healthcare awareness and cold climate demand.

Material Insights

Cotton is the leading material segment with 40% market share, valued for comfort and breathability. Synthetic fibers, including polyester and nylon, are gaining popularity for durability and moisture management. Blended fabrics provide a balance between cost, durability, and comfort. Niche fibers such as bamboo and silk are capturing the eco-friendly and luxury segments.

Distribution Channel Insights

Offline retail dominates with a 50% market share, led by supermarkets, department stores, and specialty shops. Online platforms contribute 30% of sales, driven by convenience, wider product selection, and targeted marketing campaigns. D2C and subscription models are emerging, particularly in premium and eco-friendly segments. Wholesale and institutional channels cater to bulk buyers such as hospitals, sports teams, and corporate organizations.

End-Use Insights

The fashion and lifestyle segment accounts for 45% of global demand, driven by urbanization and designer sock adoption. Sports and athletics represent the fastest-growing end-use segment due to the rising fitness culture. Healthcare applications, including compression and diabetic socks, are gaining importance with aging populations. Export demand is strong in the US, Germany, and Japan, driving growth in production hubs like China and India.

| By Product Type | By Material | By Distribution Channel | By End-Use Industry | By Age & Gender |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for 28% of the global socks market, driven by high disposable income, fashion trends, and sports participation. The US demand is valued at approximately USD 5,200 million. Premium and athletic socks dominate, while online and retail channels continue to grow in parallel.

Europe

Europe holds 25% of the market share, led by Germany, the UK, and France. Fashion-conscious consumers and health-focused buyers drive demand for designer, casual, and medical socks. Germany’s market alone is valued at USD 2,800 million. Sustainable and eco-friendly socks are particularly popular among younger demographics.

Asia-Pacific

Asia-Pacific is the fastest-growing region, driven by China, India, Japan, and Australia. The combined market value for China and India is USD 4,500 million. Growth is fueled by rising disposable incomes, urbanization, and increasing e-commerce penetration. Demand for mid-range and premium socks is expanding rapidly.

Middle East & Africa

MEA accounts for ~10% of the global market share. Key markets include the UAE, Saudi Arabia, and South Africa. Demand is driven by premium and thermal socks, with increasing awareness of sports and fashion trends. Government support for textile production and exports enhances regional supply capabilities.

Latin America

LATAM represents ~7% of the global market, led by Brazil, Argentina, and Mexico. While domestic production is limited, outbound purchases of premium and athletic socks are rising among affluent consumers. Adventure and lifestyle-oriented trends are shaping demand.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Socks Market

- Nike, Inc.

- Adidas AG

- Puma SE

- Hanesbrands Inc.

- Under Armour, Inc.

- Uniqlo Co., Ltd.

- Falke Group

- Burlington Industries

- Gold Toe, Inc.

- Sockwell

- Bombas

- Smartwool

- Stance, LLC

- Happy Socks AB

- Jockey International

Recent Developments

- In March 2025, Nike introduced a sustainable performance sock line made with recycled polyester, enhancing its eco-friendly portfolio.

- In April 2025, Adidas launched a limited-edition designer sock collection in Europe, targeting urban and fashion-conscious consumers.

- In June 2025, Bombas expanded its e-commerce subscription model to Asia-Pacific, increasing direct-to-consumer reach and subscription revenue.